You’re studying TradingView VS Metatrader 4: Which Buying and selling Software program is the Greatest? by Enlightened Inventory Buying and selling initially posted on the Enlightened Inventory Buying and selling weblog.

Which Backtesting Software program is Greatest for Systematic Merchants?

TradingView VS MetaTrader 4: Evaluating Backtesting Software program for Systematic Buying and selling

In case your major aim is to construct, take a look at, and commerce rule-based methods with confidence and velocity, neither TradingView nor MetaTrader 4 is right as your major backtesting software program. That title belongs to RealTest. Nevertheless, each TradingView and MT4 supply particular options that may nonetheless serve sure merchants properly, particularly for charting and execution. Right here’s how they examine side-by-side.

TradingView VS MetaTrader 4 at a Look:

Quick on time? Right here’s how TradingView VS MetaTrader 4 examine aspect by aspect.

|

Characteristic |

TradingView |

MetaTrader 4 |

|

12 months Established |

2011 |

2005 |

|

Working System |

Internet + Home windows/Mac app |

Home windows solely |

|

Dealer Integration |

Partial, through linked accounts |

Full, broker-delivered platform |

|

Technique Language |

Pine Script v5 |

MQL4 (extra advanced, however highly effective) |

|

Backtesting Help |

Primary, restricted realism |

Technique tester with limitations |

|

Platform Value |

Freemium w/ upgrades |

Free by brokers |

|

Knowledge Entry |

Broad multi-asset protection |

Dealer-dependent |

|

Ease of Use |

Intuitive for charting and scripting |

Steeper studying curve |

Platform Overview, Value & Compatibility

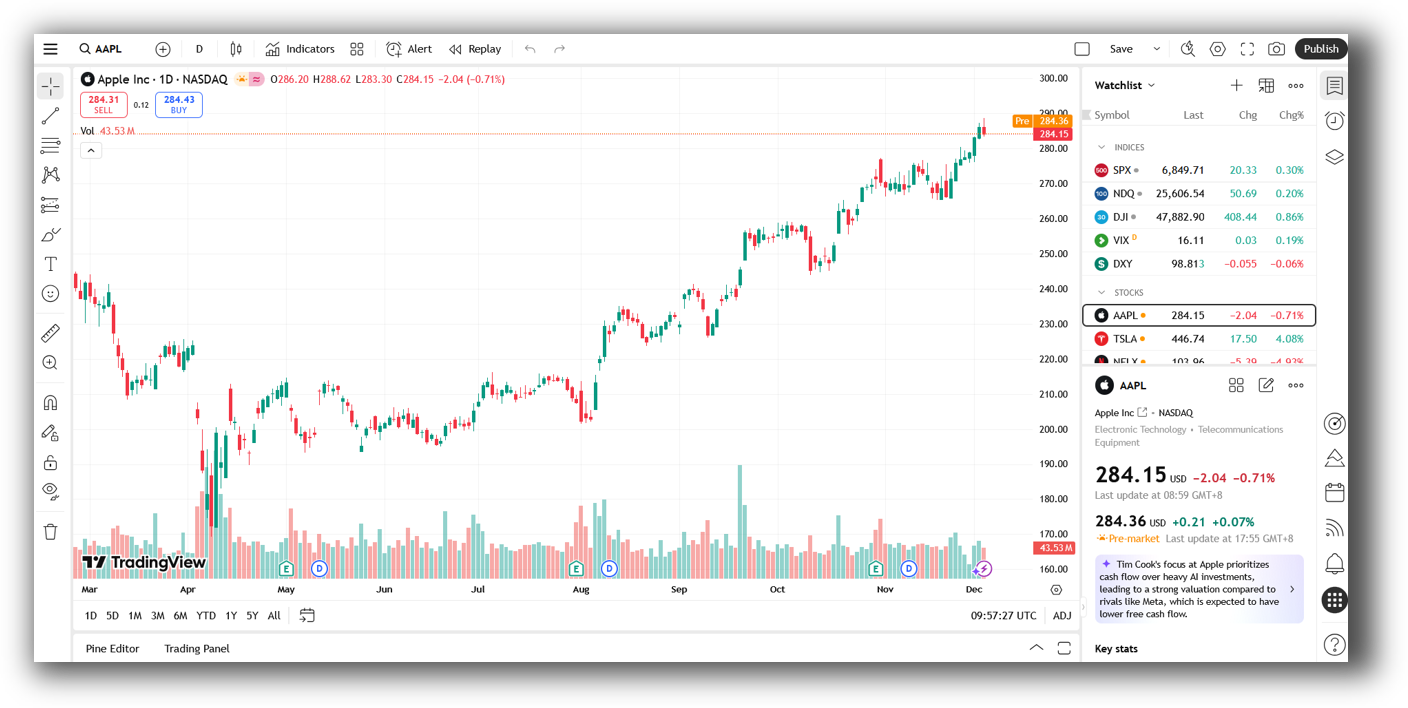

TradingView is a browser-based platform with extra desktop apps for Mac and Home windows. It’s quick, responsive, and runs with out set up. That’s an enormous plus for merchants who use a number of units. Nevertheless, full backtesting capabilities require a paid plan.

MetaTrader 4 is a Home windows-only desktop software (except run by a digital machine on Mac). It’s been round since 2005 and is extensively utilized by foreign exchange merchants.

TradingView Primary View:

MetaTrader 4 Primary View:

Market Entry & Knowledge Help in TradingView VS MetaTrader 4

TradingView connects to a variety of markets (shares, foreign exchange, crypto, future) and gives intensive historic knowledge on-demand. However backtestable knowledge is restricted to what your script requests, and also you don’t get full portfolio-level simulation.

MT4 depends totally in your dealer for knowledge. You don’t get clear historic datasets or full market depth except your dealer gives them.

