- The USD/JPY forecast edges decrease because the BoJ’s Ueda left hawkish remarks.

- The BoJ hinted at charge hikes to forestall a resurgence in inflationary stress.

- With Fed easing, the central financial institution divergence continues to favor the USD/JPY bears within the close to time period.

The USD/JPY forecast stays barely decrease on Monday because the pair slipped to mid-155.00 following hawkish alerts from BoJ’s Ueda. His feedback have strengthened the expectations that the central financial institution might increase rates of interest in December or January, narrowing the yield unfold that drove the yen weak point all year long.

–Are you to be taught extra about day buying and selling brokers? Verify our detailed guide-

Ueda harassed that the likelihood of Japan’s inflation and progress materializing is step by step rising. He additionally warned that delaying charge hikes for an prolonged interval might reignite inflation, in the end forcing a disruptive coverage adjustment. He additional added that the BoJ plans to evaluate the speed hike eventualities in its subsequent assembly and can elaborate on the long run path as soon as the speed reaches 0.75%.

Bond markets swiftly reacted, with 2-year JGBP yields hitting 1% for the primary time since 2008, whereas 20-year yields reached the very best degree since 2020. Extra help for the yen got here from the November Composite PMI information, which rose to 52.0, reflecting a modest enchancment in personal sector exercise.

On the US aspect, the Greenback struggles to search out upside momentum because the dovish Fed commentary has pushed the Greenback Index to 2-week lows. The market individuals are more and more pricing in one other charge lower this month. The Fed-BoJ divergence continues to favor yen bulls.

Broad market sentiment stays cautious at the start of December, including additional power to the yen’s demand as a secure haven. Buyers are additionally monitoring the political uncertainty forward of a possible succession to Fed Chair Powell. Reviews that White Home adviser Kevin Hassett is a number one candidate are additionally weakening the greenback additional.

Regardless of the current drop in USD/JPY, the analyst views the yen’s power as being capped within the medium time period, because the US-Japan yield unfold stays huge, even after narrowing to its tightest level since April 2022.

USD/JPY Key Occasions Forward

Shifting forward, the main information launch on the day is the US ISM Manufacturing PMI. Later this week, the US labor information and different key releases might present recent impetus.

USD/JPY Technical Forecast: Oversold Circumstances

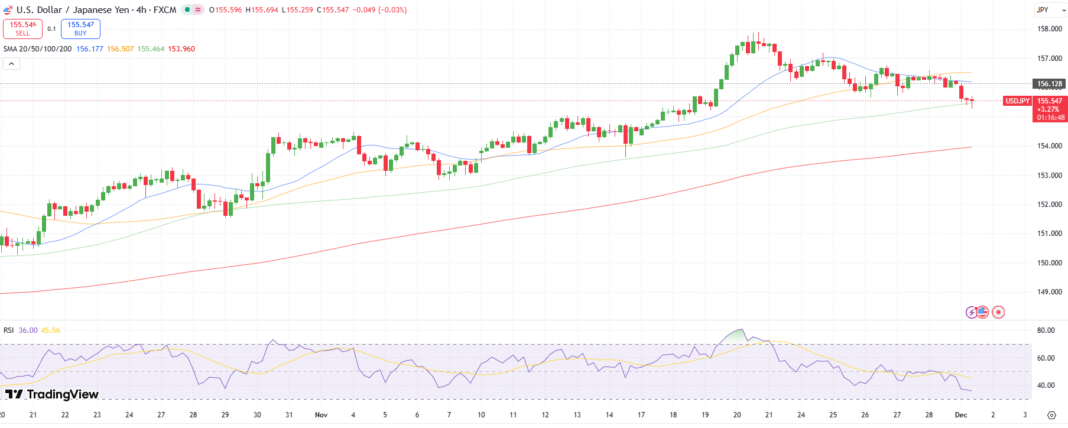

The USD/JPY 4-hour chart reveals a bearish momentum strengthening under the important thing MAs. The value is step by step heading to check the 200-period MA close to 154.00. The extent coincides with the 14th November lows as effectively. Nevertheless, the RSI is approaching the oversold space, suggesting a gentle consolidation.

–Are you to be taught extra about crypto alerts? Verify our detailed guide-

On breaking the 200-period MA, the value might slip additional to 152.80 forward of 151.50. On the upside, sustaining above the 155.50 degree might appeal to patrons and look to check the 20-period MA close to 156.20 forward of the 50-period MA round 156.50.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must contemplate whether or not you may afford to take the excessive threat of dropping your cash.