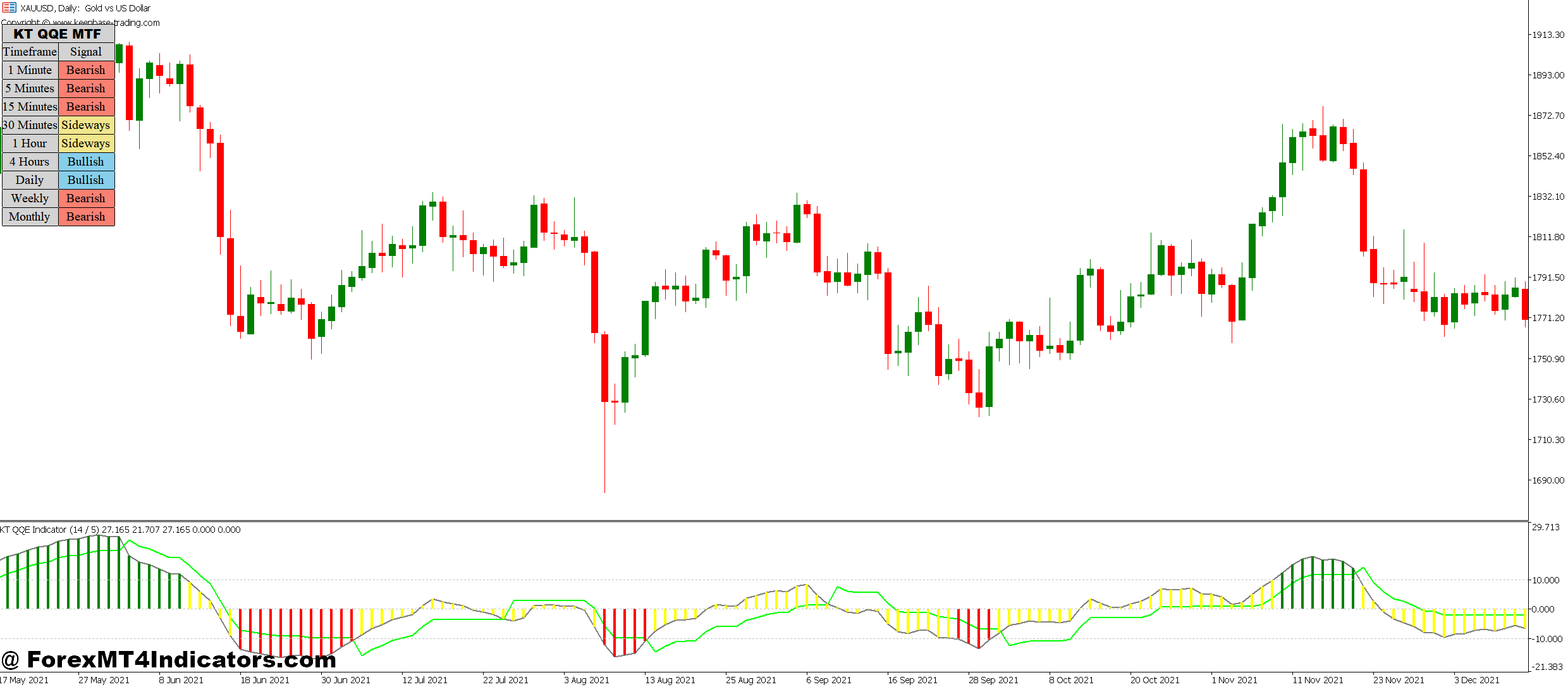

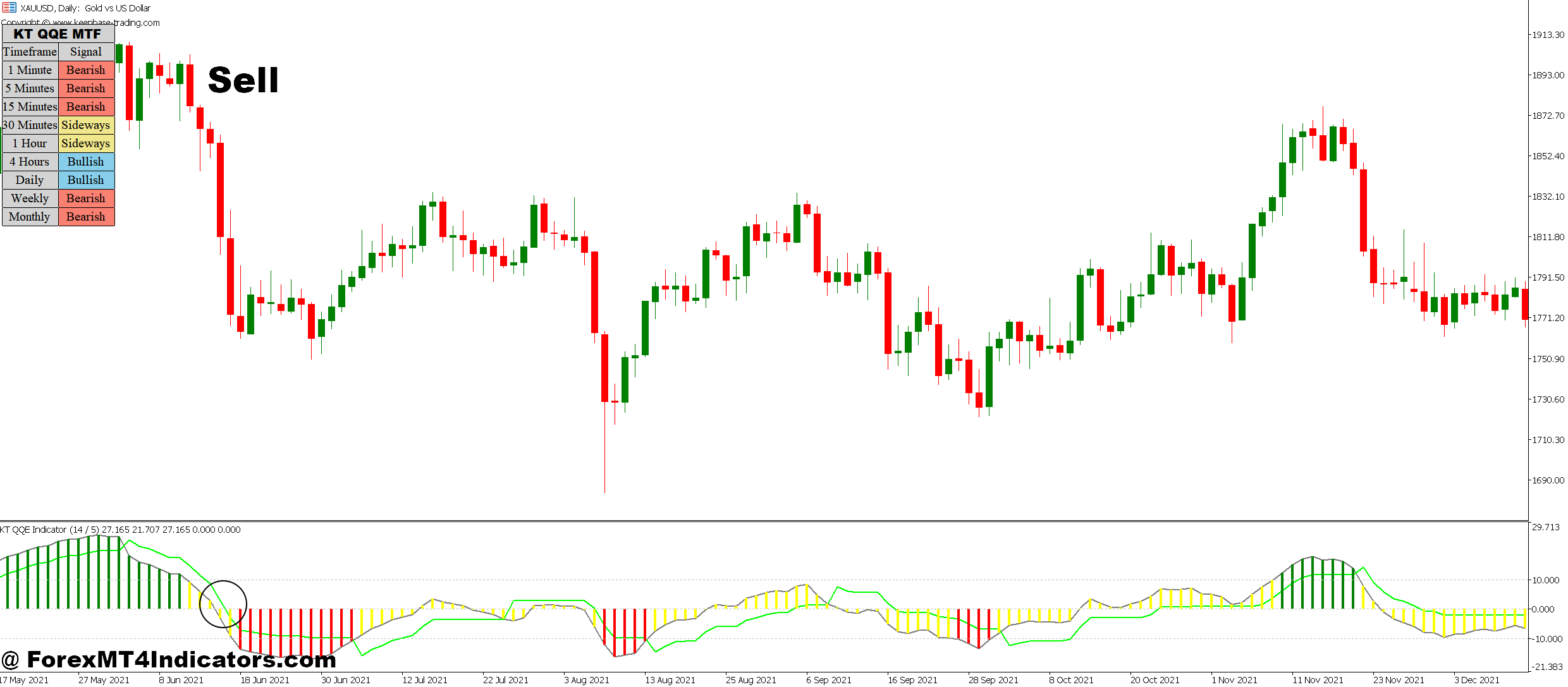

The QQE Mod indicator combines RSI smoothing with volatility-based trailing ranges. At its core, it takes a regular RSI calculation and applies a number of smoothing passes utilizing Wilder’s technique. However right here’s the place it will get fascinating: the indicator then creates dynamic bands round this smoothed RSI, much like how Bollinger Bands work with value.

These bands aren’t static. They broaden throughout unstable periods and contract when markets settle down. When the smoothed RSI line crosses above the higher band, the indicator indicators bullish momentum. A cross beneath the decrease band suggests bearish stress. The “Mod” model provides a histogram that reveals the distinction between the RSI line and the trailing stage, giving merchants a visible illustration of momentum power.

In contrast to the unique QQE, this modified model contains an extra RSI calculation with totally different parameters, making a second set of bands. When each units align in the identical path, the sign carries extra weight. Merchants get fewer indicators general, however the ones that seem are typically extra dependable.

