- USDJPY ↓ 2.5% YTD

- Yen anticipated to be one of many most unstable G10 currencies vs USD

- US PCE + Japan CPI combo = contemporary volatility?

- Japan CPI forecast to set off strikes of ↑ 0.4% & ↓ 0.2%

- Bloomberg FX mannequin – 74% USDJPY – (150.21 – 155.26)

Whilst anticipation builds forward of the US CPI report this afternoon (Friday, thirteenth February), merchants are bracing for extra high-risk occasions within the week forward.

From the Fed’s assembly minutes to the Japan CPI report and the US December PCE index, amongst different key experiences will probably be in focus:

Monday, sixteenth February

- US Markets closed for Presidents’ Day vacation

- JPY: Japan This fall GDP, industrial manufacturing

- EUR: Eurozone Industrial Manufacturing (Dec)

- CAD: Canada Housing Begins (Jan)

Tuesday, seventeenth February

- AUD: RBA Assembly Minutes

- GBP: UK Unemployment Price (Dec)

- EUR: Germany ZEW Financial Sentiment Index (Feb)

- JPY: Japan Stability of Commerce (Jan)

- USD: US Empire manufacturing

Wednesday, 18th February

- GBP: UK Inflation Price (Jan)

- USD: FOMC Minutes, US Constructing Permits (Nov, Dec), Sturdy Items Orders (Dec), Housing Begins (Nov, Dec)

- NZD: New Zealand fee determination

- Crude (WTI, Brent): US API Crude Oil Inventory Change (w/e Feb 13)

Thursday, nineteenth February

- AUD: Australia Employment Information (Jan)

- USD: US Stability of Commerce (Dec), Preliminary Jobless Claims (w/e Feb 14)

- EUR: Eurozone Client Confidence (Feb)

- Crude (WTI, Brent): US EIA Crude Oil shares Change (w/e Feb 13)

- US30: Walmart earnings

Friday, twentieth February

- GBP: UK Retail Gross sales (Jan), S&P World Manufacturing & Providers PMIs (Feb)

- EUR: Germany HCOB Manufacturing, Providers & Composite PMIs (Feb)

- CAD: Canada Retail Gross sales (Jan)

- JPY: Japan CPI, S&P World manufacturing

- USD: US PCE Value Index (Dec), GDP Progress Price (This fall), Private Earnings & Spending (Dec)

