Set and neglect buying and selling is a phrase that I coined a number of years again in an article I wrote on the subject. It’s a buying and selling method that works in the event you observe it, to place it merely. Because of this, I write about it typically, and people of you who’ve been following me for a while little doubt perceive the primary advantages of the set and neglect buying and selling method.

Set and neglect buying and selling is a phrase that I coined a number of years again in an article I wrote on the subject. It’s a buying and selling method that works in the event you observe it, to place it merely. Because of this, I write about it typically, and people of you who’ve been following me for a while little doubt perceive the primary advantages of the set and neglect buying and selling method.

Nevertheless, in at the moment’s lesson, I need to concentrate on the psychological facets and advantages of the set and neglect method and why it can assist your buying and selling efficiency, primarily based on my private experiences.

We get many members who electronic mail us repeatedly with success tales after they’ve adopted the set and neglect method. Hopefully, extra of you’ll begin trialing this idea as a result of there may be nothing that makes me happier than listening to my college students’ success tales.

As chances are you’ll already know from a few of my different articles on this matter, set and neglect buying and selling works partially due to the way in which it lets you systemize the entry, cease and goal of your trades. By permitting the sting to play out uninterrupted, with out you fidgeting with it for arbitrary causes, your long-term buying and selling efficiency will enhance merely as a ‘side-effect’.

Nevertheless, there are additionally some essential psychological advantages of set and neglect buying and selling which I don’t typically focus on.

On this lesson, I need to concentrate on the psychological advantages of set and neglect buying and selling to assist extra of you make the psychological transition to this fashion of buying and selling. By committing to the commerce fully earlier than you even place it, it means you’re figuring out the commerce, inserting the orders and strolling away with little or no monitoring. It additionally means being at peace and avoiding the emotional ups and downs that include watching your trades as they’re dwell. It means strolling away and letting the market ‘do the work’ while you go do one thing extra productive or enjoyable. It means eradicating your self from the temptations of chart-watching and getting influenced by chart whipsaws from information releases, short-term volatility and so forth. In brief, it means setting and forgetting!

By understanding the psychological benefits of set and neglect buying and selling, maybe you’ll acquire a deeper understanding of its energy and start buying and selling this manner sooner.

Psychological benefits…

1. Considerably Scale back Stress & Emotional Ups & Downs

Buying and selling might be as irritating or as stress-free as you need it to be, all of it depends upon what you do. When you sit there staring on the charts all evening when you need to be asleep, you’re doing to drive-up your physique’s stress response and your cortisol (stress hormone) ranges will sky-rocket each from the shortage of sleep and from over-thinking about your trades.

Now, as if the stress wasn’t unhealthy sufficient, it’s going to worsen. You’re additionally going to harm your buying and selling efficiency by doing what I described above, it will work to additional improve your stress ranges. Ultimately, you may be drained, indignant, pissed off, on the verge of tears and left with an empty buying and selling account.

By using my set and neglect buying and selling method, you possibly can remove all this stress, fear and dropping! Present me a set and neglect dealer and I’ll present you a stress-free dealer who’s on the trail to buying and selling success. There have been research carried out on traders / merchants and their buying and selling efficiency in relation to their buying and selling frequency, and so they at all times present that less-involved merchants do higher over the long-run. Equally, despite the fact that buying and selling is a male-dominated enviornment, when ladies do step into it they have an inclination to do a lot better on common than males. Why? Easy; they don’t over-trade as a lot and they don’t danger an excessive amount of like many males do. The rationale has to do with males having larger testosterone ranges (a hormone that makes males take extra dangers and really feel over-confident, issues that may damage you in buying and selling). I’ve an article during which I focus on this feminine vs. male buying and selling phenomena extra in-depth, test it out: What’s The Weakest Hyperlink in Your Buying and selling? Suffice it to say, us males usually are not at all times proper, and we are able to and will be taught from ladies typically and buying and selling appears to be one space the place we are able to profit from their seemingly innate skill to set and neglect their trades.

