Silver didn’t drift decrease; it collapsed. On the Dwelling Your Greatness podcast, Ben and I break down what a sudden 32% drop in silver actually means, and why strikes like this have a tendency to do probably the most emotional harm to buyers. We discuss by means of how individuals sometimes react in actual time throughout these moments, and why that response typically results in poor choices proper when readability is required most.

Throughout our dialog, Ben challenges me on whether or not one of these promoting is a warning signal or a basic shakeout, how silver compares to gold on this setting, and what the charts are literally signaling beneath the headlines. We additionally dig into crowd psychology, panic cycles, and why violent value strikes have a tendency to indicate up when buyers really feel least ready, making self-discipline and expertise way more vital than predictions.

Join my free Investing e-newsletter right here

The subjects Ben and I mentioned embody:

- 00:00 Intro

- 00:43 SILVER COLLAPSED… Now What?

- 01:58 This Is The place Traders Get Wrecked

- 04:20 The Technical Dealer’s Charts: What Occurs Subsequent

- 12:13 Gold Isn’t Secure Both (But)

- 19:36 The Crowd All the time Panics Too Late

- 26:17 The Solely Technique That Survives This

- 34:29 The Emotional Cycle Behind Each Crash

- 34:57 Euphoria Earlier than the Rug Pull

- 37:28 Getting ready for the Reset Earlier than It Hits

- 40:33 What To Do If You’re 25 vs 55

- 44:29 Cease Following Feelings. Observe Charts.

- 50:19 Chris Vermeulen’s Story: The Lesson That Stayed

- 55:37 “Monetary Loss Destroys Lives”

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

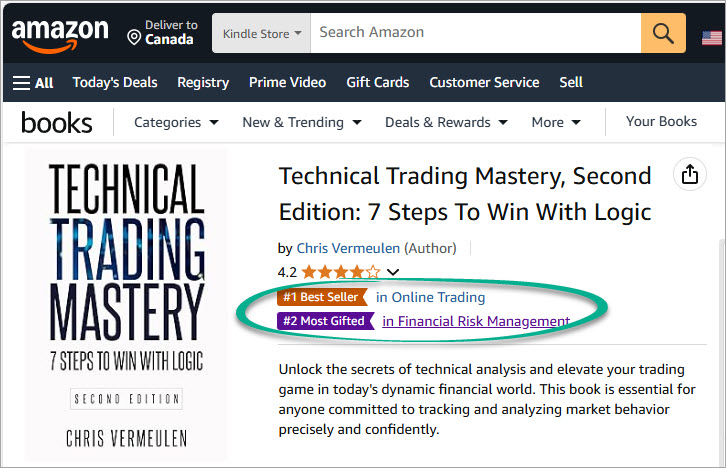

MY FREE INDICATORS IN MY BOOKS

Disclaimer: This e mail is meant solely for informational and academic functions and shouldn’t be construed as personalised funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Change Fee or any state regulator. The content material supplied doesn’t represent a advice to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to alter with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions might change at any time with out discover. Readers are solely liable for their very own funding choices. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding choices. Efficiency outcomes referenced might embody each reside buying and selling knowledge and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t mirror precise buying and selling. No illustration is being made that any account will or is more likely to obtain income or losses just like these proven. Testimonials and endorsements included on this communication is probably not consultant of all customers’ experiences and will not be ensures of future efficiency or success. We might obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material supplied is normal market commentary and never tailor-made to any particular person’s monetary state of affairs. Previous efficiency just isn’t indicative of future outcomes. Investing includes threat, together with the potential lack of capital.