Regardless of the steep selloff in the midst of the week, the S&P 500’s restoration on Friday was sufficient to carry it again to a breakeven for the week. The NASDAQ Composite? Not so – it did find yourself within the purple, closing below a reasonably vital technical help stage that had been appearing as a reasonably dependable flooring. Even so, even then the NASDAQ stays above its most vital flooring, as does the S&P 500.

In different phrases, final week wasn’t a loss of life blow.

There are definitely extra purple flags waving now than there week in the past although. Certainly, we’re nearer to a long-overdue meltdown than we’ve been in an extended whereas. One or two extra tough days may nonetheless push the entire shebang off the cliff’s edge.

We’ll level out all these traces within the sand in a second. First, let’s take a look at final week’s largest financial information and preview what’s within the lineup for this week.

Financial Information Evaluation

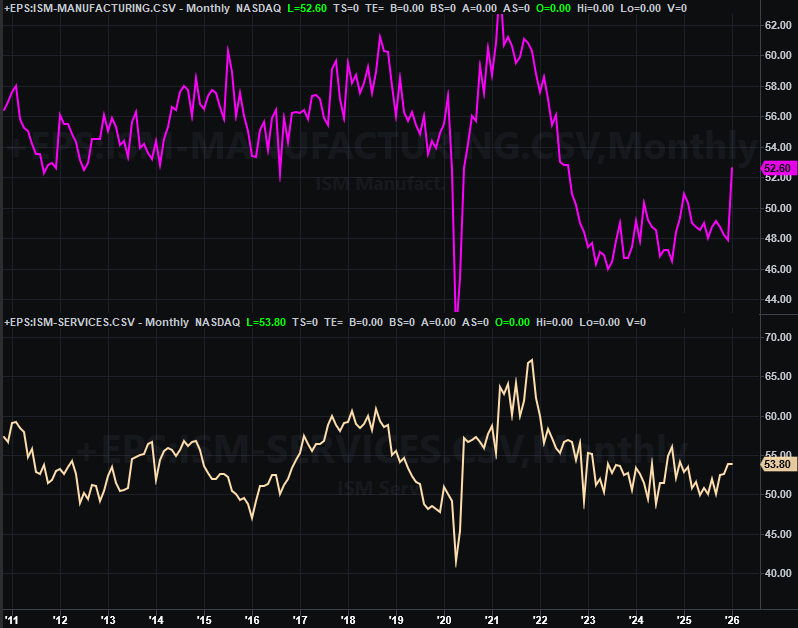

The roles report that was initially due on Friday of final week ended up being postponed till Wednesday of this week. So, the one numbers we truly acquired had been the financial barometers from the Institute of Provide Administration. They had been good and unhealthy, however extra good than unhealthy. Manufacturing exercise was catapulted to a multiyear excessive, and although the providers index didn’t budge from December’s stage, it’s nonetheless holding above the pivotal 50 mark it fought its method again above late final 12 months.

ISM Companies, Manufacturing Index Charts

Supply: Institute of Provide Administration, TradeStation

This in fact leans in a bullish path, even when earnings and mass layoffs don’t make it appear to be the financial system’s truly firing on all cylinders.

Financial Information Report Calendar

Supply: Briefing.com, TradeStation

As was famous, January’s jobs numbers will likely be posted on Wednesday. Economists count on a repeat of December’s figures, roughly; the unemployment price ought to maintain at a fairly wholesome 4.4%, and payroll progress of 55,000.

Unemployment Price, Payroll Progress Charts

Supply: Convention Board, College of Michigan, TradeStation

There’s little room for disappointment right here, in fact, notably after the market flashed some severe vulnerability final week.

Earlier than that report, although, we’ll be getting December’s retail gross sales figures on Tuesday. Forecasts name for a slight slowing from November’s progress tempo, however progress nonetheless.

Retail Gross sales Charts

Supply: Census Bureau, TradeStation

All issues thought of, retail spending stays a stunning vibrant spot for the financial system, and by extension, for the inventory market itself.

On Thursday we’ll begin a streak of vital actual property information, with gross sales of present properties. They’ve been solidly rising because the center of final 12 months, and whereas nonetheless at low ranges, that is encouraging. Simply know that economists don’t imagine this uptrend continued by final month.