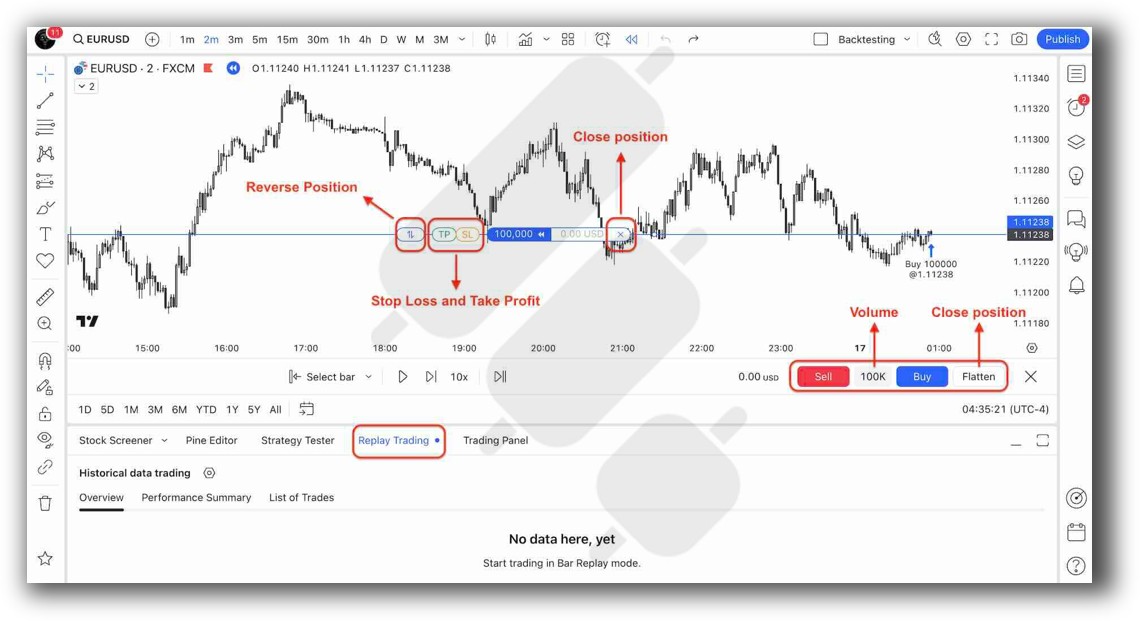

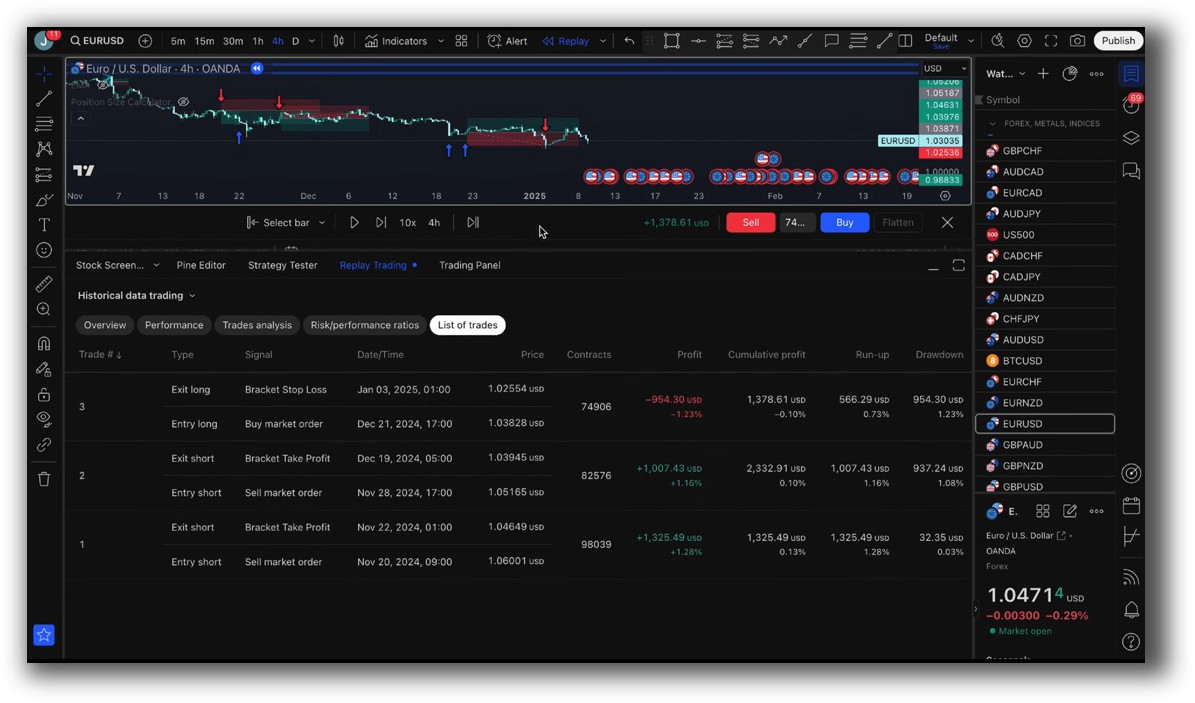

TradingView Backtesting Interface:

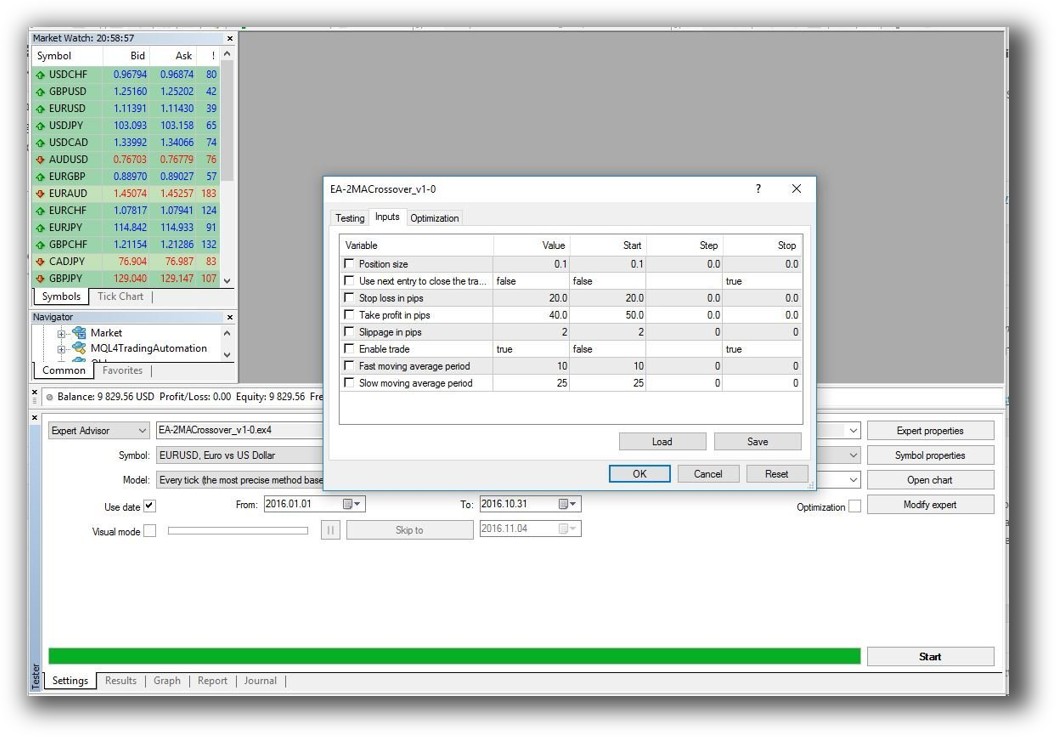

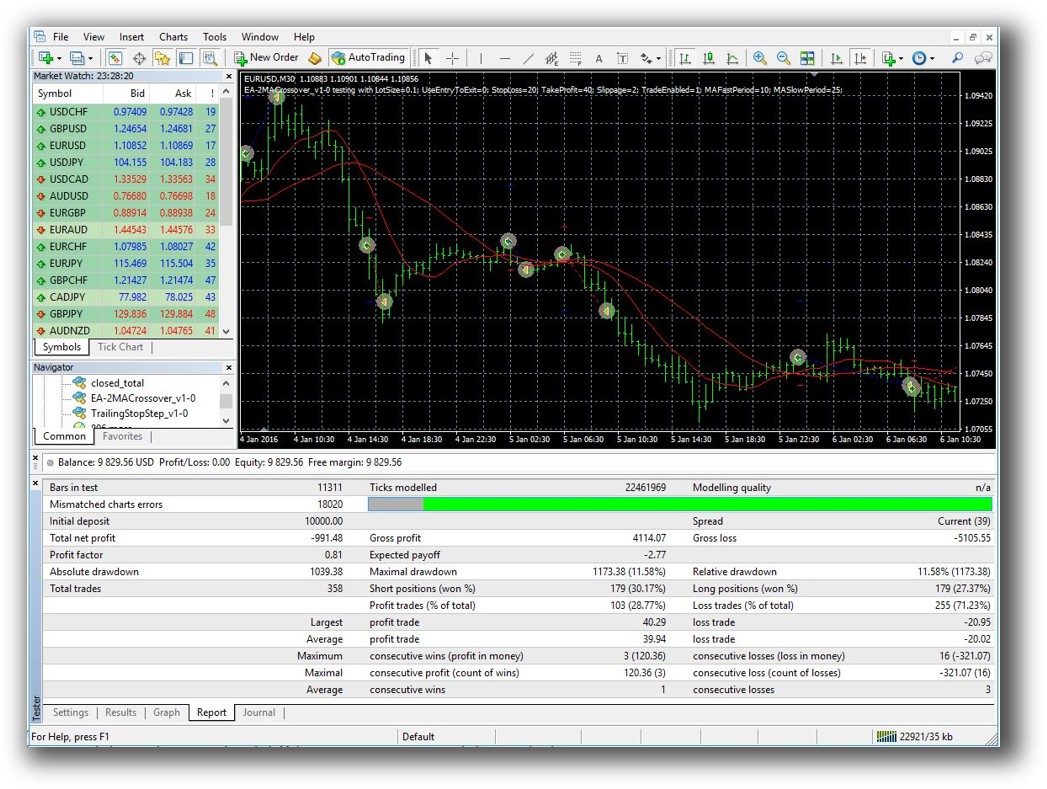

MetaTrader 4 Backtesting Interface:

Constructing & Customizing Buying and selling Methods

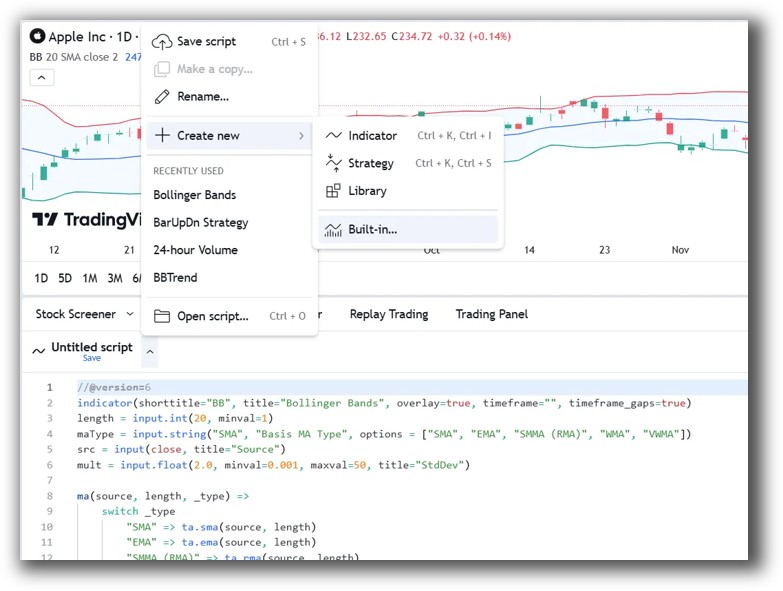

TradingView makes use of Pine Script. It’s accessible and beginner-friendly, however restricted in flexibility. You possibly can construct easy methods and backtest them bar-by-bar on the chart. Nevertheless, there’s no help for portfolio-level testing or multi-symbol methods.

