On this episode of Treasured Metals Projections, I be a part of Craig Hemke of Sprott Cash to interrupt down what the charts, cycles, and capital flows are signalling for gold, silver, and mining shares as we transfer into 2026. Silver has damaged out of a protracted consolidation part, a kind of transfer that traditionally can result in highly effective upside expansions, with technical projections reaching as excessive as $106 per ounce. Gold can also be coming into a essential part, with momentum and construction pointing towards a possible advance into the $5,100 to $5,200 space if the pattern continues to strengthen.

I clarify the technical circumstances behind this shift, together with volatility growth, pattern affirmation, and the broader macro backdrop driving capital towards laborious belongings as fairness markets start to indicate topping conduct. The dialogue additionally covers how the Greatest Asset Now framework measures relative energy throughout asset lessons, the place treasured metals at present rank, and why historic cycles such because the Benner Cycle recommend 2026 might mark an vital inflection level for each equities and treasured metals.

Join my free Investing publication right here

The subjects Craig and I mentioned embrace:

- 0:00 – Welcome to 2026: Treasured Metals Projections

- 02:11 The Greatest Asset Now: Silver’s Surge

- 06:10 Gold’s Lengthy-Time period Developments and Quick-Time period Methods

- 09:56 Mining Sector Insights: ETFs and Market Dynamics

- 16:09 Equities in 2026: Developments and Predictions

- 20:04 Navigating Market Cycles: Dangers and Alternatives

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

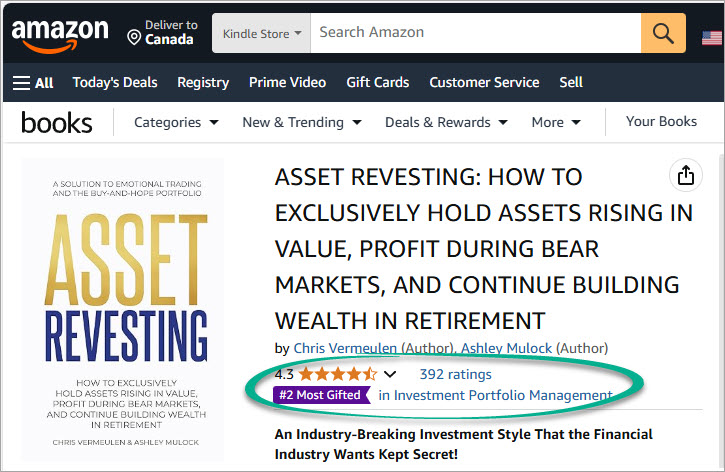

MY FREE INDICATORS IN MY BOOKS

Disclaimer: This e-mail is meant solely for informational and academic functions and shouldn’t be construed as personalised funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Trade Fee or any state regulator. The content material offered doesn’t represent a suggestion to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to alter with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions could change at any time with out discover. Readers are solely accountable for their very own funding selections. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding selections. Efficiency outcomes referenced could embrace each dwell buying and selling knowledge and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t replicate precise buying and selling. No illustration is being made that any account will or is prone to obtain earnings or losses just like these proven. Testimonials and endorsements included on this communication is probably not consultant of all customers’ experiences and should not ensures of future efficiency or success. We could obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material offered is common market commentary and never tailor-made to any particular person’s monetary scenario. Previous efficiency shouldn’t be indicative of future outcomes. Investing includes danger, together with the potential lack of capital.