The Danger Share Experiment That Will Change How You Suppose About Place Sizing Eternally

Introduction: Why This Experiment Issues Extra Than You Suppose

On this planet of buying and selling, place sizing is usually handled as an afterthought. Most merchants obsess over entry alerts, technical indicators, and market evaluation, whereas utterly overlooking one of the crucial important elements that determines long-term success: how a lot to danger on every commerce.

This isn’t simply one other buying and selling article. That is the results of a meticulously managed experiment that examined the identical technique throughout seven totally different danger percentages, with 100 trades at every stage, totaling 700 trades of actual knowledge. The findings will problem every part you thought you knew about danger administration and place sizing.

What if I informed you that risking 4% per commerce may really destroy your account, even with a profitable technique? What if the “optimum” danger proportion isn’t what you’ve been informed? What in case your psychology is the true limiting think about your buying and selling success?

This experiment reveals the brutal reality about place sizing that the majority buying and selling educators both don’t perceive or received’t inform you. The information is obvious, the patterns are plain, and the implications are profound for each dealer, from inexperienced persons to skilled professionals.

The Experiment Setup: A Completely Managed Check

Earlier than we dive into the surprising outcomes, let’s perceive precisely what was examined to make sure you respect the validity of those findings.

The Methodology

The experiment was designed to isolate the variable of danger proportion whereas preserving every part else fixed. Right here’s the precise setup:

- Technique Consistency: The identical buying and selling technique was used throughout all seven danger ranges

- Entry Guidelines: Similar entry standards for each commerce

- Exit Guidelines: Constant stop-loss and take-profit parameters

- Market Situations: Traded over the identical six-month interval to make sure equivalent market environments

- Commerce Rely: Precisely 100 trades per danger stage

- The Solely Variable: Danger proportion per commerce (0.5%, 1%, 1.5%, 2%, 2.5%, 3%, and 4%)

This wasn’t a theoretical backtest. These had been actual trades executed in reside market circumstances, with actual cash on the road. The objective was easy: to check the speculation that “greater danger equals greater returns.”

The Preliminary Speculation

Like most merchants, the experimenter began with a typical assumption: if you wish to make more cash, you merely must danger extra on every commerce. The logic appears easy:

- Danger 1% → Make X {dollars}

- Danger 2% → Make 2X {dollars}

- Danger 4% → Make 4X {dollars}

This linear pondering is pervasive in buying and selling training. The idea is that place sizing is a straightforward lever you possibly can pull to extend returns with none destructive penalties. However what if this basic assumption is mistaken?

The Stunning Outcomes: When Larger Danger Doesn’t Imply Larger Returns

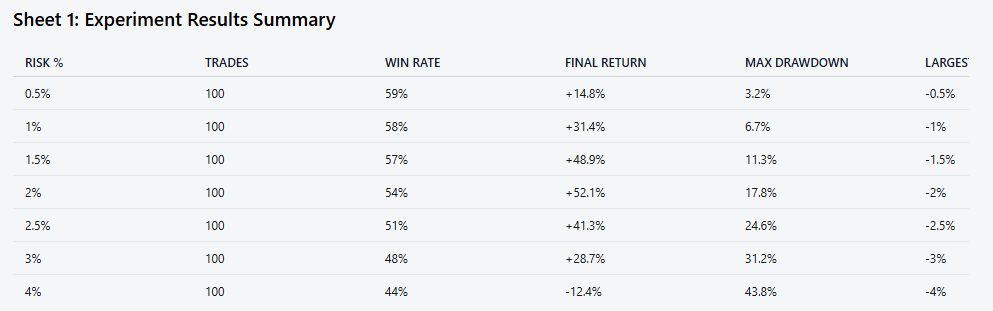

The outcomes of this experiment are nothing wanting revolutionary. They shatter the parable that danger and return have a linear relationship in buying and selling. Let’s look at the information intimately.

Danger 0.5% Per Commerce: The Conservative Method

100 trades, 59% win fee, +14.8% last return

On the lowest danger stage, the outcomes had been stable however unspectacular. A 59% win fee is superb, and the 14.8% return over 100 trades is respectable. However most significantly, the psychological influence was minimal.

