Full Disclosure: We’re affiliate companions with Searching for Alpha, which implies we might earn a fee in case you subscribe by way of our hyperlink (at no further price to you). We solely promote Searching for Alpha as a result of we genuinely use and love their service.

You may get a 7-Day FREE Trial to in search of alpha right here!

Introduction

In the event you’re an investor searching for an edge, you’ve seemingly heard of Searching for Alpha. Searching for Alpha payments itself as “the world’s largest investing group powered by the knowledge and variety of crowdsourcing”[1]. Since launching in 2004, it has grown into some of the standard inventory analysis platforms, attracting over 20 million month-to-month visits[2]. As a longtime person of the location (first as a free member and later as a Premium subscriber), I need to share why I completely love Searching for Alpha and the way it’s change into an indispensable instrument in my investing toolkit.

On this complete evaluate, I’ll cowl what makes Searching for Alpha distinctive, the options and advantages of their Premium service, the way it has improved my funding outcomes, and who would possibly (or may not) discover it price the associated fee. By the top, you’ll perceive why I’m such a fan of Searching for Alpha’s content material and group – and whether or not it may gain advantage your individual investing journey.

(Spoiler: I consider it might probably, particularly in case you reap the benefits of its highly effective Quant Scores and wealthy analysis library.)

What Is Searching for Alpha?

Searching for Alpha is a crowdsourced funding analysis platform the place hundreds of buyers and analysts publish articles on shares, ETFs, and different monetary matters each day. In contrast to conventional monetary information websites, a lot of the content material on Searching for Alpha is contributed by unbiased writers – over 7,000 contributors produce round 10,000 articles per thirty days![3]. However don’t mistake it for a free-for-all message board; articles undergo an editorial evaluate to make sure a baseline of high quality and transparency. Contributors are vetted to keep away from conflicts of curiosity, and should disclose positions in any shares they write about[4]. This mannequin creates a vibrant mixture of views on any given inventory, from bullish takes to bearish warnings.

In consequence, Searching for Alpha presents a range of viewpoints you gained’t discover on most single-expert newsletters. For instance, on a preferred inventory you would possibly see one creator arguing the bull case, one other the bear case, and dozens of person feedback debating each. Some readers discover the number of opinions overwhelming (“for each pitch posted, there’s a counter – it made my head spin,” one person famous)[5]. Personally, I discover it invaluable: seeing a number of sides of a inventory helps me assume critically. In reality, one Searching for Alpha person defended this range, declaring that it’s higher to see all sides than to have a one-sided take pressured on everybody[6]. The energetic remark sections typically add much more perception – typically the feedback are as informative because the articles, serving to determine flaws or strengths in an argument.

Searching for Alpha operates on a freemium mannequin. Primary membership is free (you’ll be able to learn some articles and get Wall Road analyst inventory scores), however Premium unlocks probably the most helpful options. I used the free model for a very long time to learn just a few articles right here and there, however ultimately the advantages satisfied me to improve to Premium. Right here’s an outline of what Searching for Alpha Premium presents and why it’s been price it for me.

Key Options of Searching for Alpha Premium

Searching for Alpha Premium is basically an upgraded model of the platform’s fundamental membership, packing in a ton of analysis instruments and knowledge. Listed here are a number of the standout options and advantages you get as a Premium subscriber:

- Limitless Entry to Articles & Evaluation: Premium members can learn all articles on the location, together with in-depth inventory evaluation from hundreds of contributors. (Free customers are restricted by a paywall after a sure variety of articles or older content material.) With Premium, I by no means hit a paywall, which is nice as a result of there are over 1 million investing concepts within the archive![7] I get limitless entry to not simply articles, but additionally earnings name transcripts and even audio recordings of these requires hundreds of shares[8]. That is vastly useful for doing deep analysis on an organization – I can learn the most recent earnings transcript or investor presentation proper on Searching for Alpha.

