Hiya everybody! In at this time’s article, we’ll study the latest efficiency of Russell 2000 ETF ($IWM) by the lens of Elliott Wave Concept. We’ll assessment how the highly effective rally from the November 2025 low unfolded as a textbook 5-wave impulse and focus on our evolving forecast for the subsequent transfer. Let’s dive into the construction and expectations for this tech large.

5 Wave Impulse + 7 Swing WXY correction

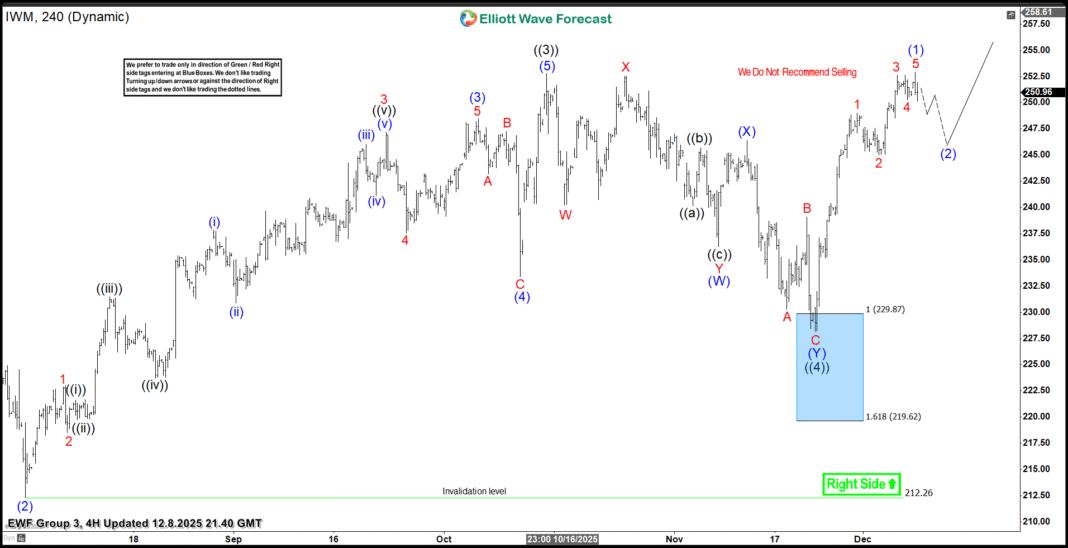

$IWM 4H Elliott Wave Chart 11.18.2025:

Within the 4-hour Elliott Wave depend from Nov 18, 2025, we noticed that $IWM accomplished a 5-wave impulsive cycle at black ((3)). As anticipated, this preliminary wave prompted a pullback. We anticipated this pullback to unfold in 7 swings, seemingly discovering patrons within the blue field equal legs space between $229.87 and $219.62.

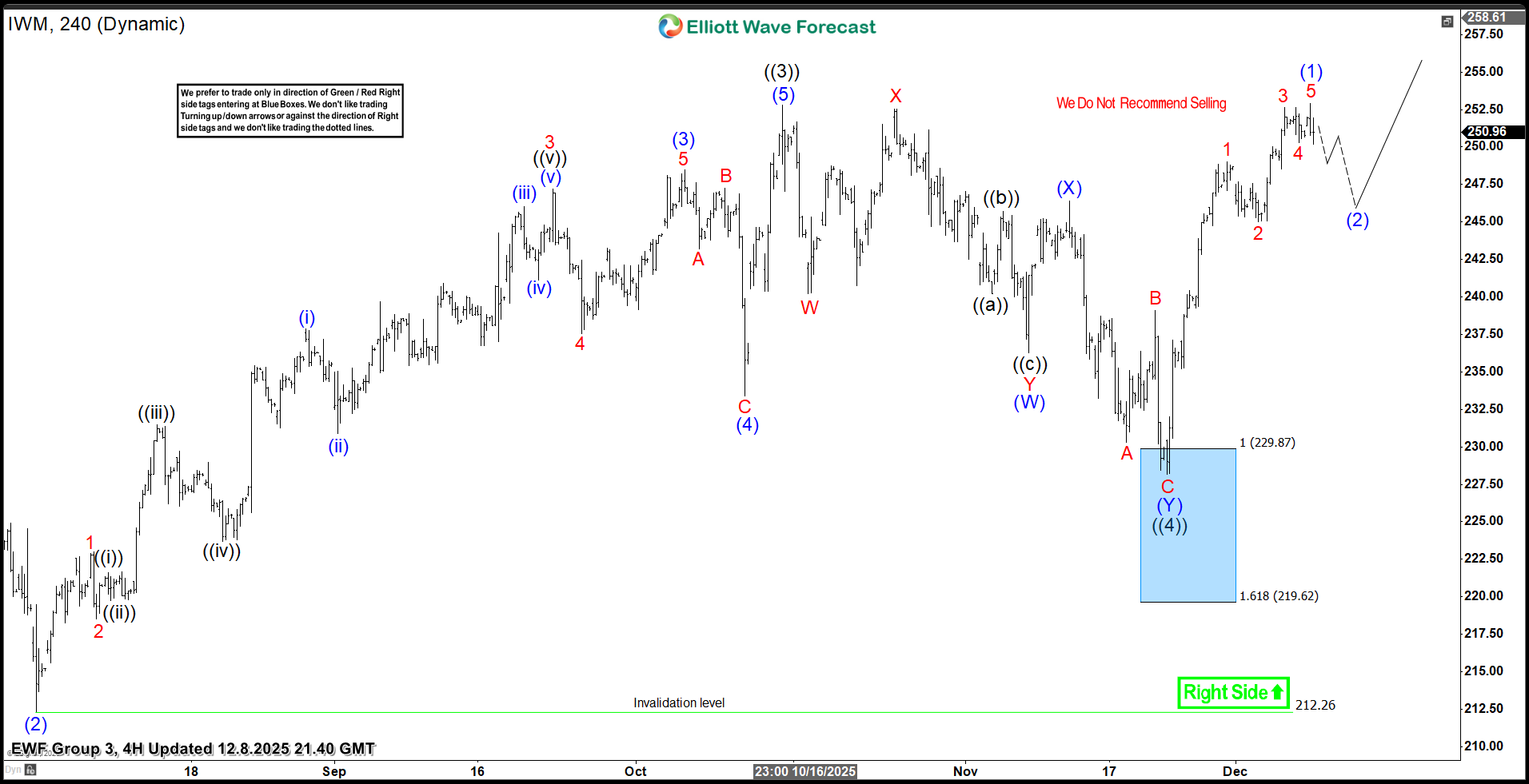

$IWM 4H Elliott Wave Chart 12.08.2025:

The most recent replace reveals the robust response from the blue field space. The ETF was capable of rally 11% and hit new all-time highs. Proper now, the ETF is searching for a pullback to digest the latest positive aspects and proceed climbing. We predict $IWM might attain $258–$268 subsequent.

Conclusion

In conclusion, our Elliott Wave evaluation of $IWM continues to show correct, suggesting that the ETF stays well-supported in opposition to its November 2025 lows. Subsequently, for merchants who capitalized on the entry alternatives offered within the “blue field” space, the $258–$268 zone ought to be carefully monitored as the subsequent vital goal. Within the interim, retaining a vigilant eye out for any wholesome corrective pullbacks might current contemporary entry alternatives for these seeking to be part of the development.

Finally, by making use of the ideas of Elliott Wave Concept, merchants can acquire a deeper understanding of market cycles, higher anticipate the construction of upcoming strikes, and in the end improve their threat administration methods in dynamic markets like the present one for $IWM.