Sensible Cash Ideas (SMC) refers to cost motion rules that reveal how institutional merchants—banks, hedge funds, and huge monetary entities—transfer markets. The MT5 indicator automates the detection of those patterns, which in any other case require hours of guide chart evaluation.

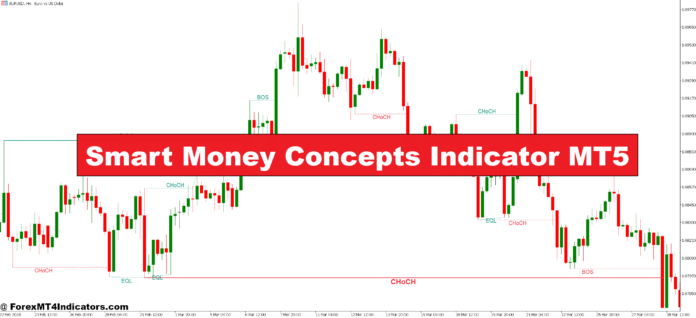

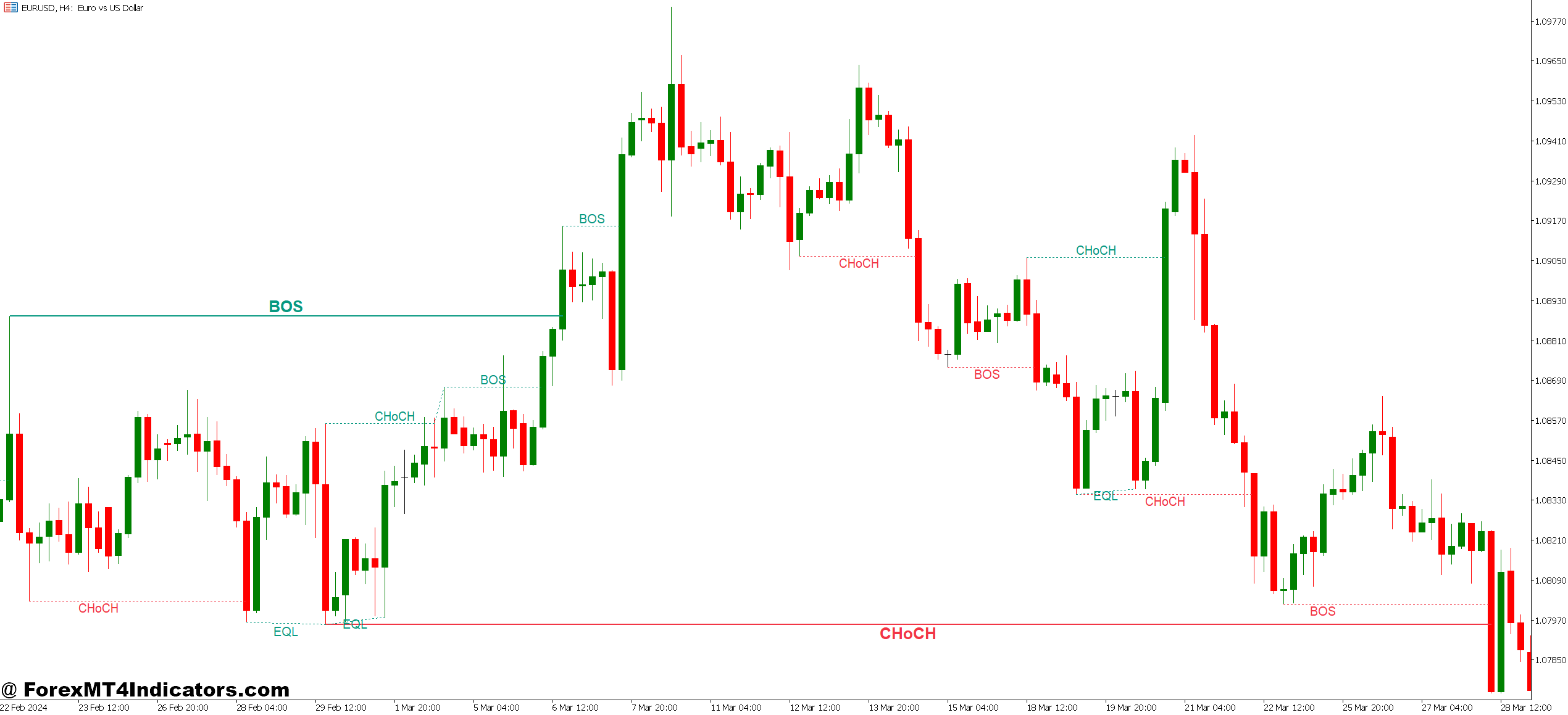

The indicator marks a number of key constructions. Order blocks seem as rectangles highlighting the final bullish or bearish candle earlier than a powerful transfer. These zones symbolize the place establishments positioned important orders. Honest worth gaps (FVGs) present imbalances the place worth moved too shortly, leaving inefficiencies that always get crammed later. Break of construction (BOS) factors establish when worth breaks earlier swing factors, confirming development path.

What separates this from customary help and resistance? Specificity. Relatively than drawing arbitrary zones, the indicator pinpoints actual areas the place institutional algorithms possible triggered. On EUR/USD’s day by day chart, an order block at 1.0850 may symbolize the place the European Central Financial institution’s buying and selling desk amassed positions throughout a quiet Asian session.

The Mechanics Behind the Indicators

The indicator scans for particular worth patterns that recommend institutional exercise. For order blocks, it identifies the final opposite-color candle earlier than a powerful impulse transfer. If worth rallies 50 pips with out retracement, that last bearish candle earlier than the surge turns into a bullish order block—establishments possible absorbed all promoting stress there.

Honest worth gaps emerge when three consecutive candles create an area between the excessive of candle one and the low of candle three. This occurs when giant orders hit the market, inflicting slippage and gaps within the order e book. The indicator marks these zones as a result of establishments typically let worth revisit them earlier than persevering with the development.