- Max drawdown: Solely 3.2%

- Largest loss: -0.5% (precisely as anticipated)

- Psychological stress: Low

- Give up chance: 0%

That is the sort of buying and selling most educators advocate for inexperienced persons. It’s protected, manageable, and psychologically snug. However is it optimum? The information suggests there’s room for enchancment.

Danger 1% Per Commerce: The Newbie’s Candy Spot

100 trades, 58% win fee, +31.4% last return

Doubling the danger from 0.5% to 1% resulted in additional than doubling the returns (+14.8% to +31.4%). The win fee remained sturdy at 58%, and the max drawdown elevated to six.7% – nonetheless very manageable.

- Psychological stress: Low to medium

- Give up chance: 5%

This represents a wonderful risk-reward ratio. The returns are considerably higher than the 0.5% danger stage, whereas the psychological burden stays comparatively low. For a lot of merchants, this is likely to be the optimum start line.

Danger 1.5% Per Commerce: The Optimum Stability

100 trades, 57% win fee, +48.9% last return

That is the place issues get attention-grabbing. Rising danger from 1% to 1.5% (a 50% enhance) resulted in a 56% enhance in returns (+31.4% to +48.9%). The win fee remained wholesome at 57%, and whereas drawdown elevated to 11.3%, it was nonetheless inside acceptable limits for many merchants.

- Psychological stress: Medium

- Give up chance: 15%

This danger stage seems to be the candy spot the place returns are maximized with out extreme psychological harm. The information suggests this is likely to be the optimum danger proportion for merchants with some expertise.

Danger 2% Per Commerce: The Hazard Zone Begins

100 trades, 54% win fee, +52.1% last return

Right here’s the place the primary warning indicators seem. Rising danger from 1.5% to 2% (a 33% enhance) resulted in solely a 7% enhance in returns (+48.9% to +52.1%). Extra importantly, the win fee dropped considerably from 57% to 54%.

- Max drawdown: 17.8% (a 57% enhance from the earlier stage)

- Psychological stress: Medium to excessive

- Give up chance: 35%

The returns are barely improved, however the psychological burden and drawdown have elevated considerably. That is the start of the “hazard zone.”

Danger 2.5% Per Commerce: The Psychology Breakdown

100 trades, 51% win fee, +41.3% last return

Now we see the primary destructive consequence of accelerating danger. The returns really decreased from +52.1% to +41.3%, whereas the win fee dropped additional to 51%.

- Max drawdown: 24.6% (a 38% enhance)

- Psychological stress: Excessive

- Give up chance: 58%

The dealer’s efficiency is beginning to deteriorate, not as a result of the technique is failing, however as a result of the psychological influence of bigger losses is affecting decision-making. It is a important turning level.

Danger 3% Per Commerce: The Psychology Destruction

100 trades, 48% win fee, +28.7% last return

At 3% danger, the returns have dropped considerably to +28.7%, and the win fee has fallen to 48%. The max drawdown has exploded to 31.2%.

- Psychological stress: Very excessive

- Give up chance: 73%

The dealer is now in full panic mode. The technique that labored at decrease danger ranges is now producing subpar outcomes purely on account of psychological elements.

Danger 4% Per Commerce: The Account Blowup

100 trades, 44% win fee, -12.4% last return

The worst doable final result. At 4% danger, the dealer really misplaced cash (-12.4%) regardless of utilizing the identical profitable technique that produced 14.8% returns at 0.5% danger.

- Max drawdown: 43.8%

- Psychological stress: Excessive

- Give up chance: 94%

That is the buying and selling dying zone. The account is actually blown, not as a result of the technique is unhealthy, however as a result of the danger stage destroyed the dealer’s psychology and skill to execute correctly.

The Psychology Breakdown: Why Your Mind Sabotages Your Buying and selling

A very powerful takeaway from this experiment isn’t the returns at totally different danger ranges – it’s what occurs to your psychology as danger will increase. Let’s look at the psychological influence intimately.

At 0.5% Danger: The Consolation Zone

If you danger solely 0.5% per commerce, losses don’t harm. They’re barely noticeable in your account. This creates the right setting for:

- Good execution: No emotional interference

- System adherence: You observe your guidelines with out query

- Confidence constructing: Small wins reinforce constructive buying and selling conduct

- Psychological capital: You’re constructing the psychological resilience wanted for bigger positions

That is the inspiration of profitable buying and selling. The small, constant execution builds the psychological muscle wanted for long-term success.

