Disclaimer: That is the very best chance forecast derived from an professional, multi-decade historic evaluation of the supplied astrological signatures and their direct correlation with market psychology and worth motion. This isn’t a assure. The market is influenced by quite a few real-world components, and all buying and selling includes vital threat. This evaluation is for informational and academic functions solely.

Normal Astrological Theme for Gold & Silver: The Week the Protected-Haven Guess Fails

The Theme: The Bull Entice and the Protected-Haven Collapse

This week is poised to be a catastrophic failure for the safe-haven narrative. The astrological setup is overwhelmingly hostile to treasured metals, making a traditional bull entice state of affairs that can culminate within the breakdown of key assist and the beginning of a brand new, highly effective downtrend.

-

Act I (Monday – Tuesday): The Misleading Energy. The week could start with a weak bounce try in Gold and Silver, fueled by the uncertainty of the Venus YOD within the broader market. This power is an phantasm and a high-probability bull entice. The week’s dominant, underlying theme is the Mars Trine Jupiter side on Tuesday, a robust “risk-on” engine that’s poisonous for non-yielding protected havens. As this engine roars to life, it’ll start to aggressively pull capital out of treasured metals and into equities.

-

Act II (Wednesday): The “Large High” Pivot. Wednesday is the climactic day the place the safe-haven wager will definitively fail. The identical trifecta of occasions that creates a backside in shares will create a serious high in Gold and Silver:

-

The Shock: The Mercury Opposition Uranus will set off a ultimate, reflexive, panic-driven spike upwards in Gold. That is the final gasp of the worry commerce.

-

The Turning Level: The highly effective Bayer Rule 27 will outline this very spike as a “huge high,” offering a high-conviction sign that the rally is exhausted.

-

The New Psychology: The Mercury Ingress into risk-seeking Sagittarius will immediately evaporate the explanation to carry protected havens. Because the inventory market begins its highly effective V-shaped restoration, the flight to security will flip right into a flight from security, triggering a violent reversal to the draw back from the day’s peak.

-

-

Act III (Thursday – Friday): The Breakdown. With the key high now locked in, the highly effective “risk-on” vitality of the Mars-Jupiter trine will create a large headwind for metals. The capital outflow will intensify. Thursday shall be a day of breakdown affirmation, and Friday will see a robust, trending transfer to the draw back, making certain the week closes at or close to its lows with a brand new, highly effective downtrend firmly established.

