On this dialogue with Vladyslav Grabarskyy on the Wealth Constructing Blueprint podcast, I stroll by way of the technical circumstances that proceed to level to rising threat within the fairness markets and an essential rotation happening beneath the floor. The charts present clear indicators of stress throughout a number of main sectors, together with the AI-driven leaders and components of the cryptocurrency area, which frequently seem forward of broader market shifts.

We additionally take an in depth take a look at gold, silver, and the important thing ranges which have traditionally preceded important strikes. Valuable metals proceed to point out robust long-term constructions as capital searches for stability. From there, we discover the setups creating in mining shares, copper, uranium, oil, and pure fuel, and the way these developments match into the bigger market cycle. The main focus of this dialog is knowing what the market is definitely signaling and why being ready for main transitions could make a significant distinction for long-term traders.

Join my free Investing publication right here

The subjects Vladyslav and I mentioned embody:

- 00:00 – Introduction

- 00:55 – U.S. Financial Outlook, Valuable Metals, Monetary Disaster, Worry, Uncertainty & the U.S. Greenback

- 02:28 – Inventory Market Outlook: AI Shares & Making ready for a Main Upcoming Reset

- 04:28 – Chris’s Technique

- 05:22 – Charts Do Not Look Wholesome for the Inventory Market & Why Chris Is Ready on the Sidelines

- 07:44 – Bitcoin: Chart Sample of Instability & Why Chris Stays Away from Bitcoin

- 09:40 – Gold: The Large Upcoming Transfer That May Sign a Peak — Analyzing Fibonacci Ranges

- 11:51 – Rotation of Capital From the Inventory Market Into Gold, Value Targets & The right way to Play This Transfer

- 14:48 – How Far Can This Gold Bull Market Go? Is This the Final Push Earlier than a Main Pullback?

- 16:50 – Silver: Is Silver’s 45-Yr Cup-and-Deal with Sample Utterly Irrelevant?

- 17:58 – May Silver Blow Off to $80 per Ounce within the Subsequent 1–3 Months?

- 19:48 – Mining Shares: Giant Caps vs. Juniors, Bubble Part & Potential Sharp Pullback

- 22:38 – Junior Miners Haven’t Reached Earlier Peaks — Does This Imply We’re Not Close to the Prime But?

- 23:52 – How Chris Expects Gold to Carry out Over the Subsequent Few Years (Detailed Breakdown)

- 25:33 – Copper & Uranium Outlook & Why Every thing Appears to be like Frothy

- 26:43 – Oil & Pure Gasoline: Why Oil May Drop to $40 per Barrel or Decrease

- 29:09 – Portfolio Methods To Survive This Reset 33:40 – Placing Every thing Collectively

Able to be taught extra about what I do to remain calm throughout chaos? Click on the hyperlinks under!

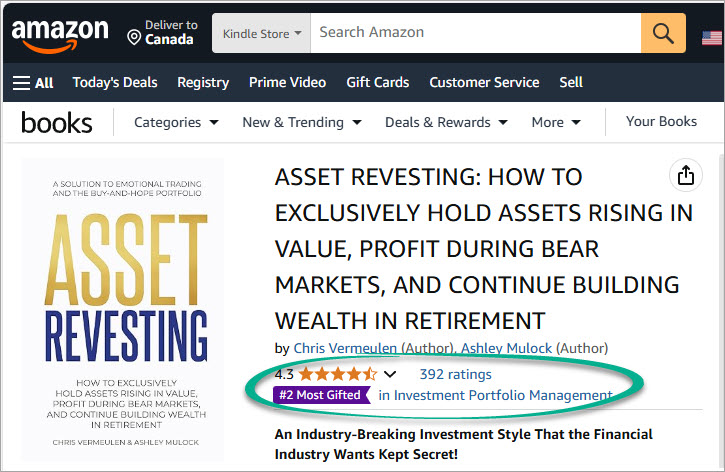

CHRIS VERMEULEN’S PREMIUM ASSET REVESTING SIGNALS:

https://thetechnicaltraders.com/investment-solutions/

Espresso cheers!

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

Disclaimer: This electronic mail is meant solely for informational and academic functions and shouldn’t be construed as customized funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Change Fee or any state regulator. The content material supplied doesn’t represent a advice to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to alter with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions might change at any time with out discover. Readers are solely chargeable for their very own funding selections. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding selections. Efficiency outcomes referenced might embody each dwell buying and selling information and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t replicate precise buying and selling. No illustration is being made that any account will or is prone to obtain income or losses much like these proven. Testimonials and endorsements included on this communication will not be consultant of all customers’ experiences and are usually not ensures of future efficiency or success. We might obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material supplied is normal market commentary and never tailor-made to any particular person’s monetary scenario. Previous efficiency shouldn’t be indicative of future outcomes. Investing includes threat, together with the potential lack of capital.