By RoboForex Analytical Division

The USD/JPY pair climbed to a nine-month excessive on Friday, approaching the important thing 154.00 stage. The yen concluded October with losses of roughly 4%, marking a extremely unsuccessful month. The forex’s decline was exacerbated by home political shifts, following the election of Sanae Takaichi as Prime Minister. Takaichi is a recognized advocate for stimulative fiscal coverage and the upkeep of ultra-loose financial situations—a mix that usually weighs on a forex.

This dovish political backdrop was complemented by the Financial institution of Japan’s resolution to carry rates of interest regular in October. Governor Kazuo Ueda additional dampened sentiment by warning that tighter international commerce situations may stifle financial progress and cut back company earnings.

In a notable shift, the brand new Finance Minister, Satsuki Katayama, clarified that she not views a yen alternate price of 120-130 per greenback as acceptable. She emphasised that forex stability is now her main focus, a remark markets interpreted as a step again from direct intervention.

The yen additionally confronted strain from a broadly strengthening US greenback. Market expectations for additional Federal Reserve price cuts have receded, whereas knowledge exhibiting higher-than-expected inflation in Tokyo for October sophisticated the home coverage outlook.

Technical Evaluation: USD/JPY

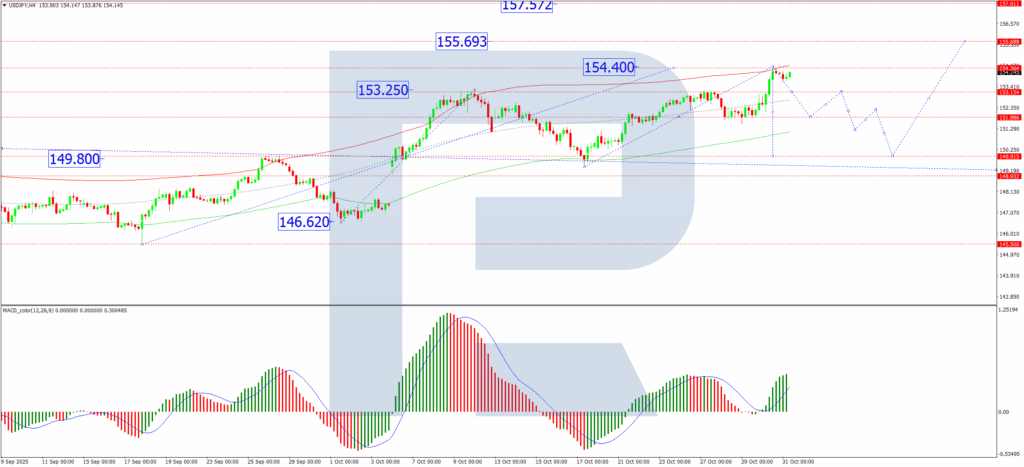

H4 Chart:

On the H4 chart, USD/JPY has accomplished a bullish wave construction, reaching 154.40. The pair is now prone to enter a interval of consolidation at these highs. A decisive downward breakout from this vary would sign the beginning of a correction, with an preliminary goal at 151.88. Conversely, an upward breakout would open the trail for the subsequent leg of the rally in the direction of 155.70.

This technical outlook is supported by the MACD indicator. Its sign line stays above zero and is pointing firmly upwards, confirming the underlying bullish momentum.

H1 Chart:

On the H1 chart, the market accomplished an preliminary progress wave to 153.33, shaped a good consolidation vary, after which broke upwards to attain its native goal of 154.40. Following this peak, a pullback in the direction of a minimum of 153.33 is anticipated. Upon discovering help, the subsequent upward wave is predicted to focus on 154.83, with the potential to increase the broader bullish pattern in the direction of 155.15.

The Stochastic oscillator aligns with this view. Its sign line is above 50 and rising sharply in the direction of 80, indicating that short-term bullish momentum stays intact.

Conclusion

The yen’s sharp decline in October was pushed by an ideal storm of home political and financial dovishness, coupled with a resurgent US greenback. Technically, USD/JPY’s bullish construction is firmly established. Whereas a short-term correction is feasible, the trail of least resistance stays skewed to the upside, with key targets at 155.70 on the H4 chart. All eyes will probably be on whether or not Japanese authorities will transition from verbal intervention to concrete motion if the yen’s weak spot persists.

Disclaimer:

Any forecasts contained herein are primarily based on the creator’s specific opinion. This evaluation will not be handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes primarily based on buying and selling suggestions and critiques contained herein.

- USD/JPY Hits 9-Month Excessive as Yen Endures Robust October Oct 31, 2025

- GBP/USD Finds a Flooring at 1.3200 After Fed-Induced Promote-Off Oct 30, 2025

- A Key Day for EUR/USD because the Fed Resolution Looms Oct 29, 2025

- The British Index UK100 hit a brand new all-time excessive. The Australian greenback strengthened, reaching a three-week excessive Oct 29, 2025

- The US and China representatives reached a preliminary commerce settlement. Saudi Arabia is as soon as once more leaning in the direction of growing oil manufacturing Oct 28, 2025

- Gold Rebounds to 4,000 USD Mark Oct 28, 2025

- USD/JPY Exams Key February Highs Oct 27, 2025

- US inventory indices set worth data amid smooth inflation knowledge Oct 27, 2025

- US authorities shutdown enters fourth week. Oil jumps amid new sanctions towards Russia Oct 24, 2025

- EUR/USD Consolidates Forward of Potential Additional Losses Oct 24, 2025