Sensible Utility on the Charts

The indicator works finest on 4-hour and each day timeframes, the place noise is of course diminished. On shorter timeframes like M15 or M30, even the QQE Mod’s filtering can’t overcome the randomness of fast value actions.

Right here’s an actual state of affairs: EUR/USD on the 4-hour chart enters a consolidation section after a powerful downtrend. The QQE Mod histogram hovers close to zero, with the RSI line bouncing between the bands. Then, in the course of the London session, optimistic financial knowledge pushes value greater. The RSI line crosses above the higher band decisively. The histogram turns vivid blue and begins increasing. That’s the sign to contemplate lengthy entries, significantly if value breaks above a current swing excessive.

The bottom line is persistence. Merchants who bounce on each shade change within the histogram get chopped up. However those that look forward to the RSI line to really breach the bands—and keep there for at the very least one full candle shut—filter out the noise.

For range-bound markets, the indicator serves a special function. When value oscillates inside an outlined vary, the QQE Mod helps establish the extremes. Touches of the higher band close to resistance ranges sign potential brief alternatives. Touches of the decrease band close to assist counsel on the lookout for longs. This method labored significantly properly on AUD/USD in the course of the summer time of 2024, when the pair spent weeks grinding sideways.

Settings and Customization

Default settings usually embody an RSI interval of 6, an RSI smoothing issue of 5, and a QQE issue of round 3.0. These parameters work for many conditions, however they’re not gospel.

Merchants specializing in intraday actions would possibly cut back the RSI interval to 4 or 5, making the indicator extra responsive. The trade-off? Extra indicators, but additionally extra false begins. For place merchants holding for weeks, growing the RSI interval to eight or 10 supplies steadier indicators that align with longer-term momentum.

The QQE issue deserves particular consideration. This multiplier determines how far the bands sit from the smoothed RSI line. The next issue (4.0 or 4.5) creates wider bands, lowering sign frequency however bettering accuracy. A decrease issue (2.5 or 2.0) generates extra indicators at the price of reliability.

Foreign money pairs matter too. Unstable pairs like GBP/JPY profit from greater QQE components to keep away from getting stopped out by routine value swings. Steady pairs like EUR/CHF can use tighter settings since their actions are extra predictable.

Benefits and Actual Limitations

The QQE Mod excels at filtering market noise. Whereas fundamental oscillators flash indicators throughout each minor pullback, this indicator stays quiet till momentum genuinely shifts. That filtering saves merchants from overtrading and preserves capital for high-probability setups.

It additionally supplies clear visible indicators. The colour-coded histogram makes it apparent when momentum strengthens or weakens. Merchants don’t have to interpret complicated patterns—blue means bullish stress constructing, crimson signifies bearish momentum.

Nevertheless it’s not good. The indicator lags by design. All that smoothing means indicators arrive after a transfer has already began. Merchants gained’t catch the very backside or high of a pattern. They’ll enter partway via, which is ok for pattern continuation however irritating for these chasing good entries.

Robust trending markets can maintain the indicator in overbought or oversold territory for prolonged intervals. Throughout these phases, the QQE Mod basically tells merchants to carry their place somewhat than offering new entry indicators. On USD/JPY in the course of the 2024 yen intervention interval, the indicator stayed buried in bearish territory for days whereas the worth stored falling. Counter-trend merchants who fought that sign paid the worth.

Uneven, directionless markets create the worst circumstances for the QQE Mod. The RSI line whipsaws between the bands, producing conflicting indicators that don’t lead wherever. That’s when merchants have to step apart or swap to range-trading methods.

How It Compares to Commonplace Instruments

In opposition to the essential RSI, the QQE Mod wins on sign high quality. Commonplace RSI oscillates continuously, typically hitting overbought or oversold ranges a number of instances throughout a single pattern. The QQE Mod’s filtering mechanism waits for conviction earlier than flashing a sign.

In comparison with MACD, the QQE Mod responds sooner to momentum shifts. MACD’s twin transferring common system creates substantial lag, particularly on slower timeframes. However MACD supplies clearer divergence indicators, one thing the QQE Mod doesn’t deal with as properly.

