After they wanted to essentially the most, the bulls discovered a method of preventing again. Simply don’t learn an excessive amount of into final week’s 3.7% rebound from the S&P 500. Thanksgiving week is often artificially bullish (final week’s precise quantity was more and more weak), and after three tough weeks earlier than final week, some type of bounce again might have been anticipated. The true take a look at of this restoration effort comes this week, though to its credit score, the market did handle to struggle its method again above a few essential traces within the sand.

We’ll weight all of it in a second. First, let’s work our method by the financial information that was served up final week; we’re catching up on a few of the numbers that had been delayed by the federal authorities’s shutdown.

Financial Information Evaluation

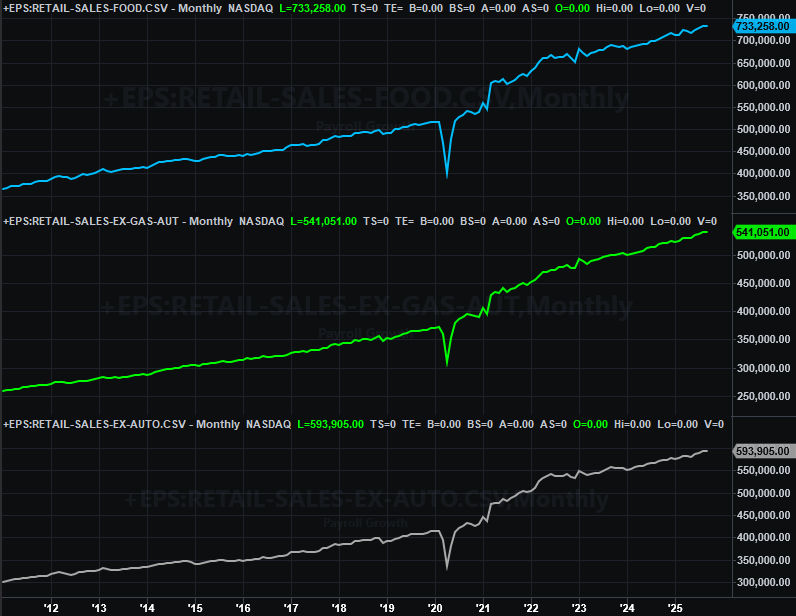

The occasion began on Tuesday, with September’s (not October’s) retail gross sales from the Census Bureau. As anticipated, they had been up — modestly — extending long-established developments even when a lot of this progress displays easy inflation. On the very least customers are arising with the cash to cross alongside to retailers.

Retail Gross sales Charts

Supply: Census Bureau, TradeStation

We additionally confirmed September’s shopper and producer inflation charges, roughly matching the latest charges… that are at or close to the Federal Reserve’s long-term targets. Regardless of the rhetoric, it’s going to be powerful the Fed to justify the speed cuts which can be speculated to be on the near-term radar.

Shopper, Producer Inflation Fee Charts

Supply: Bureau of Labor Statistics, TradeStation

We additionally heard the Case-Shiller Residence Worth Index from Commonplace & Poor’s on Tuesday, once more for September. They fell barely — once more – as did the FHFA’s measure (albeit barely) for the primary time shortly. This lull underscores the argument that the housing market actually is beginning to cool off; additional underscoring this argument continues to be the truth that whole transactions stay at comparatively low ranges.

Residence Worth Index Charts

Supply: Commonplace & Poor’s, FHFA, TradeStation

Lastly, though not but plotted on our chart under, the Convention Board’s measure of shopper confidence tumbled to a multi-month low of 88.7, jibing with final week’s reported main lull within the College of Michigan’s sentiment measure.

Shopper Confidence Charts

Supply: Convention Board, College of Michigan, TradeStation

We nonetheless contend that there’s a possible contrarian facet to the buyer confidence numbers. That’s to say, the market is likely to be hitting backside when customers are feeling their most pessimistic. The issue with this premise is timing. We don’t precisely know when customers are feeling their lowest, and it might take weeks for the market to hit its final backside (and it’s actually nowhere close to what might represent a significant low proper now).

