It was over. The bears dealt their blow. There was no approach the already-vulnerable market was going to get again up from that one.

Then it did. With a wholesome restoration effort on Thursday adopted by one other one on Friday, the bulls dragged the market again above a few important strains within the sand. Each of the indices are actually again above all of their key indicator strains, which means the trail of least resistance from right here is bullish — not bearish.

And but, the bigger-picture momentum continues to be leaning in a bearish course.

We’ll take a look at what occurred (and what didn’t occur) in a second. Let’s first run via among the financial reviews that lastly acquired caught up final week.

Financial Knowledge Evaluation

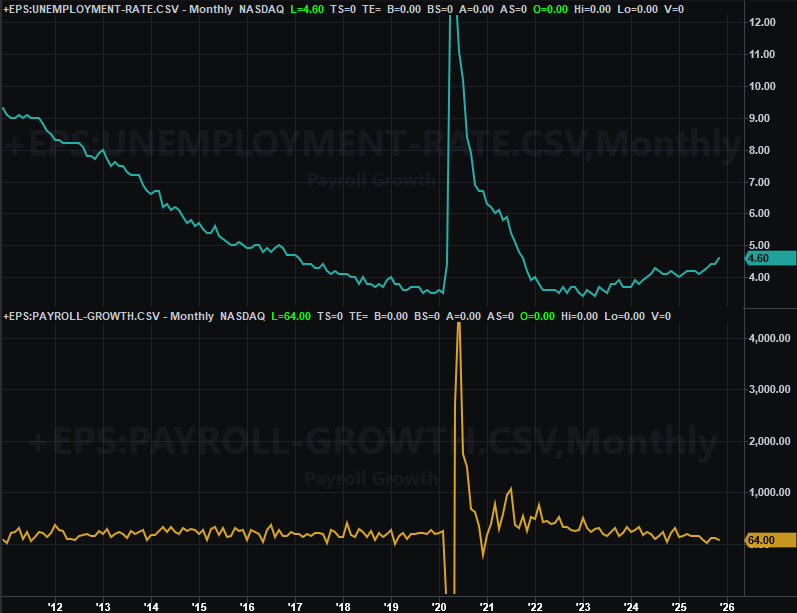

Busy week, starting with Tuesday’s jobs report for November. It comes as no shock that slower payroll development coincides with a slight uptick within the unemployment fee. Neither are but at alarming ranges although, notably provided that current rate of interest cuts ought to assist spur financial exercise (even when solely modestly).

Unemployment Price, Payroll Development Charts

Supply: Bureau of Labor Statistics, TradeStation

Additionally on Tuesday we acquired final month’s retail gross sales report. It was neither sizzling nor chilly. Fairly, it merely prolonged the shallow uptrends we’ve seen since early 2023… which is nice.

Retail Gross sales Charts

Supply: Census Bureau, TradeStation

Then on Thursday we acquired November’s client inflation report (skipping October’s). Encouraging information on this entrance. General inflation fell from an annualized tempo of three.0% to 2.7%, whereas core inflation slipped from 3.0% to 2.6%. That is again towards goal ranges, and maybe extra vital, says the Federal Reserve had some room to chop the rates of interest it lower per week earlier. Furthermore, assuming nothing main modifications within the meantime, this leaves the Fed some room to make the cuts it says it’s seeking to make subsequent 12 months.

Client, Producer Inflation Price Charts

Supply: Institute of Provide Administration, TradeStation

Then on Friday we heard about final month’s gross sales of present properties, though there wasn’t a lot to listen to. The annualized tempo got here in at 4.1 million once more.

New, Current House Gross sales Charts

Supply: Nationwide Assn. Realtors, Census Bureau, TradeStation

There’s no phrase but on when — or even when — we’ll get September’s new-home gross sales from the Census Bureau (though we’re considering not). Given all that we do know concerning the influence of the federal government shutdown in addition to the present surroundings, it more and more appears doubtless the August’s surge was a one-off fluke. We anticipate no matter quantity we get subsequent will likely be again to pretty modest ranges.

