The market managed to dial again any doubt about its bigger-picture rally following the small setback from a pair weeks in the past. Final week the S&P 500 superior almost 1.1%, making one other file excessive within the course of. The NASDAQ Composite, in the meantime, was up a bit of greater than 1.3%, additionally touching a brand new all-time excessive. No actual surprises there. As we famous in final week’s Weekly Market Outlook, even unhealthy weeks had been bullish in some methods, leaving the bullish undertow intact.

Nonetheless, there’s no denying the acquire appears to be dropping steam. Breadth is weakening, and technically, so is momentum.

Perhaps it’s only a non permanent headwind; there’s actually some resistance instantly above for a number of the indexes. Regardless, the general pattern continues to be bullish just because each indexes stay above all of their transferring common traces and above most of their straight-line assist ranges.

We’ll present what this seems to be like in a second. Let’s first take a look at the small quantity of financial information that was really posted final week.

Financial Knowledge Evaluation

Sure, the federal government shutdown is delaying the discharge of financial information from its companies. The large one we didn’t get final week was Friday’s jobs report from the Division of Labor. We’ll share these numbers as soon as we get them. Within the meantime we nonetheless heard a number of key experiences from non-government organizations…

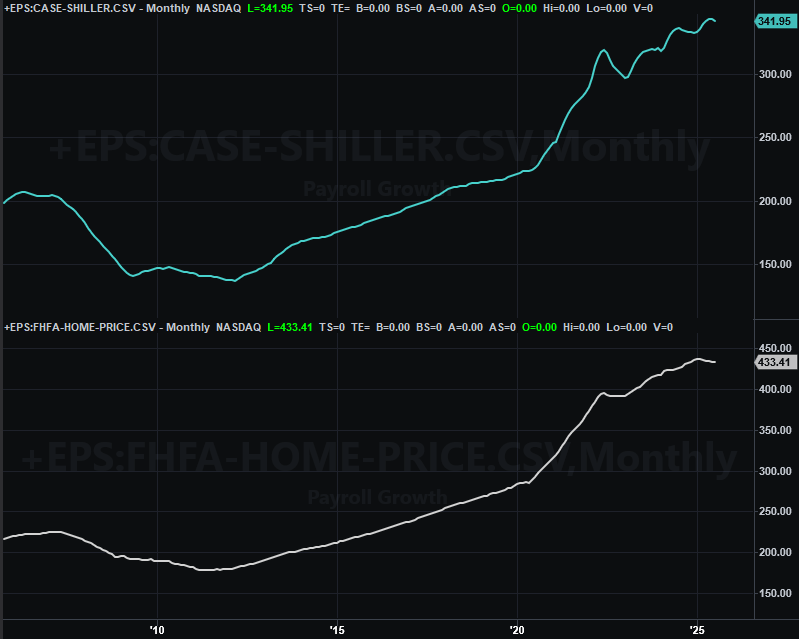

…like Commonplace & Poor’s Case-Shiller Index of residence costs on Tuesday (though we did hear the FHFA’s measure of residence costs as nicely that day). Each items of information had been from July, so it’s a bit dated already. In each circumstances although, we’re seeing weak point agency up.

House Worth Index Charts

Supply: FHFA, Nationwide Assn. of Realtors, TradeStation

It’s unsurprising although, on condition that we’re additionally seeing subpar begins and permits in addition to tepid actual property gross sales transactions stay tepid (save final month’s shock surge in new residence gross sales, which isn’t apt to final).

We additionally obtained the one-and-only studying on client confidence from the Convention Board on Tuesday, rounding out the College of Michigan’s third and remaining sentiment rating for September reported final week. In each circumstances they fell from August’s ranges, extending bigger-picture downtrends. Shoppers are clearly tiring of fixed tariff worries, and extra lately, a weakening jobs market.

Shopper Sentiment Charts

Supply: Convention Board, College of Michigan, TradeStation

Simply do not forget that this weak confidence will ultimately be interpreted as a contrarian bullish sign. We’re simply not fairly there but… most likely.

