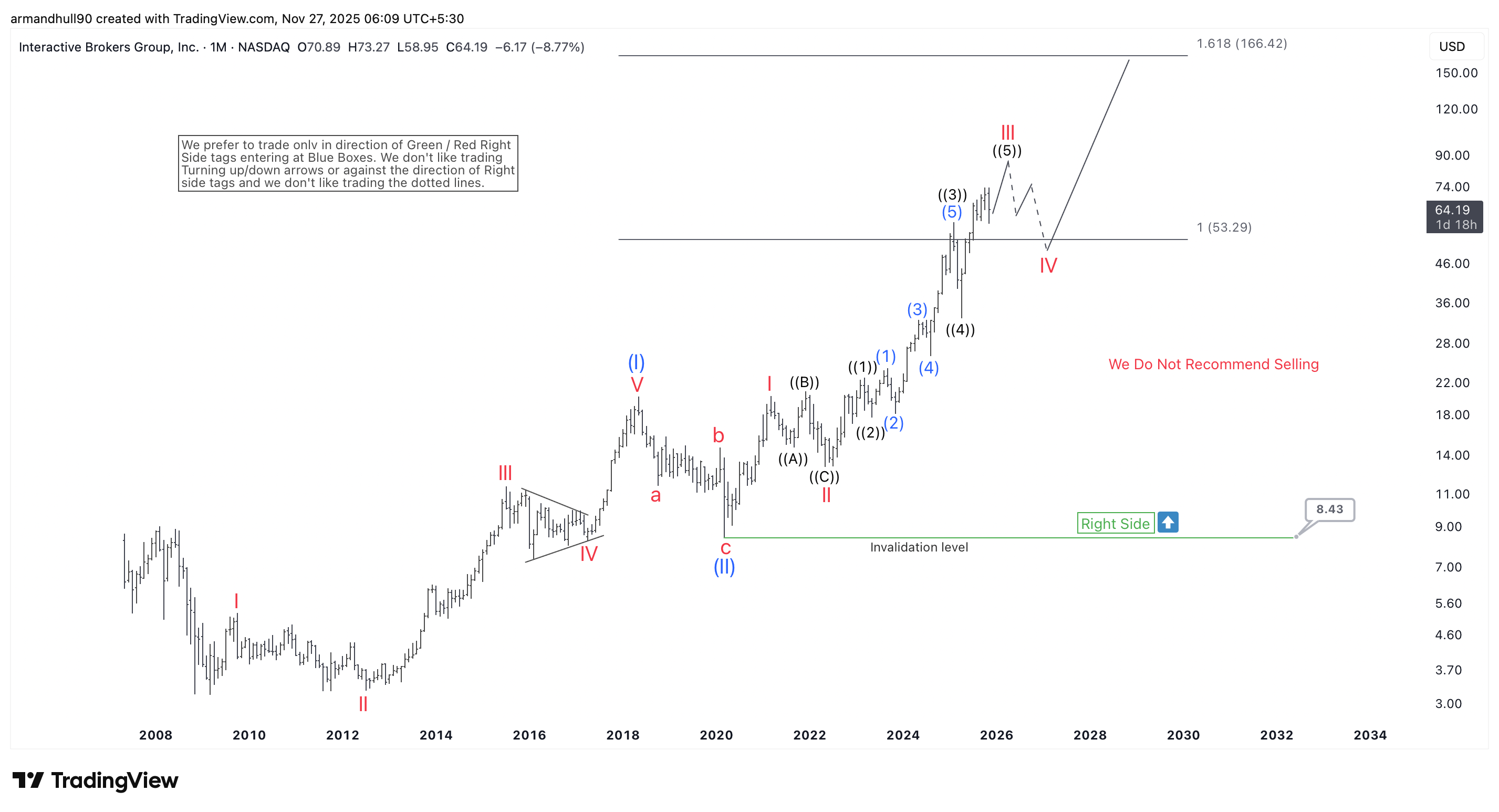

IBKR advances in a robust Wave III construction, with Fibonacci projections pointing towards 86 within the close to time period and a long-term goal of 166 USD—whereas sustaining bullish validation above 8.43.

Interactive Brokers Group (NASDAQ: IBKR) continues to take care of a resilient bullish construction, supported by a transparent Elliott Wave development. The inventory has not too long ago accomplished a major corrective part and has now entered what seems to be an impulsive and doubtlessly explosive bullish cycle. Understanding this wave construction is important for merchants in search of alternatives, particularly as worth motion unfolds towards greater Fibonacci targets.

Wave Counts Recommend IBKR Is in a Highly effective Wave III

After ending wave (II) on the 8.43 USD stage, the inventory began wave (III), which represents a higher-degree impulsive part. Wave (III) usually delivers sturdy and prolonged strikes, and IBKR is exhibiting indicators of that behaviour. The construction now signifies that the inventory is advancing inside wave III of (III). This section is often probably the most highly effective portion of the impulse. Third waves have a tendency to point out steep momentum and sometimes exceed early worth projections.

Inside wave III, IBKR seems to be ending wave ((5)). This last leg is predicted to push towards 86 USD. If momentum continues to construct, the transfer might lengthen above this stage. A break of resistance would additional validate the energy of wave III and will open the door to greater costs.

Potential Pullback and Lengthy-Time period Bullish Goal

As soon as wave III concludes, the inventory ought to start wave IV. This construction often unfolds in 3, 7, or 11 swings. A managed pullback throughout this part could provide a contemporary shopping for alternative. The bullish situation stays legitimate so long as wave IV holds above 8.43 USD.

The long-term Fibonacci projection for wave V of (III) sits close to 166 USD. This goal is derived from the 1.618 Fibonacci extension of earlier impulse waves. The alignment between worth construction and Fibonacci measurements helps the upper goal. If worth follows the anticipated path, IBKR might ship important upside within the coming months and years.

Conclusion

IBKR maintains a agency bullish outlook underneath the Elliott Wave framework. Wave ((5)) inside wave III is nearing its finish, and a wave IV pullback could quickly arrange one other shopping for alternative. The important thing stage to look at stays 8.43 USD. So long as worth holds above this assist, IBKR might advance towards 86 USD first and ultimately goal for the 166 USD Fibonacci goal. The setup continues to favor the bulls, supported by a transparent construction and robust pattern momentum.