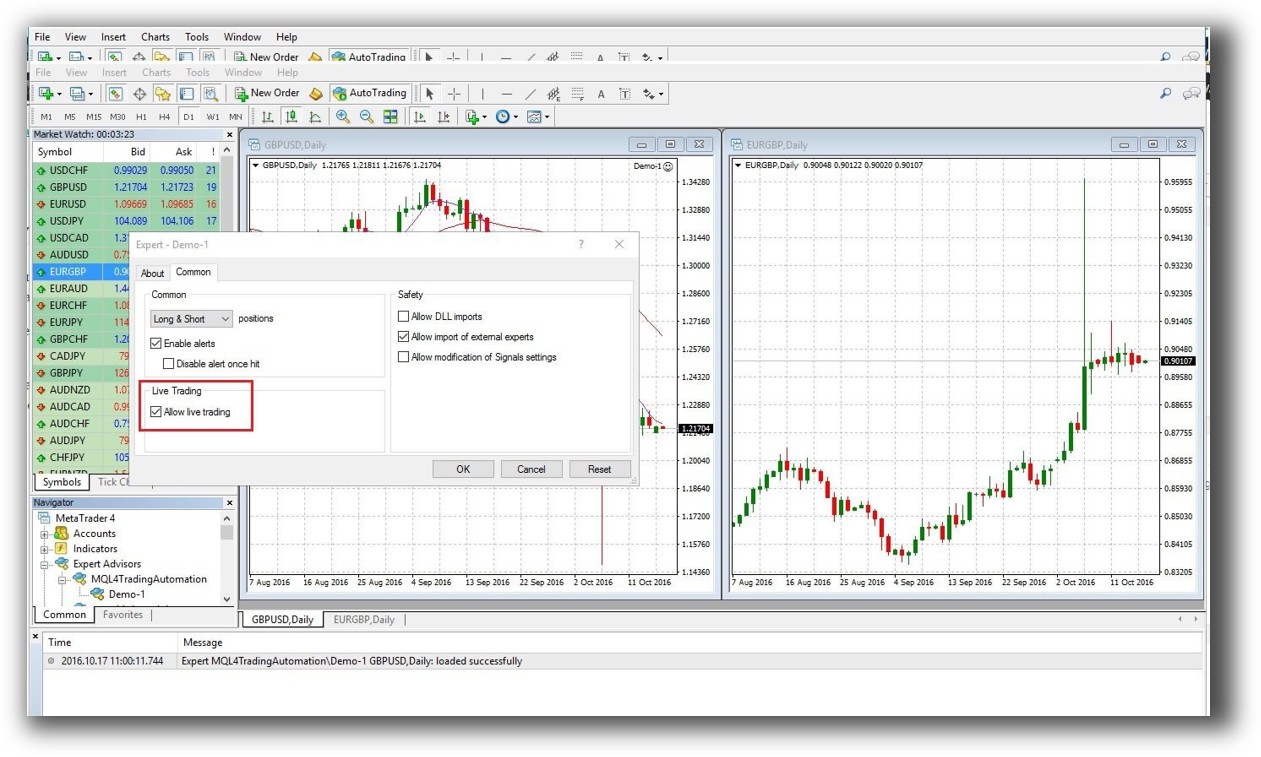

MetaTrader 4 makes use of MQL4, a way more highly effective and sophisticated scripting language. It helps indicators, scripts, and automatic Knowledgeable Advisors (EAs), however has a steeper studying curve. For programmers, it gives extra flexibility than Pine Script.

If you happen to’re simply beginning with buying and selling system improvement, TradingView is less complicated to study. However MT4 gives extra depth, at the price of complexity.

Verify Out: Buying and selling System Improvement

TradingView Code Editor:

MetaTrader 4 Code Editor:

Backtesting Efficiency, Velocity & Realism

That is the place each platforms fall brief for critical system merchants.

TradingView doesn’t help true portfolio backtesting. You possibly can take a look at one instrument at a time, however there’s no simulation of place sizing, slippage, or capital allocation throughout a number of symbols. Velocity is restricted by the platform’s visible interface.

MT4 features a built-in Technique Tester. It permits for visible and non-visual backtesting of EAs, however solely on one image at a time. There are workarounds with multi-symbol EAs, however they’re not user-friendly. Execution realism (e.g. order fills, delays) is minimal except closely custom-made.

If backtesting realism, drawdown, and simulation accuracy matter to you, and they need to, use RealTest as an alternative. It’s sooner, extra sensible, and helps full portfolio-level simulation.

Try: Backtesting | Drawdown

TradingView Backtest Report:

MetaTrader 4 Backtest Report:

Technique Optimization & Stress Testing Instruments

TradingView has no built-in optimization. It’s good to manually change parameters and rerun the script. This makes robustness testing tedious and error-prone.

MetaTrader 4 consists of parameter optimization with a number of modes and customized standards. Nevertheless, it’s infamous for curve becoming. It additionally lacks walk-forward evaluation and different fashionable robustness instruments.

In case your purpose is to carry out buying and selling system optimization that’s quick, steady, and repeatable, MT4 is best than TradingView, however nonetheless second-rate in comparison with skilled instruments like RealTest or Amibroker.

Charting Options, Sign Exploration & Stay Execution

TradingView shines right here. It gives clear, quick charts with a whole lot of built-in indicators and overlays. The scanner is highly effective and customizable. Execution integration is restricted to sure brokers, however bettering.

MT4 gives primary charting and a clunky scanner (Market Watch). Execution is built-in and usually sooner, however customers say the expertise is dated, it seems like software program from 2005, as a result of it’s.

If you wish to visually discover the market and spot concepts, TradingView wins palms down. If you would like quick execution in foreign exchange, MT4 should still be helpful.