The one different numbers we heard final week was the Institute of Provide Administration’s measures of companies in addition to manufacturing exercise. Manufacturing edged a bit of larger, however stays under 50. Providers, in the meantime, it nonetheless above 50, however the information is in a transparent downtrend that ought to drag the index under 50 quickly sufficient.

ISM Service, Manufacturing Index Charts

Supply: Convention Board, College of Michigan, TradeStation

Every little thing else is on the grid.

Financial Knowledge Report Calendar

Supply: Briefing.com, TradeStation

This week was already going to be a bit gentle by way of financial experiences. So long as the federal government shutdown persists powerful, it’s going to be even lighter. The one factor of curiosity that can be posted regardless is Wednesday’s launch of final month’s FOMC assembly’s minutes. Pay attention for any delicate adjustments to the language, though it’s unlikely we’ll hear something opposite to the Fed’s plans to chop rates of interest just a few extra occasions into subsequent 12 months.

That being stated, ought to the shutdown finish, we’ll possible hear September’s jobs report shortly thereafter. Simply maintain your ears open and your eyes peeled.

Inventory Market Index Evaluation

Maybe the perfect factor concerning the rally that’s been underway since April is that it’s by no means been allowed to go unchecked or uninterrupted for lengthy sufficient to stumble right into a setback that would evolve into one thing extra. That’s what the each day chart of the S&P 500 under tells us anyway. It’s not rallied greater than about seven days at a time with out some form of measurable dip… simply sufficient to maintain the advance from overheating, permitting it to final so long as it has. Discover that the index hasn’t been under the straight-line assist (purple, dashed) that’s been in place since Could; the yellow arrows mark each key occasion the place that line served as a flooring.

S&P 500 Every day Chart, with Quantity and VIX

Supply: TradeNavigator

Now take a step again and take a look at the larger image, through a weekly chart of the S&P 500. From this vantage level we will see the slightly-jagged however generally-steady uptrend from April’s low. It’s by no means actually “gone parabolic.” Reasonably, it’s simply chugged alongside at a sustainable tempo. Additionally discover that the index simply inched its manner again into the slender buying and selling vary that first fashioned again in 2023 (framed by dashed traces). There’s rather more room for it to maintain transferring larger earlier than bumping into both of the higher boundaries (blue, and purple).

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

There are a few barely regarding element to spotlight on the weekly chart although. The primary of those is, though it’s not simple to see with the chart of the S&P 500 itself, the MACD traces do recommend that the rally is dropping steam. And the second? It looks like the Volatility Index (or VIX) is beginning to type a bowl form and curve its manner again into an uptrend. If that is so, ultimately it’s going to weigh on inventory costs. The query is, how a lot and the way lengthy will it weigh on them?

The NASDAQ Composite’s each day chart seems to be fairly comparable, however with one noteworthy exception. That’s, reasonably than straight-line assist, the composite is capped by straight-line resistance (yellow, dashed). That being stated, the NASDAQ can also be fairly nicely supported too.

NASDAQ Composite Every day Chart, with Quantity and VXN

Supply: TradeNavigator

A extra critical ceiling is in play on the weekly chart… the one which extends all the way in which again to 2023 (purple, dashed). And, you too can see the NASDAQ’s momentum is fading whereas at approaches this long-term resistance line. The composite’s volatility index (VXN) appears to be attempting to inch its manner upward once more as nicely, just like the S&P 500’s VIX. This units the stage for bearishness, however as was the case with the S&P 500, the pattern right here continues to be bullish. There’s additionally loads of technical assist under, any and all of which might forestall a small selloff from turning into an even bigger one.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

This can be a frustratingly uncommon state of affairs. The market is overdue for a real correction. However, the bulls simply aren’t letting it occur. They may in the end although, and sure earlier than later. Nonetheless, it’s been harmful to foretell a pullback that requires you to battle the tape. Let’s assume this bullish momentum goes to stay in place till it’s crystal clear that we will’t. That may take the failure of a number of technical flooring, and a transparent upward thrust from each of the volatility indexes. The laborious half is ready, not figuring out when that’s lastly going to occur, or when and the place it’d finish.

We’ll discuss extra about that when it really issues. Simply don’t dig in too deep within the meantime.