Following via on the bullish finish to the earlier week, shares logged one other web winner final week. All instructed, the S&P 500 superior 0.7%, whereas the NASDAQ jumped 2.2%. Each reached new information within the course of.

And but, it’s something however the sort of motion the bulls want to see. Not solely has the market now pushed deep into technically-overbought ranges, however the NASDAQ Composite simply ran into a significant technical ceiling. Each of the indices additionally suspiciously peeled again from their intraweek highs, which is the type of motion you may anticipate to see proper after a blowoff prime, and on this case, an exhaustion hole.

In different phrases, the bulls’ effort to maintain issues transferring increased could have simply inadvertently burned up the final little bit of remaining gas the rally had within the tank.

We’ll have a look at the matter in some element under. First, let’s have a look at the financial stories we’re getting, in addition to level out those we’re not getting.

Financial Information Evaluation

The now-month-long authorities shutdown remains to be in impact, stopping sure financial knowledge usually launched by authorities entities from being launched. Final week we didn’t get the preliminary estimate of Q3’s GDP (Bureau of Financial Evaluation), nor did we get September’s measure of private incomes and client expenditures (Bureau of Labor Statistics) that the Fed reportedly considers when making rate of interest choices. With the notable exception of inflation — to assist decide 2026’s Social Safety COLA — most government-supplied knowledge is now a month behind.

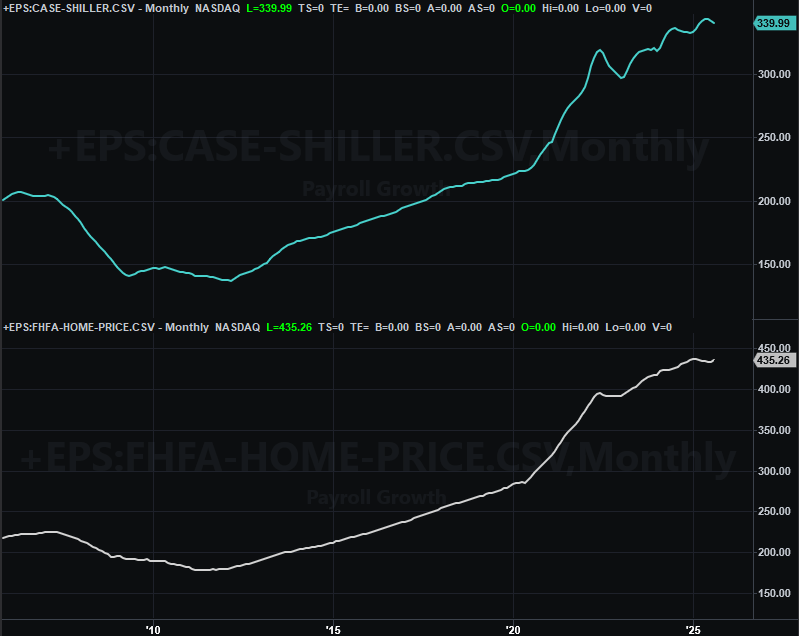

We did get residence worth numbers from the FHFA on Tuesday although, together with the Case-Shiller Residence Worth Index on the identical day. Frustratingly, they proceed to maneuver on reverse instructions, making it troublesome to know which one is telling the precise story. For what it’s value although, we’re extra inclined to take the Case-Shiller knowledge at face worth as a pricing barometer for actual property.

Residence Worth Index Charts

Supply: FHFA, Normal & Poor’s, TradeStation

We additionally heard the Convention Board’s report on October’s client sentiment on Tuesday, rounding out the sentiment measure provided by the College of Michigan per week earlier. As anticipated, the Convention Board’s quantity fell a bit to 94.6, though that wasn’t fairly as little as the anticipated 93.2. Regardless of the case, customers are clearly feeling fairly discouraged. Lingering inflation and the torpid economic system are the important thing culprits.

Shopper Sentiment Charts

Supply: Convention Board, College of Michigan, TradeStation

Every thing else is on the grid.

Financial Information Report Calendar

Supply: Briefing.com, TradeStation

This week isn’t prone to be too busy, notably if the federal authorities stays shut down. We’ll preview as if we’re going to listen to every part on schedule although.

