Shares ended up hammering out one other win final week, however the simple lethargy can’t be ignored. The few bulls that had been shopping for in had been hesitant to take action. It’s as in the event that they’re hesitant to take action, understanding or sensing a critical problem is on the horizon. It simply wants a catalyst.

Extra to the purpose for merchants attempting to make some sense of all of it, be cautious of attempting to power something right here merely since you’re on the lookout for a commerce. With the market in no-man’s land, so to talk, that is arguably a time simply to hold again and let shares discover their bearings, after which make your transfer. We’ll present you precisely why in a second. First, let’s proceed to atone for financial information, together with some that had been lacking till now.

Financial Information Evaluation

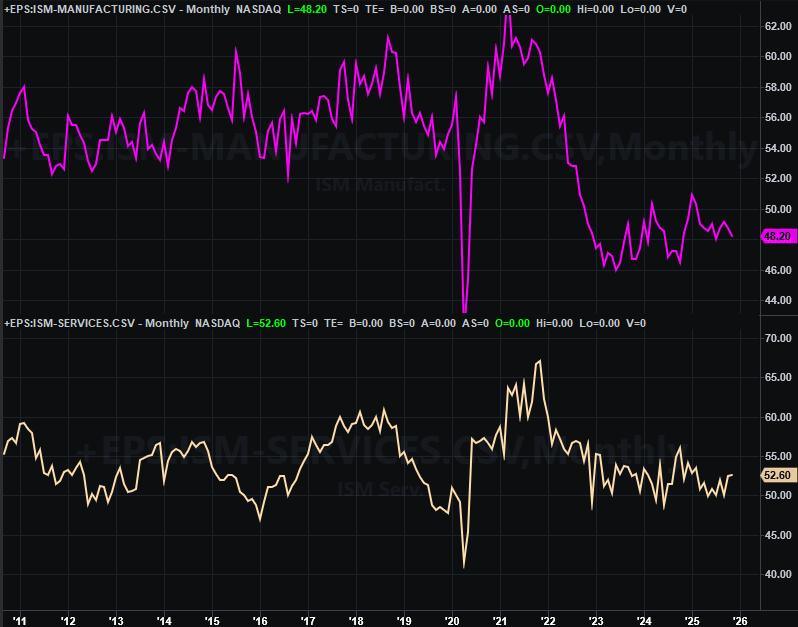

Not quite a lot of new knowledge was launched final week, however we did get October’s financial exercise numbers from the Institute of Provide Administration. Manufacturing exercise fell, all however confirming the obvious lull since January’s peak is the actual deal. Companies exercise ticked a little bit larger although, and continues to counsel the financial system’s attempting to get this half of issues going. We actually want the manufacturing industries to get going, nonetheless, is the U.S. financial system goes to really thrive.

ISM Companies, Manufacturing Index Charts

Supply: Institute of Provide Administration, TradeStation

The Federal Authorities continues to be taking part in catch-up. Final week we lastly acquired September’s capability utilization and industrial productiveness knowledge from the Federal Reserve… though it unsurprisingly wasn’t inspiring. Manufacturing was up just a bit from August’s lull, however solely a little bit, whereas capability utilization fell, arising in need of expectations.

Industrial Manufacturing, Capability Utilization Charts

Supply: Federal Reserve, TradeStation

Just like the ISM knowledge, the Fed’s financial barometers are sending a blended message, and much more so provided that the Federal Reserve says there’s at the very least a glimmer of enchancment when it comes to industrial output. Let’s not soar to any sort of conclusion right here simply but.

Every little thing else is on the grid, together with September’s private revenue and spending adjustments. Each are up, and at wholesome ranges that don’t point out a dire want for the FOMC to tweak rates of interest.

Financial Information Report Calendar

Supply: Briefing.com, TradeStation

Except one of many delayed financial stories from the federal authorities sneaks is manner onto the calendar this week, there’s nothing main scheduled for the week forward aside from one factor, though that one factor is a biggie. That’s Wednesday’s aforementioned determination on rates of interest. As of the newest look the market’s betting there’s an 87% probability of a quarter-point minimize, which is able to dial the Fed Funds Charge right down to a goal vary of three.5% to three.75%.

Inventory Market Index Evaluation

The market adopted by way of on the earlier week’s bullish reversal final week… type of. When all was stated and finished, the S&P 500 superior 0.3%. That’s not a lot. Maybe much more alarming, nonetheless, is the dearth of quantity behind the feeble effort, and the truth that the trouble slowed even additional when the index’s document excessive of 6,920. Is there one thing about this potential technical ceiling? Are merchants on the lookout for one thing they’ll use as an excuse to show this rebound effort round earlier than it ever actually will get going?

S&P 500 Day by day Chart, with Quantity and VIX

Supply: TradeNavigator

And the NASDAQ Composite’s every day chart seems comparable, albeit with one noteworthy distinction. That’s, final week’s 0.9% acquire nonetheless didn’t push the index up sufficient to check its late-October peak. It did, nonetheless, check — with out breaking above — what had been a dependable help line (yellow, dashed) going all the way in which again to Might. Has this line since become a technical ceiling? It actually seems prefer it has.

NASDAQ Composite Day by day Chart, with Quantity and VXN

Supply: TradeNavigator

Maybe greater than something although, there’s even much less bullish quantity behind the NASDAQ’s acquire than there was with the S&P 500, as soon as once more suggesting there’s truly little or no conviction behind this effort. The one factor conserving the advance alive could also be expectations of bullishness for what’s normally a bullish time of yr.

And that’s not an assumption or guess. The info helps the declare. Because the chart under illustrates, the latter half of December is normally robust in a bull market, however the S&P 500 is already effectively above the norm at this time limit for the everyday bullish yr. (That is after all could also be a giant a part of the explanation the bulls are hesitating right here.)

S&P 500 Common Yearly Cumulative Efficiency

Supply: TradeNavigator

No weekly chart of both index this week… not a lot level. They don’t present us something we are able to’t already see from the every day charts.

So, that is primarily a judgment name … rather more so than common, anyway. Merchants are nonetheless performing like they’re on the lookout for any proof that shares can’t go any larger, a lot in order that they’re making one. Their chief problem is that nobody’s had sufficient guts but to deal a proverbial loss of life blow that will get that bearish ball actually rolling. That might be a break under the 100-day transferring common line (grey) for each indices. The bears acquired near that market a pair weeks in the past, however didn’t pull the set off when it actually mattered. That prospect continues to be very a lot on the desk although, even when merchants have already determined December goes to stay as bullish because it normally is. The larger problem to this prospect stays the truth that the market continues to be so technically overbought — and overvalued.

Backside line? The market’s not tipping its hand right here; it might not even know what it needs to do subsequent. And it’s additional confused by the calendar. Simply sit tight for now and don’t attempt to power something. We’ll get some significant readability quickly sufficient.