Criterias used for printing new bars

The rule that triggers a brand new bar determines what the chart emphasizes.

| Rule | Chart Varieties | Emphasizes |

|---|---|---|

| Time-Primarily based | Candlesticks / OHLC | Chronology, session context, timing |

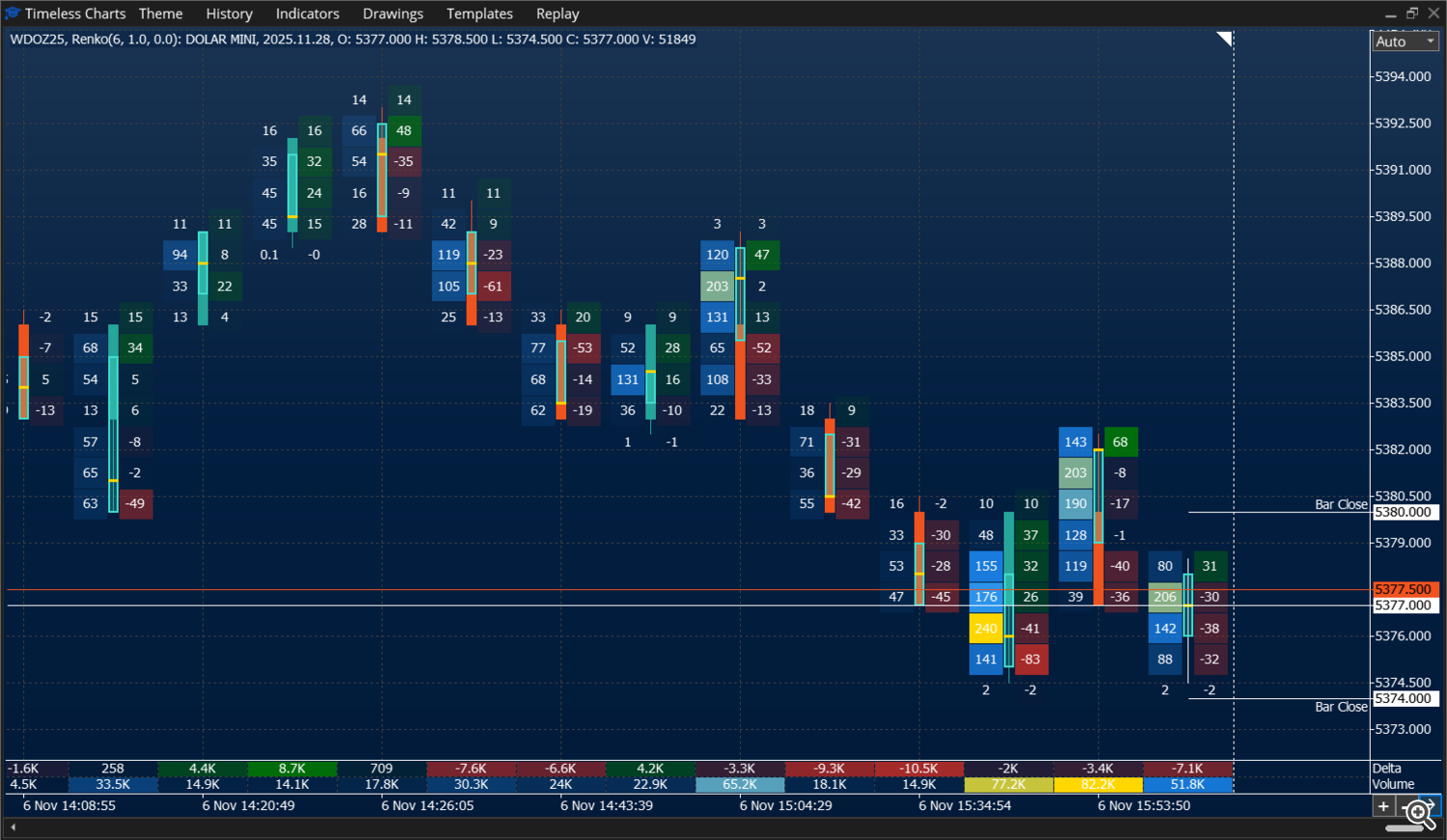

| Worth-Distance (Development) | Renko (all variants) | Equal value steps, pattern readability, noise discount |

| Reversal-Primarily based | Level & Determine, Kagi, Line Break | Swings, breakouts, regime turns |

| Volatility-Primarily based | Vary Bars | Normalized strikes by peak (H–L) |

| Exercise-Primarily based | Tick/Trades Bars, Quantity Bars | Participation, event-driven construction |