2. Assist Treatment Your Obsessive Chart-Watching

Have you ever ever heard of optimistic reinforcement? It’s while you get a reward from doing the precise factor, it will then reinforce regardless of the ‘proper factor’ was that you simply did in order that hopefully you retain doing it. It really works on youngsters and it could actually work on adults too, particularly in buying and selling.

Once you watch charts on a regular basis, you’re in all probability going to lose cash, so the chart-watching is a detrimental conduct. The difficult half right here is that the act of chart-watching can really feel excellent whilst you’re doing it (dopamine – the chemical in your mind that provides you the frenzy you get from the ‘hope’ of being profitable), so you’re basically getting a psychological reward from committing a detrimental conduct and you’re reinforcing a detrimental conduct by persevering with to do that. Subsequently, merchants get caught in an addictive cycle of watching charts, making the identical errors again and again and dropping cash.

However, YOU CAN STOP THIS and YOU CAN REVERSE IT! By using set and neglect buying and selling you possibly can actually start to reinforce optimistic conduct moderately than detrimental. This can work like a optimistic suggestions loop during which the improved efficiency you see from behaving correctly within the markets works to make you need to proceed that optimistic conduct. It’s no completely different than somebody who sticks to a regime of train over a interval of months; quickly sufficient the endorphins and improved power and energy-levels start to strengthen the conduct of figuring out persistently. Sure, at first it could look like a ‘boring’ chore you don’t need to do and it could even damage just a little, however relaxation assured, that ache is nice for you.

Setting and forgetting your trades is actually the important thing to eliminating nearly each detrimental buying and selling conduct that merchants have. You have to implement this before later.

A person smarter than me as soon as mentioned; “Undergo the ache of self-discipline or undergo the ache of remorse”. Which means, pay your dues, be disciplined now and it’ll repay later, or you possibly can proceed to behave lazy and undisciplined and you’ll undergo the ache of remorse later.

3. Sleep at Evening – Know What You Stand to Lose or Make

Sleep is important to all bodily and psychological course of within the human physique. There are millions of research on this. I can let you know for a 100% iron-clad indisputable fact that IF you’re dropping sleep from watching charts and worrying about dropping an excessive amount of or not successful sufficient, you’re hurting your buying and selling efficiency and you’re beginning down the highway to reinforcing detrimental buying and selling habits as we mentioned in level 2.

If you end up utilizing set and neglect buying and selling, your cease loss and revenue targets are pre-defined, so you already know what you stand to lose and what you stand to win on any given commerce. I can let you know from expertise, this makes it loads simpler to get and keep asleep at evening so don’t under-estimate this profit!

This brings up one other level: When you already know what you stand to lose or win on a commerce it goes a good distance in the direction of eliminating grasping conduct. Greed is a large purpose merchants fail. It causes them to carry trades too lengthy whether or not the commerce is transferring of their favor or in opposition to them. What number of occasions have you ever been in an enormous successful commerce and also you didn’t take the revenue since you had no revenue goal or since you moved your revenue goal from its preliminary setting? That is greed. Being grasping inevitably causes merchants to finish up with no cash.

Bulls generate income, bears generate income, Pigs? Pigs get slaughtered! That is likely one of the oldest Wall Road sayings and it rings louder than maybe another, nonetheless to at the present time.

Once you set a revenue goal and persist with it, you aren’t being grasping, so over-time it is best to find yourself being profitable. Once you set a cease loss and persist with it, you possibly can pre-define your danger to a greenback quantity you’re mentally OK with (doubtlessly) dropping. Once you regulate your danger correctly and you already know what you possibly can lose, you shouldn’t have any downside setting your commerce and strolling away.

Disclaimer: There may be by no means a 100% sure consequence for any commerce and losses can typically exceed cease losses on account of slippage.

