Disclaimer

This evaluation represents the highest-probability forecast derived from knowledgeable, multi-decade historic analysis of astrological signatures and their documented correlation with market psychology and worth motion.

No Assure

This isn’t a assure of future market efficiency. Monetary markets are influenced by quite a few dynamic and unpredictable real-world elements. All buying and selling and funding actions carry important threat, together with the potential lack of principal.

Academic Function Solely

This content material is strictly for informational and academic functions and shouldn’t be construed as monetary recommendation or a advice to purchase, promote, or commerce any monetary instrument.

Seek the advice of a Skilled

We strongly advise you to seek the advice of a professional monetary advisor earlier than making any funding selections. Any actions you’re taking primarily based on this evaluation are solely your duty. We assume no legal responsibility for any monetary income or losses that will happen.

This week is a textbook astrological setup for a traditional “shakeout and reversal” sample. The market narrative is a story of two distinct and opposing halves. The primary act, from Monday to Wednesday, is ruled by extraordinarily restrictive and chaotic bearish astrology. It begins with the brutal Mars Sq. Saturn facet mixed with a significant high sign from Bayer Rule 27, engineered to set off a tough rejection at a key provide zone and provoke a pointy, fear-driven downtrend. This transfer is designed to punish trapped longs and drive capitulation. The breakdown might be amplified mid-week by the Mercury-Uranus opposition, a traditional set off for an data shock and a high-velocity liquidation occasion. The second act, nonetheless, brings a dramatic reversal. The psychological pivot happens on Thursday with Mercury’s ingress into optimistic Sagittarius. This indicators an aggressive reversal of sentiment from worry to “risk-on,” resulting in a robust, V-shaped restoration and short-squeeze into the tip of the week. Merchants should put together for excessive volatility and a significant reversal mid-week.

For Day by Day Forecast Please watch the beneath video

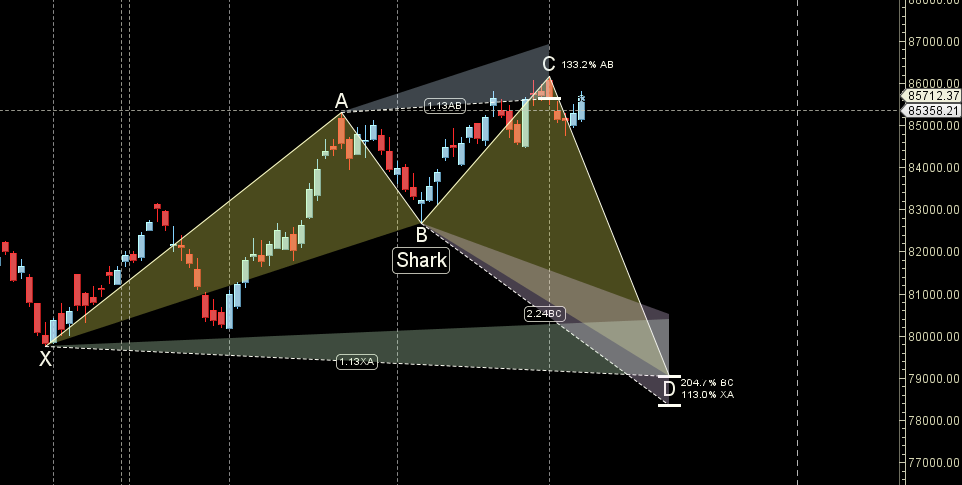

SENSEX Harmonic Sample

Sensex unable to cross SHARK sample PRZ zone of 86000 fall in the direction of 85000/84700

SENSEX Gann Angles

Sensex is between its 4×3 and 1×1 gann angle.

SENSEX Provide and Demand

Self Explanatory Chart

SENSEX Time Evaluation Stress Dates

Key Pivot Dates: Watch 08/11 Dec

SENSEX Weekly Chart

Weekly Outdoors Bar

SENSEX Month-to-month Charts

86100 is Month-to-month resistance zone 83129 is Assist zone.

SENSEX Weekly Ranges

SENSEX Development Deciding Stage: 85640

SENSEX Resistance: 85931,86222,86512,86803

SENSEX Assist: 85350,85059,84768,84478

Ranges talked about are SENSEX Spot

Study Extra:

W.D. Gann Buying and selling Methods – Learn to decode markets utilizing worth, time, and geometry.

Buying and selling Utilizing Monetary Astrology – Uncover how planetary movement impacts market conduct and find out how to commerce it successfully.

Able to Commerce Like a Time-Grasp?

Be a part of our one-on-one mentorship to grasp astro-timing, Gann evaluation, and institutional-grade setups.

Name: 09985711341

Electronic mail: bhandaribrahmesh@gmail.com

Ranges talked about are SENSEX Spot

As all the time I want you most well being and buying and selling success

Associated