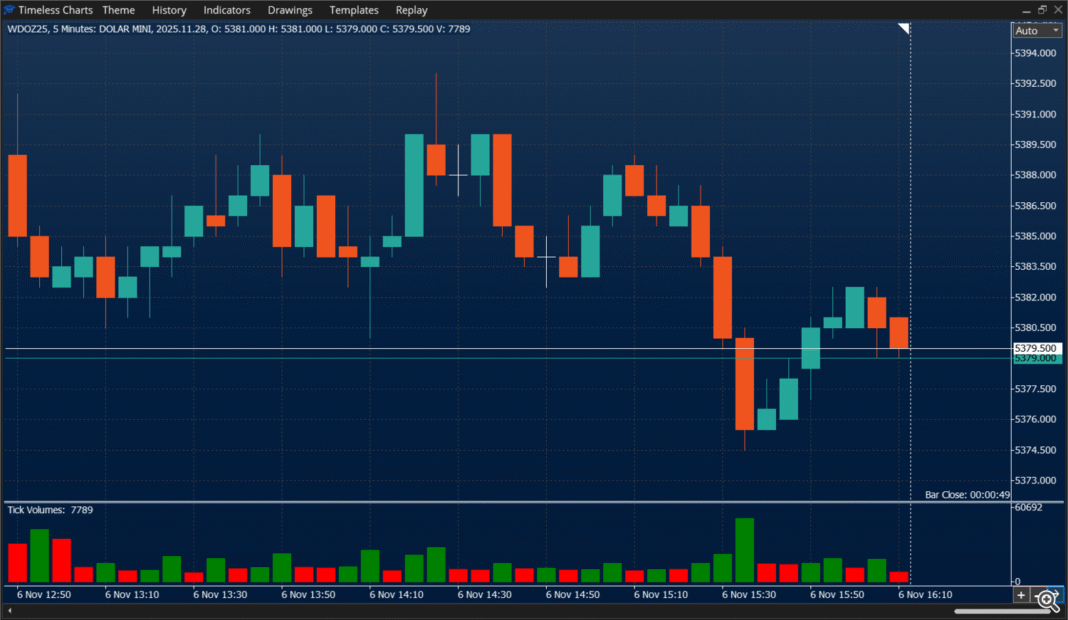

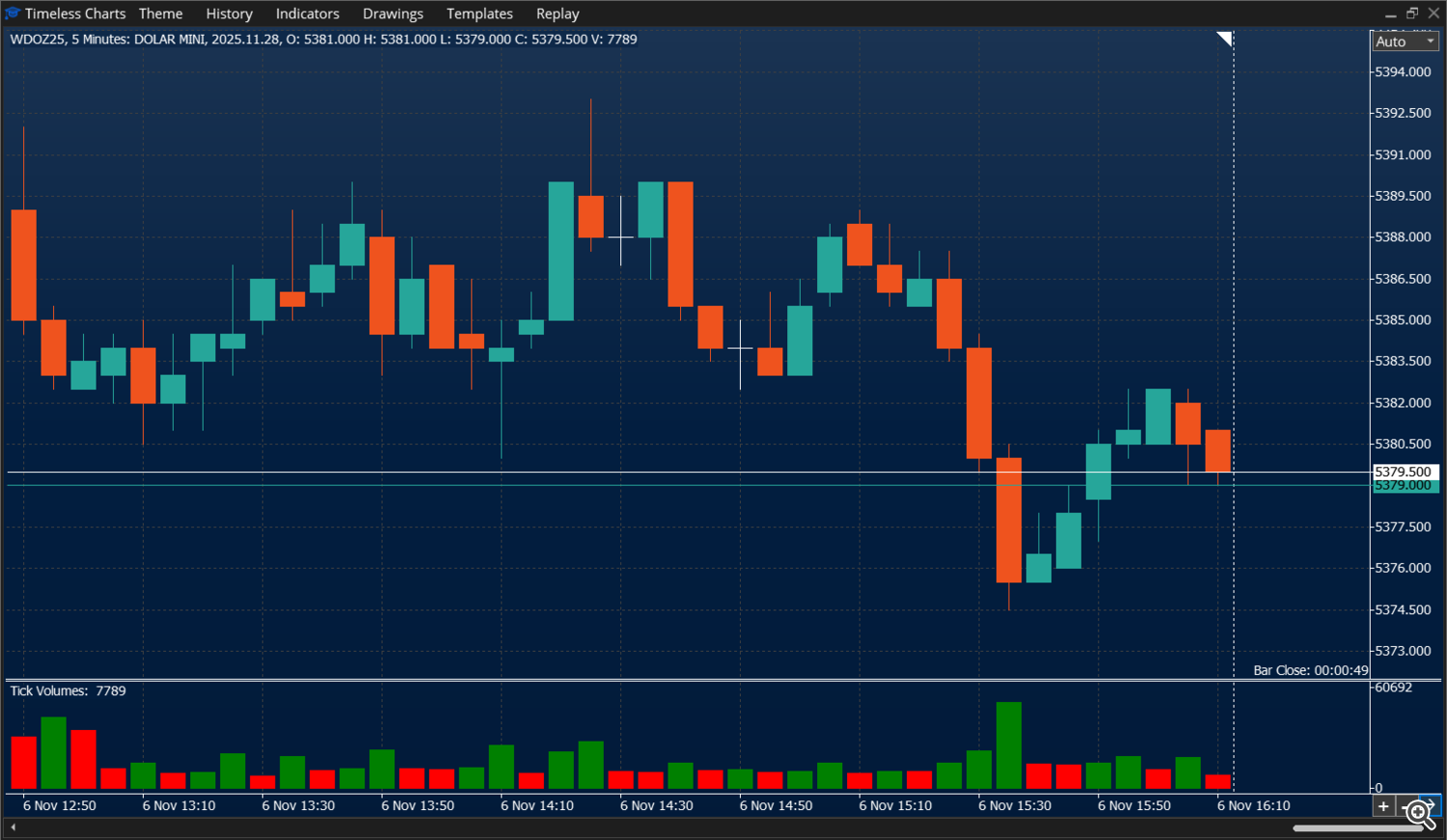

Rule: Time-Primarily based

Candlesticks / OHLC

A brand new bar kinds each mounted interval (e.g., 1m, 5m, 1h, each day). This preserves timing and session rhythm, however can add “empty” bars throughout sluggish intervals and really dense bars throughout quick bursts.

- Use when: You want session context, information timing, and a common reference for evaluation.

- Parameters: Timeframe (multi-TF views assist); contemplate session separators and RTH/ETH filters.