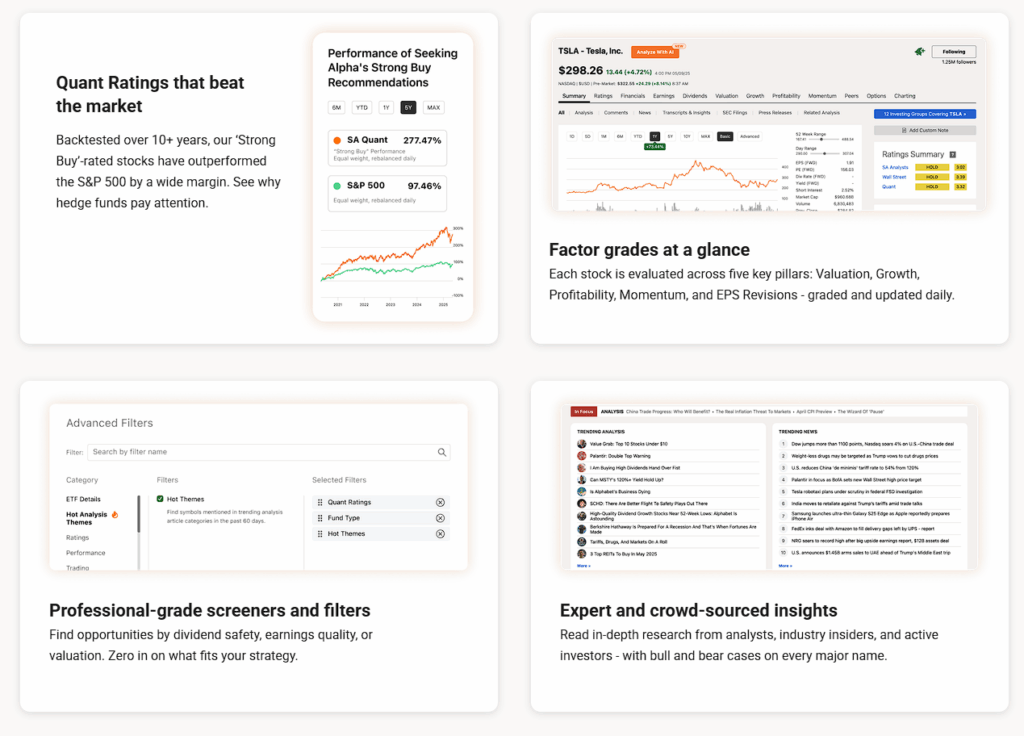

- Proprietary “Quant Scores” for Each Inventory: The crown jewel of Searching for Alpha Premium is the Quant Score system. Searching for Alpha’s Quant Scores use an algorithm (developed by their Head of Quantitative Technique, Steven Cress, CFA) to grade shares on components like worth, development, profitability, momentum, and analysts’ earnings revisions. Each inventory on the platform will get an general Quant Score (Sturdy Purchase, Purchase, Maintain, Promote, or Sturdy Promote) and issue grades (A-F) for these 5 classes[9]. This provides you an instantaneous snapshot of a inventory’s elementary and technical well being. I really like this function – it’s like having a digital analyst rapidly inform me the standard of a inventory. Much more impressively, these Quant Scores aren’t simply fancy metrics; they’ve been extraordinarily predictive of efficiency. (Extra on that within the subsequent part – the outcomes are jaw-dropping[10].)

- Prime-Rated Inventory Screeners and “Prime Shares” Lists: Premium provides you entry to strong inventory screeners the place you’ll be able to filter shares based mostly on Quant Scores, issue grades, dividend grades, sector, market cap, and so on. As an illustration, I typically use the screener to seek out shares with a “Sturdy Purchase” Quant Score and top-tier grades in development or profitability. There are additionally pre-built “Prime Shares” lists (e.g. Prime Rated Tech Shares, Prime Dividend Shares, Prime Small-Cap Shares, and so on.) that leverage the scores to floor extremely rated funding concepts[11]. This has helped me uncover new alternatives with out having to comb by way of hundreds of tickers manually.

- Superior Charting and Comparability Instruments: The platform contains instruments to evaluate shares side-by-side on key fundamentals and scores, as much as six at a time[12]. This makes it simple to, say, evaluate two corporations in the identical business throughout valuation, development, and Quant scores. Searching for Alpha additionally gives as much as 10 years of monetary statements for each inventory (with good visualizations to see developments in income, margins, and so on.)[13]. In brief, it might probably typically function a one-stop analysis terminal – I discover I don’t must hop between Yahoo Finance, Finviz, and different websites as a lot as a result of loads of knowledge is correct there on SA.