Change of character (CHoCH) detection requires the algorithm to trace swing highs and lows. When worth breaks a earlier swing level with momentum, it alerts potential development reversal. The indicator measures the break’s power by analyzing quantity and candle measurement—weak breaks typically fail, sturdy ones persist.

The calculation isn’t rocket science, but it surely’s tedious. Merchants who manually mark these ranges may miss half of them throughout fast-moving classes. The indicator processes each candle mechanically, sustaining consistency that guide evaluation can’t match.

Actual-World Buying and selling Eventualities

Right here’s how merchants apply this. On USD/JPY’s 4-hour chart final month, worth created a bearish order block at 149.80 after a pointy selloff. Two days later, throughout London open, worth rallied again to 149.75—proper into that zone. Sellers appeared instantly, pushing worth down 120 pips over the following 12 hours. That’s textbook order block rejection.

Honest worth gaps work in a different way. When EUR/GBP dropped 80 pips in half-hour after a BOE assertion, it left a niche between 0.8520 and 0.8535. Sensible merchants didn’t chase the transfer down. They waited. Three classes later, worth retraced to 0.8528—the center of that hole—earlier than persevering with decrease. Affected person merchants who set restrict orders within the FVG caught the continuation.

However right here’s the factor—not each sign works. Through the 2023 March banking disaster, USD/CHF created a bullish order block at 0.9180. Worth returned to check it 3 times, and all 3 times it failed. Why? Basic worry overwhelmed technical constructions. The Swiss franc’s safe-haven demand trumped technical ranges.

That’s why skilled merchants mix SMC with context. A bullish order block means little if the Federal Reserve simply introduced emergency charge cuts. The indicator exhibits the place establishments traded earlier than, not what they’ll do throughout unprecedented occasions.