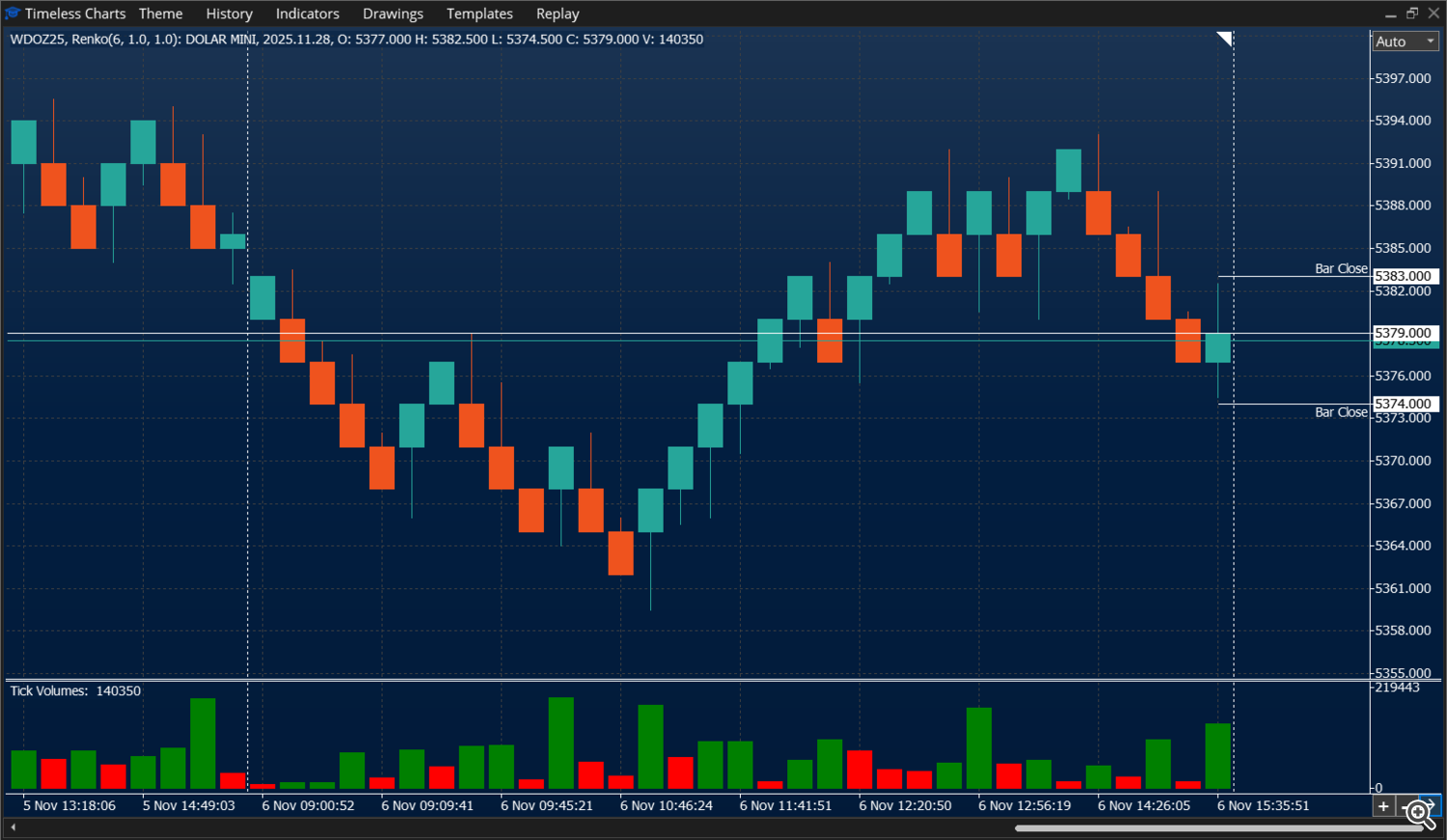

Rule: Worth-Distance

Renko

Prints a brand new brick every time value advances by a hard and fast field measurement. Bricks stack in a single route till value strikes sufficient to reverse and begin a brand new column. Variants (Median, Turbo/Hybrid) alter open/shut placement or wick filtering.

- Use when: You need pattern readability, noise discount, and equal step measurement throughout the transfer.