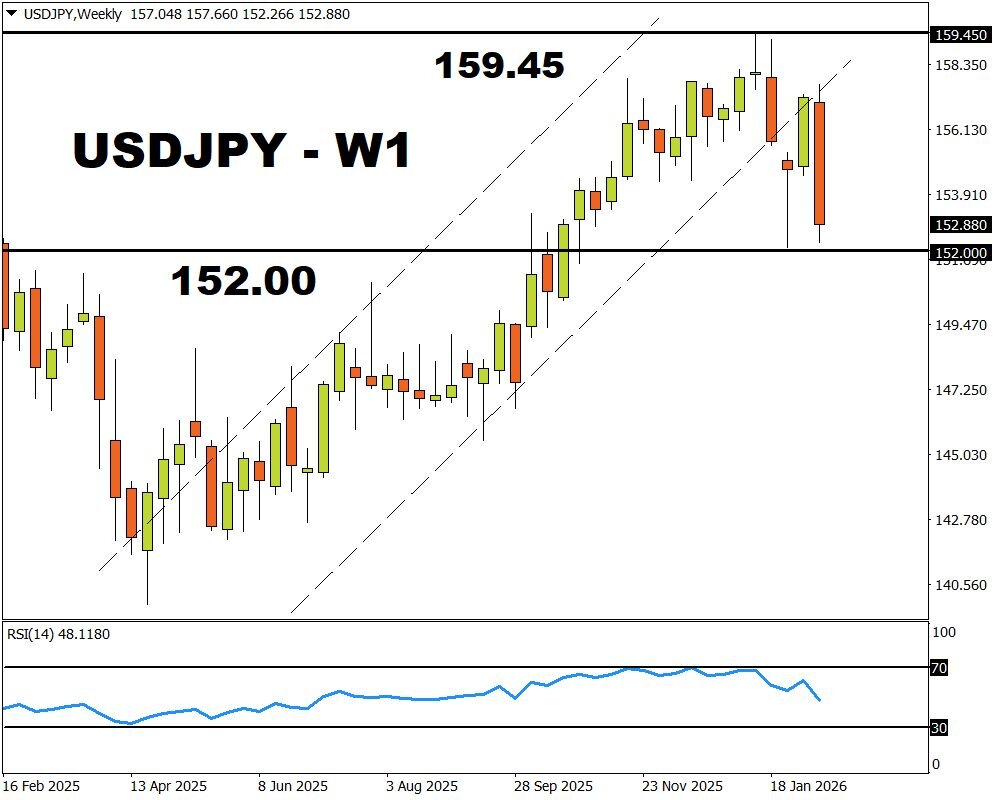

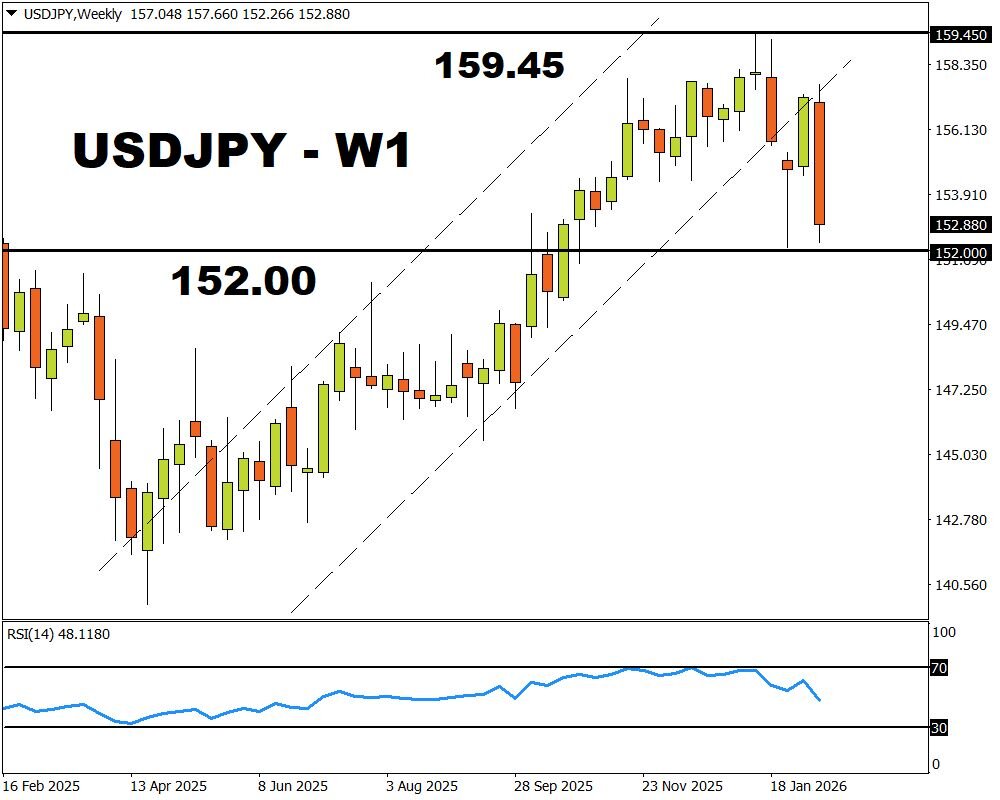

The USDJPY is again in focus because of a string of high-impact knowledge releases from america and Japan.

Over the previous few weeks, the USDJPY has exhibited heightened volatility amid issues about intervention, political danger in Japan, and general greenback volatility.

With the Yen anticipated to be some of the unstable G10 currencies versus the USD subsequent week, this might spell contemporary buying and selling alternatives.

Listed below are 3 causes why the USDJPY might see important swings:

1) Fed minutes + US December PCE

The Federal Reserve releases minutes from its Jan 27 – 28 assembly, when it held rates of interest regular. Any new clues concerning future coverage strikes might impression expectations for decrease charges over the approaching months.

However the main danger occasion for the greenback often is the Fed’s most popular inflation gauge – the Core PCE.

