A Wholesome Pattern Confirmed: FIIs Double Down on Bullish Stance as New Cash Enters Financial institution Nifty

On the second buying and selling day of 2026, the Financial institution Nifty Index Futures market supplied one other sturdy and unambiguous sign {that a} wholesome, sustainable bull development is taking root. Following up on their preliminary shopping for, Overseas Institutional Traders (FIIs) as soon as once more confirmed their bullish conviction, accumulating an additional 1,147 contracts price ₹207 crore.

Extra necessary than the shopping for itself was the underlying dynamic it revealed: the online Open Curiosity (OI) continued to broaden, rising by 525 contracts. This can be a high-quality, bullish sign. It confirms that the present rally is not only a fleeting reversal however is being fueled by new, assured capital, with FIIs main the cost.

Decoding the Information: The Mechanics of a Assured Accumulation Part

The mixture of methodical FII shopping for and rising market participation is the traditional signature of a wholesome, budding bull run.

-

FIIs: The Constant Accumulators: This second consecutive day of serious shopping for confirms that the FIIs’ bullish pivot just isn’t a random occasion however a deliberate, strategic shift. They’re in a section of methodical accumulation, viewing the present market ranges as a chance to construct a big lengthy place for the interval forward. This constant shopping for strain establishes a powerful institutional help ground below the market, essentially altering its character from defensive to proactive.

-

The Open Curiosity Validation: The continued rise in Open Curiosity is the market’s stamp of approval on this new development. A rally on falling OI is a weak, suspicious rally pushed by exiting shorts. A rally on rising OI, as we’re seeing now, is an indication of immense well being. It means new cash is getting into the market with conviction.

The truth that OI grew, however by lower than the FII purchase determine, can be insightful. It exhibits that whereas there was some profit-taking or place closure out there, the FIIs’ shopping for energy was sturdy sufficient to soak up all of it and nonetheless forge 525 new, energetic contracts. This can be a signal of a strong, two-sided market the place the bulls are the clearly dominant pressure.

Key Implications for the Market

-

A Pattern with Sturdy Foundations: The rally is now being constructed on a stable basis of recent, institutional lengthy positions, making it much more sturdy than a easy short-squeeze.

-

The “Purchase the Dip” Mentality is Cemented: With the market’s strongest gamers constantly accumulating, the prevailing psychology is now firmly entrenched. Any weak point or intraday dip is more likely to be seen by a rising pool of members as a shopping for alternative.

-

The Path of Least Resistance Stays Up: The dual engines of institutional shopping for and broadening market participation have created a strong tailwind. The trail of least resistance is unequivocally to the upside.

Conclusion

The info from this session supplies highly effective affirmation of a brand new, wholesome bull development. The FIIs are offering clear management, and the regular progress in Open Curiosity is simple proof of rising, broad-based conviction. The Financial institution Nifty has began the 12 months with a strong and sustainable accumulation section, with all of the underlying dynamics now in place for a continued and assured transfer to increased ranges.

Final Evaluation will be learn right here

The Financial institution Nifty has delivered a spectacular and textbook breakout, completely validating our earlier evaluation. The confluence of the NR21 sample and the Mercury home change supplied the explosive gasoline for a strong 400+ level rally, shattering earlier limitations and establishing a brand new all-time excessive of 60,203.

Now, this highly effective technical momentum is being met with an interesting and sophisticated combine of recent catalysts: a paradoxically bullish geopolitical occasion and a pointy, cautionary astrological reversal sign. The market is now at a essential inflection level the place one among two very completely different paths will likely be chosen.

1. The Bullish Catalyst: A Geopolitical Disaster with a Optimistic Twist for India

A significant new geopolitical occasion has entered the stage with the growing scenario between the US and Venezuela. Whereas international tensions usually create a risk-off atmosphere, your evaluation has appropriately recognized the distinctive and constructive potential end result for India. A battle that disrupts Venezuelan oil provide may result in a fall in international oil costs, a significant financial boon for India. This is able to straight and positively influence India’s present account deficit, strengthening the Rupee and offering a strong basic tailwind for the banking sector. This creates a powerful, logical case for continued bullish momentum.

2. The Astrological Warning: Bayer Rule 6 and the Mars Reversal Level

Converging with this bullish basic story is a potent and traditionally vital astrological timing sign: Bayer Rule 6. This rule identifies a “vital reversal level” when Mars transits by particular levels, as it’s doing now.

That is the core battle of the present setup. The market is at a brand new, euphoric all-time excessive, backed by a constructive financial catalyst, but it has concurrently arrived at a pre-calculated cyclical level recognized for producing main development reversals. Mars, the planet of motion and aggression, will pressure a decisive decision.

3. The Definitive Battleground: The 59,959 Line within the Sand

This highly effective confluence of conflicting forces has created a brand new, high-stakes battlefield, which will likely be outlined by a single, essential help zone. The market’s response to this stage would be the closing verdict, revealing whether or not the bullish fundamentals or the bearish reversal cycle is stronger.

-

The Bullish Continuation Case: So long as the bulls are capable of efficiently defend the essential 59,959 help stage, the bullish narrative will stay intact. A maintain right here would counsel that the market is absorbing the reversal vitality and is able to use the constructive basic information to launch the subsequent leg of its rally, focusing on 60,450 and 60,942.

