- Information analytics and Transaction Value Evaluation (TCA) have turn into basic to the FX market.

- Analytics are presently utilized in pre- and post-trade, informing higher determination making.

- The adoption of AI allows technologically superior companies to simply seize and analyse extra information from extra counterparties and markets – giving them an info and workflow benefit.

LSEG FX not too long ago printed the second analysis report in a two-part sequence, FX Priorities for 2025 By analyzing the main focus areas cited by FX buying and selling companies, this analysis permits market individuals to benchmark themselves in opposition to broader market traits and determine options obtainable to drive progress and stay aggressive.

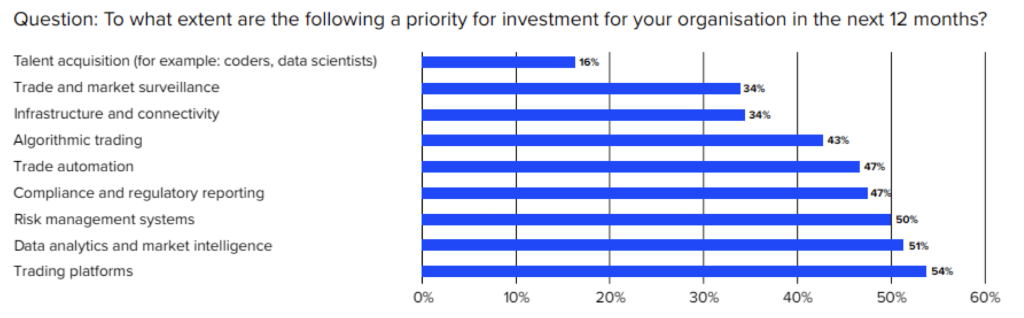

A key precedence recognized within the report is the significance of knowledge analytics. Of the 400 FX professionals surveyed world wide, over half are prioritising and investing on this space. (see chart beneath)

Past the quote: a brand new period of FX transparency

Proving greatest execution is extra than simply receiving 5 quotes in competitors and buying and selling on the most effective worth. It has pushed companies to take a look at the overall value of a commerce, and TCA is now broadly used within the FX business by all varieties of companies.

This rising reliance on TCA is reshaping how companies consider execution high quality and continues to evolve, as noticed by Alex Goraieb, Head of FX Information, Analytics and Pre-trade Workflows at LSEG FX: “There may be a whole lot of speak about TCA in the intervening time, which wants excellent information to drive the analytics. It virtually feels that now there’s, an emergence of recent suppliers on this area that enable much more transparency throughout the liquidity obtainable and how one can interact with that liquidity.”

The benefit of trusted information and algos

The supply of extra FX information and higher know-how has pushed using buying and selling algorithms, which allow companies to commerce extra effectively and cut up FX trades into smaller sizes to scale back footprint.

Nonetheless, the provision of companies which analyse the efficiency of algos is driving adoption. Alex Goraieb mentioned: “The information doesn’t lie. The analytics will present the trail, and so both it should inform them the algo is just not fairly delivering what it promised, or that the algos are delivering a greater efficiency over what they used to do.”

The mixing of analytics into pre-trade workflows can also be reworking algo choice and utilization. Romael Karam, Director of Hedge Fund Technique at LSEG FX expanded on this: “In post-trade you’ll be able to take a look at how algos have carried out, and you’ll take a look at that in opposition to an entire vary of various parameters and completely different benchmarks. However the actually highly effective piece is the pre-trade answer that we now have delivered in Workspace, with our companions, Tradefeedr. Shoppers can evaluate and verify precisely which algo or group of algos they need to be contemplating, for various market environments. Utilizing this service shoppers may even analyse whether or not or not they need to use an algo for particular currencies or market circumstances. Finally it provides shoppers the arrogance to make use of algos extra actively.”

Alex Goraieb commented on how completely different companies are utilizing the info analytics: “I’ve had a whole lot of conversations with massive corporates and asset managers round this matter, and in lots of instances it’s about transparency and shoppers understanding the fashions earlier than they decide to utilizing them. Up to now you solely discovered how good a mannequin was while you’ve truly used it repeatedly and also you seemed on the outcomes. So having a robust suite of analytics and information that has discovered from the expertise of everyone that’s gone earlier than is useful. This implies that you could decide which is the easiest way to mitigate the chance on the commerce for any explicit circumstance.”

The subsequent frontier for AI in FX buying and selling

With FX buying and selling companies specializing in innovation and investing in subsequent gen options, the market will proceed to evolve and incorporate using AI to tell higher determination making.

instance of that is within the pricing of FX Swaps, the place companies are capturing information from a number of sources to assist them construct extra correct curves. This contains information regarding FX Swaps and Forwards, FX Spot, STIR Futures, OIS, IRS and Cross-Foreign money Foundation Swaps. Up to now it will not be attainable to seize and analyse all of those information sources, however as know-how and AI have superior, a small however rising variety of companies are analysing all of this information in real-time to provide them an info benefit.

Now that we now have pre- and post-trade analytics, the subsequent probably step is to make use of information analytics throughout a commerce. Bart Joris, Head of Promote-side Buying and selling at LSEG commented, “We’re very nicely acquainted out there with analytics and TCA. Nowadays we’re utilizing TCA in pre- and post-trade. What’s the subsequent actual evolution? What you’re going to have is at-trade TCA. Once you do your execution, it is possible for you to to make use of analytics to see in real-time how the commerce is progressing and to remain knowledgeable in case it is advisable to change your execution technique.”

The quotes on this article are from an interview carried out in July 2025.

To request a duplicate of the second version of LSEG’s international FX analysis please scan the QR code.