Fibonacci arcs are a buying and selling indicator used for figuring out potential help and resistance ranges primarily based on the Fibonacci sequence. These arcs are drawn utilizing two excessive factors, usually a swing excessive and swing low, after which projected outward utilizing key Fibonacci ratios—38.2%, 50%, and 61.8%. The arcs mark potential help or resistance zones, serving to merchants anticipate value motion and attainable reversals.

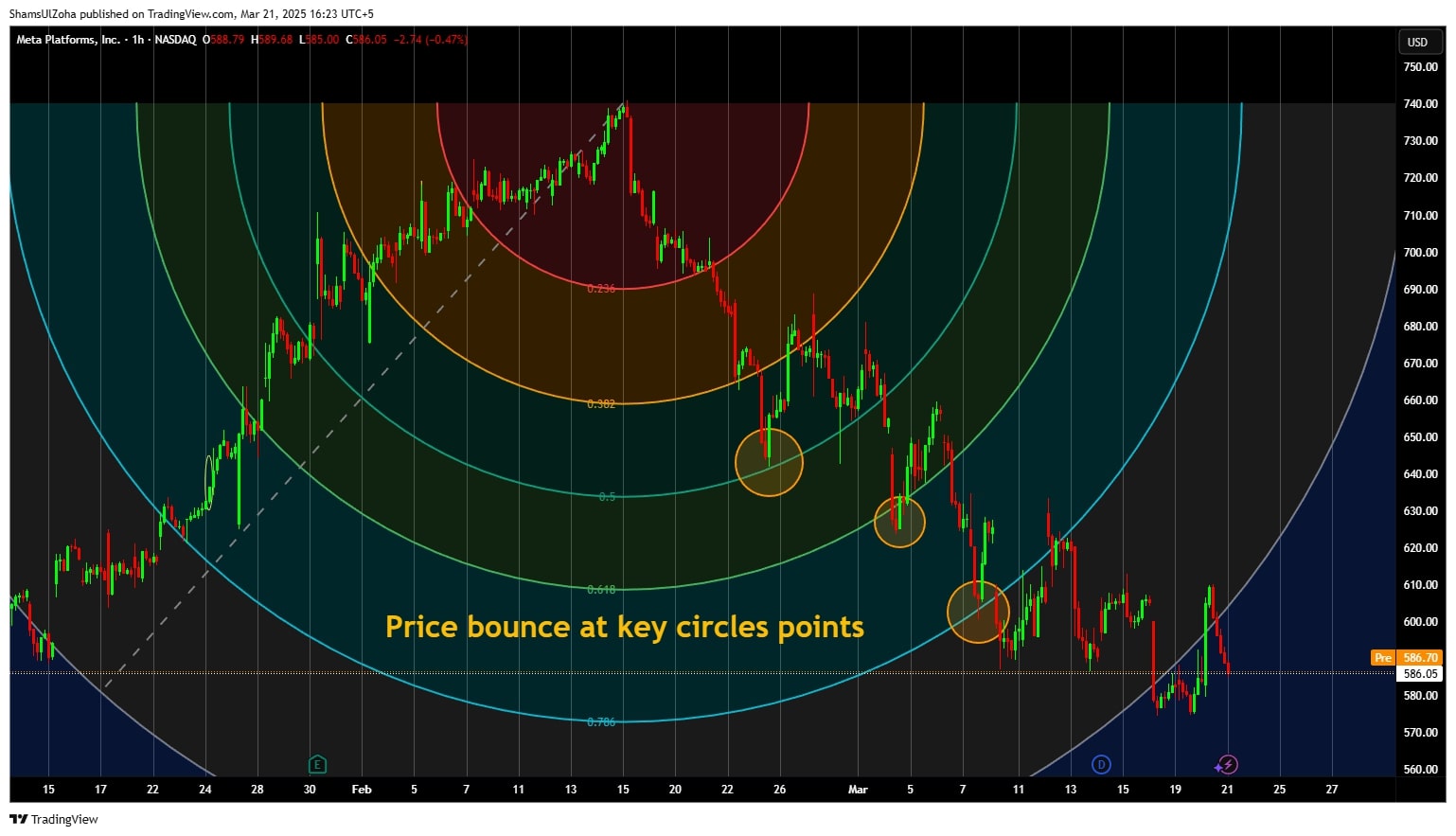

Consider Fibonacci arcs as round arcs that assist merchants dynamically establish help and resistance areas. When value approaches these arcs, merchants can assess whether or not the market will discover help or resistance, resulting in potential buying and selling alternatives. Understanding Fibonacci arcs entails recognizing how value ranges work together with these arcs drawn at key Fibonacci retracement ranges.