- Portfolio Monitoring & Alerts: Considered one of my favourite Premium options is the Portfolio monitor. I linked my brokerage accounts to Searching for Alpha, so the platform robotically imports my holdings and tracks the Quant Score on every of my shares[14]. I can log in and at a look see a “well being rating” of my portfolio based mostly on what number of of my positions are rated Sturdy Purchase, Maintain, Promote, and so on. Even higher, I’ve arrange e-mail alerts in order that if any inventory I personal will get downgraded to a Promote or Sturdy Promote by the Quant mannequin, I get notified in actual time[14]. This acts like an early-warning system; on just a few events I’ve been in a position to exit a place earlier than it declined as a result of Searching for Alpha’s quant alerts turned detrimental on a inventory in my portfolio. That sort of well timed alert is invaluable for threat administration.

Instance of the Searching for Alpha Premium “Portfolio Well being” dashboard, which reveals the Quant Scores for shares in your portfolio. Linking your brokerage account permits Searching for Alpha to robotically monitor your holdings and warn you to ranking modifications[15].

- Group and Commentary: Premium additionally enhances the group expertise. You possibly can observe favourite authors and get alerts once they publish new articles, and also you acquire the power to learn all remark threads (free customers could be restricted after a sure variety of feedback). I’ve found some good investing minds on Searching for Alpha whom I observe often. The positioning’s group of buyers could be very energetic – typically the remark part will debate an article’s thesis, share extra knowledge, or present various viewpoints. As one Reddit person famous, the feedback on Searching for Alpha articles will be “very informative” (and infrequently present “what not to do,” which can be helpful!)[16]. It appears like being a part of an investor dialogue membership 24/7.

- Further Premium Perks: A couple of different perks price mentioning: Premium subscribers get creator efficiency analytics (you’ll be able to see an creator’s monitor report on previous inventory suggestions – nice for accountability), dividend inventory scores (grades for dividend security, yield, development, and so on.), and ad-free looking on the location. There’s even a comparatively new Alpha Picks publication (separate from Premium; extra on this later) for inventory picks, and a top-tier PRO stage for skilled buyers, however for most individuals Premium presents greater than sufficient.

As you’ll be able to see, Searching for Alpha Premium packs loads of worth for energetic buyers. However instruments apart, the massive query is: does it really assist you make higher funding choices and returns? In my expertise, sure – and the efficiency statistics again that up in a giant means.

You may get a 7-Day FREE Trial to in search of alpha right here!

Quant Scores and Efficiency – Do They Work?

One of many first issues that intrigued me about Searching for Alpha was the declare that their Quant Scores have a confirmed monitor report of beating the market. It virtually sounded too good to be true. Nevertheless, after utilizing the platform and digging into the info, I grew to become a believer. The proof is compelling that Searching for Alpha’s Quant system works – it persistently identifies profitable shares (and flags the losers).

Searching for Alpha’s backtested efficiency of “Sturdy Purchase” rated shares vs. the S&P 500. A hypothetical $10,000 invested in top-rated shares in 2010 would have grown to over $280,000 by 2025, dramatically outperforming the identical funding within the S&P 500 index[10].

In line with an unbiased tutorial research in 2024 by professors on the College of Kentucky, Searching for Alpha’s proprietary Quant Scores “strongly predict” future inventory returns and provide “pronounced advantages” to buyers[17]. That could be a exceptional endorsement – I can’t recall many stock-picking providers which were validated by tutorial analysis. The quant mannequin appears to be like at a mixture of elementary and technical components, and apparently these components collectively do a terrific job at separating winners from laggards.

The efficiency numbers communicate for themselves. Over the previous a number of years (2017 by way of 2023 and into 2024), shares that the Quant system rated as “Sturdy Purchase” have outperformed the S&P 500 each single 12 months[18]. In reality, during the last 10 years, Sturdy Purchase-rated shares on Searching for Alpha returned +1,754% (cumulative) in comparison with +385% for the S&P 500[10]. That’s roughly 5x the market’s return – turning a $100k portfolio into $1.85 million, whereas the identical cash within the index grew to become about $485k. Much more telling, shares that the Quant system flagged as “Very Bearish” (robust promote) massively underperformed the market, validating that the mannequin might help keep away from disasters[10]. In sensible phrases, the takeaway is: in case you solely purchase shares with very excessive Quant scores and keep away from these with poor scores, you’ll have significantly crushed the market. It’s not a assure of future outcomes, in fact, however the historic edge is spectacular.

