As anticipated, final week the market bounced again a bit from the foremost setback suffered two Fridays in the past. As feared, it wasn’t a lot of a bounce (relative to the sheer measurement of that one-day stumble anyway). It’s simply too quickly to say issues are on the mend. The S&P 500’s 1.8% acquire for the week didn’t truly clear any main hurdles, and positively did unwind the prior week’s loss. Shares might nonetheless simply slip into extra severe hassle from right here.

The excellent news (nonetheless) is, it’s crystal clear the place that promoting will attain some extent the place it’s going to grow to be self-fueling. And it’s not too distant from the place shares ended final week’s motion.

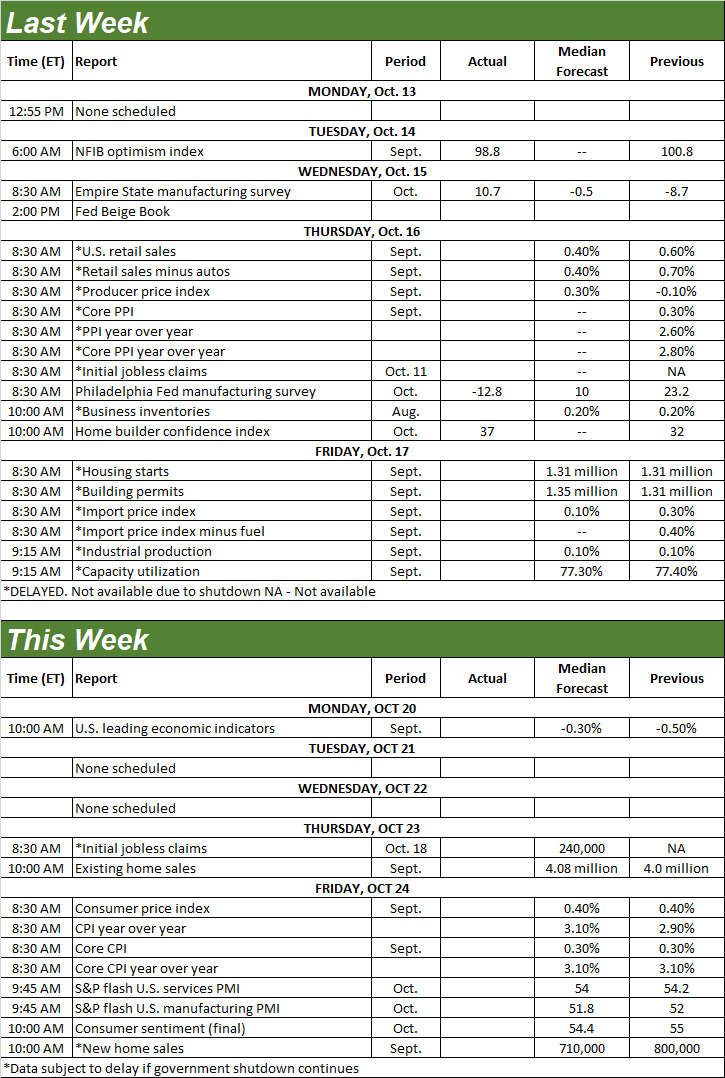

We’ll have a look at these ranges in some element in a second. Let’s first speak concerning the financial knowledge we’re not getting, and what we would lastly get subsequent week.

Financial Knowledge Evaluation

Information flash! The federal authorities continues to be shut down. Traders don’t see to care a lot. They’re nonetheless shifting as if it doesn’t matter (and maybe it doesn’t). Because of the shutdown although, we didn’t hear final week’s scheduled stories on inflation, retail gross sales, housing begins and constructing permits, and capability utilization and industrial manufacturing. We’re additionally nonetheless lacking September’s jobs report.

Every thing we did hear — which isn’t a lot — is on the grid.

Financial Knowledge Report Calendar

Supply: Briefing.com, TradeStation

This week’s fairly mild. In reality, the one information we’re going to get is on the actual property entrance. On Tuesday we’ll hear Thursday’s gross sales of current houses for September from the Nationwide Affiliation of Realtors, and on Friday, we would hear final month’s new residence gross sales knowledge from the Census Bureau. Forecasts calling for a slight enchancment in current residence gross sales, though it would nonetheless be alarming low. In the meantime, new residence gross sales are anticipated to peel again from August’s unusual surge. The client’s incentives that spurred this swell of purchases isn’t sustainable.