Lastly, on Friday we additionally acquired the third and closing replace of the College of Michigan’s sentiment index for December. Though this isn’t but plotted on the chart, it was up from November’s closing studying, rolling in at 52.9. That’s nonetheless fairly poor although.

Client Sentiment Charts

Supply: Convention Board, College of Michigan, TradeStation

The Convention Board’s client confidence rating for this month is approaching Tuesday of the week forward. It’s anticipated to tick larger as properly.

Every thing else is on the grid.

Financial Knowledge Report Calendar

Supply: Briefing.com, TradeStation

This holiday-shortened week goes to be fairly gentle. The truth is, the one different gadgets within the lineup in addition to Tuesday’s take a look at client confidence is the Fed’s report on capability utilization and industrial manufacturing for October and November, due the identical day. We should always see just a little progress, however solely just a little.

Capability Utilization, Industrial Manufacturing Charts

Supply: Federal Reserve, TradeStation

That is no small matter both. There’s a reasonably sturdy correlation between these numbers and company earnings and the market’s long-term course. We actually have to see sustained progress right here earlier than relying on this already-overvalued market to actually develop into its present costs.

Inventory Market Index Evaluation

The S&P 500’s 0.1% acquire final was so small that it might nearly be thought of meaningless. And on a web foundation, it was. How issues took form in the course of the week although – with a serious bounceback from a troubling intraweek low – has slightly bullish implications.

The day by day chart beneath tells the story. As of Wednesday’s shut, the S&P 500 was again beneath its 20-day (blue) and 50-day (purple) shifting common strains. And, having not truly made a excessive above October’s peak round 6,909 (crimson, dashed) at a degree when the broad market is already dealing with valuation challenges, this actually felt prefer it may very well be the start of an overdue correction.

The bears and bulls modified their thoughts (once more) on Thursday, and as of Friday had saved them modified. The S&P 500 was again above the short-term shifting common strains it had simply fallen beneath two days earlier.

S&P 500 Every day Chart, with Quantity and VIX

Supply: TradeNavigator

The weekly chart of the S&P 500 beneath sort of illustrates why this considerably unlikely restoration effort was in a position to materialize. Because it seems, Wednesday’s intraday low touched a rising technical help line (blue, dashed) that extends all the best way again to April’s low.

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

The S&P 500’s weekly chart additionally reminds us that the index continues to be in the end being steered larger by a number of totally different strains, all of that are a part of an even bigger bullish channel that first began to change into evident in 2023. Extra to the purpose, discover there’s room to maintain rising earlier than a number of of those technical ceilings are examined as resistance. The index might arguably transfer to roughly 7,600 earlier than hitting the final of those technical ceilings, even when that will drive the broad market to an outrageous valuation.

The NASDAQ Composite’s weekly chart tells the identical fundamental story, by the best way. That’s, final week’s turnaround was sparked by a mere contact of a help line (blue, dashed) that extends all the best way again to April’s low. And, the composite’s longer-term pattern stays properly framed by help and resistance strains that go all the best way again to 2023. The one actual distinction right here is that the NASDAQ is nearer to its higher boundary than the S&P 500 is. Certainly, the composite seems to be additionally discovering help on the midline (yellow, dashed) of this buying and selling vary.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

The odd half? Each weekly charts above are nonetheless exhibiting us a bearish MACD cross that first took form in late November, and in each instances have technically change into extra bearish within the meantime.

It’s not fairly as a wierd as it could appear to be on the floor although. Neither of the indexes have truly made any significant web progress since then. The undertow might nonetheless be bearish. It’s simply that the bears are ready for the one stumble they will actually latch unto and begin a self-sustaining wave of profit-taking. We don’t have it but. However, the strains within the sand that may get that ball rolling are very properly outlined. They’re simply super-tough.