I’ve personally benefited from following Quant Scores. For instance, I found a mid-cap tech inventory (SMCI) in 2022 as a result of it shot as much as the #1 spot in Searching for Alpha’s quant rankings for its class. I seemingly wouldn’t have heard of this inventory so early in any other case. After seeing its stellar quant rating and doing my very own due diligence, I made a decision to purchase in. That inventory ended up being an enormous winner – in truth, one person on Reddit famous that discovering SMCI by way of Searching for Alpha’s quant system “made [them] hundreds of years of subscription prices” in earnings[19] (a little bit of hyperbole, however you get the purpose – it paid for the subscription many instances over!). One other investor requested how Searching for Alpha helped him discover such a gem, and he replied: it was “by way of their quant system… as soon as I noticed it within the prime 5 after which #1, I investigated additional.” He acknowledged not each article is ideal, however “the rankings do determine many extraordinarily good shares and ETFs.”[20]. That aligns with my expertise – the Quant Scores have been a wonderful place to begin for locating alternatives.

Past the Quant system, Searching for Alpha has rolled out an Alpha Picks service (out there individually or bundled with Premium) that takes the highest-rated Quant shares and selects two picks every month for subscribers. I subscribed to Alpha Picks when it launched in 2022 out of curiosity, and I’ve been very impressed. They report that in its first three years, the Alpha Picks portfolio has averaged +71% returns vs about +24% for the S&P 500 (an outperformance of ~47% in simply 3 years)[21]. Most of the particular person picks have been house runs – as an illustration, one decide (AppLovin, APP) is up 933% since Nov 2023, and a 2022 decide (Tremendous Micro, SMCI – the identical one I discussed) was offered for a 968% acquire[22]. Total, 12 out of 79 inventory picks doubled or extra, and about 78% of all picks had been worthwhile[23]. These are fairly astounding outcomes, simply beating {most professional} newsletters. (Alpha Picks leverages the Quant engine to seek out prime concepts, which seemingly explains its success.)

The underside line on efficiency: Searching for Alpha provides actual worth. Whether or not you utilize it to supply contemporary inventory concepts, to observe your portfolio’s well being, or just to get affirmation by yourself evaluation, the platform’s data-driven instruments have a demonstrated monitor report. Shares with Sturdy Purchase quant scores have massively outperformed, and even Searching for Alpha’s personal mannequin portfolio of picks is crushing the market[24]. In my case, utilizing Searching for Alpha has undoubtedly made me a extra knowledgeable (and worthwhile) investor – it’s helped me spot winners I may need missed and keep away from pitfalls I may need in any other case stepped into.

In fact, you continue to need to put in your individual analysis and never observe something blindly. As one skilled person aptly mentioned: Searching for Alpha is “completely [worth it]… assuming you aren’t a gullible rube who simply believes the whole lot you learn. The information articles are nice; the opinion articles are often not nice (as a result of most writers are selling their providers….) however typically they’re terrific, and it’s even helpful to learn the concepts of ‘improper’ writers”[16]. That’s a good evaluation – you’ll get one of the best outcomes in case you deal with the Quant scores and articles as informational instruments to information your choices, moderately than gospel. I all the time cross-check essential info and use a number of sources, however Searching for Alpha typically serves because the central hub of my evaluation course of now.

Professionals and Cons of Searching for Alpha Premium

No service is ideal for everybody. Primarily based on my expertise (and suggestions from different customers), listed below are some key execs and cons of Searching for Alpha, particularly compared to different funding analysis choices:

Professionals:

- In depth Analysis & Information in One Place: Searching for Alpha presents an all-in-one platform for analysis – articles, inventory knowledge, scores, information, and transcripts. The breadth of knowledge means you’ll be able to dive deep into nearly any inventory with out leaving the location. The comfort of getting the whole lot from elementary knowledge to various opinions in a single place is a big time-saver for critical buyers.

- Highly effective Quantitative Instruments: The Quant Scores and issue grades present a dependable, quantitative examine on shares. It is a function opponents largely don’t match. These scores have been verified by unbiased analysis and have traditionally crushed the market[17][10]. In follow, I’ve discovered the quant scores very helpful for screening and monitoring investments – it’s like having an algorithmic analyst working for you 24/7.