For Day by Day Forecast Please watch the beneath video

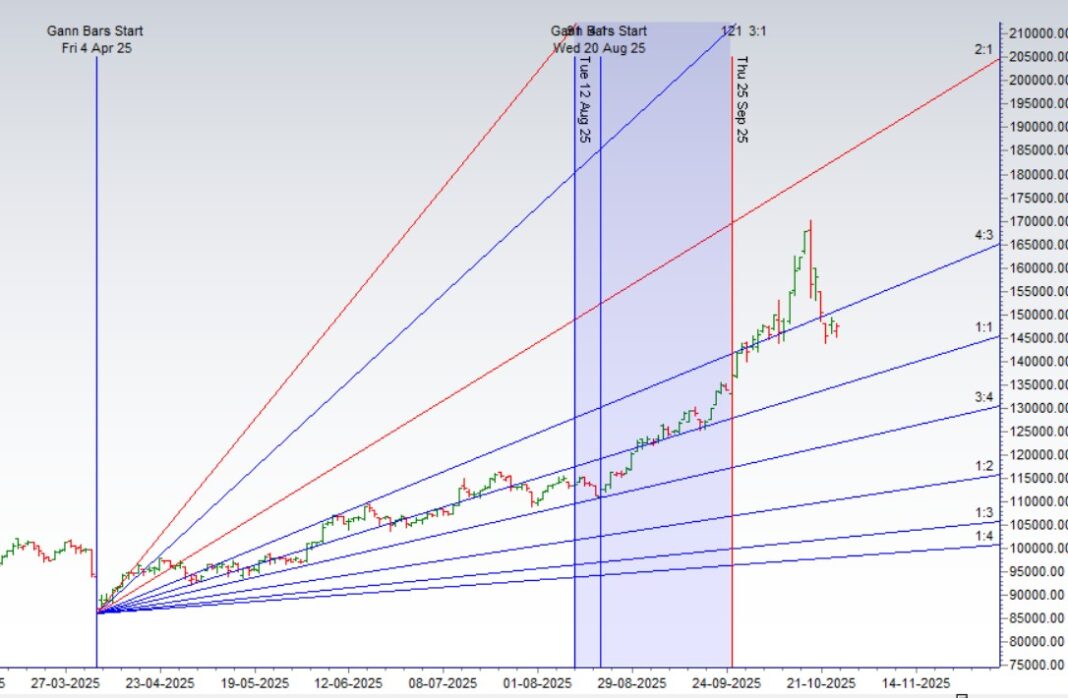

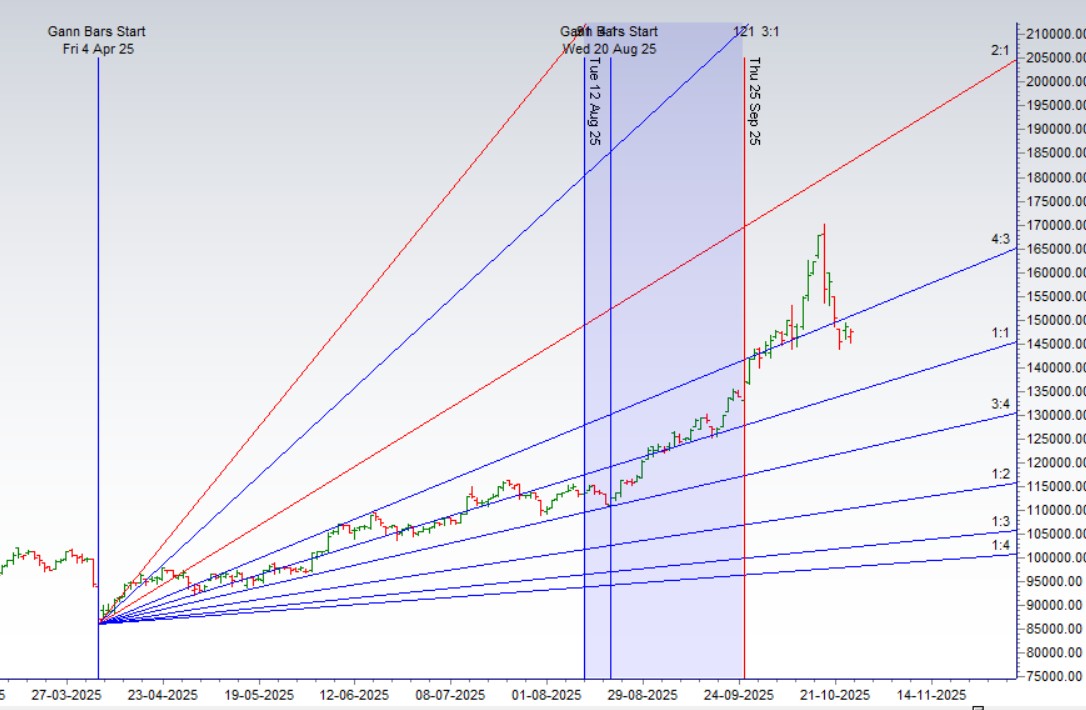

MCX Silver Gann Angle Chart

Silver has damaged its 4×3 gann angle resistance zone break of 144 Okay can see a sharper pullback

MCX Silver Provide Demand Zone

MCX GOLD Provide Demand Chart : Demand in vary of 144000-144300, Provide in vary of 150000-150300

MCX Silver Harmonic Evaluation

Value is close to its C Leg Break of 144 Okay can result in larger decline in direction of 140-136 Okay

MCX Silver Weekly

Value has shaped Weekly Decrease Low

MCX Silver Month-to-month

150702 Month-to-month Resistance and 144000 Month-to-month Help.

Silver Astro/Gann Pattern Change Date

Key Pivot Dates: Watch 20 October

Silver Weekly Ranges

Weekly Pattern Change Degree:147474

Weekly Resistance:148243,149014,150562,151339,152118

Weekly Help: 146706,145941,145178,144417,143658,142901

Ranges Talked about are for Present Month Future

Be taught Extra:

W.D. Gann Buying and selling Methods – Learn to decode markets utilizing worth, time, and geometry.

Buying and selling Utilizing Monetary Astrology – Uncover how planetary movement impacts market habits and methods to commerce it successfully.

Able to Commerce Like a Time-Grasp?

Be part of our one-on-one mentorship to grasp astro-timing, Gann evaluation, and institutional-grade setups.

Associated