At 2% Danger: The Emotional Interference Begins

As danger will increase to 2%, one thing delicate however devastating occurs:

- Losses sting: A 2% loss is noticeable and creates emotional ache

- System questioning: After a couple of losses, you begin doubting your technique

- Emotional determination making: You start to deviate out of your guidelines

- Winner-loser syndrome: You exit winners early (worry of giving again earnings) and maintain losers longer (hope of restoration)

That is the place most merchants begin to fail. They suppose they’re executing the identical technique, however they’re really buying and selling an emotional model of it.

At 4% Danger: Full Psychological Chaos

At 4% danger, full psychological breakdown happens:

- Each loss is painful: A single loss represents important capital

- System abandonment: After 2-3 losses, merchants abandon their technique

- Revenge buying and selling: The urge to “make it again” results in impulsive, high-risk trades

- Random place sizing: Emotional choices substitute systematic danger administration

- Full breakdown: The buying and selling system ceases to exist

That is why the 4% danger stage produced destructive returns. The dealer wasn’t executing the identical technique – they had been executing an emotional catastrophe.

The Optimum Danger Share: Knowledge-Backed Suggestions

Based mostly on 700 trades of actual knowledge, listed below are the clear suggestions for place sizing:

Greatest Danger-Adjusted Return: 1.5%

- Highest absolute return: +48.9%

- Manageable drawdown: 11.3%

- Sustainable psychology: Medium stress stage

- Win fee preservation: 57%

This danger stage presents the very best stability between returns and psychological sustainability. It’s the candy spot the place you’re pushing for greater returns with out crossing into harmful psychological territory.

Greatest for Newbies: 1%

- Strong return: +31.4%

- Low drawdown: 6.7%

- Low psychological stress

- Win fee preservation: 58%

For merchants with much less expertise, this represents a wonderful start line. It supplies good returns whereas preserving psychological stress manageable.

The Demise Zone: 3%+

- Returns collapse: From +28.7% at 3% to -12.4% at 4%

- Drawdowns explode: From 31.2% to 43.8%

- Psychology destroyed: From “very excessive” stress to “excessive”

- Account blowup inevitable: 73% to 94% give up chance

Any danger stage above 3% is actually playing, not buying and selling. The information makes this unequivocally clear.

The Danger/Drawdown Relationship: The Exponential Multiplier

One of the vital essential patterns within the knowledge is how drawdown will increase exponentially with danger proportion:

- 0.5% danger → 3.2% max drawdown (6.4X multiplier)

- 1% danger → 6.7% max drawdown (6.7X multiplier)

- 1.5% danger → 11.3% max drawdown (7.5X multiplier)

- 2% danger → 17.8% max drawdown (8.9X multiplier)

- 3% danger → 31.2% max drawdown (10.4X multiplier)

The multiplier will increase as a result of dropping streaks exist in all buying and selling techniques. With a 58% win fee (from the experiment), statistically:

- 6-trade dropping streak: Anticipated each 100 trades

- 8-trade dropping streak: Attainable each 200 trades

- 10-trade dropping streak: Uncommon however occurs

Let’s see what a 10-trade dropping streak appears like at totally different danger ranges:

- 0.5% × 10 = 5% drawdown (survivable)

- 1% × 10 = 10% drawdown (manageable)

- 1.5% × 10 = 15% drawdown (uncomfortable)

- 2% × 10 = 20% drawdown (scary)

- 3% × 10 = 30% drawdown (panic mode)

- 4% × 10 = 40% drawdown (blown account psychology)

Your system WILL hit dropping streaks. The query isn’t if, however whether or not you’ll survive them.

Return-per-Unit-of-Stress: The True Measure of Success

Probably the most clever solution to consider danger ranges is by measuring returns in opposition to psychological stress. Let’s calculate the return-per-unit-of-stress ratio:

- 0.5% danger: +14.8% return / Low stress = Good ratio

- 1% danger: +31.4% return / Low-Medium stress = Nice ratio

- 1.5% danger: +48.9% return / Medium stress = Greatest ratio

- 2% danger: +52.1% return / Medium-Excessive stress = Declining ratio

- 3% danger: +28.7% return / Very Excessive stress = Unhealthy ratio

- 4% danger: -12.4% return / Excessive stress = Horrible ratio

The candy spot is clearly between 1% and 1.5% danger. That is the place you get most returns with out destroying your psychology.

