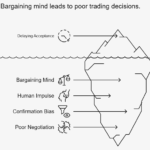

There comes a second in each dealer’s journey when the market nudges your exit, and the thoughts begins its quiet riot. Your inner voice begins to barter, “Wait… possibly this isn’t actual. Possibly it’s only a sentiment wobble, not a real break.”

This negotiation will not be distinctive to buying and selling. It’s the similar internal dialogue individuals expertise in moments of loss or grief—the bargaining stage during which the thoughts tries to rewrite actuality to keep away from ache. In buying and selling, as in life, bargaining is the ultimate try and keep away from discomfort.

However simply as grief asks for acceptance, not negotiation, so does a cease.

When the cease hits, the problem is now not the chart — it’s your willingness to honour the principles you made once you have been calm, clear, and unhurried.

- A cease will not be a prediction of what the market will do.

- A cease is a promise you made to your self.

- And that promise is examined in the course of the second you least need to preserve it.

Why Stops Should Not Be Negotiated

The second your cease set off happens is when you’re most susceptible to emotional distortion. Like somebody navigating the early hours of loss, the dealer enters a psychological state the place the thoughts pleads for an exception — “If I simply wait, possibly issues will return to how they have been.”

This bargaining intuition is human. It is usually harmful.

Stops exist exactly as a result of real-time decision-making is impaired by emotion. They take away you from the battlefield earlier than your considering turns into clouded by the very biases you got down to keep away from.

The rule is straightforward:

Cease hit → Exit. Instantly. No bargaining.

Readability is a present, nevertheless it typically arrives solely after motion.

Structural vs Sentiment — A Helpful Distinction, However Not within the Second

Merchants typically ask whether or not the worth transfer was structural or sentiment-driven. It’s a sound distinction — however not in actual time.

Simply as somebody in grief can not decide their emotional panorama clearly till time has handed, a dealer can not reliably interpret the character of a decline within the second it’s unfolding.

Market-wide drops might be sentiment, whereas sharp breaks might be construction. And typically the distinction solely turns into evident in hindsight. Your job in the course of the second of influence is to not interpret. Your job is to execute.

Reflection comes later, when emotion has settled.

The Phantasm of Ready for “Affirmation”

When the thoughts is bargaining, it searches for situations that permit delay:

When the thoughts is bargaining, it searches for situations that permit delay:

- “I’ll look ahead to a dying cross.”

- “I’ll verify quantity.”

- “Possibly the pattern isn’t damaged but.”

This mirrors the human impulse to postpone accepting arduous truths.

However affirmation on the cease stage is just one other type of bargaining. When you require affirmation after your cease stage is breached, you now not have a cease — you’ve got a negotiation.

And negotiations in moments of loss not often finish nicely.

The Seduction of Partially Exiting

Promoting “some however not all” feels emotionally clever, very similar to the way in which a grieving thoughts seeks partial acceptance: “Possibly I can settle for this piece however not the entire reality.”

However until partial exits are explicitly a part of your system’s design, they introduce:

- inconsistent threat,

- distorted place sizing,

- and an incapability to check your method.

Most significantly, they permit hope to re-enter the dialog — one thing you labored arduous to maintain out.

Hope will not be a buying and selling technique. It’s a bargaining chip provided by the emotional thoughts.

There Is No Excellent Cease — However There Is Sincere Behaviour

You’ll at all times face trades the place the cease triggers and the market then turns again up. It feels unjust. It feels such as you’ve been punished for obeying your guidelines.

This too mirrors grief: doing “all the things proper” and nonetheless feeling ache.

However that is the required discomfort of systematic buying and selling. Variance will not be a mistake — it’s the worth of longevity.

Your job is to not keep away from each unsuitable exit. Your job is to keep away from catastrophic ones.

And that occurs solely when stops are handled as directions, not invites to renegotiate your future.

The Dealer’s Measure

The market is detached to your hopes, your cleverness, your want for equity. It’s unmoved by how a lot you need a commerce to work.

Stops check honesty, not intelligence.

They ask:

Will you settle for actuality, or will you cut price with it?

In grief, acceptance is the trail ahead. In buying and selling, the identical is true.

When the cease hits, crucial factor you are able to do is reply with readability, not negotiation.

The dealer who exits with out bargaining protects capital, emotional equilibrium, and the integrity of their system.

Submit Views: 21