- Parameters: Field measurement (mounted or ATR-based). Bigger = smoother traits; smaller = extra element.

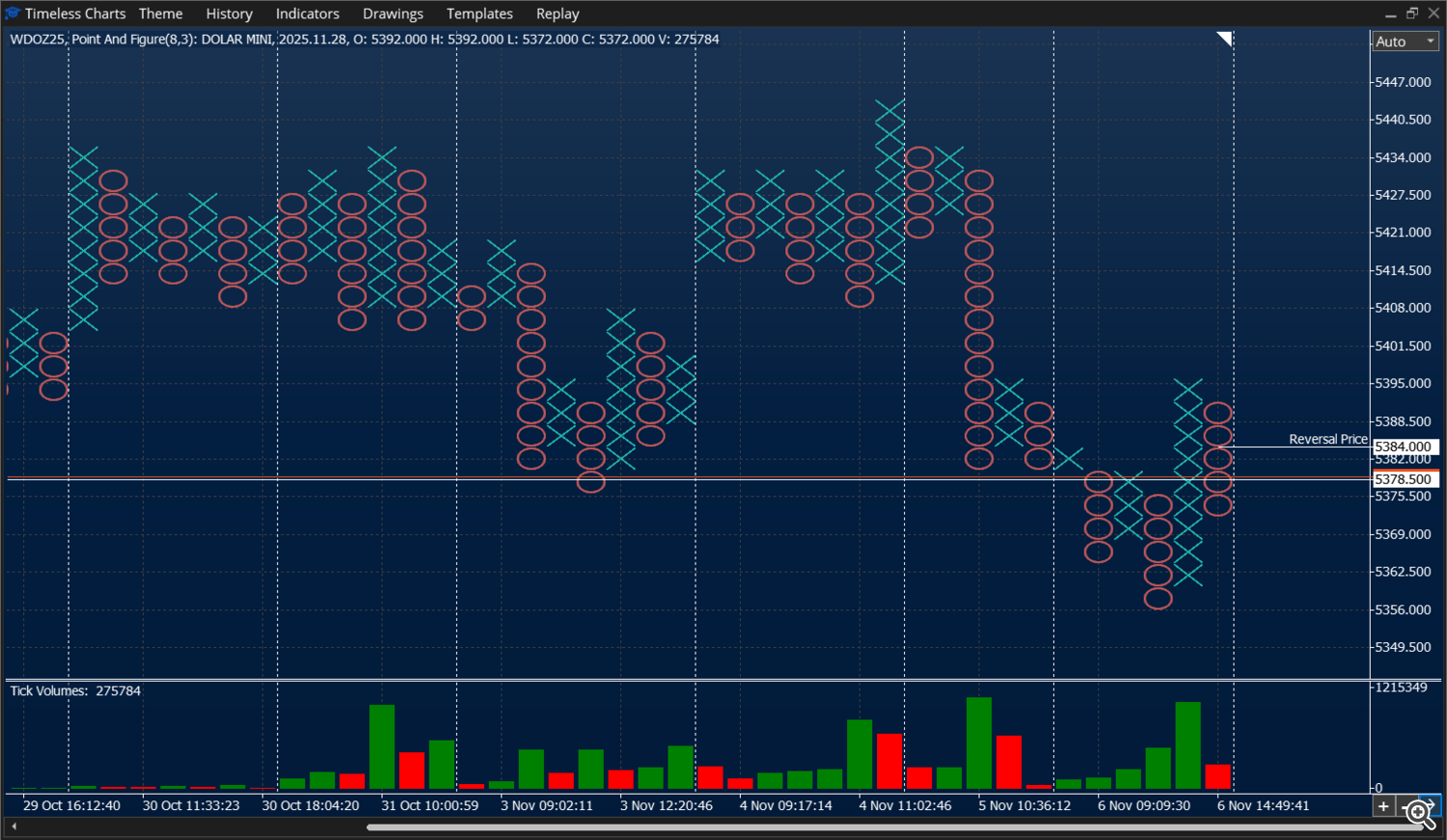

Rule: Reversal-Primarily based

Level & Determine

Columns of X (up) and O (down). Field measurement controls sensitivity; a brand new column begins solely after an outlined reversal quantity (e.g., 3 containers). Removes the time axis to emphasise ranges, breakouts, and targets.

