Good night, merchants and buyers.

A comparatively quiet day for equities — indices closed blended, with the S&P 500 and Nasdaq flat, whereas small caps (Russell 2000) lagged. Massive-cap tech stays close to all-time highs, however participation continues to slender — a typical late-stage signal the place massive cash hides in mega-caps whereas smaller shares stall.

The actual motion at present got here from valuable metals, the place we noticed a full-on meltdown throughout the board.

Valuable Metals: From Euphoria to Exit

Gold suffered its greatest one-day decline since 2013.

This was the identical space the place we locked in our discretionary gold commerce income a few weeks in the past on the Fibonacci goal — and as famous then, we have been getting into “no man’s land” the place value may swing +4% to -4% every day.

That’s precisely what performed out at present.

- Gold, silver, and miners all reversed sharply decrease.

- Silver miners (SILJ) have been hit hardest, down over 11% on panic quantity.

- This seems to be like a crowded commerce unwinding, as latecomers who chased the transfer at the moment are capitulating.

Keep in mind: the smaller the asset and the extra speculative the sector, the larger the swings.

Silver and its miners can ship excellent runs — however additionally they appropriate violently.

Perspective & Market Cycle Parallels

If we step again, at present’s pullback in gold suits neatly into the 2008 analog we’ve mentioned:

- Then, each gold and the S&P hit new highs collectively.

- Gold noticed a sharp preliminary selloff, stabilized, then launched larger as shares rolled over.

We could also be in that very same stage now — a short-term shock inside a longer-term setup.

As soon as equities weaken once more, gold, silver, platinum, and palladium may simply lead the following upside surge.

For that purpose, I favor the bodily metals or direct ETFs (like GLD, SLV) over miners.

Miners are nonetheless shares and can endure alongside the fairness market if volatility expands.

Sentiment & Conduct

Right this moment’s quantity in GDX, GDXJ, and SILJ exhibits fear-driven liquidation — seemingly a mixture of:

- Revenue-taking from early longs, and

- Panic promoting from FOMO consumers who entered late within the transfer.

That is regular in bubble-type phases.

As soon as the emotional mud settles, gold and silver may stabilize and stage their subsequent leg larger — however volatility will stay intense.

Bonds & Defensive Rotation

Bonds continued to agency, performing as a partial protected haven whereas equities tread water.

The month-to-month chart of TLT nonetheless suggests a basing course of — sluggish, however constructive.

As threat urge for food fades, we should always see bonds reclaim their defensive management once more within the months forward.

Key Takeaways

- Equities: Flat and indecisive

- Gold: Largest one-day drop since 2013; volatility getting into peak section.

- Silver & Miners: Hardest hit; traditional crowded-trade washout.

- Bonds: Slowly turning defensive; early indicators of base forming.

Backside Line

Right this moment’s selloff in valuable metals wasn’t random — it was a traditional emotional shakeout after weeks of FOMO shopping for.

Gold’s long-term development stays bullish, however short-term volatility is peaking.

If historical past rhymes, we may quickly see gold resume management as equities weaken — however till that confirms, endurance and place administration are key.

Speak quickly, and commerce protected.

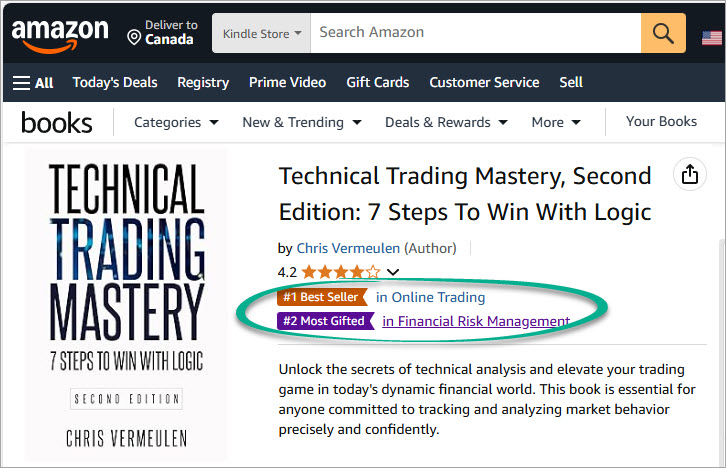

Chris Vermeulen

✔ PREMIUM ETF SIGNALS: https://thetechnicaltraders.com/investment-solutions/

✔ OPTIONS TRADING SIGNALS: https://thetechnicaltraders.com/ots/

✔ FREE ANALYSIS NEWSLETTER: https://TheTechnicalTraders.com/publication/

MY FREE INDICATORS IN MY BOOKS

Disclaimer:

The content material printed on this web site, together with weblog posts, movies, analysis articles, and commentary, is meant solely for informational and academic functions and shouldn’t be construed as funding recommendation. Technical Merchants Ltd. and its associates are not registered as funding advisers with the U.S. Securities and Alternate Fee or any state securities authority. The knowledge supplied is common in nature and is not tailor-made to the funding wants of any particular particular person. Nothing printed on this web site constitutes a advice to purchase, promote, or maintain any specific safety, commodity, or monetary instrument. The views expressed signify the opinions of the authors and are topic to alter at any time with out discover. Efficiency outcomes mentioned could embrace reside buying and selling outcomes and/or backtested or hypothetical information. Hypothetical outcomes are inherently restricted and don’t mirror precise buying and selling efficiency. No illustration is made that any account will or is prone to obtain income or losses just like these mentioned. Previous efficiency will not be indicative of future outcomes. All investments contain threat, together with the potential lack of principal. Testimonials and person experiences offered might not be consultant of others and don’t assure future success. Some content material could include affiliate hyperlinks or promotional materials, from which we could earn compensation. This doesn’t affect our content material or editorial independence. By accessing this web site or consuming its content material, you acknowledge that you’re solely answerable for your individual monetary choices and comply with seek the advice of a licensed monetary skilled earlier than performing on any info supplied.