The market simply suffered its first dropping week up to now eight. And but, the larger development continues to be bullish. It could be much more bullish now than it was as of per week earlier, actually, in gentle of the place the bulls drew their strains within the sand final week. Some older and well-established technical assist strains proceed to maintain the market propped up. The extra they do, the extra solidified the advance turns into.

The largest shock? How nicely shares did throughout a month that’s unhealthy extra usually than good.

Positive, the market’s much more technically weak to a pullback now than it was a month in the past, with steep valuations additional weighing on shares. We must pay the proverbial piper ultimately.

Shares have a humorous approach of climbing a wall of fear although.

We’ll dissect the state of affairs in a second. Let’s first run via final week’s financial stories and take a look at what’s within the pipeline for this week.

Financial Knowledge Evaluation

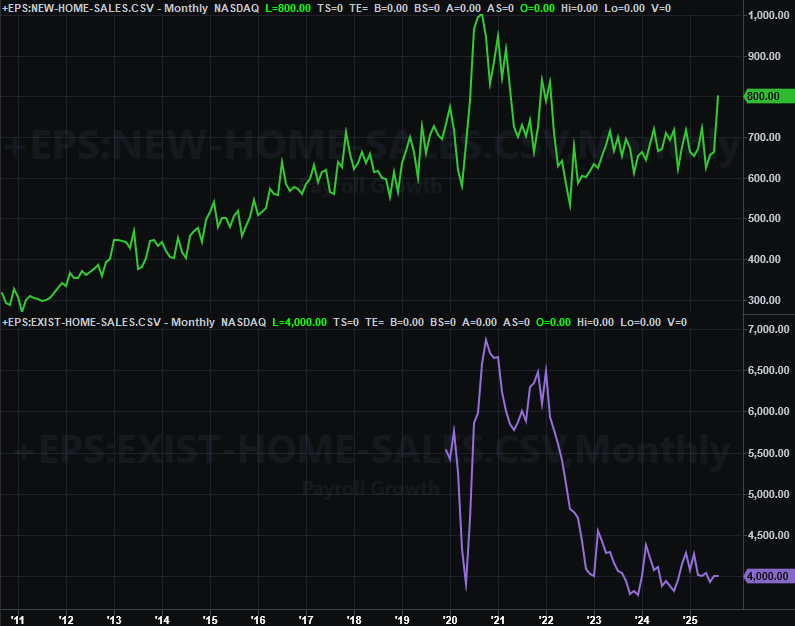

Most of final week’s financial information was surprisingly good, beginning with Wednesday’s take a look at final month’s gross sales of latest properties; we obtained present dwelling gross sales numbers on Thursday. Gross sales of present properties rolled in at 4.0 million, down only a hair from July’s determine, and a tad higher than forecasted. New dwelling gross sales, nonetheless, soared from 664,000 to 800,000 in August, blowing estimates of 649,000 out of the water. Credit score vendor’s beneficiant incentives and value breaks, principally, nonetheless. The business could also be fearing a little bit of a pile-up in stock at a degree when financial lethargy takes a fair larger toll. (This fear was lifted a minimum of a little bit bit in September, in fact. In different phrases, don’t search for a repeat of this energy for this month.)

New, Present Residence Gross sales Charts

Supply: Bureau of Labor Statistics, TradeStation

We’re not charting it right here, however do know that the private spending and earnings knowledge for August each stay wholesome. This has an affect on the Federal Reserve’s Fed Funds Fee, which in fact fell 1 / 4 of a degree per week earlier, and is predicted to edge a little bit decrease nicely into subsequent yr. It’s additionally price mentioning that the third and remaining estimate of Q2’s GDP progress was raised from 3.3% to three.8%. So, the financial system is buzzing greater than the pessimists appears to want it was.

Every little thing else is on the grid.

Financial Knowledge Report Calendar

Supply: Briefing.com, TradeStation

This week’s going to be a comparatively busy one as nicely, beginning with Tuesday’s take a look at the July’s dwelling costs. The FHFA Residence Value Index has been drifting decrease since March, and it considerably appears to be like just like the Case-Shiller Index is peaking (once more) now. Given the backdrop and what we find out about builders dropping costs simply to maneuver stock, it’s doubtless we’ll see a little bit of weak point by way of costs.

Residence Value Index Charts

Supply: FHFA, Nationwide Assn. of Realtors, TradeStation

Simply bear in mind this this dwelling value knowledge solely displays properties which have transacted. It doesn’t point out assessed values or asking costs.