The whole lot else is on the grid.

Financial Information Report Calendar

Supply: Briefing.com, TradeStation

This week goes to be a reasonably mild one, largely as a result of we’ll not be getting a report we’d often count on for the primary week of any given month. That’s the roles report for October, which has been postponed for no less than one other week. We will probably be getting ADP’s employment report on Wednesday although, providing a touch of what could also be within the playing cards. Additionally maintain your eyes and ears open on Friday for the September’s shopper spending and private earnings information from the Census Bureau, with the Federal Reserve additionally considers when making rate of interest selections.

The approaching week’s biggie, nevertheless, is arguably Monday’s manufacturing index replace from the Institute of Provide Administration to be adopted by the Companies Index replace on Wednesday. Each stay stagnant, and never at significantly spectacular ranges.

ISM Companies, Manufacturing Index Charts

Supply: Institute of Provide Administration, TradeStation

Inventory Market Index Evaluation

Sure, shares bounced again with a little bit of a vengeance final week, with the S&P 500 hovering 3.7% whereas the NASDAQ Composite jumped greater than 5%. Based mostly on these numbers alone it could be straightforward to leap to a bullish conclusion.

Simply maintain the motion in context. The vacation-shortened buying and selling week tends to be a great one, however not one which essentially sees any actual bullish follow-through. There was additionally a conspicuous quantity of quantity missing with the hassle; this isn’t essentially a majority opinion.

Nonetheless, the transfer pushed each of the important thing indexes again above vital traces. Because the day by day chart of the S&P 500 under exhibits us, as an example, the index is now again above each its 20-day shifting common line (blue) and its 50-day line (purple). If a dip is within the playing cards, no less than being above them now offers the index one thing to probably act as a ground.

S&P 500 Every day Chart, with Quantity and VIX

Supply: TradeNavigator

Ditto for the NASDAQ, though its day by day chart under exhibits us one thing else price stating. That’s the truth that the rally effort stopped when a long-established technical assist line (yellow, dashed) was encountered.

NASDAQ Composite Every day Chart, with Quantity and VXN

Supply: TradeNavigator

Does this imply something? Possibly. Or, possibly not. It’s too quickly to say. It’s simply curious, and price mentioning just because if the bears wished to begin pushing again once more, this is able to be the subsequent greatest place to take action.

The NASDAQ Composite’s day by day chart additionally reminds us, nevertheless, that the 100-day shifting common line (grey) at 22,162 continues to be a significant technical ground; the identical goes for the S&P 500. Even a rekindled pullback effort from right here wouldn’t essentially should evolve right into a full-blown catastrophe.

Right here’s the weekly chart of the NASDAQ, for a bit extra perspective. As you may see, the composite continues to be finally framed inside a long-established bullish channel, having just lately pushed up and off the dissecting midline of that rising vary to maneuver again nearby of the channel’s higher boundary. It’s going to be powerful to maneuver above that ceiling it doesn’t matter what occurs subsequent, and irrespective of how a lot momentum it appears like we’ve on the time.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

Actually, final week’s motion is such an outlier that it could be harmful to come back to any conclusion based mostly on it. It’s bullish in and of itself, however we all know the market’s technically overbought to not point out overvalued. It’s going to be powerful so as to add beneficial properties from right here.

Sure, to date most something that would function technical assist has finished so, staving off any severe selloff. There’s simply no denying the 50%(+) runup from April’s low is inviting to profit-takers. It’s simply that the worry of lacking out on extra upside is stopping sufficient promoting to kick-start a extra severe selloff.

The danger continues to be there although. It simply wants a catalyst… a catalyst that’s far much less more likely to materialize over the last month of the 12 months, which is traditionally bullish. Don’t be stunned to see numerous push-and-pull indecision for just a few weeks, with not a lot internet progress in both route.