- Energetic Investor Group: Searching for Alpha has a extremely energetic group of buyers and merchants. The commentary and discussions can yield nice insights or not less than expose you to totally different viewpoints. It feels extra interactive than providers like Morningstar, that are extra static. In the event you take pleasure in discussing shares or studying from others’ views, SA’s group is a good useful resource[16].

- Straightforward-to-Use Interface: Regardless of the wealth of knowledge, the platform is usually intuitive. The positioning and app are well-designed and beginner-friendly (definitely extra so than some rivals’ interfaces, which will be clunky)[25]. Establishing a portfolio, creating watchlists, and discovering analysis on a inventory is easy. I additionally recognize the alerts and customizations out there.

- Good Worth (Particularly with Reductions): At face worth, Searching for Alpha Premium’s common worth is round $299 per 12 months[26]. Continuously, although, there are promotions for brand spanking new subscribers (on the time of writing, I’ve seen offers round ~$240/12 months, and typically a 7-day free trial or first month for $4.95)[27]. For the quantity of content material and instruments you get, I consider that is very inexpensive – particularly in comparison with different providers. For instance, Morningstar costs ~$249/12 months for his or her premium, Motley Idiot’s inventory choosing service is ~$199/12 months (however presents far fewer options), and Zacks costs ~$495/12 months for its premium analysis[28]. Provided that Searching for Alpha’s monitor report is arguably higher than most, I think about it nicely price the associated fee. (And in case you’re affected person, you’ll be able to typically snag a sale – they hardly ever low cost, but it surely does occur[29].)

Cons:

- Info Overload: The flip facet of getting a lot content material is that it may be overwhelming. Much less skilled buyers would possibly really feel swamped by the amount of articles and knowledge out there[30]. In the event you observe many authors or shares, you could possibly be studying all day. It takes a little bit of talent to filter noise from high quality. Some customers have famous that with so many opinions on a inventory, it may be complicated (“for each bull article there’s a bear article”)[5]. That is true – you’ll must synthesize the information and make your individual judgment, which not everybody has the time or want to do.

- Variable Article High quality: As a result of contributors have a variety of backgrounds, not each article is top-notch. Person-generated evaluation isn’t all the time vetted for accuracy past fundamental editorial requirements[31]. Some authors are skilled analysts or portfolio managers, whereas others could be hobbyists. Moreover, just a few authors might discuss up shares they’re bullish on (and even promote their very own paid newsletters). As one critic put it, “Principally folks there are pushing their very own pursuits, not yours”[32]. That’s a bit harsh for my part – there are many genuinely insightful writers on SA – but it surely’s true you’ll be able to’t take each article at face worth. You would possibly sometimes learn a very rosy piece on a inventory that later flops, or a very dire bearish take that by no means materializes. The hot button is to make use of the group enter as one a part of your analysis, not the whole thing. The excellent news is that with Premium you’ll be able to simply take a look at an creator’s monitor report to gauge credibility, and the remark part typically calls out weak arguments rapidly.

- Premium Paywall and Cell App Quirks: A typical criticism is that virtually all one of the best content material is behind the Premium paywall now (as of some years in the past, SA restricted free entry considerably, which aggravated longtime free customers)[33]. So to completely make the most of Searching for Alpha, you actually do want a paid subscription. Additionally, whereas I discover the interface simple, just a few technical quirks exist – for instance, linking a brokerage for portfolio syncing had some hiccups prior to now, and notifications on the cell app can typically lag. Some customers reported less-than-perfect experiences with customer support or cancelation processes[34], although I personally haven’t had main points on that entrance.

Total, the execs far outweigh the cons for me. The sorts of buyers who may not profit from Searching for Alpha are those that don’t need to do any analysis in any respect (in case you purely need “purchase this, promote that” with little interest in the underlying evaluation, a stock-picking publication would possibly swimsuit you higher) or very informal buyers who simply follow index funds. In reality, Searching for Alpha itself acknowledges this:

Who Ought to (and Shouldn’t) Subscribe to Searching for Alpha?

In my view, Searching for Alpha Premium is greatest fitted to:

- Energetic, self-directed buyers and merchants. In the event you take pleasure in researching shares, managing your individual portfolio, and staying on prime of market information, SA Premium gives a treasure trove of sources. It’s incredible for long-term buyers, worth buyers, development inventory fanatics, dividend buyers, and energetic merchants alike – primarily anybody choosing their very own shares or ETFs will discover instruments to assist[35]. The platform provides you the info and viewpoints to make knowledgeable choices and fine-tune your technique.