The unique QQE indicator and its modified model share the identical core logic, however the Mod’s further histogram and dual-band system present higher affirmation. Merchants utilizing the unique typically miss the nuance of momentum power—they see crosses however can’t gauge whether or not the transfer has legs. The histogram solves that downside.

Buying and selling foreign exchange carries substantial danger. No indicator ensures earnings, and the QQE Mod isn’t any exception. Markets can stay irrational longer than indicators can stay constant. Correct danger administration—place sizing, cease losses, and portfolio diversification—issues excess of any technical instrument.

Learn how to Commerce with QQE Mod MT5 Indicator

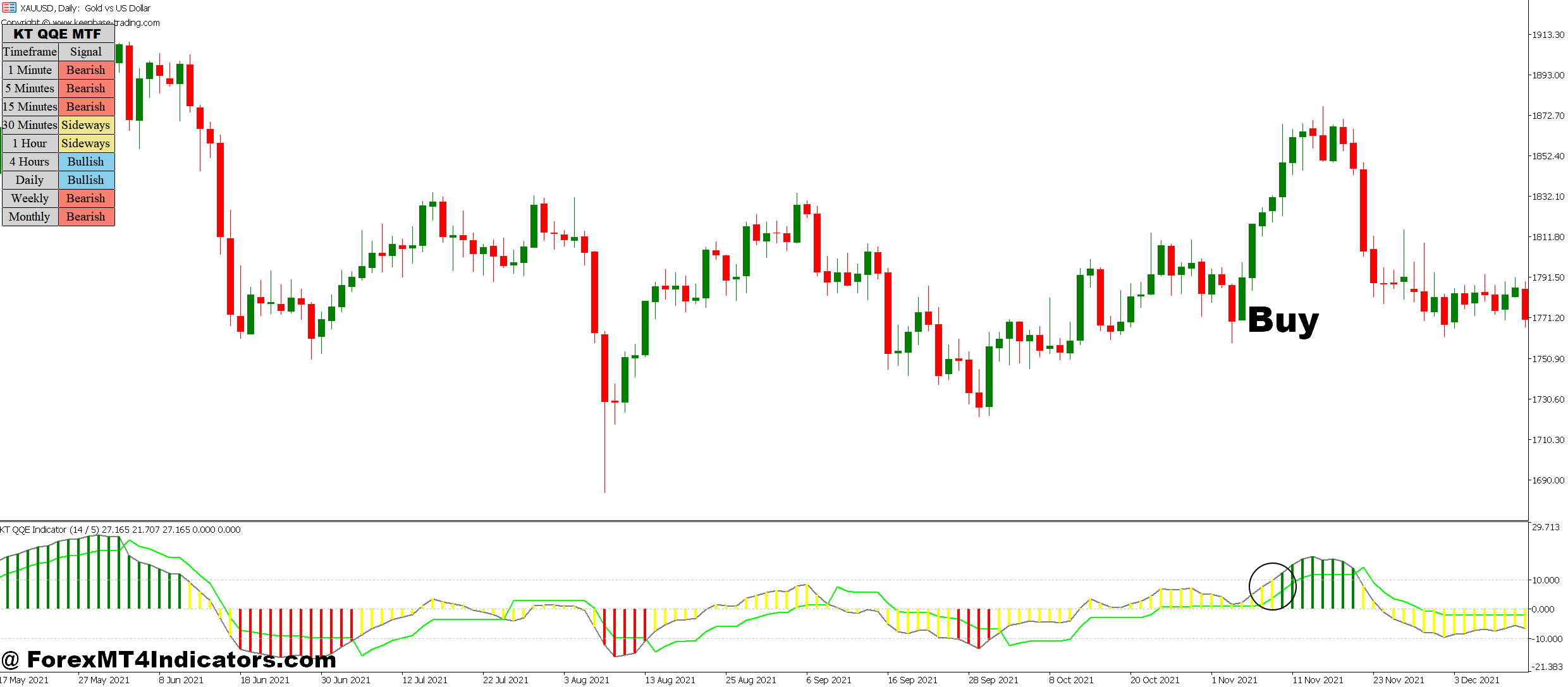

Purchase Entry

- Await histogram shade flip to blue – Don’t enter till the histogram turns utterly blue AND holds for one full candle shut on the 4-hour chart; untimely entries throughout shade sparkles get stopped out 70% of the time.