Verify Out Order Sorts | Automated Buying and selling Techniques

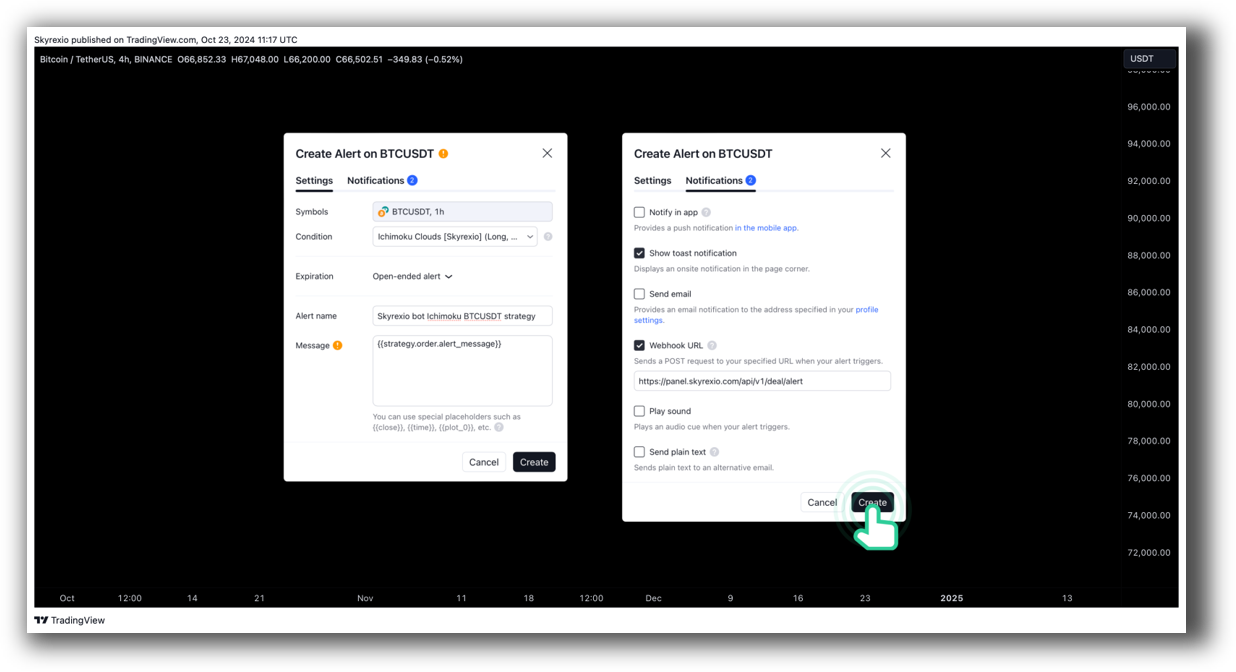

TradingView Automation Set Up:

MetaTrader 4 Automation Set Up:

Help, Documentation & Studying Sources

TradingView has fashionable documentation and an enormous public script library. It’s simple to search out examples and study Pine Script. Neighborhood help is robust, particularly for indicator improvement.

MetaTrader 4 has fragmented documentation. Most help comes from third-party boards, not official channels. The MetaEditor software helps with code constructing, but it surely’s not beginner-friendly.

In comparison with both, RealTest gives clear, fashionable documentation with a concentrate on backtesting velocity and system readability, a significant profit for merchants constructing a portfolio of methods.

TradingView Neighborhood Concepts Entrance Web page is illustrated down beneath:

MetaTrader 4 Discussion board Entrance Web page is illustrated down beneath:

TradingView VS MetaTrader 4: Which One Ought to You Use?

In case your focus is ease of use, fashionable charting, and easy technique testing, TradingView gives a greater consumer expertise.

If you would like automation, dealer execution, and may deal with advanced scripting, MetaTrader 4 is extra versatile.

However for critical system merchants centered on constant earnings, neither is one of the best core backtesting software.

Our Suggestion

Use TradingView for market visualization, scanning, and early-stage scripting.

Use MetaTrader 4 provided that you’re dedicated to foreign currency trading with automated EAs and are snug coding in MQL4.

However for true systematic buying and selling success (the place velocity, realism, and multi-strategy simulation matter) use RealTest. It’s purpose-built for merchants who wish to commerce professionally with consistency and confidence.

Need The Remainder of the Puzzle?

Backtesting software program is only one piece. The actual transformation occurs while you align your instruments, your methods, and your psychology together with your objectives.

If you happen to’re uninterested in chasing suggestions and wish to construct wealth systematically, the subsequent step is obvious: The Dealer Success System.

Inside, you’ll uncover:

- Confirmed buying and selling methods

- A step-by-step backtesting framework

- Place sizing instruments

- Automation methods that allow you to commerce in half-hour or much less

Buying and selling and Backtesting Software program Evaluation Checklist

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Past Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Past Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Past Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Past Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Past Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Past Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Past Charts VS Optuma

- Past Charts VS TradingView

- Past Charts VS MetaTrader 4 (MT4)

- Past Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)

The publish TradingView VS Metatrader 4: Which Buying and selling Software program is the Greatest? first appeared on Enlightened Inventory Buying and selling.