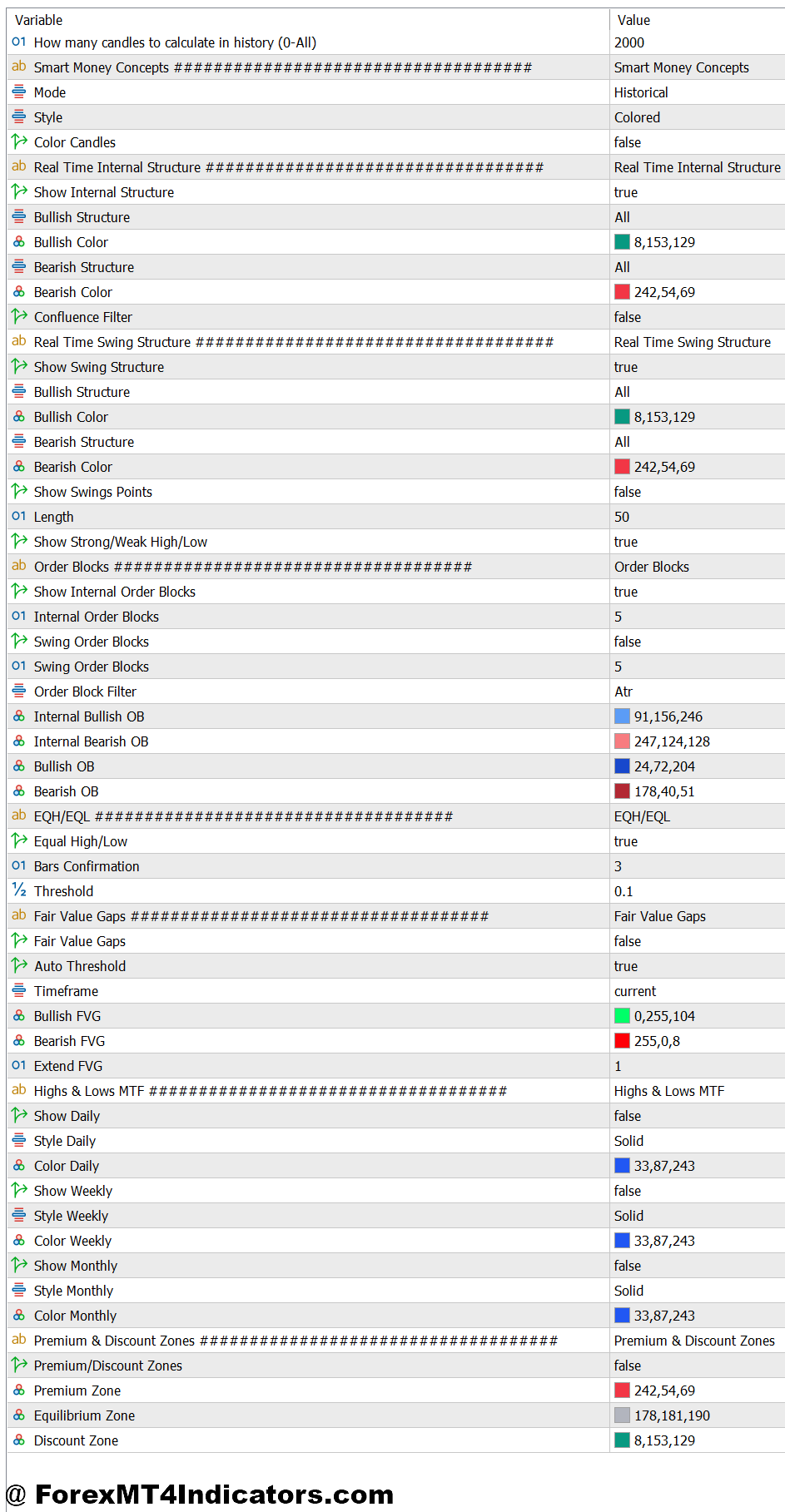

Settings and Customization

The indicator’s default parameters work for swing buying and selling on H4 and day by day timeframes. The lookback interval—normally set to 50 candles—determines how far again the algorithm scans for swing factors. Shorter lookbacks (20-30) swimsuit scalpers on 15-minute charts however generate extra false alerts. Longer lookbacks (100+) scale back noise however may miss latest construction shifts.

Order block sensitivity controls what number of zones seem in your chart. Excessive sensitivity exhibits each minor block, cluttering the display. Low sensitivity shows solely the strongest zones the place institutional exercise was most evident. Most merchants set this to medium, then regulate primarily based on their pair’s volatility.

Shade coding helps handle info overload. Bullish zones in blue, bearish in crimson, mitigated blocks in grey—this visible hierarchy lets merchants scan charts shortly. Some merchants make older blocks clear, focusing solely on latest constructions.

For GBP/JPY’s wild 200-pip day by day ranges, wider order blocks (15-20 pips) work higher than the default 10 pips. Tight spreads on EUR/USD enable narrower zones. The indicator doesn’t mechanically regulate for volatility, so merchants should fine-tune settings for every pair.