Markets are forecasting the core PCE deflator to rise 2.9% in December in comparison with 2.8% within the earlier month. Finally, indicators of rising inflationary pressures might additional cool bets across the Fed reducing charges anytime quickly.

USDJPY is forecast to maneuver 0.2% up or 0.3% down in a 6-hour window after the US PCE report.

2) Japan This fall GDP + Japan CPI

It’s a knowledge heavy week in Japan with the most recent GDP figures and key CPI report more likely to form bets across the BoJ mountaineering charges.

Financial development is anticipated to have rebounded in This fall, whereas CPI is seen cooling 1.6% in January in comparison with the two.1% within the earlier month.

Merchants are at present pricing in a 78% likelihood that the BoJ hikes charges by April. Any main shifts to those expectations might rock the Japanese Yen.

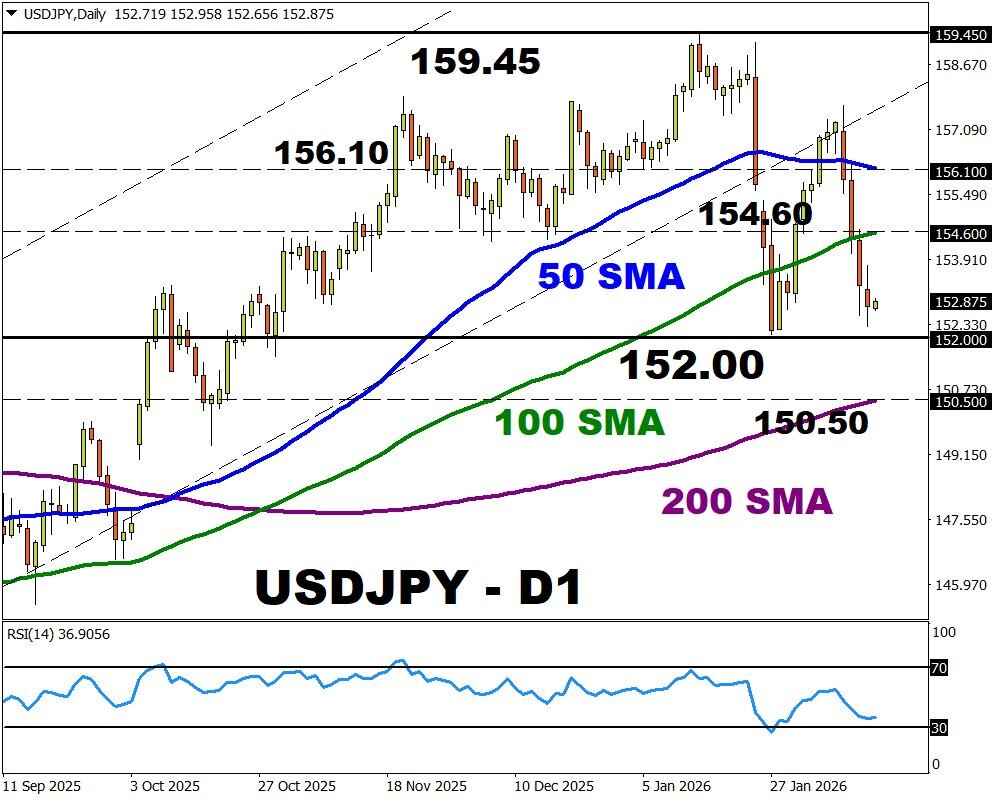

3) Technical forces

The USDJPY is underneath stress on the every day charts with costs approaching the 152.00 assist degree. Nevertheless, the RSI is approaching oversold ranges.

- A strong breakout and every day shut under 152.00 might open a path towards the 200-day SMA at 150.50.

- Ought to 152.00 show to be dependable assist, this might ship costs towards the 100 and 50-day SMA.

Bloomberg’s FX mannequin factors to a 74.6% likelihood that USDJPY will commerce throughout the 150.28 – 155.04 vary over the subsequent one-week interval.

ForexTime Ltd (FXTM) is an award profitable worldwide on-line foreign exchange dealer regulated by CySEC 185/12 www.forextime.com