By RoboForex Analytical Division

The USD/JPY pair is buying and selling firmly round 156.56 on Monday, preserving the Japanese yen in a deeply weak place. Markets stay on excessive alert as they assess a refrain of verbal interventions from Japanese officers geared toward stemming the decline of the nationwide foreign money.

The warnings intensified on Sunday when Takuji Aida, an adviser to Prime Minister Sanae Takaichi, acknowledged that Tokyo is ready to intervene immediately within the foreign money market if the yen’s weak point begins to inflict important hurt on the economic system.

This follows related expressions of concern from Financial institution of Japan Governor Kazuo Ueda and Finance Minister Satsuki Katayama final week. Their feedback have considerably heightened expectations of potential market intervention, with many analysts figuring out the 160.00 stage as a important line within the sand, recalling that this zone prompted official motion throughout earlier episodes of yen weak point.

The yen’s sell-off, which drove it to a ten-month low final week, was initially triggered by the brand new cupboard’s substantial stimulus bundle. The plan raised alarms over Japan’s fiscal well being, whereas the administration’s continued insistence on ultra-loose financial coverage has offered a basic backdrop for additional foreign money depreciation.

Technical Evaluation: USD/JPY

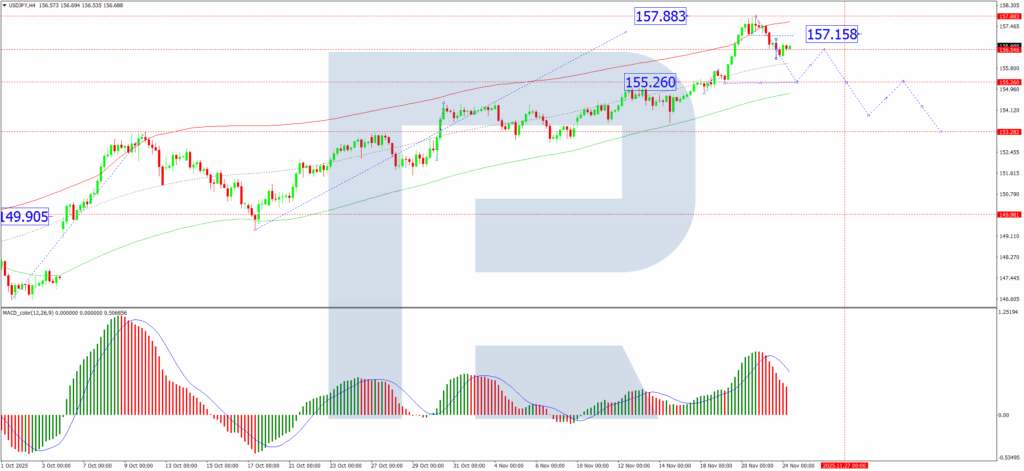

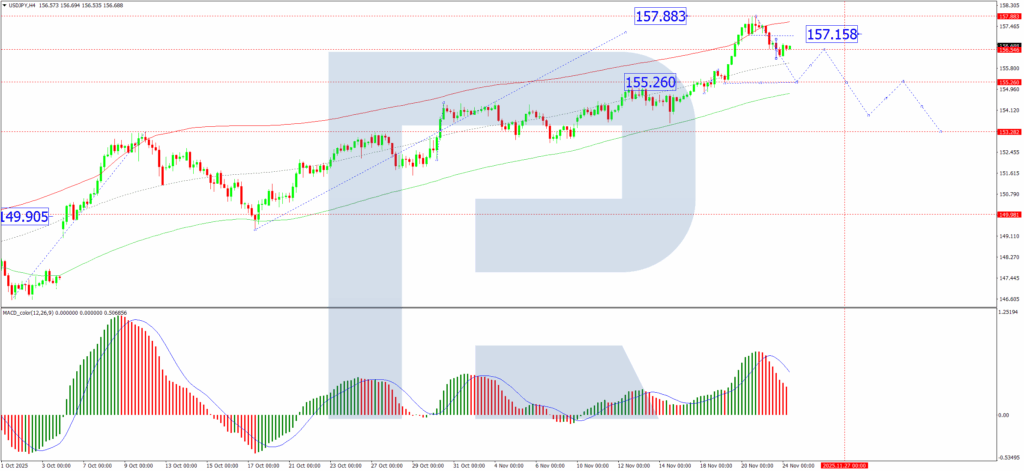

H4 Chart:

On the H4 chart, USD/JPY accomplished its first downward impulse to 156.19 and is now forming a consolidation vary round 156.55. An upward breakout from this vary is predicted to set off a corrective rally in the direction of 157.15. Following this correction, we anticipate the resumption of the bearish transfer, initiating a brand new downward impulse with an preliminary goal at 154.00. A break beneath this stage would open the trail for a deeper correction in the direction of 153.30. This situation is technically supported by the MACD indicator. Its sign line is above zero however is pointing decisively downward, suggesting that whereas the pair is correcting from overbought situations, the underlying momentum is shifting bearish.

