It took a short time to determine, however after occupied with it for a day, merchants lastly determined to get (again) on the bullish bandwagon. The S&P 500 gained one other 1.2% final week to mark the third weekly win in a row. It’s additionally now deep into record-high territory, defying the calendar in addition to the truth that valuations have reached wild ranges. By no means even thoughts the truth that shares are so technically overbought right here.

This might be thought of a meltup. And the difficult half about meltups is, you by no means actually know and the place they’re going to finish. There’s sure room for shares to maintain shifting increased from right here, nevertheless, as uncommon is it may be to rally 38% in lower than six months with out something even type of like a correction.

We’ll dissect all of the technical unlikelihoods and odds in a second. Let’s first take a look at final week’s financial reviews.

Financial Knowledge Evaluation

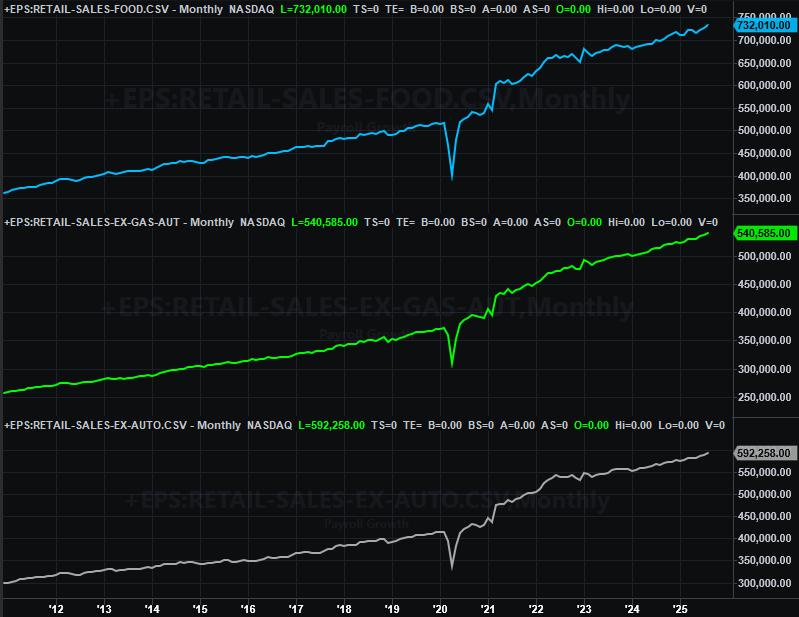

Final week’s large information was after all the Federal Reserve’s determination to chop the Fed Funds price by one-quarter of a degree, nevertheless it wasn’t the one noteworthy financial information from final week to digest. On Tuesday, for example, we heard about August’s retail gross sales. Retail spending has been trending increased at a constant even when modest tempo. That didn’t change this time round. At the least shoppers are doing their half to maintain the financial system shifting ahead.

Retail Gross sales Charts

Supply: Census Bureau, TradeStation

Additionally on Tuesday we heard final month’s capability utilization and industrial manufacturing figures. Economists weren’t anticipating a lot change from July’s lackluster ranges, and that’s precisely what we received. The issue is, that’s nonetheless an issue. Industrial output is stagnating at present ranges, and using the nation’s manufacturing unit capability continues to broadly dwindle. It’s uncommon for this to be the case and likewise see company earnings proceed rising for very lengthy.

Industrial Manufacturing, Capability Utilization Charts

Supply: Federal Reserve, TradeStation

And as may have been anticipated given the present situation of the true property market, housing begins in addition to constructing permits each fell in August, and each rolled in measurably decrease than anticipated. And permits are plunging, reaching one other multiyear low final month. Actual property’s woes are plain now. It’s only a query of how a lot ripple impact it’s going to have on the remainder of the financial system.

Housing Begins, Constructing Permits Charts

Supply: Census Bureau, TradeStation

The biggie from final week after all was Wednesday’s price reduce determination, and the acknowledgement that extra could also be on the best way. Traders weren’t fairly certain what to initially make of the language, attempting to determine if the transfer was a warning of financial headwinds or a motive to anticipate bullishness. When all was stated and performed, merchants selected bullishness.

The whole lot else is on the grid.

