If you purchase one thing by one of many hyperlinks on our web site, we might earn an affiliate fee.

“Effectively duh, backtesting outcomes is if you make 1,000,000% return.”

That is what many new merchants suppose and that is why over 90% of merchants fail.

If you wish to change into a profitable dealer, you are going to should learn the way correctly consider a buying and selling technique and regulate your notion of what’s backtesting consequence.

Spoiler alert: Most profitable buying and selling methods begin off as mediocre and even poor.

However by continuous testing and iteration, they’re made into worthwhile methods.

Identical to profitable merchants are made, not born…profitable methods require an funding of effort and time.

The place to Begin

The very first thing to grasp about backtesting is that the majority profitable buying and selling methods did not begin out that means.

An awesome buying and selling technique is rather like any nice invention.

It begins with an thought and the inventor needs to resolve an issue.

Merchants wish to resolve the issue of creating wealth constantly within the markets.

You’ll in all probability should refine your buying and selling technique thought to make it worthwhile.

When you perceive that buying and selling methods hardly ever begin off as worthwhile, it then is sensible that breakeven backtesting or barely worthwhile outcomes can really be factor.

If a technique is breakeven (or near it), then you definately simply might need to do a couple of tweaks to get it to worthwhile.

Many instances, experimenting with cash administration or exits could make a technique worthwhile.

With that in thoughts, listed below are extra particulars on what to search for in your testing outcomes.

Historic Knowledge Utilized in Backtests

Earlier than I get into analyzing your precise backtesting outcomes, one necessary factor to think about is how a lot historic information was utilized in your backtests.

Many backtesting platforms solely provide you with 1 or 2 years of backtesting information.

This isn’t almost sufficient to determine how a technique will carry out over completely different market situations and cycles.

So if you’re backtesting, get as a lot historic information as attainable.

Outline a Evaluation Interval

After getting loads of historic information to check with, be sure you outline your evaluate interval in your methods.

If you’re creating a technique on the every day chart, you may wish to evaluate the returns on a yearly foundation.

Now in case you’re testing on the 1 hour chart, you need to in all probability evaluate your month-to-month outcomes.

Then work out your common return per your evaluate time interval.

You in all probability will not be worthwhile in each evaluate interval, however you wish to see what kind of drawdowns you will should endure and what to anticipate from the buying and selling technique.

This evaluation will can help you examine buying and selling methods in an goal method and decide which methods you could wish to pursue and which of them to drop.

Set a Objective

Now it is time to determine what issues to you.

A “good” buying and selling technique must be good for you and no one else.

It will not essentially be probably the most worthwhile or probably the most constant.

But when it meets your revenue wants, then that is all that issues.

A phrase of warning right here…

Many merchants (myself included) begin out with unrealistic targets for his or her methods.

So set a objective, however you may end up having to regulate what you anticipate out of one buying and selling technique.

You might need to commerce a number of buying and selling methods or markets to get the outcomes you are in search of.

Do not get discouraged nonetheless, in case you hold working the outcomes will come.

The right way to Determine Buying and selling Methods with Potential

There are 3 primary kinds of backtesting outcomes:

- Horrible

- Breakeven

- Worthwhile

Now I will outline every and present you what to search for in every.

A Horrible Backtesting Outcome

This one is clear.

If the technique loses 80% of the account or extra, then you definately in all probability should not spend any extra time with it.