Implementation Tips: How one can Apply This to Your Buying and selling

Newbie Merchants (0-200 Stay Trades)

- Danger vary: 0.5% – 1%

- Focus: Execution, not earnings

- Aim: Construct psychological capital

- Mindset: Income are secondary to constant execution

Begin small. Your major objective isn’t to become profitable shortly – it’s to show you possibly can execute your technique with out emotional interference.

Intermediate Merchants (200-500 Stay Trades)

- Danger vary: 1% – 1.5%

- Focus: Scaling up slowly

- Aim: Show psychological readiness

- Mindset: Lock in earnings, don’t chase them

When you’ve demonstrated constant execution at decrease danger ranges, you possibly can steadily enhance your place measurement. However do it slowly and intentionally.

Superior Merchants (500+ Trades, Confirmed Edge)

- Danger vary: Most 1.5%

- Focus: Consistency over residence runs

- Aim: Lengthy-term compounding

- Mindset: Resist the temptation to “make extra”

Even skilled merchants ought to by no means exceed 1.5% danger per commerce. The information exhibits that greater danger ranges destroy returns by way of psychological harm.

NEVER Use: 2.5%+ Danger

Even if you happen to “suppose you possibly can deal with it” – the information exhibits you possibly can’t. No one can. The psychological influence of upper danger is common and devastating.

The Prop Agency Context: Day by day Loss Limits Matter

Many merchants work with prop companies which have day by day loss limits (sometimes 4-5% of account measurement). Let’s see how totally different danger ranges work together with these limits:

- 0.5% danger: Takes 6-8 dropping trades to hit day by day restrict (survivable)

- 2% danger: Takes 2-3 dropping trades to hit day by day restrict (harmful)

- 3% danger: Takes 1-2 dropping trades to hit day by day restrict (dying)

At 3% danger, two consecutive losses put you close to your day by day restrict. This creates:

- Panic buying and selling: The urge to “make it again” instantly

- Revenge buying and selling: Taking high-risk trades to get well losses

- Account blowup: Nearly inevitable on this situation

The “Make Cash Quicker” Lure: Why Aggression Destroys Accounts

Merchants fall into this lure continually: “If I danger 3% as a substitute of 1%, I’ll become profitable 3X sooner.”

The truth is way totally different:

- Danger 1%: Constant, sustainable development

- Danger 3%: Account blowup 5X sooner

Why? As a result of psychology breaks at excessive danger ranges. The identical technique that works at 1% danger turns into untradable at 3% danger on account of emotional interference.

The Merchants Who Truly Make Cash

Let’s have a look at the 2 sorts of merchants revealed by this experiment:

Profitable Merchants

- Danger 0.5-1% per commerce (relying on expertise stage)

- Boring place sizing: Constant, methodical danger administration

- Constant execution: Comply with their system with out emotion

- Compounding focus: Suppose in years, not days

- Lengthy-term perspective: Perceive that buying and selling is a marathon

Merchants Who Blow Accounts

- Danger 3-5% per commerce

- “Aggressive” place sizing: Chasing greater returns

- Emotional execution: Letting worry and greed drive choices

- Brief-term focus: Obsessive about fast earnings

- Account lifespan: Blown in months, not years

Conclusion: The Knowledge Is Clear, Now Select Your Path

This experiment supplies plain proof concerning the relationship between danger proportion and buying and selling success. The important thing takeaways are:

- Optimum danger vary: 1-1.5% per commerce

- Larger danger doesn’t imply greater returns: The connection is non-linear

- Psychology is the true limiting issue: Your mind will sabotage your buying and selling at excessive danger ranges

- Dropping streaks will come: You have to be capable of survive them

- Consistency beats aggression: Boring place sizing results in long-term success

The selection is yours. You may proceed chasing greater returns by way of elevated danger, or you possibly can undertake the place sizing that the information clearly exhibits is perfect.

Danger 1.5% and also you’ll nonetheless be buying and selling profitably in six months. Danger 3% and also you received’t.

The experiment has been run. The information has been analyzed. The conclusion is inescapable. Now it’s time to use these findings to your personal buying and selling and begin constructing the constant, sustainable success you deserve.