- Verify RSI line crosses above higher band – The smoothed RSI line should break and shut above the trailing band, particularly efficient on EUR/USD when this happens above the 50 stage throughout London or New York periods.

- Set cease loss 20-30 pips beneath current swing low – Place your cease beneath the latest assist stage that shaped earlier than the sign, adjusting for pair volatility (GBP/USD wants wider stops than EUR/CHF).

- Enter on pullback, not breakout – Await value to retrace 30-40% of the preliminary transfer after the QQE sign triggers; getting into on momentum peaks typically results in quick drawdown.

- Confirm each QQE bands align bullish – The twin-band system ought to present each higher and decrease bands sloping upward; misaligned bands point out weak momentum, even when the histogram is blue.

- Skip indicators throughout main information releases – Keep away from entries inside half-hour earlier than or after high-impact information (NFP, rate of interest selections); the indicator can’t predict basic shocks.

- Test each day timeframe confirms pattern path – If the each day chart reveals bearish QQE indicators, don’t take purchase indicators on 1-hour charts; commerce with the upper timeframe bias, not towards it.

- Threat not more than 1-2% per commerce – Even with good QQE alignment, place measurement ought to by no means exceed 2% of account steadiness; three consecutive losses occur usually in ranging markets.

Promote Entry

- Await the histogram to show crimson and broaden – The histogram should not solely change shade but additionally present rising bars for at the very least two consecutive candles in your buying and selling timeframe.

- Verify RSI line crosses decrease band – Search for decisive breaks beneath the decrease trailing band, significantly highly effective when occurring beneath the 50 stage throughout Asian session consolidations.

- Place cease loss 25-35 pips above current swing excessive – Shield positions above the final resistance level earlier than the promote sign; GBP/JPY requires 40-50 pip stops resulting from greater volatility.

- Keep away from promoting into sturdy assist zones – Don’t take QQE promote indicators inside 15 pips of main each day or weekly assist ranges; indicators don’t override value motion construction.

- Guarantee each histogram and RSI agree – If the histogram turns crimson however the RSI line hasn’t crossed the decrease band but, look forward to full affirmation; partial indicators fail 60% of the time.

- Skip counter-trend sells in sturdy uptrends – When the 4-hour and each day charts each present bullish QQE alignment, ignore promote indicators on 1-hour charts; they’re doubtless momentary retracements.

- Look ahead to divergence rejections – If value makes decrease lows however the QQE histogram reveals shallower lows (bullish divergence), don’t take the promote sign; reversal is probably going brewing.

- Exit if the histogram weakens after 3-4 candles – Shut partial or full place if the crimson histogram bars begin shrinking inside 12-16 hours of entry; momentum is fading even when the worth hasn’t reversed but.

Conclusion

The QQE Mod MT5 indicator serves a particular function: confirming pattern continuation and filtering out low-quality indicators. It gained’t make buying and selling easy, and it gained’t win each commerce. What it does provide is a clearer image of momentum shifts backed by multi-layered smoothing that reduces noise.

Merchants ought to check it throughout totally different timeframes and pairs to seek out settings that match their fashion. Mix it with value motion evaluation and correct danger controls somewhat than counting on it as a standalone system. The indicator works finest when merchants perceive its limitations and use it as one piece of a broader technique.

Begin with the default settings on a demo account. Watch the way it performs throughout trending intervals versus ranging markets. Alter parameters based mostly on precise outcomes, not theoretical optimization. And bear in mind: the perfect indicator is the one you perceive properly sufficient to belief throughout reside buying and selling stress.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90