We’re additionally going to listen to September’s studying of the Convention Board’s measure of client confidence on Tuesday. We really obtained the third and remaining look the College of Michigan’s sentiment rating for this month on Friday of final week. It fell a bit, because the Convention Board’s measure is predicted to do as nicely. And in each instances, it will lengthen bigger-picture downtrends which have been in place for some time.

Client Sentiment Charts

Supply: Convention Board, College of Michigan, TradeStation

In fact, there’ll come a time when sentiment will get so weak that it’s really bullish. Additionally in fact, whereas client confidence could also be weak presently, none of that pessimism seems to be being mirrored in inventory costs (which proceed to inflate).

Lastly, we’re additionally getting each key numbers from the Institute of Provide Administration this week. September’s manufacturing measure will probably be launched on Wednesday, with providers knowledge due on Friday. Search for a slight improve in manufacturing exercise, however not sufficient to push again above the pivotal 50 stage. The providers index is definitely anticipated to fall a bit, but ought to nonetheless maintain above 50. In each instances it appears to be like like we’re attempting to begin an uptrend. It’s only a wrestle.

ISM Service, Manufacturing Index Charts

Supply: Convention Board, College of Michigan, TradeStation

Inventory Market Index Evaluation

The market might need taken a slight tumble final week. Even so the bigger-picture nonetheless appears to be like bullish.

Nowhere is that this extra evident than with the each day chart of the S&P 500. Have a look. The index took one final bullish step on Monday earlier than beginning to peel again on Tuesday. It saved falling too, proper up till it ran into its 20-day shifting common line (blue) at 6,562 on Thursday… the identical day it touched a rising assist line (crimson, dashed) that extends all the best way again to late-Could. This was the perfect place for the bulls to make their stand, they usually did.

S&P 500 Every day Chart, with Quantity and VIX

Supply: TradeNavigator

Backing as much as a weekly chart exhibits us that whereas the runup from April’s low is sizable, it solely barely places the index again on the slender bullish path it was on between 2023 and late 2024. There’s nonetheless room for it to proceed rallying no matter which of its technical ceilings you apply.

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

Nonetheless, the sheer quantity of floor the S&P 500 has lined with none form of corrective effort is uncommon. You’ll have anticipated to see some form of extra critical take a look at by now.

Both approach, there’s room and cause to name for extra upside.

The NASDAQ Composite’s story is analogous, by the best way, even when not equivalent. Because the each day chart illustrates, the composite examined a short-term technical ceiling (yellow, dashed) connecting the NASDAQ’s highs going all the best way again to Could. Even with Tuesday’s and Wednesday’s (and Thursday’s) promoting, nonetheless, the composite ended the week on a bullish foot.

NASDAQ Composite Every day Chart, with Quantity and VXN

Supply: TradeNavigator

The weekly chart of the NASDAQ Composite places the each day motion within the correct perspective… dropping a refined however vital trace. That’s, though this doesn’t appear to be the case with the S&P 500, the composite’s advance seems to (nonetheless) be slowing down. The MACD strains stays proceed to converge, with the volatility index (VXN) appears to be like prefer it’s attempting to twist its approach out of a downtrend into an uptrend.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

That is net-bearish. The NASDAQ tends to steer the market increased in addition to decrease. If it’s lagging, it suggests total brewing weak point.

We clearly don’t have that but in a decisive approach. As was instructed final week, the composite’s obtained a ton of technical assist at the moment round 24,730. That ground would nonetheless should be snapped in an enormous method to even begin entertaining bigger-picture bearishness. Within the meantime, there’s room for the NASDAQ Composite to proceed shifting increased earlier than testing technical resistance.

As is the case with the S&P 500 although, the sheer quantity of uninterrupted distance lined simply since April leaves us involved about an overdue pullback. It’s only a matter of when the bulls are keen to let the bears get it going. They’re clearly not but.

Let’s assume the bigger-picture uptrend goes to stay in place till we clearly simply can’t anymore. This implies being fairly tolerant of slight stumbles, which clearly haven’t been a problem of late. Simply hold the general vulnerability in thoughts. As soon as a correction does lastly get going and begin smashing a number of technical flooring, it might be a bit painful, and even a little bit scary. There’s a variety of pent-up profit-taking simply ready for an excuse right here. We’ll discuss draw back targets when the time comes.