4. Train the Psychological Muscle groups of Routine & Self-discipline

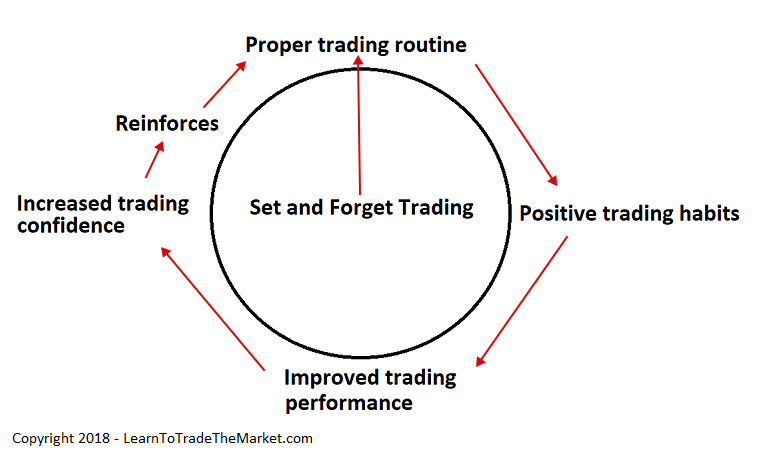

Once you make the dedication to begin set and neglect buying and selling, you’re kicking off a course of that’s self-reinforcing and can proceed to strengthen the longer you employ it. The facility of routine and self-discipline, of repeating an efficient system or course of and staying accountable to THAT, will aid you speed up your improvement of the correct buying and selling habits.

After you have the correct buying and selling habits in place you will note improved buying and selling efficiency which supplies rise to an enormous surge of buying and selling confidence in each your self and what you’re doing. This reinforces the routine you began with and all of it stems from committing to the set and neglect buying and selling method.

Here’s what this appears to be like like in a diagram. Discover that set and neglect is within the middle, as a result of it actually all begins with that concept – when you commit you’ll rapidly determine the correct buying and selling routine from the assistance of my articles and buying and selling programs, then it actually begins to nearly ‘handle itself’ so long as you keep disciplined and persist with the set and neglect plan.

The set and neglect ‘wheel’ of buying and selling success:

5. Confidence By way of Attaining Higher Buying and selling Outcomes

Confidence in enterprise, buying and selling and even in your private life is one thing that really is so vital that it has no greenback worth; it’s invaluable. Confidence breeds extra confidence and it really works to strengthen these optimistic buying and selling habits we mentioned earlier. By buying and selling correctly not solely are you reinforcing optimistic buying and selling habits however you’re breeding confidence in your self and your skill to stay to a plan, this confidence helps you persist with what was working. It’s all a optimistic suggestions loop as I mentioned earlier than.

Confidence is spawned by the momentum of successful trades or on the very least, having higher buying and selling experiences and having extra management over the capital in your account; the strategic planning that set and neglect permits, that ends in improved outcomes. It’s not going to occur suddenly, however over time, while you grasp this fashion of buying and selling, you’ll begin to really feel extra in management since you’re controlling the issues you possibly can and never making an attempt to regulate the issues you possibly can’t (the market’s motion is uncontrollable).

Being extra assured will spawn extra motivation to proceed mastering the act of discovering the commerce and inserting the commerce. It’s identical to the sooner instance I gave of train; while you recover from the preliminary ‘ache’ of it or the preliminary ‘I don’t need to do that feeling’ and also you begin seeing optimistic outcomes, it’s going to inject you with an entire boat-load of motivation and confidence that may work to gas your on-going progress and quest for being the very best. This gives you the willpower and self-discipline it’s essential to make it as a dealer.

Conclusion

I concentrate on the set and neglect method and 95% of the time I’ll resign to the actual fact I’m about to lose XYZ or make XYZ on a commerce; this works to remove the potential of creating emotional errors. The expectation of my buying and selling methodology mixed with the set and neglect cash administration method has helped me, in addition to a lot of my college students enhance their buying and selling. It’s not a precise science, and naturally there shall be occasions trades are adjusted and there are occasions that no quantity of mechanical cash administration can override the pure human emotion of buying and selling, however we’re not after perfection, we’re after coaching and exercising the thoughts to have the ability to let go of the necessity to management the outcomes and management the market, after all of the market goes to do what it’s going to do with or with out us watching it or buying and selling it. All we are able to do is management ourselves and our personal behaviors out there and that’s what set and neglect buying and selling is all about.

What did you consider this lesson? Please share it with us within the feedback beneath!