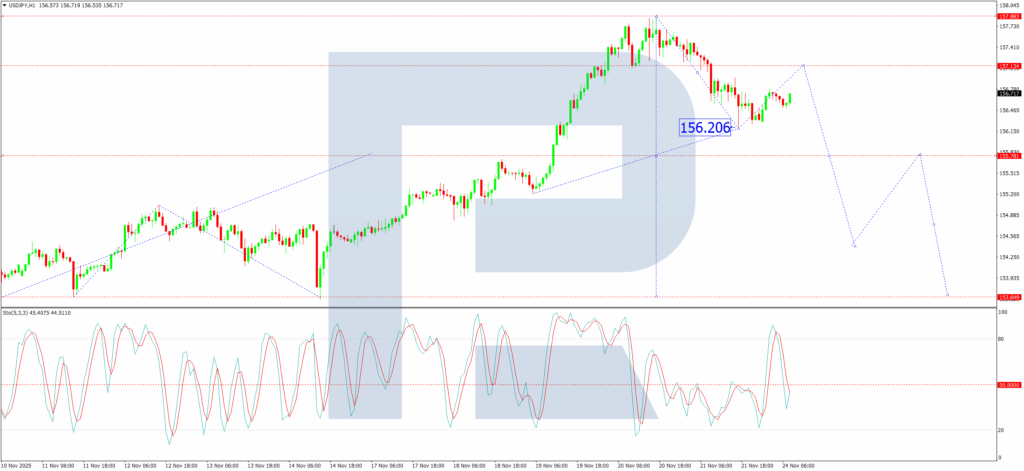

H1 Chart:

On the H1 chart, the pair accomplished a downward wave to 156.20. We are actually observing a corrective part for this transfer, with an preliminary goal set at 157.13. Upon completion of this upward correction, we anticipate the subsequent leg of the downtrend to develop, focusing on 154.44. The Stochastic oscillator confirms this near-term view. Its sign line is above 50 and rising in the direction of 80, indicating that short-term shopping for stress is driving the correction earlier than the bigger bearish pattern reasserts itself.

Conclusion

The yen stays caught between basic pressures from home coverage and escalating verbal intervention from authorities. Technically, the USD/JPY pair is finishing a corrective bounce inside a newly established short-term downtrend. Whereas an increase in the direction of 157.15 is probably going within the close to time period, this ought to be considered as a corrective transfer inside a broader bearish construction that targets a decline in the direction of 154.00 and doubtlessly 153.30. All eyes stay on the 160.00 stage, broadly considered as the brink for potential official intervention.

Disclaimer:

Any forecasts contained herein are primarily based on the writer’s specific opinion. This evaluation will not be handled as buying and selling recommendation. RoboForex bears no duty for buying and selling outcomes primarily based on buying and selling suggestions and evaluations contained herein.

- Yen Beneath Sustained Strain, Igniting Intervention Fears Nov 24, 2025

- Considerations in regards to the synthetic intelligence sector triggered a worldwide promote‑off of belongings Nov 21, 2025

- Gold Treads Water Amid Combined Alerts Nov 21, 2025

- The PBOC stored rates of interest unchanged as anticipated. Nvidia’s report beat projections and eased considerations about AI investments Nov 20, 2025

- GBP/USD Weakens Quickly Amid Dovish Knowledge and Exterior Pressures Nov 20, 2025

- German DAX (DE40) fell to a 5‑month low. Traders stay cautious forward of key financial releases Nov 19, 2025

- Gold Dips in Wholesome Correction Nov 19, 2025

- Oil costs stay beneath stress. Canada’s inflation fell to the Financial institution of Canada’s goal stage Nov 18, 2025

- September NFP, Nvidia & Bitcoin in focus Nov 18, 2025

- EUR/USD Declines as Market Awaits Key US Employment Knowledge Nov 18, 2025