A defensive inventory is what traders ought to need in unsure market circumstances and will maintain when market circumstances are very powerful.

All traders need to revenue from the monetary market as a lot as attainable, however rookies appear to need much more than others. The so-called defensive shares are the closest instruments of those traders. That’s as a result of defensive shares are much less influenced by the macroeconomic context and even by crises.

What’s a Defensive Inventory

Many traders are continually in search of to decrease the impression the market volatility has on their portfolios. Because of this, they allocate a portion of their whole portfolios for defensive shares as a part of a sound threat administration technique.

That’s as a result of the defensive shares are much less affected by an financial slowdown.

Consider the defensive inventory as insurance coverage. They shield the traders from massive losses when inventory markets enter into correction territory.

The explanation for that is easy. Defensive shares are usually shares of firms from sectors the place demand for items and providers don’t lower as a lot as different sectors throughout financial slowdowns.

Just a few examples of defensive shares embrace public utility firms like gasoline and electrical energy, meals, tobacco, medication, cosmetics and so on.

Give it some thought. Let’s assume we’re in recession:

- You’ll proceed to make use of electrical energy and warmth, take showers and wash dishes throughout a recession

- You’ll proceed to make cellphone calls to your loved ones, pals and work colleagues throughout unhealthy financial occasions

- You’ll proceed to purchase meals. Possibly not from the costly eating places, however from smaller groceries

- In case you are a smoker, the possibilities are you’re nonetheless going to purchase cigarettes. Possibly not the costly ones, however you’ll probably purchase a less expensive model

- You received’t lower purchases of cleaning soap, toothpaste and lotions used each day

- You’ll proceed to take medicines even throughout occasions of financial slowdown.

The fact is that you’ll select to chop different bills, however not those linked to both fundamental human wants or addictions.

That’s why defensive shares are thought of probably the most steady shares available on the market, providing a continuing dividend and remaining considerably unaffected by the volatility of the inventory market. Throughout adversarial financial circumstances, defensive shares usually outperform most different shares available in the market.

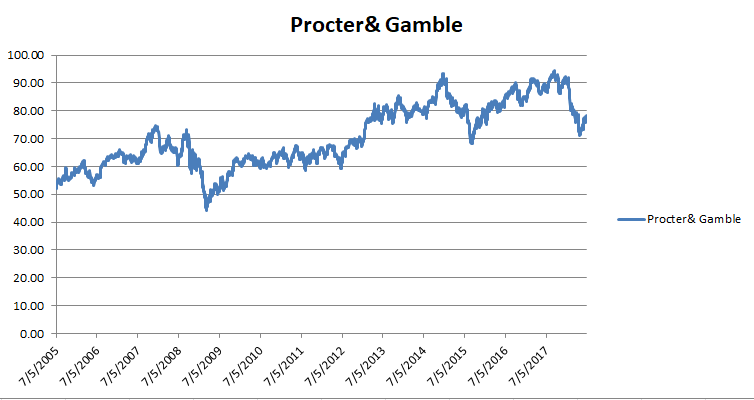

Let’s analyze the charts plotted above. The primary chart is a defensive inventory, Procter & Gamble, a multi-national client items company. The chart was plotted for 2015 – 2018 interval.

The second chart is Goldman Sachs, main international funding banking, securities and funding administration agency, throughout the identical interval.

If we glance on the charts on the 2007–2008 interval when the monetary disaster was dominating the monetary markets, we instantly see the ability of defensive shares throughout adversarial circumstances.

In the course of the worst monetary disaster because the Nice Despair of the Nineteen Thirties, Procter & Gamble inventory halved in worth from round 75$ to 35$. The defensive facet of the inventory wasn’t ready to deal with the magnitude of the disaster.

However have a look at the Goldman Sachs evolution throughout that interval. The inventory fell from 250 $ to a minimal of fifty$. That’s fairly a correction.

If we have a look at the next subsequent 2 -3 years after the disaster, we see the value of Procter & Gamble inventory recovering and stabilizing. The Goldman Sachs evolution throughout that interval was extraordinarily risky, with enormous upward and downward swings.

The primary benefit of defensive shares is that, over time, they’ve usually carried out as anticipated. Up to now 50 years, utilities, healthcare and meals shares have outperformed the broad market throughout bear markets. These shares have additionally outperformed throughout recessions, however not by a big margin as you’ll be able to see within the instance above.

The best way to Determine Defensive Shares

Figuring out a defensive inventory may appear simple at first sight. Nevertheless, this process is extra complicated than we’d suppose. An inexperienced investor would decide some shares from utilities, telecoms, prescribed drugs or meals retail sectors and think about the job achieved.

That’s not the neatest approach to embrace defensive shares in your portfolio. Simply because a inventory belongs to a defensive sector, this doesn’t imply that you’re shielded from losses.

There are a number of methods wherein an investor can establish the optimum defensive shares, with the bottom dangers.

Beta Coefficient

Probably the most used instrument by analysts is the BETA coefficient, which exhibits the correlation between the evolution of a inventory and the general market evolution.

The BETA coefficient of a inventory is a measure of its volatility towards a benchmark, consultant for the general inventory market evolution. The indicator exhibits how a lot a inventory will correlate with the normal market pattern and what dangers this firm implies.

The decrease the diploma of correlation, the extra helpful the inventory is when the market decreases. Nevertheless, the calculation of the BETA indicator for all firms on the inventory trade implies a reasonably massive effort from an investor.

So, when are speaking about BETA, we discuss threat and we consult with the volatility of a inventory. In different phrases, it measures the chance that the worth of the shares will change dramatically in a brief time period.

Particularly, the beta indicator displays the traders’ response to the evolution of the corporate wherein it invests.

For instance, the BETA worth of 1 signifies that the inventory value strikes in step with the worldwide market. If the market rises 20%, the inventory value will rise 20%, if it drops 10%, so does the value of the inventory. This isn’t calculated each day however over just a few months.

Low-value BETA and high-value BETA

To begin with, we have to know that the BETA coefficient has two principal values relying on which traders are concentrating on the technique they’re excited by:

- Shares which have a excessive BETA coefficient are extra risky than the market. The upper the beta, the extra risky they’re. If the market rises by 10%, the inventory will enhance by the next margin, of 15%, for instance. Throughout adversarial circumstances when the market will report correction, these shares will lower much more.

- However, low beta shares are much less risky than the market. If the market decreases by 10%, the inventory will lower by a decrease margin, of 5%, for instance. Nevertheless, the defensive shares will not be anticipated to expertise important will increase throughout occasions of financial advance.

This can be very helpful to consider the BETA worth of an trade when evaluating firms in that trade. Through the use of the BETA coefficient, we select the trade and purchase the fitting shares for our funding plans.

We all know, for instance, that tech shares have a excessive beta and the know-how trade has a excessive volatility.

Let’s think about a situation the place we all know that the BETA coefficient for telecom shares is 1.2 and we discover a firm with a beta coefficient of 0.8. This offers us the next info: the corporate is much less risky than the market and extremely steady inside the trade it belongs to.

Common True Vary

Defensive shares may be simply recognized by analyzing the value vary they’ve advanced over a given interval. The decrease the distinction between the utmost interval and the minimal of the interval, the extra steady the inventory may be. This interprets into the truth that a defensive inventory has a decrease threat of recording massive corrections within the quick time period.

The common true vary reveals details about how risky a defensive inventory truly is:

- Excessive ranges reveal excessive volatility

- Small ranges counsel low volatility.

It’s a helpful indicator for giving an thought about how a lot the value of a defensive inventory might transfer in an outlined time-frame.

Distinction between the Present Worth and the Minimal Worth

One other criterion via which an investor can establish defensive shares is the distinction between the present market value and its minimal value. The nearer the inventory is to its minimal worth, the decrease the correction charge.

That is considerably logical contemplating the truth that so long as the inventory didn’t enhance, the promoting stress can be decrease.

As a substitute, shares which are buying and selling close to their most ranges are riskier as a result of, in occasions of instability on the inventory trade, they might undergo extra intensive corrections.

Benefits of Defensive Shares

Greater dividend yields

A giant benefit of defensive shares is that they’re non-cyclical. These shares produce stable earnings whatever the efficiency of the bigger economic system. In addition they provide increased than common dividend yields as a result of the businesses pay out most of their earnings to shareholders.

Shield your capital

Crucial benefit of defensive shares is that they’ve the potential to guard traders’ capital throughout a slowdown. In the event you spend money on defensive shares you’re much less more likely to be affected by what occurs within the nation’s economic system.

In fact, defensive shares will lower throughout a recession, however the impression might be a lot decrease in comparison with the remainder of the market.

Decrease Volatility

Crucial position of the market volatility is to estimate the worth of market threat. In different phrases, the volatility measures the market threat that an investor is prepared to take when investing in a sure inventory.

Defensive shares are usually thought of non-volatile and steady. They register reasonable value fluctuations. While you spend money on a defensive inventory you already know that the possibilities for the inventory to report main fluctuations briefly durations of time are slim.

Protected-Haven throughout Turmoil

Defensive shares are thought of safe-haven property. A secure-haven asset protects traders throughout crises.

You need to not confuse the time period “safe-haven” with “hedging”. Hedging protects traders throughout regular occasions, however not essentially throughout the recession. A secure-haven asset is anticipated to retain its worth in occasions of market turbulence when most asset costs decline.

Defensive shares will not be utterly recession-proof. Let’s consult with them as recession-resistant. Defensive shares are extra proof against unhealthy financial circumstances as a result of their hyperlink to fundamental human wants or addictions, however they’re certainly not invincible.

Disadvantages of Defensive Shares

Decrease Returns throughout Financial Increase

Throughout an financial slowdown, defensive shares usually outperform most different shares available in the market. Nevertheless, throughout occasions of financial increase, the defensive shares don’t often report important will increase in comparison with different shares.

Have a look at the evolution of the Procter & Gamble defensive inventory since 2013, throughout a interval of optimism and a wholesome economic system. Not a lot occurred throughout this era.

In comparison with the evolution of the Dow Jones Industrial Common, we instantly see the distinction. When the optimism is excessive and the markets are recording necessary will increase, much less risky firms like defensive shares are left behind by traders, preferring to take a position their cash in riskier investments.

Low Volatility

For an investor with a high-risk aversion, a non-volatile defensive inventory isn’t thought of a horny alternative. Certain, it’d provide him some insurance coverage throughout unhealthy occasions, however the defensive shares received’t deliver explosive earnings in a short while.

Because of this, defensive shares are thought of boring by aggressive traders.

Ultimate Ideas

In the event you want to spend money on the long run and you’ve got a low tolerance for big capital losses, defensive shares will go well with you.

By including some defensive shares in your portfolio you’ll scale back the general threat of your portfolio whereas remaining totally invested. On the identical time, you’ll mitigate massive losses of capital in periods of turbulent monetary occasions.

Nevertheless, you shouldn’t anticipate to report increased whole returns than conventional benchmarks throughout robust bull markets. In the event you spend money on defensive shares it is best to anticipate long-term returns just like conventional benchmarks however at a big discount in portfolio volatility.

Many rookies think about that investing in a portfolio of defensive shares is a great transfer that can provide them excessive returns. Nevertheless, the important thing to any funding portfolio is diversification. In the event you’re planning to spend money on defensive shares you should diversify your portfolio throughout many alternative sectors.