Choices present buyers with the power to proactively hedge their portfolios in opposition to potential market crashes. On this article, we’ll focus on the significance of being proactively hedged in an choices portfolio.

Why to Hedge?

One of the important the reason why you will need to be proactively hedged in an choices portfolio is that it’s too late to hedge as soon as a market crash has already began.

When a market crash happens, the costs of shares plummet, and buyers endure vital losses. The time to hedge your portfolio is earlier than the crash happens, not after. Proactive hedging entails taking steps to guard your portfolio earlier than the market downturn happens.

Proactive hedging entails buying choices that may profit from a market downturn. These choices are sometimes put choices, which give the holder the precise to promote an underlying asset at a predetermined value.

When the market crashes, the worth of those put choices will increase, offsetting the losses incurred within the underlying inventory. One more reason why you will need to be proactively hedged in an choices portfolio is that it could assist scale back the general danger of the portfolio.

By buying put choices, buyers are primarily shopping for insurance coverage in opposition to potential market downturns. Whereas the price of these choices will be vital, they’ll present a major return on funding if a market crash happens. In essence, proactive hedging is a type of danger administration that may assist shield buyers from vital losses.

Moreover, proactive hedging may assist buyers take benefit of market alternatives. When the market is in a downturn, there are usually alternatives to buy shares at discounted costs. By hedging their portfolios, buyers can shield themselves in opposition to losses whereas nonetheless having the capital accessible to reap the benefits of these alternatives.

The Collar

There’s a well-known approach was proactively hedged whereas seeking to revenue. This method is named the “collar” technique.

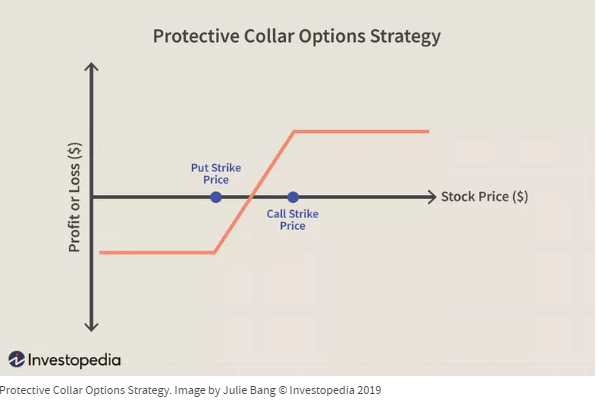

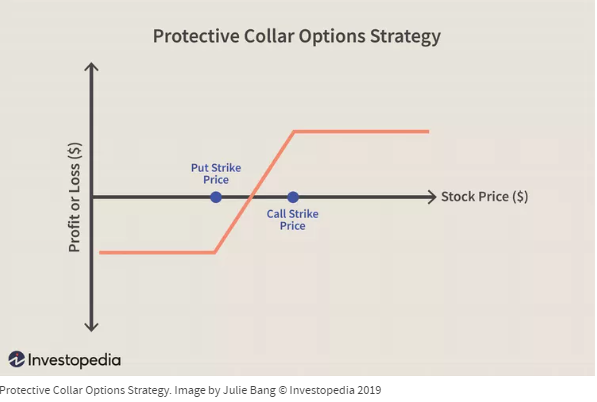

This technique entails concurrently buying put choices to shield in opposition to draw back danger whereas promoting name choices to generate earnings. The earnings generated from promoting the decision choices can be utilized to finance the acquisition of the put choices, successfully making a “collar” across the portfolio.

A collar is a buying and selling technique that’s generally used to restrict the potential lack of an underlying asset whereas additionally capping its potential revenue. It’s created by combining an extended place in an asset with a protecting put choice and a brief name choice.

Whereas a collar will be an efficient method to shield an investor’s place available in the market, there are a number of weaknesses to this commerce construction. Listed below are just a few examples:

-

Restricted Revenue Potential: One of many most important weaknesses of a collar is that it limits the potential revenue that an investor could make. By utilizing a protecting put choice and a brief name choice, the investor is primarily giving up a few of their potential positive aspects in trade for safety in opposition to losses. Whereas this can be a sensible transfer in sure market circumstances, it may also be a hindrance in others.

-

Pricey to Implement: One other weak spot of a collar is that it may be costly to implement. It is because the investor should pay for each the protecting put choice and the quick name choice. Relying on the value of the underlying asset and the precise choices getting used, this price can add up shortly.

-

Requires Energetic Administration: A collar additionally requires energetic administration to be able to be efficient. Because of this the investor should be consistently monitoring the market and their place to be able to make knowledgeable selections about when to regulate the collar. This may be time-consuming and hectic for some buyers.

The Options

The collar technique, whereas well-known, has some weaknesses that may restrict an investor’s potential positive aspects and require energetic administration. Nonetheless, there are lesser-known methods that may obtain the objective of proactively hedging with out these downsides. These superior methods contain combining ratio spreads with butterflies and counting on second-order Greeks. In consequence, these methods supply a number of benefits, together with:

-

Higher Flexibility: These superior methods are extra versatile than the collar technique, permitting for extra nuanced changes to an investor’s place in response to altering market circumstances.

-

Decrease Value: These methods are cheaper to implement than the collar technique, which may require the acquisition of each a protecting put choice and a brief name choice.

-

Potential for Larger Positive aspects: By counting on second-order Greeks and combining ratio spreads with butterflies, these methods have the potential for increased positive aspects than the collar technique.

- Decreased Want for Energetic Administration: These superior methods can require much less energetic administration than the collar technique, which will be a profit for busy buyers or those that want a extra hands-off strategy.

Whereas the collar technique has its place in sure market circumstances, there are superior choices buying and selling methods that may supply a number of benefits over the collar technique. These methods are price exploring for buyers who’re thinking about proactively hedging their positions whereas additionally maximizing their potential positive aspects.

Conclusion

In conclusion, investing within the inventory market will be dangerous and unpredictable, however choices buying and selling can present a method to proactively hedge in opposition to potential market crashes.

Being proactively hedged entails taking steps to guard your portfolio earlier than a market downturn happens. The collar technique is a widely known approach used for proactively hedging, but it surely has some weaknesses that may restrict an investor’s potential positive aspects and require energetic administration. Nonetheless, there are superior choices buying and selling methods that may supply better flexibility, decrease price, potential for increased positive aspects, and decreased want for energetic administration.

Finally, buyers ought to think about all choices buying and selling methods to seek out the one which most closely fits their danger tolerance, funding targets, and market circumstances. By proactively hedging their portfolios, buyers can scale back their danger publicity, reap the benefits of market alternatives, and doubtlessly obtain increased returns.

In regards to the Writer: Karl Domm’s 29+ years in choices buying and selling showcases his means to commerce for a dwelling with a confirmed monitor report. His journey started as a retail dealer, and after struggling for 23 years, he lastly achieved

constant profitability in 2017 by means of his personal options-only portfolio utilizing quantitative buying and selling methods.

After he constructed a confirmed buying and selling monitor report, he accepted exterior buyers. His guide, “A Portfolio for All Markets,” focuses on choice portfolio investing. He earned a BS Diploma from Fresno State and presently resides in Clovis, California. You may observe him on YouTube and go to his web site real-pl for extra insights.