- Traders in search of a group and thought move. The service is nice if you wish to uncover new funding concepts or hear various opinions. For instance, in case you’re searching for inventory picks, the Alpha Picks publication (or simply scanning top-rated shares) can hand you some candidates on a silver platter. In the event you like to debate and study, the group facet will enchantment to you. It’s like crowdsourced analysis – somebody within the Searching for Alpha group would possibly floor a bit of information or a perspective you hadn’t thought of.

- Portfolio DIYers who need to optimize returns. In the event you handle your individual portfolio and need to enhance efficiency, Searching for Alpha’s instruments can provide you an edge. The Quant alerts might help you with timing (e.g. when a holding’s fundamentals begin to deteriorate, per the mannequin), and the infinite provide of study might help you determine what to purchase or promote. It’s additionally fairly helpful for dividend buyers wanting to observe dividend security and development metrics.

However, Searching for Alpha is probably not price it if:

- You’re a really passive investor. In case your technique is solely to purchase broad index funds or ETFs and also you’re not fascinated with particular person shares, then Premium most likely isn’t obligatory. An index investor doesn’t want each day inventory evaluation or scores – a service like Morningstar for fundamental fund information or simply your dealer’s analysis would possibly suffice. Searching for Alpha shines for inventory pickers, much less so for pure index holders (although you could possibly nonetheless profit from macro articles and commentary, it’s not the core worth).

- You don’t have time or want to learn analysis. Some folks need plug-and-play suggestions with out diving into why. Whereas Searching for Alpha does provide the Alpha Picks for a fast “simply inform me a pair shares to purchase” resolution, the principle platform is richer than that. If you recognize you gained’t use the options – e.g. you gained’t really learn analyses, display for shares, or examine the Quant scores – then paying for them is pointless. In that case, an easier (and cheaper) publication or fundamental dealer analysis could be sufficient. As one person candidly mentioned after making an attempt it, in case you’re not going to utilize the instruments, you would possibly conclude you “didn’t want their providers”[36].

For many critical buyers, nevertheless, I believe Searching for Alpha is extraordinarily useful. Even newbies can profit, if they’re prepared to study by studying and interacting – although I’d advise newbies to start out gradual and give attention to high quality over amount of knowledge (to keep away from evaluation paralysis).

Person Sentiment and Testimonials

I’m clearly a fan of Searching for Alpha, however what about others? The final sentiment from person evaluations is basically constructive, although with some combined emotions that echo the professionals/cons above.

On formal evaluate websites, Searching for Alpha scores nicely: for instance, it has a 4.8 out of 5 on the Apple App Retailer, 4.3/5 on Capterra, and round 3.9/5 on Trustpilot[37]. Many buyers reward the depth of analysis instruments, the charting and knowledge, the energetic group, and the standard of study out there. These are sometimes cited as causes the subscription is “price it.” There are additionally power-users who credit score SA for bettering their investing outcomes. As an illustration, I’ve seen folks remark that following the Quant technique or sure prime authors has led them to market-beating returns.

On the flip facet, some widespread complaints in evaluations contain customer support (some had gradual responses from assist, although others had good experiences)[34], the method of linking brokerage accounts (which had some early glitches), and the problem of separating the actually skilled evaluation from the much less credible. Relating to that final level, one Trustpilot reviewer mentioned it was typically exhausting to inform which articles had been by actual execs versus amateurs. That’s a good criticism – the platform places all analysis collectively – however the Premium function exhibiting an creator’s previous ranking historical past on a inventory does assist present context. Plus, over time you study which contributors are high-quality in your space of curiosity.

Apparently, discussions on boards like Reddit are cut up – some swear by Searching for Alpha, others are extra essential. We’ve already touched on a Reddit thread the place a person wholeheartedly endorsed the service (discovering it very helpful for the information, knowledge, and quant rankings)[16]. Conversely, one other Redditor argued it wasn’t price a penny to him as a result of he felt you could possibly get comparable information free elsewhere and that some authors push their very own agendas[32]. My take: sure, a decided investor can collect free info from varied websites (Yahoo Finance, Finviz, firm IR pages, Reddit DD posts, and so on.), however Searching for Alpha packages it in a much more environment friendly and complete means. Time is cash – and by saving me time and serving to me catch large alternatives, SA Premium greater than pays for itself. As one person on Reddit concluded after debating, the actual greatest technique to discover out if it’s price it’s to strive it your self, since any service can have each constructive and detrimental evaluations and your private investing model issues[38].

