The U.S. Treasury and IRS have issued new steerage giving crypto ETPs a transparent path to stake digital property and share rewards with buyers, eradicating a main regulatory barrier.

IRS Points Secure Harbor for Staking Inside Regulated Merchandise

The IRS on Monday launched a protected harbor framework that allows trusts to stake digital property.

The rule ensures they will accomplish that with out dropping their tax standing as funding or grantor trusts, eradicating a long-standing barrier that discouraged fund sponsors from including staking yield to regulated funding merchandise.

Below the brand new coverage, crypto ETPs monitoring proof-of-stake property resembling Ethereum (CRYPTO: ETH), Cardano (CRYPTO: ADA), or Solana (CRYPTO: SOL) can now stake immediately.

They might distribute ensuing rewards to buyers in a transparent, tax-compliant framework.

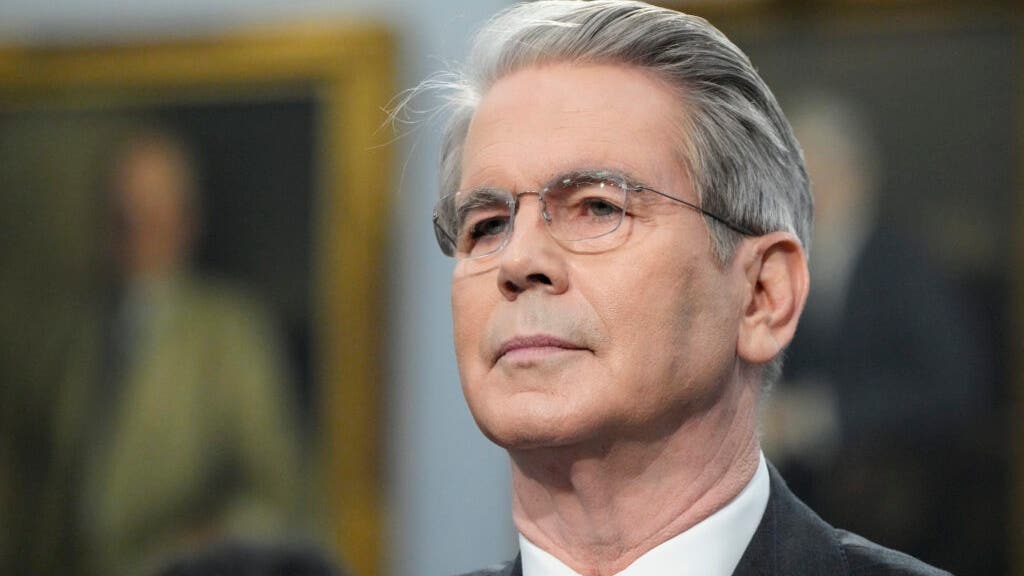

Treasury Secretary Scott Bessent mentioned the transfer “provides crypto ETPs a transparent path to stake and share rewards.”

He added that it “boosts innovation and retains America the worldwide chief in digital asset and blockchain expertise.”

Trade Leaders Name It a “Main Win” for Crypto Funds

The brand new steerage builds on Income Ruling 2023-14, which outlined how staking rewards are taxed.

It additionally follows earlier clarification from the SEC that protocol-level staking doesn’t violate securities regulation.

Invoice Hughes, senior counsel at Consensys, known as it “a significant authorized breakthrough” for the sector, saying regulated entities can now stake on behalf of buyers.

That would improve staking participation, liquidity, and community decentralization.

Fund managers consider the choice may speed up new product improvement in conventional and digital asset markets.

“It successfully removes the biggest tax uncertainty round staking,” mentioned one fund sponsor.

“We’re now exploring yield fashions inside spot ETPs prior to anticipated,” the sponsor added.

Constructing on SEC’s Liquid Staking Clarification

The Treasury transfer follows an SEC assertion from August that clarified liquid staking guidelines.

The SEC mentioned that protocol-level staking and “staking receipt tokens” fall outdoors its jurisdiction. They solely apply if linked to an funding contract.

That clarification, praised by a16z and Paradigm, was seen as a “big win for innovation,” opening the door for regulated staking integration.

The Treasury and IRS have now pushed that door totally open.

Learn Subsequent:

Picture: Shutterstock