How Fibonacci Arcs Work in Buying and selling?

Fibonacci arcs are created by drawing round arcs from a trendline that connects two excessive factors—a swing excessive and a swing low. These arcs are displayed on the key Fibonacci retracement ranges, 38.2%, 50%, and 61.8%, that are primarily based on the Fibonacci sequence.

As soon as these arcs are then drawn on a chart, they function dynamic help and resistance ranges. If costs method the arcs, merchants assess whether or not they are going to encounter resistance or discover help. Fibonacci arcs present merchants a structured option to analyze value motion and anticipate reversals in help or resistance areas.

For instance, merchants may look ahead to a retracement if a inventory approaches a 50% Fibonacci arc. If the inventory rebounds at a Fibonacci arc, it may point out a continuation of the development. Conversely, if the worth breaks by way of a key Fibonacci degree, it may recommend a development reversal.

Systematic Buying and selling Perspective: Why Guidelines Matter

In systematic buying and selling, each resolution follows a algorithm. By incorporating Fibonacci arcs, merchants can use Fibonacci rules objectively to find out entry and exit factors. Merchants use Fibonacci arcs alongside different Fibonacci research, akin to Fibonacci retracement ranges and Fibonacci extensions, to verify buying and selling alerts.

For example, a buying and selling technique might contain shopping for when value approaches the 38.2% Fibonacci arc and promoting when it reaches the 61.8% Fibonacci arc. Backtesting this technique permits merchants to find out the effectiveness of Fibonacci arcs in figuring out potential help or resistance ranges.

A key side of Fibonacci arcs is that they assist merchants make knowledgeable buying and selling choices with out relying solely on Fibonacci ranges. As a substitute, merchants can mix Fibonacci arcs with trendlines, transferring averages, and quantity evaluation to extend accuracy.

Challenges of Utilizing Fibonacci Arcs in a Buying and selling System

Whereas Fibonacci arcs present invaluable insights, they aren’t infallible. One main problem is misinterpreting Fibonacci arcs or over-optimizing buying and selling choices. If merchants apply Fibonacci arcs too aggressively, they may generate false alerts.

Fibonacci arcs marking help or resistance may additionally shift relying on market situations. Merchants ought to keep away from relying solely on Fibonacci arcs and as a substitute mix Fibonacci arcs with different indicators to verify alerts.

One other problem is knowing Fibonacci arcs in several markets. In foreign currency trading, for instance, Fibonacci arcs intersect with pace resistance strains, requiring merchants to regulate their interpretation of Fibonacci arcs.

Actionable Suggestions for Utilizing Fibonacci Arcs Successfully

To maximise the effectiveness of Fibonacci arcs, comply with these methods:

- Mix with Different Indicators: To strengthen your evaluation, use Fibonacci arcs with different technical instruments like Fibonacci retracements, transferring averages, or the Relative Power Index (RSI). The convergence of a number of indicators on the identical value degree can present stronger alerts for help or resistance.

- Be Affected person: Fibonacci arcs are finest utilized in trending markets. Fibonacci arcs might not be as dependable in sideways or uneven market situations. Anticipate a transparent development to develop earlier than making use of them to your trades.

- Modify the Scale: Since Fibonacci arcs are affected by the size of your chart, experiment with completely different chart sizes to find out the simplest scale for drawing your arcs. This helps make sure that the arcs align with reasonable help and resistance ranges.

- Backtest for Affirmation: Earlier than making use of Fibonacci arcs in reside buying and selling, backtest your technique throughout historic information to confirm its effectiveness. This helps you refine your method and will increase your confidence within the software’s predictive energy.

Fibonacci arcs whereas an fascinating idea, are in actuality not an efficient buying and selling indicator for systematic merchants as a result of they lack goal, rule-based definitions that may be persistently quantified and backtested. The location of arcs relies upon closely on subjective interpretation of swing highs and lows, which might fluctuate between merchants and even between charting platforms. This subjectivity makes it unattainable to code exact entry and exit guidelines or consider their historic efficiency with statistical rigor. With out the flexibility to backtest and validate their effectiveness utilizing sturdy, repeatable strategies, Fibonacci arcs can’t be relied upon in reside buying and selling, the place consistency and replicability are important for sustaining a real buying and selling edge.

If you happen to’re able to take your buying and selling to the following degree, mastering instruments like Fibonacci arcs and mixing them with systematic buying and selling rules will assist you to construct constant, worthwhile methods. The Dealer Success System provides step-by-step steerage that can assist you implement Fibonacci arcs and different confirmed methods into your buying and selling plan, guaranteeing long-term success in any market situation.