Conclusion: Is Searching for Alpha Price It?

After utilizing Searching for Alpha Premium for years, my sincere opinion is that it’s completely price it for buyers who will make the most of its options. The platform has earned my belief by way of tangible outcomes – the data-driven Quant Scores have confirmed their price by figuring out shares that crush the market, and by flashing warning indicators on shaky shares earlier than they tank[10]. The breadth of study and group perception on the location is second to none. It’s like getting access to hundreds of analysis analysts and a mountain of market knowledge, all at your fingertips.

The hot button is that it’s important to use it the appropriate means. Searching for Alpha gained’t magically make you cash in case you don’t learn the analysis or in case you blindly observe random recommendation. However in case you leverage the instruments intelligently – for instance, by specializing in top-rated shares, studying a wide range of viewpoints (and the feedback), and integrating that into your individual technique – it might probably considerably enhance your funding decision-making. The 2024 tutorial research, the backtested efficiency, and my very own monitor report all level to the conclusion that Searching for Alpha’s edge is actual[17][39]. It has made me a greater investor and extra assured in my portfolio selections.

I additionally recognize that Searching for Alpha retains evolving. They proceed so as to add new options (lately issues like improved charting, choices evaluation, and so on.), and the truth that they launched Alpha Picks and different providers reveals they’re making an attempt to cater to various kinds of buyers. For me, the core Premium is sufficient – it strikes the appropriate steadiness between DIY analysis and actionable steerage. It’s no shock that in rankings of funding providers, Searching for Alpha typically comes out on prime for efficiency lately[40].

Backside line: I extremely advocate Searching for Alpha Premium to any investor critical about inventory analysis or searching for an additional benefit out there. It has richly earned my endorsement by serving to me discover winners and keep away from losers, and by saving me numerous hours within the analysis course of. Given the confirmed monitor report of its inventory scores (Sturdy Buys completely trounce the market, and Sturdy Sells underperform badly[10]), I’d say not utilizing a instrument like this might really price you cash in missed alternatives.

In the event you’re curious to strive it out, Searching for Alpha typically presents a 7-day free trial for Premium so you’ll be able to expertise the options your self. I recommend you take it for a check drive – discover the articles, examine the Quant scores on shares you personal, play with the screeners – and see if it provides worth to your funding course of. You possibly can join a trial or discounted provide by way of this hyperlink to Searching for Alpha Premium, which may even apply the most recent promotion out there.

Joyful investing, and see you within the Searching for Alpha group!

You may get a 7-Day FREE Trial to in search of alpha right here!

Sources:

- Mark Brookshire, “Searching for Alpha Overview: Is Searching for Alpha Price It?” Wall Road Survivor, up to date August 17, 2025[17][10]. (Contains efficiency knowledge and particulars on Quant Scores, options, execs/cons.)

- Reddit person testimonials on r/investing[16][20] (real-world experiences with Searching for Alpha Premium).

- Searching for Alpha Help Middle – Premium Options Listing[9][13] (official description of Premium instruments and capabilities).

- Trustpilot and App Retailer evaluations summarized in Wall Road Survivor evaluate[37][34].

[1] [2] [3] [4] [8] [10] [14] [15] [17] [18] [21] [22] [23] [24] [25] [26] [27] [28] [29] [30] [31] [34] [35] [37] [39] [40] Is Searching for Alpha Price It? Efficiency Up to date August 17, 2025

[5] [6] [32] [33] [36] Searching for alpha price it ot simply one other rip-off? : r/investing

https://www.reddit.com/r/investing/feedback/1l7bqlj/seeking_alpha_worth_it_ot_just_another_scam

[7] Searching for Alpha Subscriptions – Evaluate Primary, Premium & PRO

https://seekingalpha.com/subscriptions

[9] [11] [12] [13] Searching for Alpha Premium: Listing of Options

https://assist.seekingalpha.com/premium/seeking-alpha-premium-feature-list

[16] [19] [20] [38] Is in search of alpha premium price it? Has the quant ranking paid off by way of when to purchase a inventory and even an ETF? : r/investing

https://www.reddit.com/r/investing/feedback/1c5mzan/is_seeking_alpha_premium_worth_it_has_the_quant