In my current interview on Palisades Gold Radio with Stijn Schmitz, we targeted on what I consider is without doubt one of the most vital moments traders have confronted in recent times. Valuable metals have simply gone by means of a textbook volatility cycle, a robust rally in gold and silver adopted by a pointy correction that caught many off guard. From a long run perspective, the pattern in metals nonetheless appears constructive. However within the quick time period, we’re in what I name “no man’s land.” Momentum has cooled, sentiment has shifted, and the charts are usually not but confirming the following directional transfer. That is the section the place metals both construct a correct base and launch once more, or roll over right into a deeper pullback to reset the construction. On the similar time, I stay constructive on the US greenback and see the potential for a rally, which might naturally apply stress to gold. Foreign money motion is a crucial piece of the puzzle that many traders overlook.

Equities are equally fragile proper now. The S&P 500 is clinging to its uptrend by a thread, whereas the Nasdaq is displaying early indicators of potential breakdown. I’m additionally watching capital flows, and what I see is cash rotating quietly into defensive sectors like utilities and client staples. That tells me establishments are cautious. My strategy is to not predict tops or bottoms however to observe value and respect pattern shifts. In the meanwhile, I’m holding roughly 70 p.c in money, ready for the market to tip its hand. Oil, copper, and uranium are displaying comparable consolidation patterns, suggesting {that a} broader transfer is constructing throughout asset lessons. When markets compress like this, a major enlargement normally follows. Till the charts verify route, endurance and capital preservation stay the precedence.

Join my free Investing publication right here

The matters John and I mentioned embody:

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

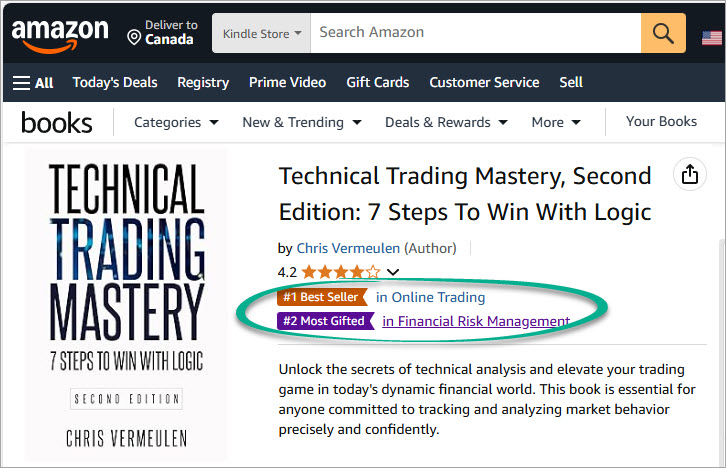

MY FREE INDICATORS IN MY BOOKS

Disclaimer: This e mail is meant solely for informational and academic functions and shouldn’t be construed as personalised funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Change Fee or any state regulator. The content material supplied doesn’t represent a suggestion to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to alter with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions might change at any time with out discover. Readers are solely answerable for their very own funding selections. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding selections. Efficiency outcomes referenced might embody each reside buying and selling information and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t replicate precise buying and selling. No illustration is being made that any account will or is prone to obtain earnings or losses just like these proven. Testimonials and endorsements included on this communication is probably not consultant of all customers’ experiences and are usually not ensures of future efficiency or success. We might obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material supplied is common market commentary and never tailor-made to any particular person’s monetary state of affairs. Previous efficiency isn’t indicative of future outcomes. Investing entails danger, together with the potential lack of capital.