The Relative Energy Index (RSI) Indicator – probably the most well-known oscillators in merchants’ arsenal. However, like several device, it has each strengths and critical drawbacks. Let’s break them down intimately, after which take a look at a contemporary answer – Forex RSI Scalper, which eliminates the principle issues of the traditional RSI.

Benefits of RSI: why merchants proceed to make use of it?

Simplicity of interpretation

✔ Ranges 30 (oversold) and 70 (overbought) are intuitively comprehensible even for rookies.

✔ Indicators are visually clear – crossing these ranges is simple to trace.

Effectiveness in trending markets

✔ In circumstances of a robust development, RSI nicely displays correction moments, offering entry factors.

✔ Divergences (discrepancies between value and RSI) typically predict reversals.

Universality of utility

✔ Works on any timeframes – from M1 to D1.

✔ Appropriate for Foreign exchange, shares, indices, cryptocurrencies, and binary choices.

Potential to mix with different indicators

✔ Usually used along with shifting averages (MA), MACD, Bollinger Bands to filter indicators.

Constructed into most buying and selling platforms

✔ Doesn’t require extra set up – out there in MetaTrader 4/5, TradingView, and different terminals.

Disadvantages of RSI: why it might probably allow you to down?

False indicators in flat (sideways)

✖ In sideways circumstances, RSI continually “twitches” between ranges 30 and 70, giving many false entries.

✖ A dealer could get a sequence of shedding trades if indicators aren’t filtered.

Delay

✖ Like all oscillators, RSI reacts to already occurred motion, not predicting it.

✖ In moments of sharp value jumps, the sign could come too late.

Mounted overbought/oversold ranges

✖ Commonplace 30/70 aren’t all the time related – in a robust development, RSI could keep within the overbought zone for a very long time with out correction.

✖ In a weak development or low volatility, ranges needs to be completely different, however the indicator doesn’t account for this.

Doesn’t contemplate market context

✖ RSI doesn’t distinguish between development and flat, inflicting contradictory indicators.

✖ In high-volatility intervals (e.g., on information), it might situation excessive values that don’t mirror the actual state of affairs.

Issues with scalping

✖ On small timeframes (M1-M5), false indicators improve.

✖ Basic RSI is just not optimized for ultra-fast buying and selling.

Forex RSI Scalper – “sensible” RSI for worthwhile buying and selling

If the traditional RSI helps you to down, strive Forex RSI Scalper – an indicator that adapts to market circumstances and minimizes the drawbacks of the usual RSI.

How is it higher than common RSI?

✅ Automated stage adjustment – the algorithm itself selects optimum overbought/oversold zones based mostly on present volatility.

✅ Clear indicators with out repainting – arrows and alerts seem solely after the candle closes.

✅ Appropriate for scalping – works on M1-M15, ideally suited for fast trades.

✅ Notifications to e mail and cellphone – no want to take a seat on the monitor.

✅ Versatile settings – you may change colours, sensitivity, sign filtering methodology.

Easy methods to use it?

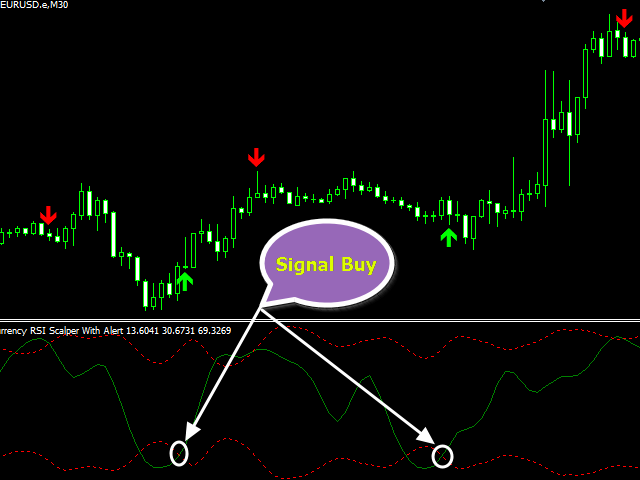

🔹 Purchase: RSI crosses the adaptive oversold stage from backside to high → lengthy sign.

🔹 Promote: RSI crosses the adaptive overbought stage from high to backside → quick sign.

🔹 Averaging: if indicators go consecutively in a single path, you may add to the place.

Obtain Forex RSI Scalper and commerce correctly:

Basic RSI is a confirmed device, however with limitations. Forex RSI Scalper solves its most important issues, making buying and selling extra correct and worthwhile. In case you’re bored with false indicators – strive the trendy strategy! 🚀

Share your expertise with the traditional RSI – what difficulties have you ever confronted?