We simply closed one other 40%-plus acquire in The Struggle Room in 332 buying and selling days utilizing certainly one of my favourite methods – the unfold.

This time it was on the XBI, a biotech ETF.

We make this play practically yearly and it delivers like clockwork because the biotech sector rotates out and in of trend.

We used a “calendar unfold” for this commerce.

A calendar unfold (additionally known as a time unfold) is an choices technique that includes shopping for and promoting choices of the identical kind (calls or places) and strike value, however with totally different expiration dates.

Right here’s the way it works:

- Purchase a longer-term choice (farther expiration)

- Promote a shorter-term choice (close to expiration)

- Each have the identical strike value and similar kind (both each calls or each places)

You’re attempting to revenue from time decay (theta) and steady costs (low volatility) within the brief time period.

- The short-term choice loses time worth sooner, benefiting you as the vendor.

- The long-term choice retains extra time worth, limiting your threat.

Basically, you need the inventory to remain close to the strike value till the brief choice expires, or in our case, you need the decay on the brief name to be far larger than the lengthy name.

As time passes, the short-term choice decays sooner.

When it expires, you may promote one other short-term choice in opposition to your lengthy one (like renting out time premium repeatedly) or if the inventory stays close to the strike value, the unfold’s worth rises as a result of the lengthy choice retains extra worth.

The time to make use of a calendar unfold is whenever you anticipate the underlying inventory to remain close to a sure value (impartial outlook till we get nearer to expiration and then you definitely see the lengthy name choose up steam whereas the brief name suffers time decay quickly.)

Now the technique shouldn’t be with out threat – no technique is (even holding money is topic to inflation threat).

If the underlying shares transfer up too quick, then you definitely run right into a delta squeeze the place each choices improve in worth equally. You might not lose cash, however you received’t make as a lot. If this was anticipated, you’ll use a vertical unfold (we’ll speak about that one other time).

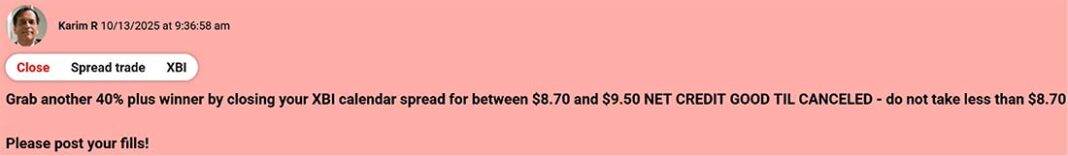

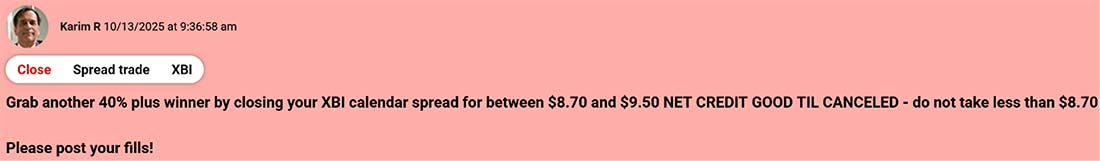

![]()

YOUR ACTION PLAN

Calendar spreads are a good way to make use of time decay to your benefit.

I additionally issued one other commerce in The Struggle Room earlier in the present day.

Click on right here to login and get that newest commerce alert.