Financial Knowledge Report Calendar

Supply: Briefing.com, TradeStation

Actual property’s present headwind could also be confirmed this week, with Wednesday’s take a look at final month’s gross sales of latest properties, adopted by August’s gross sales of present properties on Thursday. Forecasts are calling for slight declines of each, though these declines could be from already-low ranges.

New, Present Residence Gross sales Charts

Supply: Bureau of Labor Statistics, TradeStation

Search for the Convention Board’s measure of shopper confidence on Friday. It’s prone to roll in at August’s ranges once more, though the larger pattern remains to be suggesting broad deterioration.

Shopper Sentiment Charts

Supply: Convention Board, College of Michigan, TradeStation

The College of Michigan’s third and ultimate sentiment determine for September is coming subsequent week.

Additionally word that on Friday we’ll hear final month’s shopper spending and private revenue knowledge for final month (which performs an enormous position within the Fed’s choices concerning rates of interest). Each items of knowledge have confirmed financial power, and are anticipated to do the identical once more this time round.

Inventory Market Index Evaluation

Buckle up. There’s lots to speak about this week.

Let’s begin with a take a look at the weekly chart of the S&P 500 just because it’s necessary to color the image with the larger, broad brush strokes first. From this vantage level we are able to that was beforehand a help line that became a resistance line (yellow, dashed) is now not resistance. The index hurdled it final week (see the purple circle). Discover there’s nothing else to face in its method now.

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

It’s actually sort of wild whenever you take a step again and give it some thought. The S&P 500 is now up 38% in lower than half a 12 months, and remains to be going at a time of 12 months that’s sometimes bearish. That stated, whereas the chances of bearishness are excessive right here, when the market isn’t falling in September, it’s usually racing increased.

Nonetheless, whereas the momentum is bullish and there’s room to run, the chance of a sizeable pullback remains to be uncomfortable.

Simply don’t rely on essentially seeing one quickly. Though it’s doable, the form of final week’s bars purchased simply sufficient time to let the bulls hold going.

Wednesday is the important thing. Though the FOMC’s determination will get 100% of the credit score, the form of the bar (highlighted in yellow) the place the open and shut have been proper in the midst of the each day bar — a doji — signifies a pivot (albeit a small one) and a reset of merchants’ mindsets. On this occasion the bears had an opportunity to lastly flip the tide, and after occupied with it for a bit, they didn’t. The ceded management again to the bulls, restarting the clock, so to talk.

S&P 500 Every day Chart, with Quantity and VIX

Supply: TradeNavigator

The NASDAQ Composite seems to be in the same scenario, though not an identical.

Because the composite’s weekly chart reveals us, the breakout thrust from two weeks again noticed follow-through final week, but there’s nonetheless room earlier than bumping into the technical ceiling that connects all the important thing highs going again to 2023 (purple, dashed). That resistance is at the moment round 23,400 (marked in purple), and rising. On the very least you possibly can anticipate to see the bears attempt to push again there.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

And it would even occur before that, if it’s not already occurring. Because the each day chart of the NASDAQ Composite illustrates, after Wednesday’s bullish hammer-shaped bar, the index stopped rallying when it ran right into a near-term resistance line (yellow, dashed) that connects the important thing peaks since late-July.

NASDAQ Composite Every day Chart, with Quantity and VXN

Supply: TradeNavigator

So what will we do with all of this conflicting perspective? Good query. The calendar and sheer scope of the rally since mid-April nonetheless weighs on every little thing right here, even when the momentum is technically bullish. This after all solely makes shares much more ridiculously costly, and leaving all of them the extra weak to a pullback.

Nonetheless, even when the market stumbles from all the burden it’s carrying, it’s additionally proven us that it’s not prepared to surrender an excessive amount of floor. We’re seemingly in an setting the place excellent news is sweet, and dangerous information is sweet since it’s going to encourage dovishness from the Federal Reserve. That’s why we’re relying on a fast restoration within the occasion of any promoting, which is able to very doubtless begin with a pullback to 1 or any of the shorter-term shifting common strains.

In different phrases, at this level it’s the bears that must show themselves {that a} selloff is taking form. It can take the failure of a number of shifting common strains to be convincing. Barring that, we have now to lean bullishly and purchase when any pullback appears to be stabilizing and reversing. A agency thrust from the volatility indices will assist ship that message.

And sure, given the backdrop, that is loopy. You simply can’t afford to struggle the tape… not till it’s crystal clear the tape is lastly shifting within the different path.