Strengths and Weaknesses

The indicator’s greatest benefit is sample recognition pace. What takes 20 minutes to mark manually seems immediately. Throughout NFP releases or central financial institution bulletins, this pace issues—alternatives vanish in seconds.

It additionally removes emotional bias. Merchants typically draw help and resistance the place they need it, not the place it truly exists. The algorithm doesn’t care about your place or bias. It marks constructions primarily based on pure worth motion.

The restrictions? It’s reactive, not predictive. The indicator exhibits the place establishments traded, not the place they’ll commerce subsequent. That bullish order block may by no means get examined if fundamentals shift. And through low-liquidity Asian classes, order blocks from skinny buying and selling circumstances typically fail when London quantity arrives.

False alerts enhance throughout ranging markets. When USD/CAD chops in a 40-pip vary for weeks, the indicator generates a number of conflicting zones. In trending markets, it shines. In sideways grind, it struggles like each different technical instrument.

Evaluating it to straightforward pivot factors or Fibonacci retracements exhibits clear variations. Pivots use mathematical calculations primarily based on earlier excessive/low/shut. Fibonacci imposes predetermined ratios on strikes. Sensible Cash Ideas displays precise traded ranges the place quantity absorbed worth. That’s extra related than theoretical math—however solely when markets respect technical ranges in any respect.