New, Current Residence Gross sales Charts

Supply: Census Bureau, Nationwide Assn. of Realtors, TradeStation

On Friday we’ll hear the third and closing have a look at the College of Michigan’s sentiment measure. It ought to be down barely from September’s closing determine, which isn’t notably encouraging.

Shopper Sentiment Charts

Supply: Convention Board, College of Michigan, TradeStation

Search for the Convention Board’s launch of client confidence subsequent week. It’s additionally been trending decrease, and given the backdrop, it appears unlikely that is going to alter this time round.

There’s additionally apparently some expectation that we might hear final month’s client inflation report on Friday of this week, or possibly even by Friday. Economists additionally appear to assume it’s going to be as agency as August’s, if not barely increased. We’ll see.

Inventory Market Index Evaluation

We’ll begin this week’s evaluation with a have a look at the day by day chart of the S&P 500, because it tells us probably the most about what’s taking place now… and never taking place. As might have been predicted, the bulls did push again following the prior Friday’s steep selloff, by no means letting the index slip under the 50-day shifting common line (purple) at 6,564. Nonetheless, they by no means truly obtained the index again above the proverbial hump… the 20-day shifting common line (blue) at 6,676. The S&P 500 briefly traded above the pivotal degree on Wednesday and Thursday, however finally met an excessive amount of resistance. It ended up closing increased on Friday, however stays on the mistaken facet of some too many technical ceilings.

S&P 500 Every day Chart, with Quantity and VIX

Supply: TradeNavigator

Additionally discover that none of final week’s “up” days had been on increased quantity, whereas Wednesday’s and Thursday’s intraday setbacks had been on increased quantity.

The weekly chart places final week’s motion in additional perspective. From this vantage level we are able to nonetheless sense and even see that the bullish momentum that had been in place since April suffered a major blow two weeks in the past that wasn’t unwound final week; discover the MACD strains are nonetheless inching their manner towards a bearish cross. The one factor that should occur to push the bearish effort previous the tipping level is a transfer underneath the rising assist line (blue, dashed) that extends again to Might.

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

That being mentioned, discover the VIX peeled again from Thursday’s and Friday’s surge. It was an expiration day, which could clarify the above-average slide. Nonetheless, to the extent it wasn’t brought on by a wave of choice expiration, this pullback loosely works in opposition to the bearish thesis right here. Maybe worry has run its course… at the very least in the interim.

And the NASDAQ Composite’s chart seems to be nearly the identical, though it might be even a bit tighter. That’s to say, the composite fell again to a long-established rising assist line (purple, dashed) that extends again to Might, however seems to be discovering a agency flooring there now. The NASDAQ’s 50-day shifting common line (purple) at 22,110 is true under there, able to lend a serving to hand as assist.

NASDAQ Composite Every day Chart, with Quantity and VXN

Supply: TradeNavigator

Even so, just like the S&P 500, there was clearly extra bearish quantity than bullish quantity from NASDAQ-listed names final week, and it’s not just like the composite dished out a decisive bullish restoration transfer. It might have merely been unable or not able to dish out any extra draw back after such a speedy and sizable selloff two Fridays in the past. The bears might have simply regrouped since then, and now stand able to take management once more early this week.

Backside line? Issues might nonetheless simply go both manner from right here, largely as a result of the market continues to be simply too excessive, and overvalued. However, the technical pattern continues to be bullish.

The excellent news is, it’s changing into clearer and clearer the place a extra regarding diploma of promoting can (and certain will) begin. For the NASDAQ Composite it’s the 50-day shifting common line presently at 22,110, and for the S&P 500, it’s additionally the 50-day line (purple) at 6,564. In each circumstances, nevertheless, we’d actually need to see the VIX and VXN transfer above their latest technical ceilings to say the tide has really taken a flip for the more severe. Simply keep in mind even “for the more severe” doesn’t imply we’re getting into a full-blown bear market. It’s solely going to be beginning out as a much-needed corrective transfer, and reset of the longer-term advance.