- Use when: You give attention to assist/resistance, patterns (double-tops/bottoms), and clear breakout logic.

- Parameters: Field measurement and reversal (generally 3-box). Strive ATR-based sizing for cross-asset consistency.

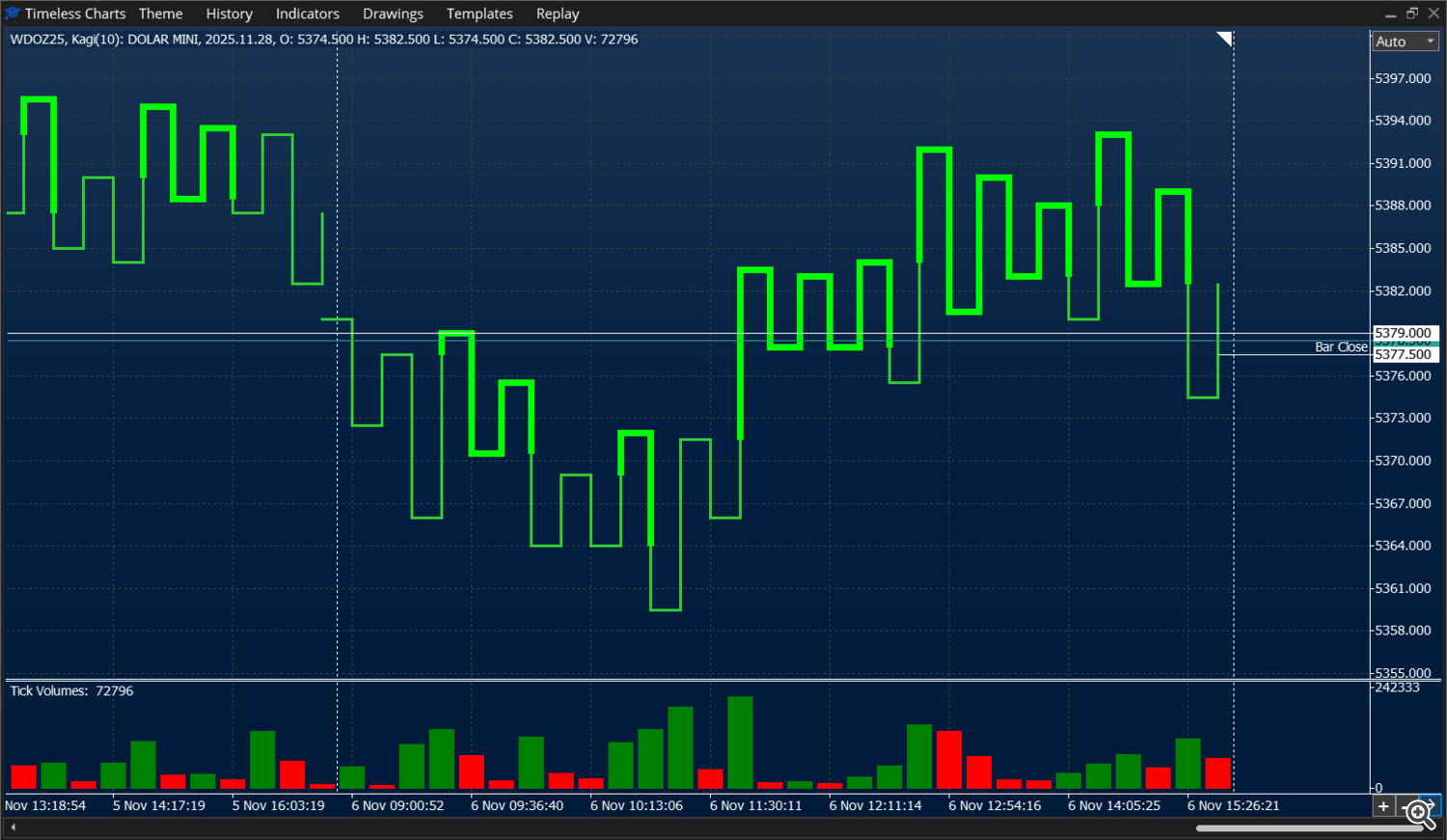

Rule: Reversal-Primarily based

Kagi

A single line that reverses solely after value strikes by an outlined reversal quantity. When value exceeds the earlier excessive/low, the road thickens or adjustments colour — switching between Yang (demand dominance) and Yin (provide dominance). Filters small noise whereas highlighting sentiment flips and key swing ranges.

