Hiya merchants. Welcome to a brand new weblog put up the place we focus on commerce setups. On this put up, the highlight shall be on TSLA which renewed the bullish pattern because the April low. The weblog will clarify how members went lengthy from this excessive zone and the potential targets space.

Tesla, Inc. (TSLA) is a worldwide chief in electrical automobiles and clear power, recognized for its innovation in EVs, battery know-how, and autonomous driving. The corporate continues to form the way forward for transportation whereas increasing its footprint in power storage and photo voltaic options.

TSLA has been in a transparent bullish sequence since its inception, persistently breaking earlier highs whereas sustaining assist above prior lows. Inside this long-term bullish cycle, which started in June 2010, a brand new one emerged in April 2025. When a bullish sequence is established, we glance to purchase dips on the excessive zone of a 3, 7, or 11-swing corrective construction. On October 1st, the inventory initiated a pullback to appropriate the sub-wave from June 2025. By early November, the rising corrective construction grew to become clear. Upon confirming a 7-swing construction, we shared the acute zone with members, indicating the seemingly commerce space.

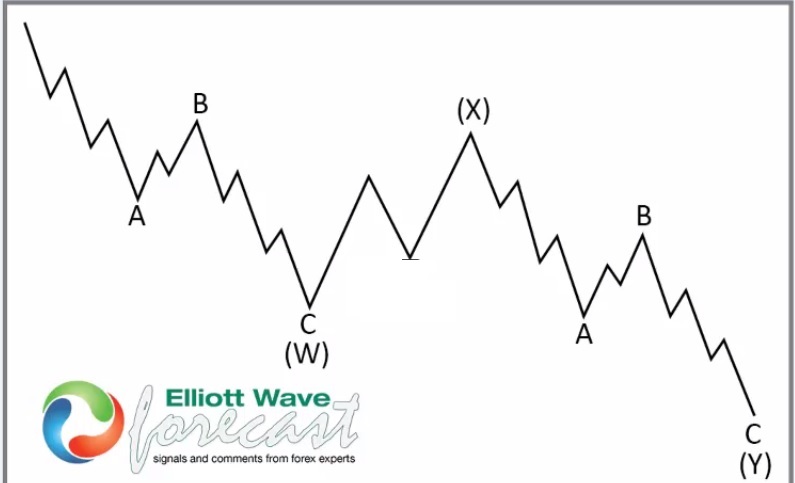

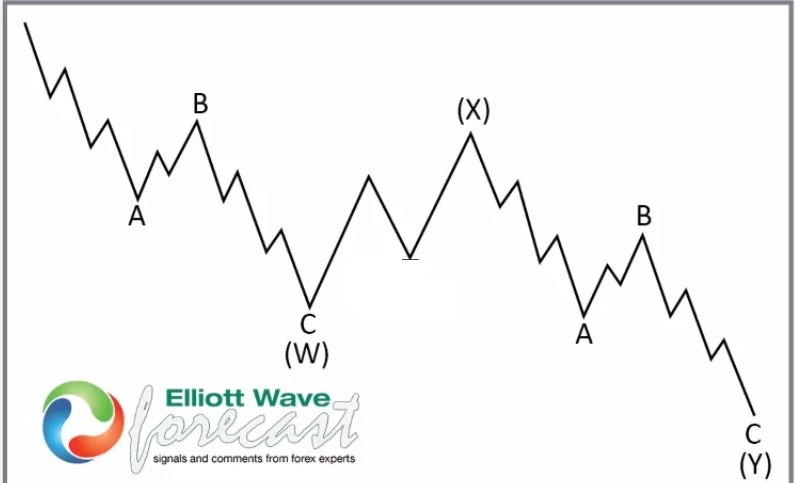

About Elliott Wave 7-swing (Double Zigzag) construction.

A double zigzag happens when a single zigzag isn’t adequate to finish the correction, resulting in a mixture of two zigzags linked by an intervening wave. It’s labeled as W-X-Y, the place:

- Wave W: The primary zigzag (5-3-5 construction).

- Wave X: A connector wave, sometimes a three-wave corrective sample (like a flat or one other smaller zigzag), which hyperlinks the 2 zigzags. Wave X usually retraces 50% to 61.8% of Wave W.

- Wave Y: The second zigzag (one other 5-3-5), normally comparable in dimension and period to Wave W, although it may be longer in some instances.

This ends in an total 5-3-5-3-5-3-5 (7-swing) construction, making it a seven-wave sample. Double zigzags are a part of the “double three” household in Elliott Wave terminology, which emphasizes their position in advanced corrections. They have a tendency to seem in waves 2 & 4 in an impulse and in wave B of a bigger correction.

At Elliott wave forecast, we like buying and selling this construction when it seems towards the pattern. That permits us to search out entry on the excessive. We recognized this construction on the TSLA H4 chart on 11.13.2025 because the chart under exhibits.

We recognized 395.5-346.80 as the acute zone the place it might entice consumers once more.

TSLA Elliott Wave Evaluation 12.24.2025

On December twenty fourth, 2025, we shared the chart above with members, demonstrating the inventory’s bounce from the acute zone (shopping for zone). On the time of writing, TSLA was buying and selling at $477, surpassing its earlier excessive. Subsequently, the same alternative might come up from the following dip. Earlier than that occurs, the inventory might attain $512, which is our ultimate revenue goal for the November setup.

Supply: https://elliottwave-forecast.com/stock-market/tsla-nears-500-off-support-zone/