First, we’ll be getting updates on the important thing financial barometers from the Institute of Provide Administration. Search for the manufacturing report on Monday, adopted by the providers knowledge on Wednesday. We’ve been seeing these two knowledge units transfer in opposing instructions, with U.S. manufacturing being the constructive one. We’d wish to see each climbing, clearly.

ISM Providers, Manufacturing Index Charts

Supply: Institute of Provide Administration, TradeStation

Because it stands proper now, we’re slated to get October’s jobs report on Friday. Because the chart under reveals us, the aforementioned financial lethargy is taking a sluggish and regular toll on the labor market. It’s not “mattress” but, however the slow-moving pattern may turn into a extra vital drawback if one thing doesn’t change quickly.

Unemployment Fee, Payroll Development Charts

Supply: Bureau of Labor Statistics, TradeStation

As a reminder, we’ve additionally not but heard September’s unemployment and payroll progress numbers. We may hear these figures on the similar time, if the shutdown ends in time, though it’s additionally doable the Bureau of Labor Statistics will quietly launch them earlier than then if for some motive the stalemate ends earlier than Friday.

Inventory Market Index Evaluation

Sure, the market noticed some beneficial properties final week, including to the ahead progress seen in the course of the earlier two weeks. Take a more in-depth have a look at the each day chart under although. All of final week’s achieve materialized on Monday. After that the bulls truly misplaced most of their drive… which makes somewhat sense. The S&P 500 additionally ran into a fairly vital technical ceiling (yellow, dashed) on Tuesday and Wednesday, which has now capped a rally effort 4 instances since early July; see the pink arrows for every occasion of this.

S&P 500 Day by day Chart, with Quantity and VIX

Supply: TradeNavigator

Now return to Monday’s bar on the each day chart above… the one with that left a giant hole behind because of the sturdy, bullish open. It’s the hole (circled), in actual fact, that we wish to discuss. Not that it all the time pans out this fashion, however typically – perhaps even “typically” on the finish of a protracted rally – gaps find yourself serving because the “final gasp” thrust seen that finally ends up serving as the height (though the hole, or distance between the prior day’s excessive and the hole day’s low, is often a bit wider than this).

Zooming out to the weekly chart put the play on/off this rising technical ceiling in perspective; it additionally reminds us there’s a corresponding technical ground (purple, dashed) that’s operating parallel with the ceiling in query. Greater than something although, discover that the weekly bar itself is a doji, the place the open and shut are primarily the identical quantity. On this case the matching numbers are additionally markedly lower than the intra-week peak, which can be one thing you’d anticipate to see on the finish of a rally and the pivot again right into a pullback.

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

The each day chart of the NASDAQ Composite appears comparable, within the sense that Wednesday’s excessive bumped right into a rising technical ceiling (mild blue, dashed) that extends all the way in which again to Might. And just like the S&P 500, the composite can be being steered increased by a rising technical help line (yellow, dashed) that extends again simply as far.

NASDAQ Composite Day by day Chart, with Quantity and VXN

Supply: TradeNavigator

That’s not the largest bearish fear right here, nonetheless. That’s solely a near-term concern. The larger fear right now is the truth that after its 60% runup from April’s low the NASDAQ additionally (lastly) ran into the higher boundary of a rising channel that’s been in place since late-2022 (pink, dashed on the weekly chart under). The bears are actually prone to make a stand right here, and now. The weekly chart of the NASDAQ Composite additionally reveals us a a lot wider potential exhaustion hole with Monday’s large bullish opening, underscoring the bearish potential right here.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

And but, we’re nonetheless not within the bearish camp. We’re solely eyeing the exit of the bullish camp, recognizing that the market’s merely come too far, too quick in too little time and is now too overvalued. It seems like the one factor actually driving this actually now’s FOMO (worry of lacking out), however that’s not one thing that may final endlessly. As soon as it lastly reverses course, it’s doubtless to take action in a giant means in a rush.

There’s the rub. The stage is ready for a long-overdue corrective transfer, however the market continues to climb a wall of fear anyway.

The excellent news is, we nonetheless know precisely what we’d wish to see earlier than presuming a real, full correction is underway. Each volatility indexes (the VIX and the VXN) might want to transfer above their current highs on the similar time the S&P 500 and the NASDAQ Composite fall below their 50-day transferring common line (purple on each each day charts above). Something much less, and the bulls are nonetheless in cost, hammering out extra rally.