About:

Triple Shifting Common Purchase Promote Alerts on MT5: https://www.mql5.com/en/market/product/158790

Origins of the Triple Shifting Common Methodology

The triple shifting common methodology traces its roots to traditional technical evaluation, constructing on twin crossover techniques popularized within the Seventies and Eighties. Whereas no single inventor claims the precise 20/50/200 SMA mixture, it evolves from broadly used durations (10, 20, 50, 100, 200) highlighted by merchants like Toni Turner and in platforms resembling MetaTrader.

The 200-period SMA serves as a long-term development filter (usually linked to the “Golden Cross/Loss of life Cross” with the 50-period), whereas including a short-term MA (like 20-period) creates a triple layer for higher affirmation. This strategy gained traction amongst trend-following merchants in shares, foreign exchange, and commodities, emphasizing alignment of short-, medium-, and long-term averages to seize sustained strikes with decreased noise in comparison with single or twin MA techniques.

Robust Factors

This methodology excels as a strong development following device, significantly with the 200 SMA performing as a serious bullish/bearish filter (value above for longs, under for shorts). Key strengths embody:

- Stronger sign affirmation — Requiring MA alignment and value positioning relative to all three averages filters out weaker traits, decreasing false breakouts frequent in twin crossover methods.

- Efficient development seize — It permits merchants to trip important strikes in trending markets, with the layered MAs offering clear visible cues for momentum power (e.g., large separation signifies sturdy traits).

- Simplicity and objectivity — Guidelines-based entries/exits promote self-discipline, making it appropriate for swing or place buying and selling throughout property like foreign exchange pairs, indices, or shares.

When Efficiency is Decrease

Like all shifting average-based techniques, this methodology is lagging by nature and performs poorly in sure circumstances:

- Ranging or sideways markets → Frequent crossovers generate whipsaws (false alerts), resulting in small losses that erode income. The MAs flatten and cluster, producing unreliable alignments.

- Uneven or low-momentum environments → With out clear traits, the technique enters too early or exits prematurely, growing drawdowns.

- Excessive volatility with out course → Sudden reversals can set off stops earlier than traits resume.

Total, the triple MA strategy shines in trending regimes however requires persistence and market choice to keep away from its inherent lagging drawbacks in non-trending phases.

Indicator Description: Triple MA System with Alerts

Commerce with Confidence Utilizing a Basic Triple Shifting Common Technique

This indicator robotically spots high-probability trend-following alternatives utilizing a confirmed 3-moving-average system. It plots clear visible alerts straight in your chart and sends instantaneous alerts to your desktop and cell phone, so that you by no means miss a commerce.

🎯 Core Performance & Buying and selling Logic

The indicator makes use of three shifting averages to filter the development and pinpoint entries. The logic is strict and clear:

BUY Sign (Inexperienced Diamond): Generated when ALL of the next circumstances are met on a closed candle:

Pattern Up: Value is above the sluggish 200-period MA.

Alignment: The 20 MA is above the 50 MA, and the 50 MA is above the 200 MA.

Set off: The candle closes above all three Shifting Averages.

SELL Sign (Purple Diamond): Generated when ALL of the alternative circumstances are met on a closed candle:

Pattern Down: Value is under the sluggish 200-period MA.

Alignment: The 20 MA is under the 50 MA, and the 50 MA is under the 200 MA.

Set off: The candle closes under all three Shifting Averages.

CLOSE Commerce Sign (Golden ‘X’): Your exit sign seems when the quick 20 MA crosses the medium 50 MA.

A golden ‘X’ under value closes a BUY commerce.

A golden ‘X’ above value closes a SELL commerce.

The indicator retains observe of the market state, so it should solely present a brand new Purchase or Promote diamond after a earlier commerce has been closed with an ‘X’.

🔔 Multi-Platform Notifications (By no means Miss a Sign)

When a brand new dwell sign is generated, you get notified in two methods:

Desktop Pop-Up Alert: A transparent message seems in your display (e.g., “XAUUSD H1 place BUY order”).

Push Notification to Your Telephone: The identical alert is distributed immediately to your MetaTrader 5 cellular app, so you possibly can monitor the markets even when away out of your pc.

Be aware: Alerts are for dwell alerts solely. You will not be spammed with historic alerts whenever you first connect the indicator.

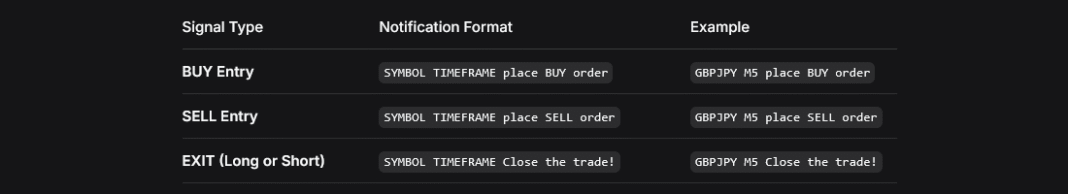

Alert messages format:

Now let’s have a look at how the indicator appears to be like hooked up to a chart:

The indicator has a easy and intuitive menu. Bellow you possibly can see the menu with the default settings:

🎨 Full Customization to Match Your Chart Type

Make the indicator look and work precisely the way you need:

Shifting Common Management: Regulate the interval, kind (SMA/EMA), colour, and line thickness for every of the three MAs.

Sign Look: Select the colour for the Purchase diamonds and Promote diamonds. Regulate the visible offset to position alerts clearly above or under value bars.

Visible Offset Tip: This setting strikes the arrows away from value for higher visibility. A worth of 300 works effectively on Day by day (D1) charts, however it is best to use a smaller worth on decrease timeframes (e.g., attempt 3-10 on a 1-minute chart). Discover the right setting on your favourite chart with one fast adjustment.

Why Select This Indicator?

It transforms the traditional triple MA crossover technique from a guide chart evaluation activity right into a exact, automated buying and selling assistant. With its strict guidelines, clear visuals, and dependable alerts, it helps you keep self-discipline and execute your plan persistently.