By RoboForex Analytical Division

The GBP/USD pair snapped a four-day successful streak, declining for a second day to commerce round 1.3135. The sell-off was triggered by UK labour market knowledge revealing an increase in unemployment and a deceleration in annual wage development. These figures have bolstered market expectations that the Financial institution of England (BoE) may provoke rate of interest cuts as early as December.

The shifting sentiment was mirrored in authorities bonds, with the two-year gilt yield falling 6 foundation factors to three.74%, its lowest stage since August 2024.

Urge for food for threat was blended throughout asset courses. European inventory indices managed good points, whereas S&P 500 futures edged down roughly 0.2%.

In forex markets, merchants are more and more pricing in a extra dovish path for BoE coverage. Present pricing implies roughly 21 foundation factors of cuts by December, with a complete of as much as 65 foundation factors of easing projected by the tip of 2026. Economists counsel that, given the softening labour market and anticipated fiscal tightening, the BoE’s base fee may fall to three.00% from the present 4.00%.

Technical Evaluation: GBP/USD

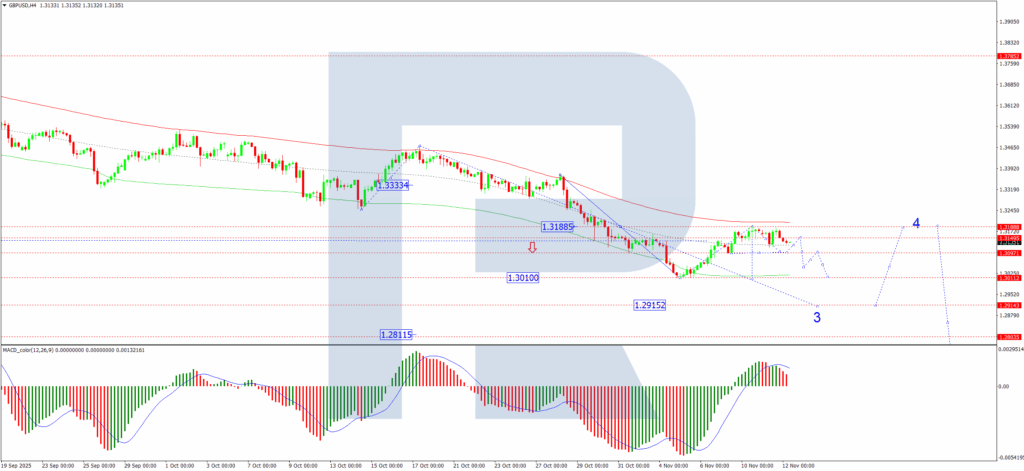

H4 Chart:

On the H4 chart, GBP/USD broke upwards from a consolidation vary round 1.3100, finishing a corrective wave to 1.3185. We now anticipate a decline again in direction of the 1.3100 assist stage. A short rebound to 1.3150 might observe, establishing a brand new consolidation vary. A subsequent downward breakout from this vary would sign a resumption of the broader downtrend, opening the trail in direction of 1.3000, with an extra potential decline to no less than 1.2915. This bearish situation is supported by the MACD indicator. Its sign line is above zero however has diverged from its histogram, suggesting the preliminary upward correction is exhausted and a brand new decline is starting.

H1 Chart:

On the H1 chart, the pair accomplished an upward correction to 1.3188 after breaking from a spread at 1.3100. A brand new downward wave is now creating, initially concentrating on 1.3108. Following this, a technical retracement to check 1.3150 from beneath is anticipated. As soon as this correction is full, the downtrend is projected to increase in direction of 1.3050. The Stochastic oscillator confirms this outlook. Its sign line is on the 20 stage, indicating oversold situations but additionally supporting the view that downward momentum is at the moment dominant.

Conclusion

The pound is weakening as smooth labour market knowledge fuels expectations of imminent BoE financial easing. Technically, the pair seems to have accomplished a corrective bounce and is now poised to renew its major downtrend. The quick focus is on the 1.3100 assist; a sustained break beneath this stage would verify a transfer in direction of 1.3000 and probably decrease.

Disclaimer:

Any forecasts contained herein are primarily based on the creator’s specific opinion. This evaluation might not be handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes primarily based on buying and selling suggestions and critiques contained herein.

- Pound Succumbs to Strain from Weak Labour Knowledge Nov 12, 2025

- USD/JPY Climbs to Contemporary 9-Month Excessive Nov 11, 2025

- The US politicians are near a funding settlement, rising the probabilities of ending the federal government shutdown this week Nov 10, 2025

- Gold Climbs to Two-Week Excessive Nov 10, 2025

- Banxico cuts rate of interest to 7.25%. Norges Financial institution holds the speed at 4% Nov 7, 2025

- USD/JPY Declines as Protected-Haven Demand Bolsters the Yen Nov 7, 2025

- The US Supreme сourt might cancel most of Trump’s reciprocal tariffs. Riksbank holds fee at 1.75% Nov 6, 2025

- GBP/USD Hovers Close to Lows as Financial institution of England Resolution Looms Nov 6, 2025

- Traders are switching to risk-off mode. The worth of Bitcoin has fallen beneath $100,000 Nov 5, 2025

- As anticipated, RBA retains the speed at 3.6%. New Zealand greenback hits 7-month low Nov 4, 2025