-

The Bearish Reversal Case: Nevertheless, a decisive break and failure to take care of the 59,900-59,959 zone would sign that the bearish energy of the Mars cycle is overwhelming the bulls. This is able to be a significant technical failure, inviting a wave of revenue reserving and focusing on a swift decline in direction of 59,470 and a extra vital fall to 58,893.

Conclusion

The Financial institution Nifty is in a uncommon and highly effective state, caught between a confirmed technical breakout with a bullish basic catalyst, and a pointy astrological reversal warning. The battle is now for management of the development, and it is going to be fought on the pivotal 59,959 help stage. The worth motion right here will present the definitive clue as to which pressure will dictate the market’s subsequent main 700+ level transfer.

Financial institution Nifty Dec Futures Open Curiosity Quantity stood at 13.7 lakh, with addition of 0.62 Lakh contracts. Moreover, the Enhance in Price of Carry implies that there was a closuer of SHORT positions immediately.

Financial institution Nifty Advance Decline Ratio at 11:03 and Financial institution Nifty Rollover Price is @59525 closed above it.

The Financial institution Nifty choices market is signaling a strong bullish breakout, with bulls decisively seizing management of the development. An exceptionally sturdy Put-Name Ratio (PCR) of 1.14 has pushed the market deep into bullish territory, indicating a excessive diploma of confidence and a near-total absence of worry. That is pushed by aggressive put writers who’ve created a formidable help construction beneath the index.

Probably the most essential improvement is the spot worth buying and selling at 60,150, which is considerably above each the Max Ache level of 59,600 and, extra importantly, the huge psychological and open curiosity wall on the 60,000 strike. This isn’t only a rally; it’s a main technical breakout that has essentially altered the market panorama.

This breakout places the massive variety of name writers on the 60,000 strike below immense strain. They’re now dealing with vital losses, which may pressure them to cowl their quick positions by shopping for futures. This “quick squeeze” may act as a strong accelerant, fueling the rally even increased.

The market’s battleground has been redrawn by this highly effective transfer:

-

Resistance: The following main resistance stage is now at 60,500, the place the subsequent vital focus of name writers is positioned.

-

Assist: The previous resistance fortress at 60,000 has now decisively flipped to develop into the brand new major help ground. An in depth under this stage could be required to negate the bullish breakout. The 59,600-59,500 zone now acts as the subsequent main help base.

In conclusion, the stalemate is damaged. The bulls are in full command, having conquered a significant resistance stage. The market has now entered a “blue-sky” territory, with the trail of least resistance firmly upwards so long as the bulls can defend the brand new 60,000 help ground.

For Positional Merchants, The Financial institution Nifty Futures’ Pattern Change Degree is At 59862 . Going Lengthy Or Brief Above Or Beneath This Degree Can Assist Them Keep On The Similar Aspect As Establishments, With A Increased Danger-reward Ratio. Intraday Merchants Can Maintain An Eye On 60276 , Which Acts As An Intraday Pattern Change Degree.

Financial institution Nifty Spot – Intraday Technical Setup

Market Remark: The index is at present buying and selling inside an outlined vary. Merchants ought to watch the next pivot zones for potential directional strikes:

-

Energy (Upside): If the index sustains above 60166, it signifies bullish momentum. The quick resistance ranges to observe are 60323, 60496 and 60729.

-

Weak spot (Draw back): Promoting strain is more likely to intensify if the index breaks under 59950. On this situation, the subsequent help zones are 59858, 59565 and 59400.

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to carefully monitor market actions and make knowledgeable choices based mostly on a well-thought-out buying and selling plan and threat administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be a part of Youtube channel : Click on right here

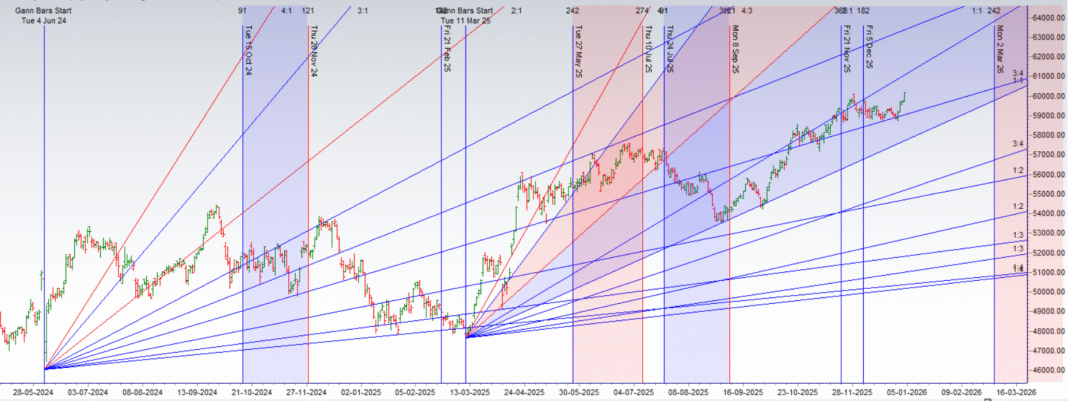

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators