Technique Inc (NASDAQ: MSTR), previously referred to as MicroStrategy, stays Bitcoin’s largest company holder. Nevertheless, a stark divergence has emerged all through 2025. Whereas Bitcoin persistently notches new all-time highs, MSTR inventory shows persistent weak spot and failing momentum. This disconnect indicators underlying technical harm.

At the moment, we analyze the bearish Elliott Wave sequence explaining this underperformance. Our evaluation outlines the crucial assist ranges and draw back targets if this corrective section continues.

Elliott Wave Evaluation

A transparent optimistic correlation linked MSTR and Bitcoin since November 2022. Nevertheless, this relationship fractured after two years. MicroStrategy peaked at $543 in November 2024. Subsequently, it entered a sideways pattern. In the meantime, Bitcoin continued climbing to new highs. Moreover, MSTR made new yearly lows. In distinction, Bitcoin held firmly above its April 2025 low.

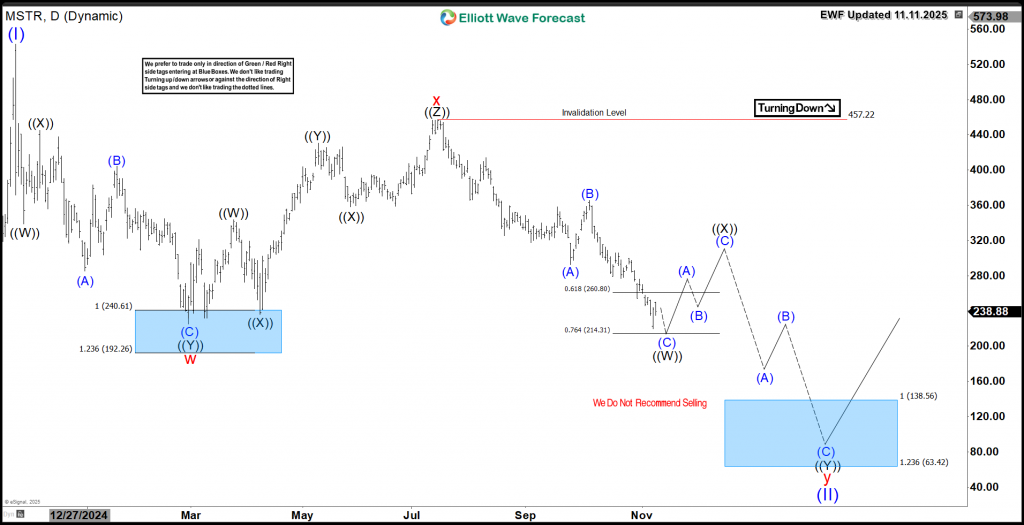

The MSTR each day chart reveals a confirmed bearish sequence. Because the November 2024 peak, the inventory has damaged under the February 2025 low. This motion confirms a bigger double three correction is now in progress.

It accomplished wave “w” in February 2025. Then, wave” x” bounced larger. At the moment, wave “y” stays in progress. Wave ((W)) reached the 61.8-76.4% Fibonacci zone. Consequently, a three-wave bounce in wave ((X)) is probably going quickly. Nevertheless, the downtrend ought to then resume.

In the end, the equal legs goal lies at $138 – $63. As soon as this shopping for space is reached, count on a robust response larger. Due to this fact, traders will possible place for the following uptrend. Ideally, this new rally will start subsequent 12 months.

MSTR Each day Chart 11.11.2025

Conclusion

Technique inventory MSTR is present process a each day correction. Consequently, merchants can use short-term bounces as promoting alternatives. In the meantime, traders ought to anticipate the following excessive space earlier than shopping for the inventory. Use our Elliott Wave technique to time entries with precision. Enter after a 3-, 7-, or 11-swing correction completes. Moreover, our proprietary Blue Field system highlights high-probability zones with pinpoint accuracy. In consequence, this disciplined methodology provides merchants the readability and confidence to catch the following bullish leg.

Supply: https://elliottwave-forecast.com/stock-market/microstrategy-mstr-bearish-shift/