- Use when: You need to visualize provide–demand shifts and pattern reversals with out time noise.

- Parameters: Reversal measurement (absolute or ATR-based). Bigger = smoother; smaller = extra turns.

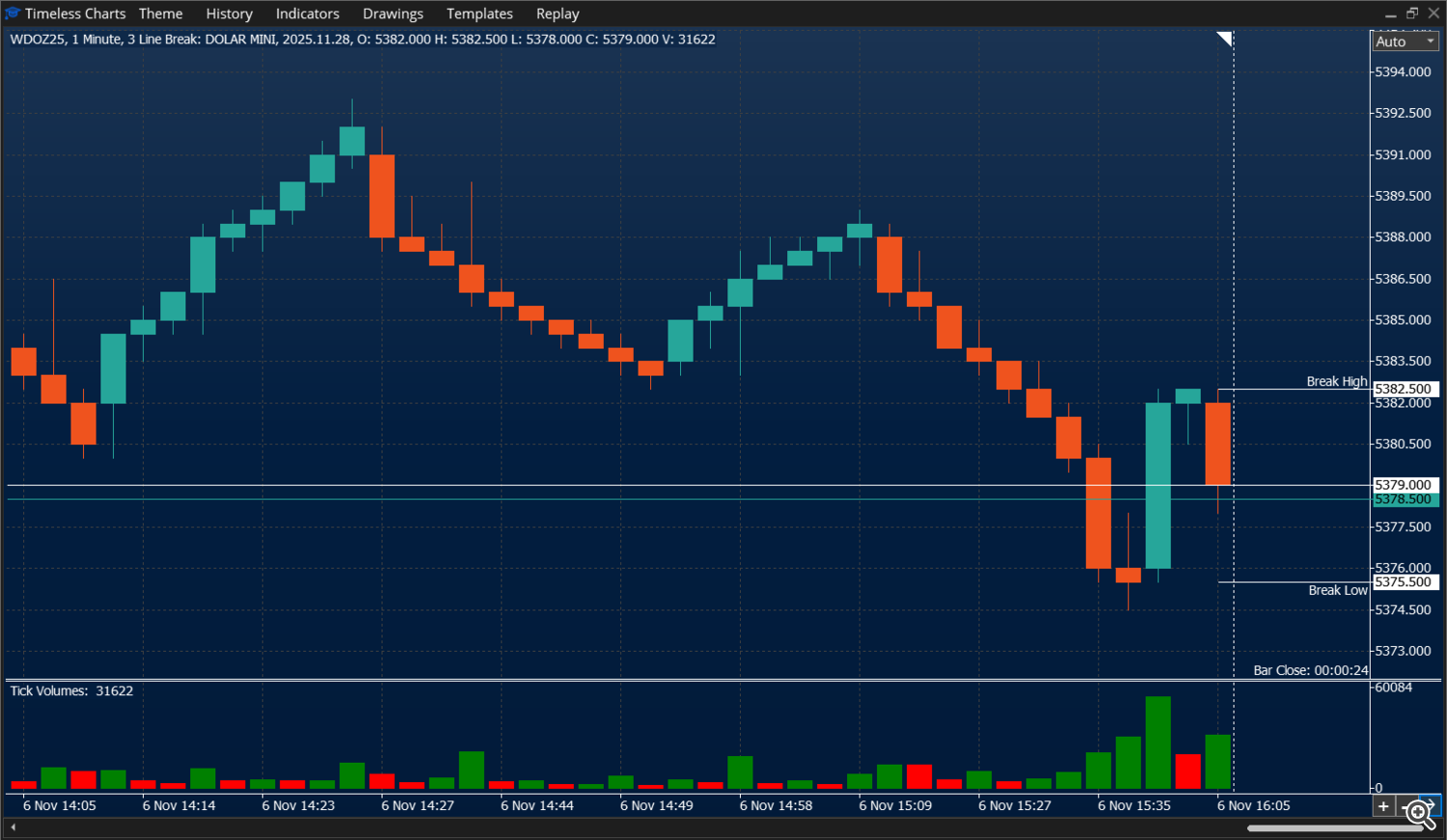

Rule: Reversal-Primarily based

Line Break

Attracts a brand new up/down line provided that the shut breaks the intense of the final N strains (basic is 3). This ignores minor back-and-forth and focuses consideration on decisive pushes.

- Use when: You favor a easy, time-free strategy to spot momentum shifts and pullback completions.

- Parameters: Variety of strains (N). Increased N = stricter affirmation, fewer however stronger indicators.

