When Costco (COST), Utilized Digital (APLD), and Zoom Communications (ZM) all present up on the identical bullish watchlist, you have got two selections…

Ignore the sign as a result of they’re from fully totally different sectors…

Or acknowledge what’s taking place beneath the floor and dig deeper. I recommend that you just do the latter proper now.

We’re getting into a brand new stage in market evolution. Synthetic intelligence isn’t a future thought or one simply reserved for Wall Avenue’s cutting-edge companies. It’s already altering how high-probability setups are noticed and traded by merchants such as you and me.

From Three-Ring Binders to Actual-Time Sign

I’ve lived by way of a number of transitions on this business. I’ve watched firsthand how know-how separates the merchants who adapt from those that get left behind.

Again within the early ’90s, once I labored as a dealer at Prudential Securities, each commerce was handbook. My mentor – Andy – had me replace a three-ring binder full of graph paper that folded out with the closing costs of shares we traded. I might use a pencil and a ruler to replace costs day by day from the Quotron. That’s how we discovered tendencies.

Ralph Acampora – the Godfather of Technical Evaluation would add further perception. My “information feed” got here from a squawk field on my desk, broadcasting market commentary from Larry Wachtel.

If I wished to position a commerce, I’d decide up the telephone, name the buying and selling desk, write up the ticket, and stroll it down the corridor. All whereas juggling shopper calls and account administration.

Quick ahead 30 years, and the issue isn’t pace anymore. It’s an overload. What was once a lack of knowledge is now a scarcity of filtration. And that’s the place synthetic intelligence can are available for the help.

Enter: Monster AI

Throughout Wednesday’s Monument Merchants LIVE occasion, Nate Bear and Ryan Fitzwater launched the brand new Monster AI system developed by Jon Najarian’s staff. Monster AI makes use of synthetic intelligence to filter by way of huge volumes of market knowledge with its proprietary modeling to generate a clear, directional outlook for any inventory.

The system assigns a bullish or bearish prediction, features a confidence rating, and pairs that with a particular choices commerce that aligns with the forecast.

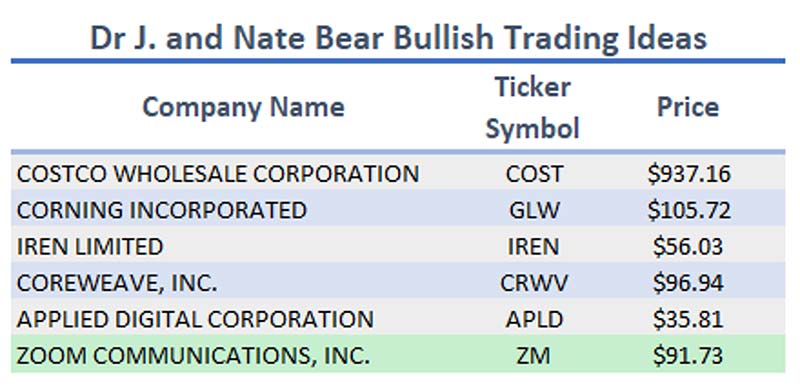

Through the session, a number of shares had been flagged by the system – together with Zoom (ZM), Corning (GLW), Costco (COST), Utilized Digital (APLD), CoreWeave (CRWV) and Iren Restricted (IREN).

And one particularly stood out…

My Favourite Thought from Monster AI: Corning (GLW)

Monster AI tagged Corning as a bullish commerce thought on January 14, 2026, suggesting the February 20, 2026, $90 name. That paid off properly. However I feel there’s extra.

Corning isn’t flashy, however its AI publicity and development story are structurally sturdy. Whereas it’s not constructing chips or coaching fashions, Corning’s fiber-optic and superior supplies know-how type crucial infrastructure behind the scenes.

The corporate provides next-gen optical connectivity to hyperscalers like Amazon and Google, powering the high-bandwidth, low-latency atmosphere AI workloads demand.

It’s not a headline identify – but it surely’s crucial. And primarily based on the latest technical breakout, the market is lastly beginning to acknowledge that.

This Below-the-Radar AI Inventory Is Again on the Transfer

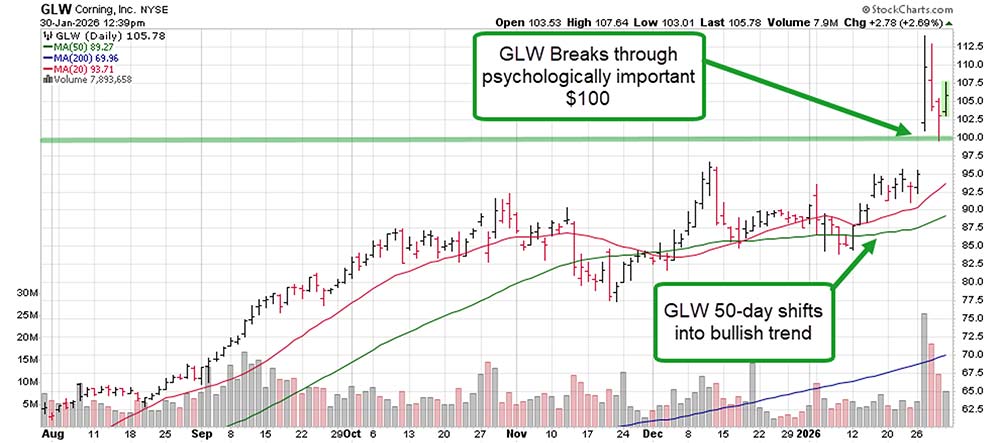

Technically, Corning simply broke out of a short-term buying and selling vary capped at $95, rallying decisively above $100. That breakout cleared a psychologically important round-number stage and shifted the inventory’s 50-day transferring common into a brand new bull market pattern.

The final time GLW’s 50-day pattern turned bullish was in Might 2025, triggering a 96% rally into the December highs. Historical past might not repeat precisely, however technically and basically, Corning is in movement once more.

![]()

YOUR ACTION PLAN

I like to leverage long-term momentum like this with a long-term name. On this case, I’m eyeing the September 18, 2026, GLW $115 calls buying and selling simply above $1,200 per contract.

This could present sufficient time premium to experience volatility spikes with out forcing early exits. My loss restrict plan contains utilizing technical patterns – a detailed beneath $100 or $95.

If Corning’s shares commerce at $150 earlier than Might 2026, this feature could be valued at roughly $3,808 per contract, primarily based on Black-Scholes calculations.

After all, choices buying and selling includes important threat and isn’t appropriate for all buyers. Perceive the dangers and prices earlier than participating in any choices methods.

FUN FACT FRIDAY

Right this moment’s brutal 30% silver crash feels apocalyptic, but it surely’s not even near the all-time document. On “Silver Thursday” (March 27, 1980), silver plunged over 50% in a single session – from $21 to $10.80 – when the Hunt brothers’ epic market nook spectacularly exploded.

That legendary massacre nonetheless holds the crown for silver’s worst single-day bloodbath in historical past.