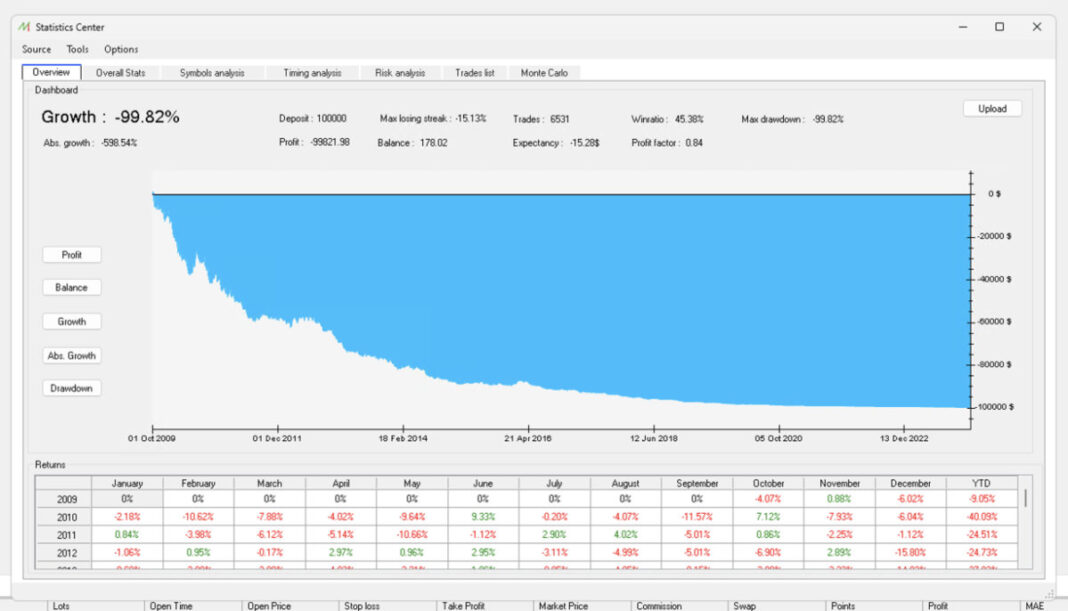

The technique above misplaced 99.82% from 2009 to 2024.

That is as dangerous because it will get.

Attempting to optimize a technique with a horrible result’s like sprucing the brass on the Titanic.

It is best to maneuver on and use your time and mind energy to create a brand new technique.

A Breakeven Backtesting Outcome

This is the place issues get thrilling.

Most new merchants will throw away a breakeven technique, however not you since you’re studying this text.

A breakeven technique can probably be optimized and made rather more worthwhile.

It would simply want a tweak or two to work properly.

Listed here are some inquiries to ask when attempting to enhance a technique:

- Are you able to eradicate the largest losers simply?

- Do dropping trades have a typical attribute? Perhaps they go longer than 2 days or they’re taken throughout a sure time of day.

- What occurs in case you set a much bigger revenue goal?

- Are you able to improve your cease loss, whereas risking the identical share of your account, so you aren’t getting stopped out so typically?

- Will utilizing a trailing cease loss enhance your outcomes?

- How do your outcomes change of you improve or lower your threat per commerce? It might be counterintuitive, however decreasing your threat per commerce can typically improve your complete return.

These are the main issues to think about when attempting to enhance the efficiency of a technique.

However do not cease there, what else are you able to consider?

A Worthwhile Backtesting Outcome

Now we get to the consequence that everybody is in search of, a worthwhile consequence on the primary attempt.

It does not occur typically, however it’s attainable.

I’ve solely had a massively worthwhile consequence on the primary attempt…twice.

However even when your outcomes had been worthwhile, you possibly can’t cease there.

You must double test your outcomes.

Actual world buying and selling may fluctuate dramatically from backtesting outcomes in case you do not account for all the pieces.

Take into account the next:

- Did you correctly account for commissions, unfold, slippage and charges?

- Will you be awake to take trades once they setup?

- Did you observe the buying and selling plan?

- Did you run a Monte Carlo simulation to see your most potential drawdown?

As soon as you have verified that your outcomes are good in a program like NakedMarkets, Foreign exchange Tester or FX Replay, congratulations, you now have a worthwhile buying and selling technique.

Now it is time to transfer on to Ahead Testing to make sure it really works.

This can be a key step to creating completely positive that your technique works earlier than risking your full buying and selling capital.

However do not cease there.

Proceed to check methods to probably make your technique higher.

See in case you can improve the return or lower the drawdowns.

Choose the one which’s extra necessary to you.

Take into account buying and selling 2 or 3 variations of your technique on the identical time to diversify your threat.

When you’re buying and selling your technique along with your full-sized account, then you possibly can repeat the method to seek out one other worthwhile technique.

Last Ideas

Once more, you in all probability will not get a brilliant worthwhile backtesting consequence in your first attempt.

The bottom line is to have the ability to spot the diamonds within the tough.

From there, you possibly can work on growing every technique to its most potential.

It is also necessary to have the ability to work out which methods won’t ever work and cease attempting to enhance them immediately.

Do not forget that buying and selling methods often are likely to carry out somewhat worse in actual life.

So account for that and do not get too enthusiastic about an enormous return.

Earlier than I’m going, I will depart you with a dialog that we had about this subject on the Assume Revenue Podcast.

It provides you with extra concepts on what to search for if you’re backtesting.