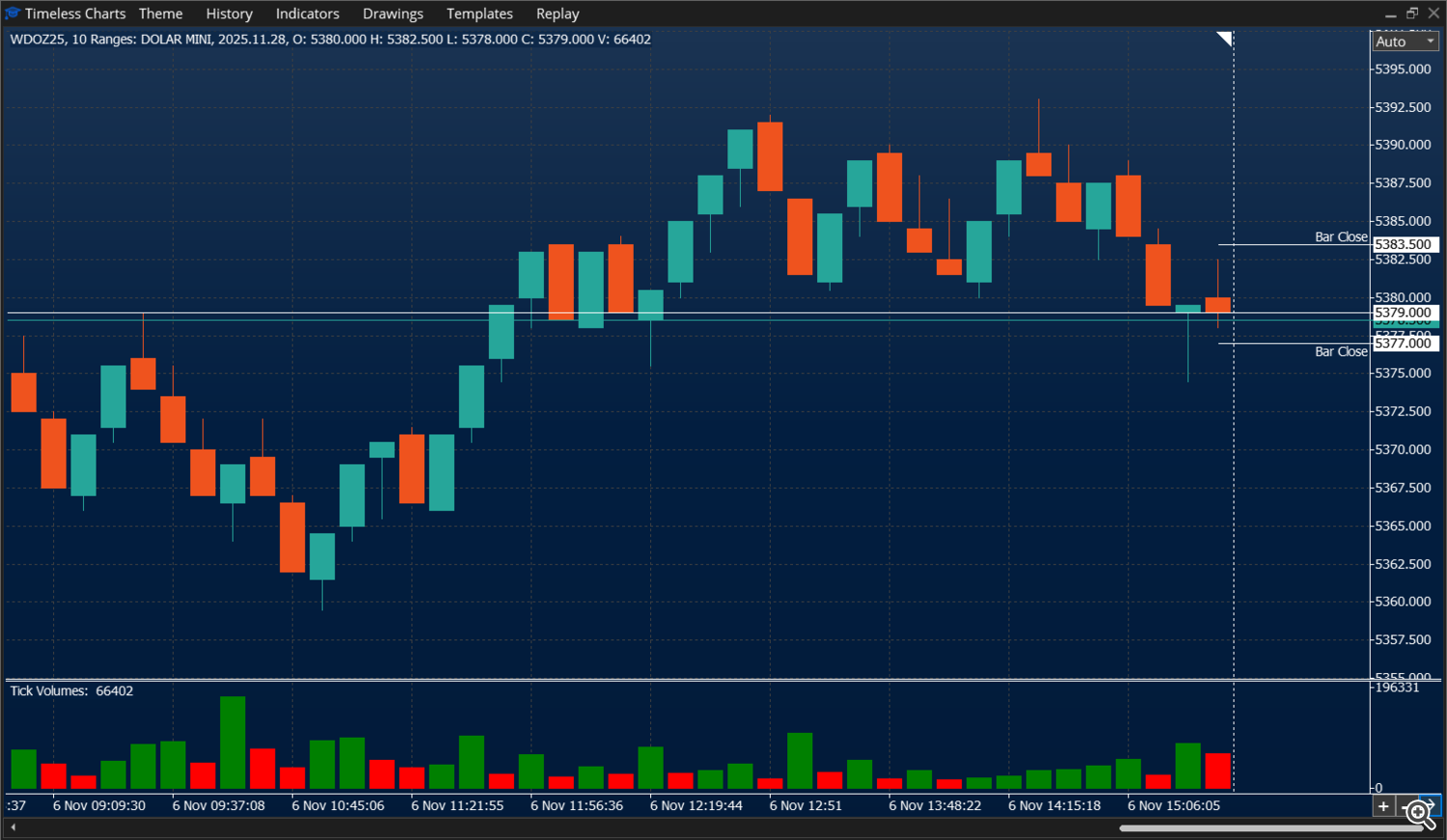

Rule: Volatility-Primarily based

Vary Bars

Every bar spans a hard and fast excessive–low vary (e.g., 10 ticks). As soon as the vary completes, the bar closes and a brand new one begins. Normalizes transfer measurement and removes time distortion from quick/sluggish intervals.

- Use when: You need normalized volatility and clearer sample repetition throughout situations.

- Parameters: Vary peak (ticks/factors). Take into account ATR-relative sizing throughout devices.

Rule: Exercise-Primarily based

Ticks / Trades Bars

Every bar incorporates precisely N trades (ticks). Construction aligns with transaction depend, not time, revealing bursts of exercise and quiet patches instantly.

- Use when: You need to anchor construction to commerce frequency and spot participation spikes.

- Parameters: Trades per bar (N). Pair with filters (e.g., session, instrument) for consistency.

