In 2008, the S&P 500 plunged 37%, sending shockwaves throughout world markets.

Nevertheless, whereas everybody else was promoting their kidneys to cowl margin calls, a small group of merchants had been quietly making a fortune:

- Mulvaney Capital gained 108% (whereas most fund managers had been updating their resumes).

- Dunn Capital returned over +50%.

- Graham Capital completed the 12 months up about +36%.

How did they do it?

They weren’t making an attempt to name the underside, predict the bailout, or outsmart the Fed.

As an alternative, they had been merely following one timeless precept: trip the pattern till it ends.

This method known as Development Following—and it has labored for many years. From the legendary Turtle Merchants to billion-dollar hedge funds, Development Following has constantly thrived in bull and bear markets, particularly throughout a disaster.

That’s why in as we speak’s put up, you’ll uncover…

- What’s Development Following and why does it work?

- 4 rules of Development Following

- A whole Development Following system that works (backed by 25 years of information)

- Execs and cons of Development Following

- Tips on how to know if Development Following is appropriate for you?

By the tip, you’ll perceive why Development Following is without doubt one of the strongest methods, and how one can apply it to your individual buying and selling.

Sound good?

Then let’s go…

Development Following defined

Development Following is all about cashing in on sustained strikes available in the market (in each uptrend and downtrend). The concept behind it’s easy: to trip the pattern until it ends.

It originated from the commodities market and was made common by Richard Dennis (and his Turtle Merchants).

Immediately, Development Following remains to be a well-liked buying and selling method and is even utilized by billion-dollar hedge funds (like Winton Group, Transtrend, and so forth.).

Why does Development Following work?

There are three predominant causes…

Behavioural biases

In case you see the market goes up 5 days in a row, what’s your first response?

“It’s too excessive! I’m not shopping for that!”

However then it goes up one other 3 days, and all of a sudden you’re hitting that purchase button sooner than I run when my spouse says, “We have to discuss!”

And when there’s worry? You promote sooner than I run away from my children after they need assistance with homework.

These behavioural biases trigger the market to pattern, and that’s how a Development Follower can revenue from it.

Data takes time to get priced in

Hedge funds and establishments transfer with measurement. In contrast to a retail dealer, they will’t simply enter a place as a result of they may transfer the market (which suggests they get a poor entry value).

So, they may accumulate their positions over weeks and generally even months. This shopping for stress will push the market larger, and by the point the “huge cash” completes their shopping for, the pattern is properly established, and a Development Follower will revenue from the transfer.

Tendencies are structural

Financial cycles result in issues like inflation, bubbles, crises, productiveness, bull markets, bear markets, and so forth. These components trigger worry and greed available in the market, which ends up in each uptrends and downtrends.

So long as these components exist, you may anticipate markets to pattern.

Now, earlier than I provide the guidelines of a Development Following system that works, you first want to grasp the rules behind it so you may make it give you the results you want.

4 rules of Development Following

1. Purchase excessive and promote larger (and vice versa)

The precept behind “purchase excessive and promote larger” is that energy tends to beget extra energy.

In contrast to traders who “purchase low and promote excessive”, Development Following doesn’t care if one thing seems costly or overbought. What issues is that the value is transferring within the route of the pattern.

By shopping for energy, you align your self with the market’s route and keep away from betting in opposition to the market. Consider it as going with the movement, not in opposition to it. Like when my spouse says we’re going procuring and I simply nod and put together my bank card for the beating.

2. Use a trailing cease loss

After you enter a commerce, when do you exit?

That’s the place a trailing cease loss is available in. It’s a dynamic cease loss that follows the value like my children comply with me after I’m making an attempt to eat ice cream. It’s the key to chopping your losses and driving your winners.

Right here’s an instance…

- You purchase a inventory at $50 and have a 20% trailing cease loss.

- If the value drops to $40, you’ll exit the commerce as a result of it has hit your trailing cease loss (calculation $50 x 0.8 = $40).

- But when the value goes as much as $60, your trailing cease loss can be at $48 (calculation $60 x 0.8 = $48).

- Now, if the value shoots as much as $200 and hits your trailing cease loss (at $160), you’d have captured an enormous winner.

Now, in the event you used a set goal revenue, it’s unlikely you’ll trip such a pattern due to feelings. Agree?

However with a trailing cease loss, you merely trip the pattern until it ends—with out guesswork.

3. Commerce many alternative markets

Right here’s the factor: developments don’t occur all over the place without delay. By buying and selling many markets, you all the time have “lottery tickets” unfold out throughout totally different asset lessons—like having a number of relationship apps as an alternative of only one.

Additionally, totally different asset lessons pattern at totally different instances:

- Commodities transfer on provide/demand shocks.

- Bonds transfer with rate of interest insurance policies.

- Currencies transfer with capital flows.

- Indices transfer on progress and earnings.

By buying and selling these totally different asset lessons, you profit from these totally different sources of developments.

Right here’s a real-world case examine:

Throughout 2014, the US inventory market was uneven. On the identical time…

- USD had appreciated strongly in opposition to EUR and JPY.

- Crude oil collapsed from $100 to $40.

- Bonds had a serious uptrend.

A Development Follower would have made a killing whereas inventory merchants had been struggling.

4. Hold losses small

Though you commerce many markets, you’ll nonetheless face frequent losses as a result of most of those trades fail to develop right into a pattern. That’s why it’s vital to chop your losses so you may dwell to battle one other day—in contrast to my hairline, which fought the nice battle however has now given up.

Development Following will not be about being proper usually. Slightly, it’s about chopping your losses and driving your winners. This manner, even with a 40% profitable charge (which is widespread for a Development Following system), you’re nonetheless worthwhile in the long term.

These 4 rules kind the spine of Development Following. However rules alone aren’t sufficient— you want clear goal buying and selling guidelines.

So now, I’ll train you a Development Following system that works (backed by knowledge)…

A Development Following system that works

Markets traded:

Currencies: GBP/USD, USD/JPY, AUD/USD, EUR/USD, USD/CNH

Metals: Gold, Copper, Silver, Palladium, Platinum

Commodities: Espresso, Euro-OAT, Corn, Soybean, Wheat

Bonds: Bund, US 5-year Notice, Lengthy Gilt, US T-Bond, Bobl

Timeframe:

Every day

Threat administration:

2%

Buying and selling guidelines (lengthy)

- Go lengthy when the value closes on the highest over the past 200 days.

- 6 ATR trailing cease loss.

Buying and selling guidelines (quick):

- Go quick when the value closes on the lowest over the past 200 days.

- 6 ATR trailing cease loss.

Right here’s an instance…

Espresso (Every day timeframe)

On July 9, 2024, Espresso made the very best shut over the past 200 days (as proven on the Donchian Channel) and gave you an entry set off to go lengthy.

On this case, the commerce labored in our favour, and also you held the place until the value hit your 6 ATR trailing cease loss on April 4, 2025. This could have netted you a acquire of 39% on the commerce.

After all, it is a cherry-picked instance. And since you are buying and selling with an goal algorithm, you may backtest this Development Following system and see the way it has carried out.

Backtest outcomes: Development Following system

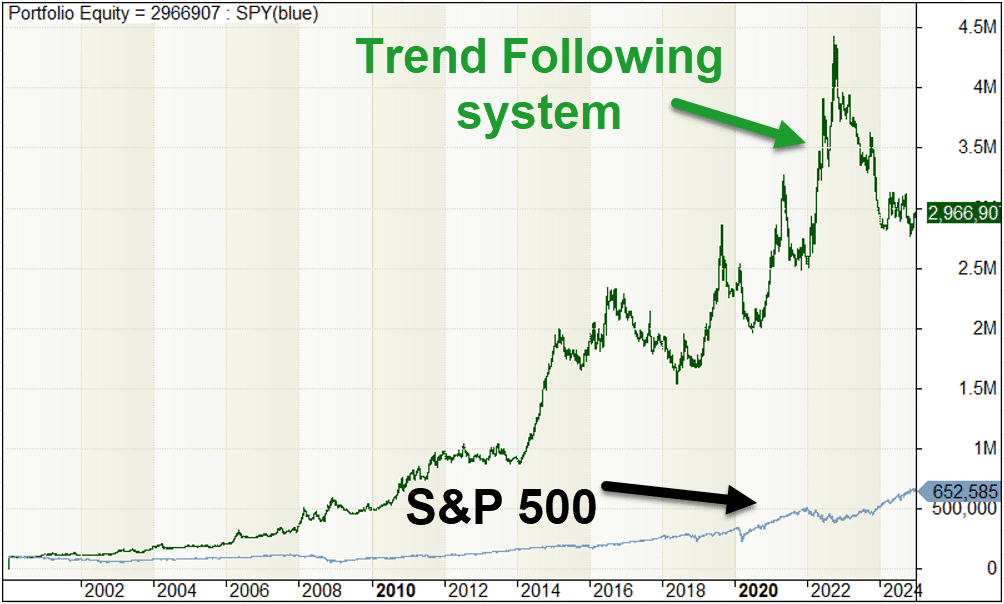

Right here’s the consequence over the past 25 years…

- Complete return: 2866% (since 2000)

- Annual return: 14.51%

- Profitable charge: 45.77%

- Dropping charge: 54.23%

- Payoff ratio: 1.74

- Most drawdown: 37.7%

Right here’s the fairness curve of the buying and selling system…

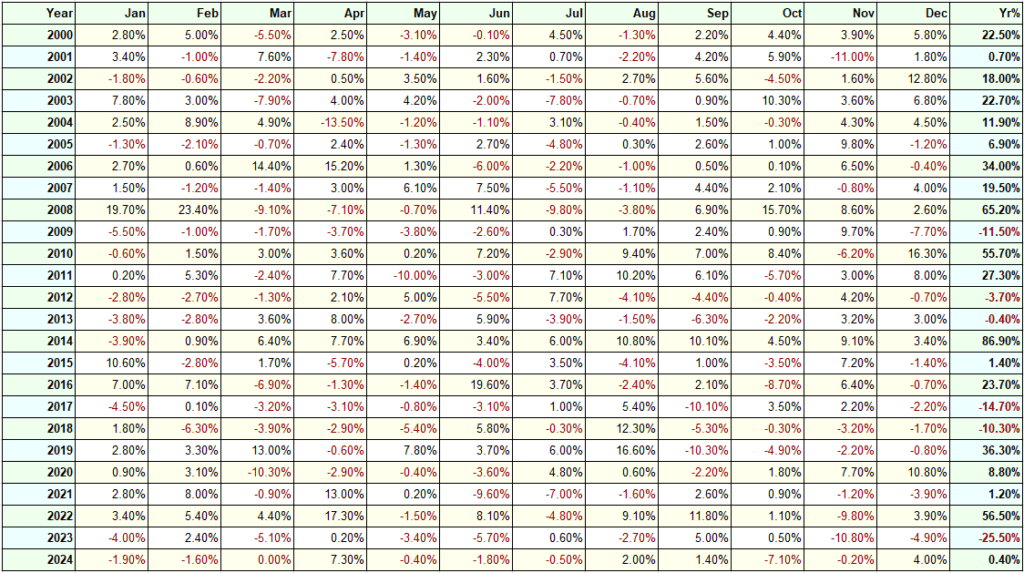

And the yearly returns…

Take note of the years 2000, 2008, 2019, and 2022.

What do you discover?

These had been all disaster intervals: the Dot Com Bubble, the Monetary Disaster, COVID-19, and the Russia-Ukraine Conflict.

Whereas the inventory market collapsed throughout this time, a Development Following method would have made a killing.

Right here’s what considered one of my college students, I Ang (from The Final Methods Dealer), has to say about Development Following…

“As confirmed, it has labored properly in bear markets and received me into commerce earlier than the large strikes, like Crude Oil.” — I Ang

Now you is likely to be questioning…

“Why does Development Following work properly throughout a disaster interval?”

Herd mentality.

Let me clarify…

Think about you’re in a cinema watching a film (Maybe Avengers: Finish Recreation). Then, in entrance of the display, you discover a flame getting bigger because the seconds go by. And earlier than you understand it, BOOM, there’s an enormous hearth!

Now let me ask you: will you proceed watching Avengers or sprint out of the cinema? I assure you’ll run out of the cinema. Why? As a result of there’s a worry in you, the worry that you simply may get burned alive. And guess what? Everybody else has the identical worry as you, in any other case often known as the herd mentality.

You’re most likely questioning:

“What has this received to do with Development Following?”

Properly, the identical applies to the monetary markets.

When there’s panic and worry within the markets, what occurs? Folks promote their shares and dangerous property, which causes the value to enter a downtrend.

For a lot of establishments (like pension funds), they will’t maintain a ton of money due to regulatory causes. So, they’d use their money to purchase up safer property like bonds, gold, the US greenback, and so forth, which causes these markets to enter an uptrend.

In case you recall, how does Development Following revenue? It seeks to revenue from developments available in the market! That’s why you usually see Development Following do exceptionally properly throughout a disaster or a recession—it’s like proudly owning a bathroom paper firm throughout COVID.

Shifting on, let’s discuss concerning the professionals and cons of Development Following…

Execs and cons of Development Following

First, the benefits of Development Following…

- Easy and sturdy

- Has labored for hundreds of years

- Does properly throughout a disaster

Development Following has easy and sturdy guidelines. In case you regarded on the buying and selling system I shared earlier, the entry & exit have solely two buying and selling guidelines. This makes it a sturdy buying and selling method, and it’s more likely to proceed working for many years to return (like the way it has labored for the previous few centuries). It’s the cockroach of buying and selling methods; it simply gained’t die.

In contrast to most buying and selling programs correlated to the inventory market, Development Following will not be correlated. This offers you safety throughout a disaster and affords you higher risk-adjusted returns in your portfolio.

This implies you’ll sleep higher at night time understanding that even when shit hits the fan, you could have a buying and selling system that may carry out properly.

Subsequent, the disadvantages of Development Following…

- Low profitable charge

- Lengthy drawdowns

- Troublesome to commerce psychologically

Development Following has a low profitable charge, wherever between 30 to 40%. This implies you’ll lose ceaselessly and have lengthy drawdowns.

You is likely to be considering: “What’s a drawdown?”

Right here’s an instance: let’s say your buying and selling account reaches a excessive of $100,000 after which declines to $90,000. That’s a drawdown of 10%.

Now, the size of a drawdown refers to how lengthy it takes to your account to succeed in a brand new fairness excessive. If it took 1 month to go from $90,000 again to $100,000, then it’s a drawdown period of 1 month.

Nevertheless, for Development Following, you may expertise a drawdown period for years, which makes this a troublesome buying and selling system to execute psychologically. In spite of everything, who likes to lose usually and never see outcomes for years?

And since it is a troublesome system to commerce, most merchants will quit when the going will get robust.

(The nice factor is that when extra folks quit, the technique is much less crowded, which suggests the sting will stay for disciplined merchants.)

Subsequent, let’s discover out…

Is Development Following appropriate for you?

Right here’s my tackle it…

Development Following is NOT for you if…

- It’s worthwhile to be proper actually because Development Following has a low profitable charge.

- That is your first buying and selling system as a result of it’s psychologically troublesome to commerce.

- You’ve a small buying and selling account as a result of it requires a minimum of a 5-figure account.

Development Following is FOR you if…

- You might be lengthy shares and need to hedge your self throughout a disaster.

- You desire a buying and selling technique uncorrelated to the inventory market.

- You’ve different buying and selling programs and need to enhance your portfolio’s adjusted returns.

Now, you could have a good suggestion whether or not Development Following fits your character and objectives.

Nonetheless, you might need just a few questions. So let’s sort out among the widespread ones I get from merchants…

Often requested questions

How can I scale back the drawdown of a Development Following system?

There are two issues you are able to do:

- Improve the variety of markets to commerce.

- Undertake a number of buying and selling programs, not only one.

That’s the rationale why in The Final Methods Dealer (UST), we train a number of buying and selling programs so you may scale back your drawdown and revenue virtually yearly no matter market circumstances.

Can Development Following work on Forex?

Development Following works greatest while you commerce many alternative markets as a result of it will increase the percentages of capturing a pattern.

By lowering the variety of markets, you scale back the percentages of capturing a pattern, drawdowns can be longer, and this makes it much more troublesome to be a Development Follower.

Can it work on shares?

The idea of Development Following could be utilized to shares, however with just a few tweaks.

- Keep away from shorting as a result of the inventory market has a bias to pattern larger.

- Have a pattern filter to remain in money throughout a bear market.

Can this be traded on decrease timeframes?

I’ve not examined this but. However hypothetically, developments are shorter on the decrease timeframe and transaction prices are larger (since you’re buying and selling extra usually).

I might assume it wouldn’t work as properly (or in no way) on the decrease timeframe.

What number of markets can I apply Development Following to?

As many as you may afford.

There are hedge funds that apply Development Following to lots of of markets for diversification functions.

Conclusion

Development Following will not be about predicting the longer term. It’s about chopping losses small and letting winners run. It’s easy, sturdy, and it really works. Historical past has confirmed it, knowledge has backed it, and billion-dollar hedge funds nonetheless depend on it as we speak.

Nevertheless, it’s psychologically robust to commerce by itself. The frequent losses and lengthy drawdowns can put on down even disciplined merchants.

That’s why inside The Final Methods Dealer (UST), you’ll discover ways to mix Development Following, Imply Reversion, and Momentum—so you may revenue in a bull market, a bear market, and even throughout a recession. The most effective half?

You solely want quarter-hour a day. Particulars right here.