Find out how to Commerce with Sensible Cash Ideas Indicator MT5

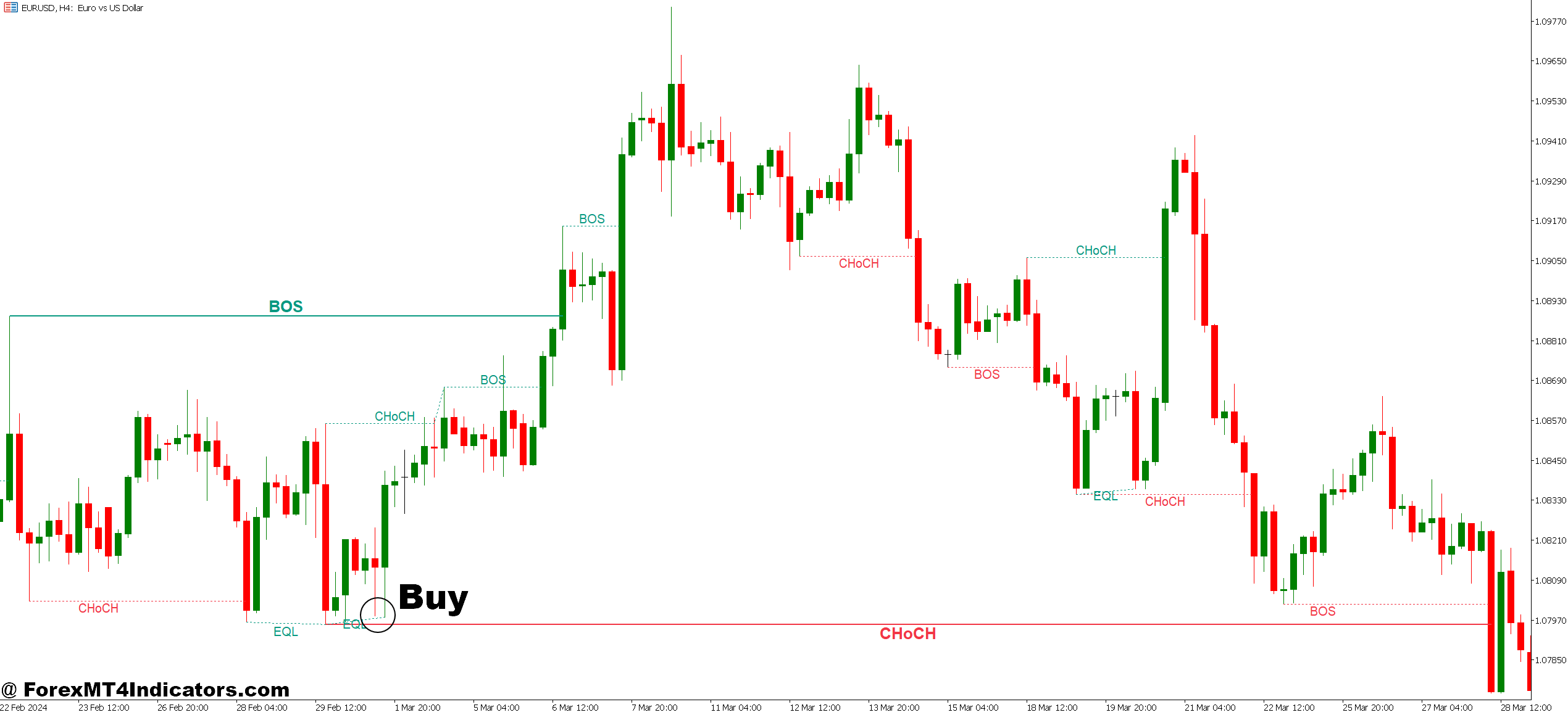

Purchase Entry

- Order Block Retest – Look ahead to worth to drop again right into a bullish order block (marked in blue) on EUR/USD 4-hour chart, then enter lengthy when a bullish engulfing candle types inside the zone, concentrating on 40-60 pips.

- Honest Worth Hole Fill – Enter purchase when worth fills 50-75% of a bullish FVG on GBP/USD 1-hour chart, inserting cease loss 5 pips under the hole’s low and aiming for two:1 risk-reward minimal.

- Break of Construction Affirmation – Take lengthy positions solely after worth breaks earlier swing excessive by not less than 15 pips on the day by day chart, then await a pullback to enter slightly than chasing the breakout instantly.

- Liquidity Sweep Setup – Purchase when worth wicks under a key low (cease hunt), then closes again above it inside 1-2 candles, indicating establishments grabbed liquidity earlier than pushing increased—works finest throughout London session.

- Danger 1% Most – By no means danger greater than 1% of account stability per SMC sign, even when the setup appears to be like excellent; EUR/USD order blocks fail 30-40% of the time throughout high-impact information occasions.

- Keep away from Vary Situations – Skip purchase alerts when worth has chopped in a 50-pip vary for 20+ hours on USD/JPY; SMC indicators generate false order blocks in sideways markets that don’t maintain.

- Quantity Affirmation Required – Solely enter when the bullish order block shaped on sturdy quantity (examine quantity indicator); thin-volume blocks on AUD/USD Asian session typically fail when London opens.

- A number of Timeframe Alignment – Confirm the purchase sign on 1-hour chart aligns with bullish construction on 4-hour and day by day charts; counter-trend trades in opposition to increased timeframe order blocks sometimes get stopped out.