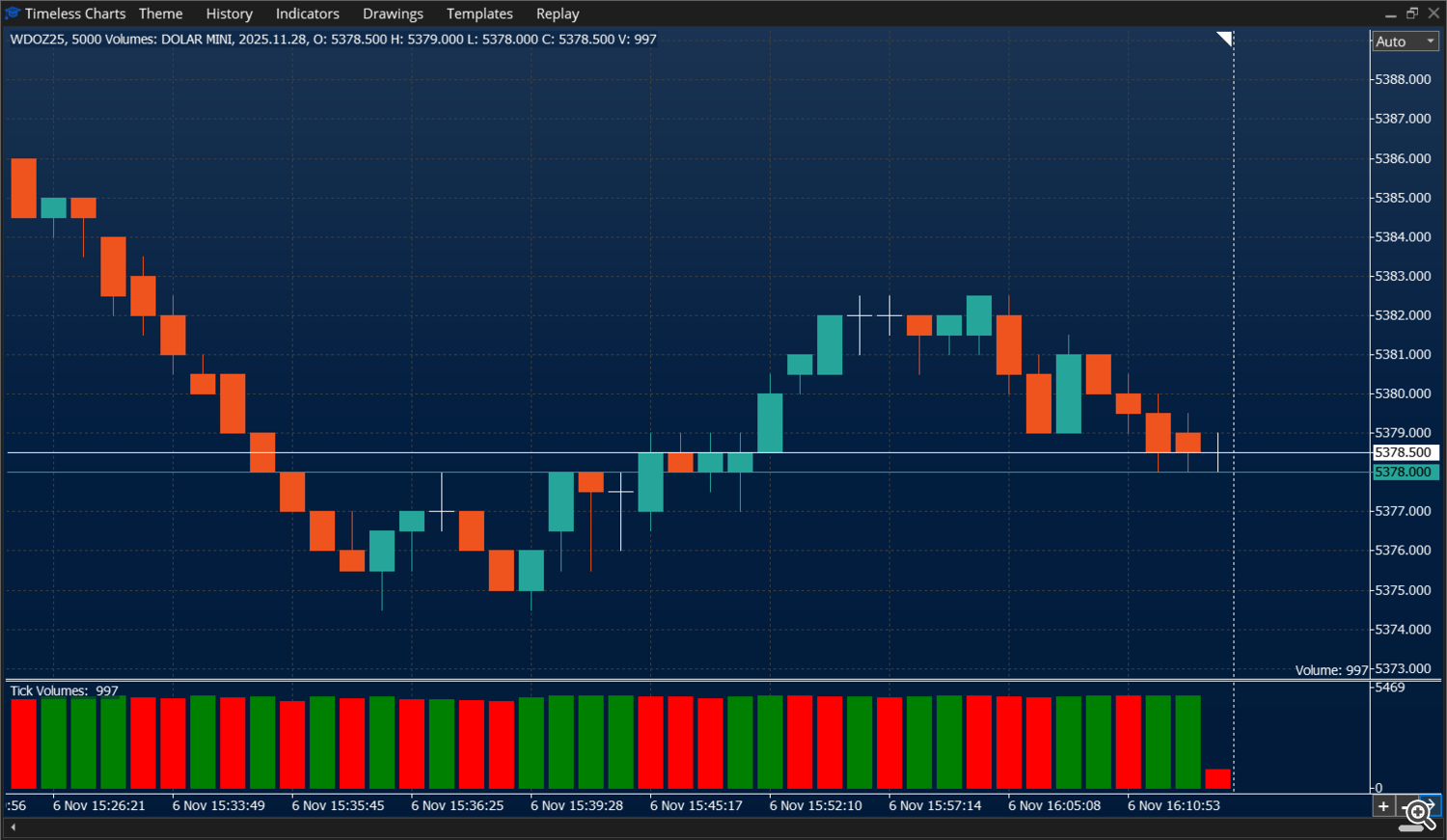

Rule: Exercise-Primarily based

Quantity Bars

Every bar accumulates precisely N models of quantity/contracts. Bars end sooner throughout heavy buying and selling and slower throughout quiet intervals, aligning construction with traded measurement.

- Use when: You care about participation and need bars to mirror precise measurement shifting the market.

- Parameters: Quantity per bar (N). Take into account ATR/average-volume guides throughout devices.

Selecting a Formation Rule

- Want session timing? Begin with Time.

- Need clear traits? Renko (distance) or Vary (H–L).

- Buying and selling swings/breakouts? Level & Determine, Kagi, Line Break.

- Give attention to participation? Tick or Quantity bars.

Tip: Many merchants pair a timeless chart for construction with a time-based chart for session context.

Timeless Bars + Order-Move

As soon as bar formation encodes significant motion, add footprints/clusters (Bid×Ask, Delta, trades), quantity profiles, and VWAP for execution clues—absorption, imbalances, and initiative vs. responsive flows. Be taught extra within the Footprint Chart Information.

Strive Timeless Charts on MT5

Deliver skilled charts to MetaTrader 5 — seconds timeframe, timeless chart varieties, footprints, and quantity evaluation.

Contains built-in technical indicators, drawing instruments, market replay, commerce panel, world crosshair and world drawings — all in a single MT5 utility.