We locked in large positive factors on Generac—and the timing couldn’t have been extra excellent.

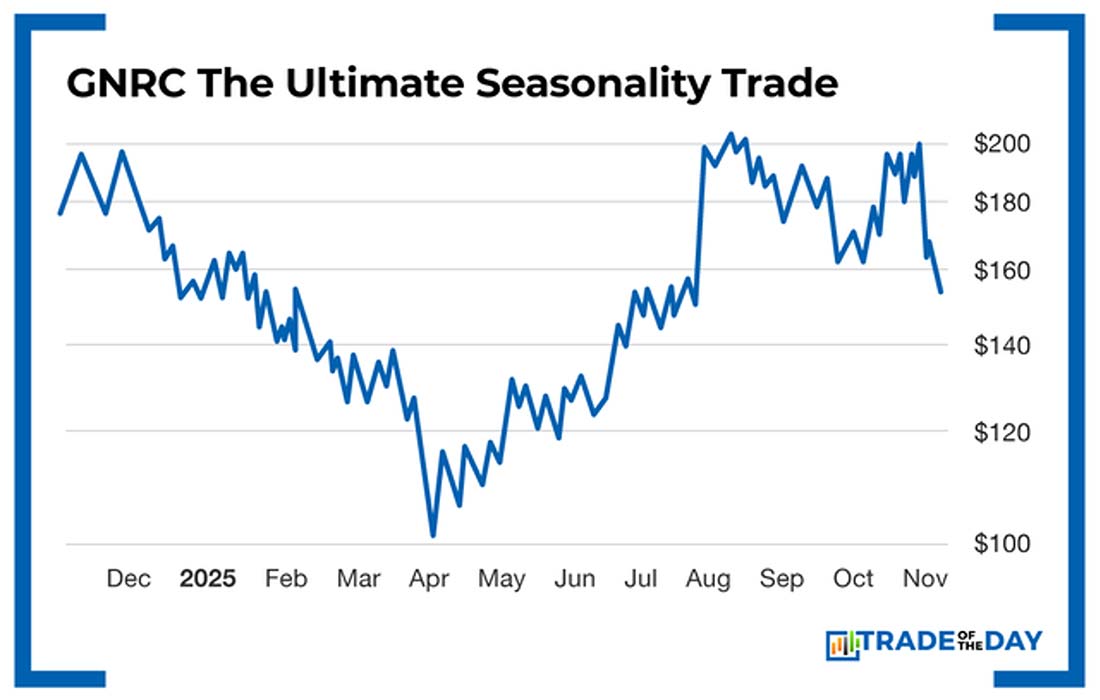

Again in late winter and early spring, we loaded up on GNRC shares in anticipation of hurricane season.

The logic was easy: yearly from June 1st by November, folks want backup mills when storms knock out energy.

We entered our choices positions and watched Generac climb to $98 per share between April and September.

That’s not a typo – $98 per share in 5 months.

The Information Backs Up the Sample

Right here’s what the numbers inform us about seasonal patterns: Generac has traditionally proven this precise conduct throughout energetic hurricane seasons. Again in 2017, when Hurricanes Harvey and Irma hit, GNRC noticed large positive factors.

In 2021, the inventory rose from round $300 in April to $450 by September—a $150-per-share transfer pushed by anticipation of hurricane season.

The sample is dependable as a result of the enterprise mannequin is easy.

When the Nationwide Hurricane Heart begins monitoring storms, folks don’t debate whether or not they want backup energy. They purchase mills.

Why We Exited When We Did

We cashed out our Generac choices place for a 52.7% revenue in 177 days… Effectively earlier than the height of hurricane season, when shares have been buying and selling above $200.

Why then? As a result of September tenth sometimes marks the height of hurricane exercise, and we’ve discovered to take cash off the desk when everybody else is getting grasping.

Good factor we did.

Hurricane season turned out to be comparatively tame this 12 months—no main storms hit the U.S. Now, Generac is buying and selling at $154, down from our exit level above $200.

Peter Lynch Had It Proper

This validates the whole lot Peter Lynch taught about investing in what you’ll be able to observe.

Lynch ran Constancy’s Magellan Fund and averaged 29% annual returns from 1977 to 1990 utilizing this precise method. See folks shopping for Dunkin’ Donuts espresso? Purchase Dunkin’ inventory.

Discover everybody heading to House Depot after storms? That’s your subsequent commerce.

The secret is understanding that seasonal trades aren’t assured—they’re chance performs.

Hurricane seasons may be tame, like 2024, or brutal like 2017. However the setup repeats each single 12 months, and that’s the place the sting comes from.

The Cycle Repeats Each 12 months

Taking a look at historic information, Generac sometimes follows this cycle: sells off in winter when hurricane demand fades, then rebounds in spring as traders place for the following season.

In 2022, GNRC dropped from $300 in September to $200 by December, then bounced again to $250 by April 2023.

The gorgeous half? There’s all the time subsequent 12 months. Hurricane season will return in June, and if Generac shares dump this winter like they sometimes do, we’ll be able to get again in come spring.

![]()

YOUR ACTION PLAN

This isn’t nearly Generac. Climate-driven demand creates alternatives throughout a number of sectors. Salt corporations like Compass Minerals spike throughout heavy snow. HVAC shares run throughout warmth waves. Insurance coverage corporations transfer on storm harm projections.

The market offers you a similar alternatives each single 12 months. You simply should be disciplined sufficient to take them—and good sufficient to exit when the setup modifications.