By RoboForex Analytical Division

The USD/JPY pair fell to 158.16 on Friday because the Japanese yen continued its restoration from earlier this week. Market individuals are more and more targeted on the upcoming Financial institution of Japan (BoJ) assembly, hoping for clearer indicators concerning the longer term tempo of rate of interest hikes.

The regulator is extensively anticipated to maintain its coverage parameters unchanged on the subsequent assembly. Nonetheless, traders are already pricing within the subsequent price hike as early as June. BoJ Governor Kazuo Ueda just lately reiterated that the central financial institution stays able to tighten coverage if financial momentum and inflation dynamics proceed to align with official forecasts.

Further assist for the yen got here from renewed issues over attainable forex intervention as USD/JPY approached the psychologically essential 160 degree. Japanese authorities have repeatedly warned in opposition to sharp, unilateral change price actions, growing market sensitivity on this zone.

On the identical time, political uncertainty continues to weigh on the yen. Markets are factoring in the potential for early parliamentary elections. Based on media studies, Prime Minister Sanae Takaichi might announce the dissolution of the decrease home in an effort to push ahead a extra energetic fiscal coverage. Additional particulars are anticipated to be introduced to representatives of the ruling coalition on 19 January.

Technical Evaluation

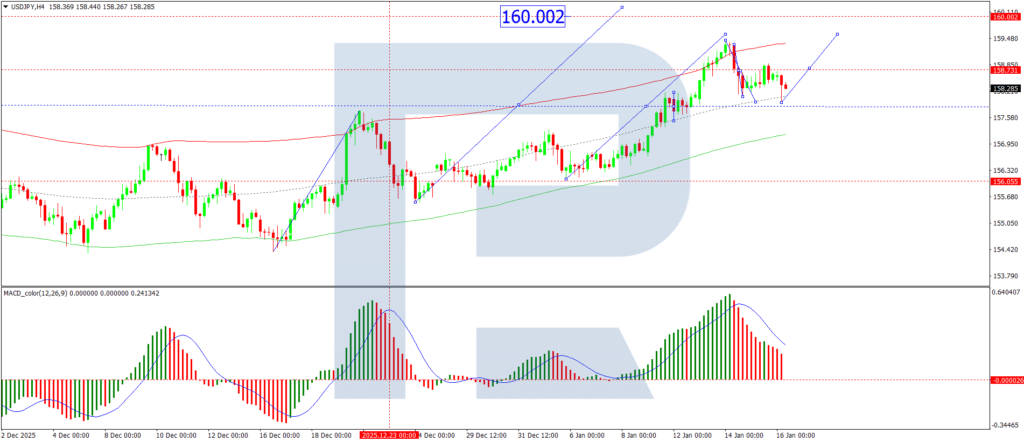

On the H4 chart, USD/JPY has corrected to the 157.90 space. For as we speak, it’s related to contemplate the potential formation of the preliminary part of a renewed upward construction, focusing on 159.59, with the prospect of an additional transfer in the direction of 160.00.

This state of affairs is technically supported by the MACD indicator, whose sign line stays above the zero degree and is directed sharply upward, indicating that bullish momentum stays regardless of the latest correction.

On the H1 chart, USD/JPY is forming a consolidation vary round 158.77. The vary has at the moment expanded downward to 157.97.

- A breakout beneath this degree would probably set off a decline in the direction of 156.60

- A breakout to the upside would open the best way for a bullish wave in the direction of 159.59

This outlook is supported by the Stochastic Oscillator, whose sign line is positioned above the 50 degree and is shifting steadily upward in the direction of 80, indicating rising bullish stress.

Conclusion

USD/JPY stays at a essential juncture, balancing yen assist from intervention dangers and expectations of BoJ tightening in opposition to ongoing stress from political uncertainty. Within the brief time period, consolidation is prone to persist, however a breakout from the present vary will outline the subsequent directional transfer. So long as the pair holds above key assist ranges, the broader bullish development in the direction of the 160 space stays technically legitimate, whereas a draw back breakout would shift focus in the direction of deeper corrective targets.

Disclaimer

Any forecasts contained herein are based mostly on the writer’s explicit opinion. This evaluation will not be handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes based mostly on buying and selling suggestions and evaluations contained herein.

- USD/JPY Slips because the Yen Reacts to a Wave of Market Information Jan 16, 2026

- Oil tumbles 5%. Tech rally pushes US shares increased Jan 16, 2026

- GBP/USD Secure: Sentiment Shifts in Favour of Sterling Jan 15, 2026

- Pure Gasoline costs plunge over 10%. Revenue-taking noticed in valuable metals. Jan 15, 2026

- Markets gripped by geopolitics, uncertainty & Trump Jan 14, 2026

- Gold Units New Highs, With Additional Good points Forward Jan 14, 2026

- EUR/USD Awaiting US Inflation Information for Course Jan 13, 2026

- Trump declares 25% tariffs on international locations buying and selling with Iran Jan 13, 2026

- USD/JPY Stalls Close to One-Yr Excessive Jan 12, 2026

- Inventory indices and valuable metals proceed to rise Jan 12, 2026