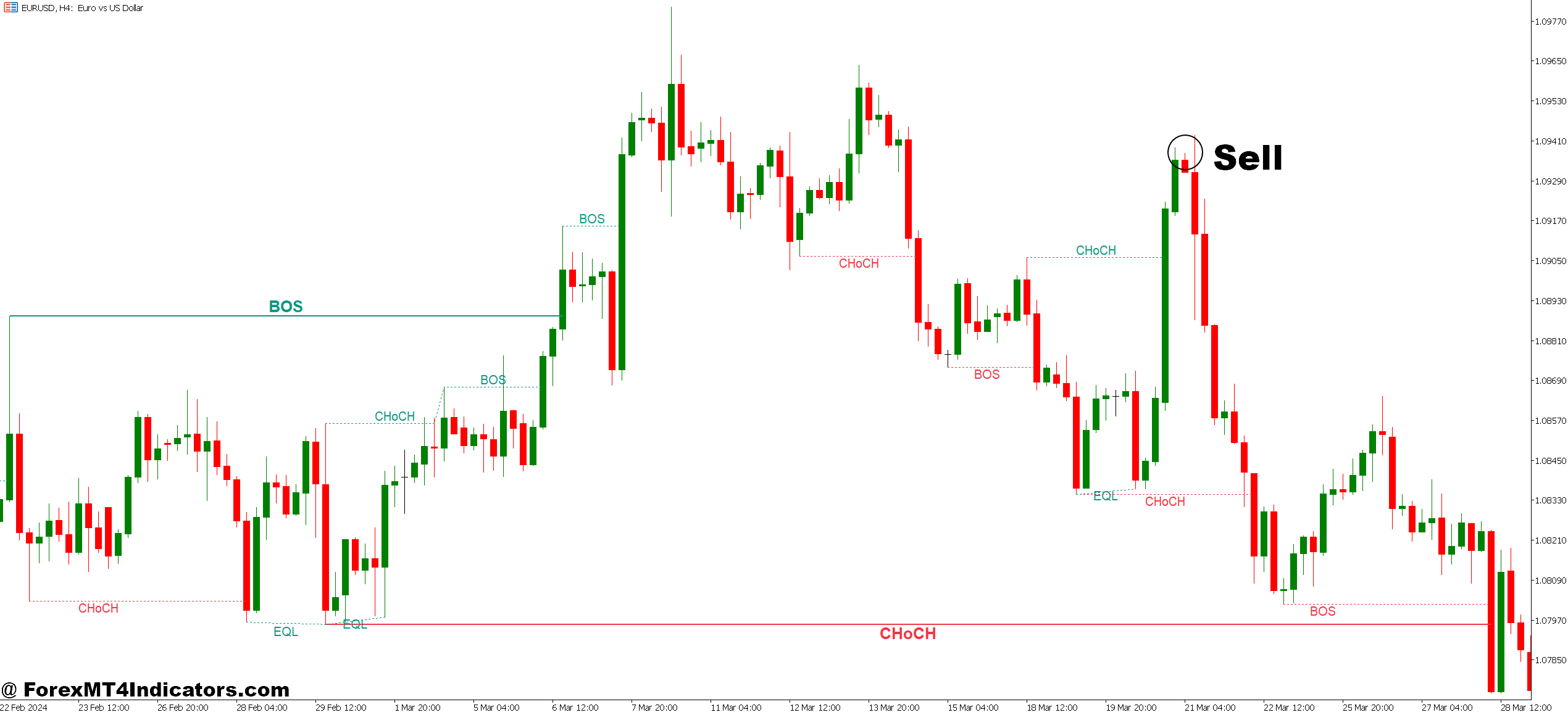

Promote Entry

- Bearish Order Block Take a look at – Enter brief when EUR/USD rallies right into a red-marked bearish order block on the 4-hour chart, ready for a bearish engulfing or sturdy rejection wick earlier than promoting.

- Honest Worth Hole Resistance – Promote when worth retraces 60-80% right into a bearish FVG on GBP/USD 15-minute chart throughout unstable information releases, setting cease loss 10 pips above hole’s excessive.

- Change of Character Break – Go brief after worth breaks under earlier swing low with momentum, however wait 2-3 candles for affirmation on day by day chart—speedy entries typically catch false breaks.

- Premium Zone Rejection – Promote when worth reaches the higher 25% of a broader vary after tapping a bearish order block, indicating establishments distributed at premium costs earlier than markdown.

- Cease Loss 2x ATR – Place stops at twice the Common True Vary above bearish order blocks on unstable pairs like GBP/JPY; tight 20-pip stops get clipped throughout regular worth fluctuation.

- Skip Throughout Robust Developments – Don’t take promote alerts in opposition to apparent uptrends on USD/CHF weekly chart; counter-trend SMC trades have 60%+ failure charges when combating main institutional path.

- Information Occasion Filter – Keep away from brief entries half-hour earlier than and after NFP, FOMC, or central financial institution choices; even legitimate bearish order blocks get blown via throughout high-impact basic releases.

- Mitigation Examine – By no means promote at order blocks that already bought examined twice and held; mitigated zones (turned grey by indicator) lose their energy after establishments already executed their orders there.

Utilizing This Indicator Responsibly

Sensible Cash Ideas Indicator MT5 supplies a framework for understanding institutional habits. Merchants who blindly enter at each order block will face disappointment. The instrument works finest when mixed with development evaluation, basic consciousness, and correct danger administration.

Danger per commerce ought to by no means exceed 1-2% of account fairness, no matter how excellent a setup appears to be like. No indicator, together with this one, predicts the longer term with certainty. Markets can stay irrational longer than accounts can stay solvent—a harsh lesson discovered by merchants who over-leveraged on “positive factor” setups.

The true worth comes from constant software over lots of of trades. Some will fail. That’s buying and selling. However when used correctly, the indicator helps tilt likelihood barely in your favor by figuring out the place the large cash truly operates. In a sport the place 70% of retail merchants lose cash, a slight edge makes all of the distinction.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90