Residence Gross sales Charts

Supply: Census Bureau, Natl. Assn. of Realtors, TradeStation

New-home gross sales needs to be launched by the Census Bureau someday within the week after this one. These gross sales stabilized at ranges under August’s surge. Even so, the larger development right here remains to be pointed upward, even when very erratically.

Lastly, on Friday search for January’s client inflation information. It’s nonetheless holding on the Fed’s goal ranges of between 2.0% and three.0%, which — given the FOMC’s current disinterest in altering rates of interest — is smart. Regardless of the case, it is a “no information is sweet information” state of affairs. A ho-hum assembly of expectations will likely be principally met with no perceived motive to cost this report into inventory costs.

Client, Producer Inflation Charts

Supply: Census Bureau, Natl. Assn. of Realtors, TradeStation

Producer inflation charges will likely be reported the week after this one, though it’s unlikely they’ll transfer a lot both.

Inventory Market Index Evaluation

It’s considerably a story of two markets. The S&P 500 managed to battle its method again to a breakeven earlier than taking over an excessive amount of water. The NASDAQ did endure a much bigger hit it didn’t bounce again from, besides, is holding above one last — and essential — technical flooring.

In each instances although, there’s rising trigger for concern.

Let’s begin with a take a look at the every day chart of the S&P 500, drawing out one essential element. That’s, as soon as once more the 100-day shifting common line (grey) presently at 6,799 stopped the promoting on Thursday, and offered a pushoff/reversal level.

S&P 500 Each day Chart, with Quantity and VIX

Supply: TradeNavigator

Nonetheless, there’s trigger for concern. Chief amongst these worries is that the quantity behind the down days stays a lot larger than the quantity behind the up days; Friday’s massive bounceback wasn’t a majority opinion.

Zooming out to a weekly chart of the S&P 500 sheds some extra gentle on the state of affairs. Particularly, the help line (pink, dashed) that extends all the way in which again to the center of final 12 months remains to be in play. However, the technical horizontal ceiling (pale blue, dashed) at 6,996 is as properly. One or the opposite goes to want to offer eventually.

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

The weekly chart exhibits us a few different issues as properly. One in all these is the truth that the bearish MACD cross we first noticed in November remains to be widening, confirming a broader improvement of bearish momentum. And, the S&P 500’s volatility index (VIX) seems to have ran into a longtime ceiling at 23.0… coinciding with Thursday’s low and subsequent rebound.

That doesn’t the weak point is over and carried out. We’d count on the bulls to push again right here and pressure the VIX to make a short-term peak; the pause is predictable. There’s nonetheless a very good likelihood, nonetheless, that the bears will regroup and restart their effort this week. If the S&P 500 goes to interrupt below its rising help line, it’s more likely to coincide with the VIX popping above the 23.0 stage. If-and-when that occurs, it’s more likely to begin a corrective transfer that will likely be troublesome to cease.

And the NASDAQ Composite is nearer to doing that than the S&P 500 is. Check out the every day chart of it under. The NASDAQ did break below its 100-day shifting common line (grey) at 23,175 on Wednesday, and didn’t claw again above it by the top of the week.

NASDAQ Composite Each day Chart, with Quantity and VXN

Supply: TradeNavigator

Discover on the every day chart that the NASDAQ’s volatility index (VXN) seems to have peaked at a longtime ceiling close to 29.0 with out truly shifting above it; that could possibly be a brief pause, as is the case with the VIX.

The weekly chart of the composite exhibits us a bit extra readability on not solely how and the place the VXN is bumping right into a ceiling, however why. As you may see, the NASDAQ Composite itself remains to be discovering help on the long-established technical flooring that’s serving because the decrease boundary of a long-term bullish channel. It was examined once more final week, and held up.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

All the identical, the bears are clearly testing bearish thresholds right here, and doing so after the composite’s confirmed horizontal resistance at 23,820 (purple, dashed), and at a time with the bearish MACD divergence is widening. One stumble could possibly be all that’s wanted to interrupt the technical help line right here, whereas concurrently sending the VXN above 29.0 for a extra sustained stretch of time.

We’ll solely want to speak about draw back targets if-and-when that occurs.