Pin bars are an EXTREMELY highly effective buying and selling sample when the suitable context is utilized.

I feel quite a lot of dealer’s find out about pin bars and different candlestick patterns after they’re new to buying and selling and assume they’re ineffective.

Don’t at all times get caught up on the hype of some flashy new indicator.

I’ve been buying and selling for 20 years and I nonetheless use pin bars in my evaluation and a few of my methods.

They’re a quite simple candlestick patterns however when paired with strong context they will foreshadow giant market reversals.

What’s a Pin Bar

A pin bar is a single candlestick with an extended tail (wick) who’s value motion demonstrates a rejection of a value stage and reversal in value closing close to its excessive (bullish pin bar) or low (bearish pin bar) for a person outlined session

You will discover pin bars utilizing a bar chart or candle stick chart on any time-frame in any market together with Crypto, Foreign exchange, Shares, Futures, and Choices.

There’s a number of various kinds of pin bars, let’s get began with among the fundamentals.

Bullish Pin Bars kind when sellers begin the session in management however value reaches a stage that’s rejected and consumers take over and dominate the rest of the session closing out close to or at highs.

Bearish Pin Bars kind when consumers begin the session in management however value reaches a stage that’s rejected and sellers take over and dominate the rest of the session closing out close to or at lows.

Anytime you’re engaged on a sample/technique improvement it’s extraordinarily essential to have a primary understanding of the speculation behind why it ought to work.

This helps construct confidence in your technique which in flip will enhance your execution.

Pin bar reversals make logical sense…

Let’s do a fast train to get the gears turning.

Think about your self getting into the above maze. You start by heading to the suitable (purple arrow) however after strolling a whilst you start to assume it may be the incorrect approach.

At level 1 you determine to show round and head again the best way you got here from.

Ultimately you get again to the place you started (level 2), and are left with two choices.

Proceed within the path you’re going or head again to level 1 once more.

More often than not it could appear logical to proceed within the path you’re going.

Nevertheless, there nonetheless are just a few instances that you just discover or bear in mind one thing and head again to level 1.

I assume a 3rd possibility could be to go away the maze lol…

The markets are moved by human feelings, so asking your self a majority of these questions will help you paint a clearer image of the market and the place value could go subsequent.

If we relate the trail you took within the maze to a pin bar, value was rejected at level 1 the place you determined to show round after which closed at level 2 near the place you started.

Which approach do you assume it should go the vast majority of the time contemplating no different components?

I’m merely attempting to convey the fundamental fundamentals behind why pin bars work. Human rational and feelings carry over into their buying and selling choices, which is what strikes the market. No completely different than the choice you made within the maze.

Pin Bar Varieties

There are variety of completely different pin bar formations you’ll be able to commerce. I personally generalize all of them as pin bars or inverted pin bars however right here’s a fast breakdown of the differing types.

Hammer

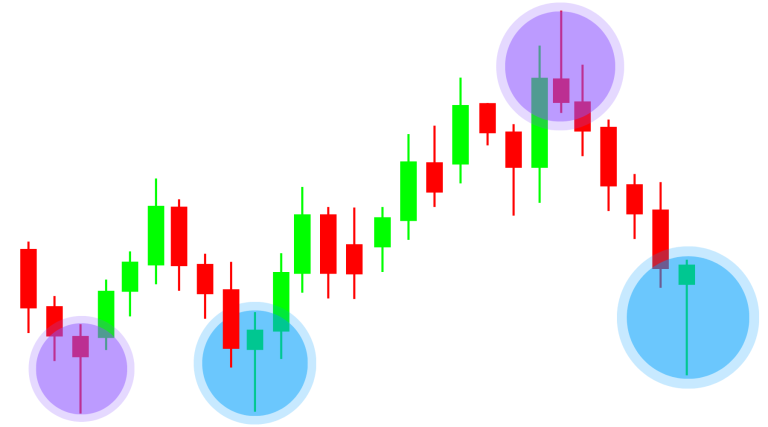

The Hammer is bullish reversal pin bar that kinds on the finish of a decline in value (downtrend).

Sellers held management in the course of the begin of the session however by the top of the session the consumers stepped in and take value near highs. The top result’s a candle with an extended decrease tail or wick which is able to exceed under the newest value motion.

Taking pictures Star

A Taking pictures Star is bearish reversal sample that kinds on the finish of an advance in value (uptrend).

Consumers maintained management in the course of the starting of the session however by the top sellers took over and drove value again down under the open of the candle.

The ensuing candlestick may have an extended higher tail or wick which ought to lengthen out above current value motion.

Inverted Hammer

The Inverted Hammer seems precisely like a taking pictures star however kinds after a downtrend in value. The lengthy higher tail indicators a possible reversal as consumers started to point out aggression but gave again some floor to the sellers earlier than the candle closed.

Hanging Man

The Hanging Man seems precisely like a hammer however kinds on the finish of an uptrend in value. The lengthy decrease tail indicators that sellers managed the beginning of the session however gave again some floor to consumers earlier than the shut.

Now let’s get into what you’re actually right here for.

How you can Commerce Pin Bars

When buying and selling pin bar reversals there’s a number of completely different entry strategies to select from.

The three commonest entry strategies are:

- Enter on the break of the excessive of a bullish pin bar or low of bearish pin bar

- Enter on a retracement

- Enter at market on shut of pin bar

There’s no excellent reply to which technique it is best to use. Most definitely you’ll find yourself utilizing all of them, which you’ll find out in your backtesting.

Personally I take advantage of all three strategies. Which one I select depends upon volatility, development, quantity evaluation, and different items of context.

Getting into at market or with a cease order at highs/lows is often going for use in sturdy trending markets.

These two strategies will usually lead to a decrease R a number of versus getting into on a retrace as a result of having to make use of a bigger cease.

Retracements are going to work finest while you’re fading a development or in a balanced market.

Pin Bar Buying and selling Methods

You’ll typically hear me say you want to construct context round a sample/sign to have an actual buying and selling technique.

Context is solely a definition of beneath what market situations you’ll commerce a sample.

As you advance as a dealer your definitions of context will grow to be extra advanced and extra particular to the technique you’re buying and selling.

To get you began, let’s take a look at some primary pin bar technique examples.

50% Retracements

Pin bars might be traded with one other reversal sample like 50% Retracements, additionally know as Midway Backs.

Look forward to a pin sample to kind at a 50% retracement stage. You may check trying to exit at completely different extensions such because the -23.6%.

In the event you’re not aware of fibonacci retracements and extensions right here’s an in-depth information.

VWAP Bounce

On sturdy breakout days a retrace again to the amount weighted common value (VWAP) can present alternative to get in on the development. Search for a pin bar to kind within the path of the general development at VWAP.

Transferring Common Bounce

Decide your favourite shifting common and await a powerful development.

When you’ve confirmed a powerful development look to play a pin bar bounce off the shifting common.

Double Backside/Prime + Added Context

The next setups is getting a littler extra superior as we start so as to add completely different items of context collectively.

On the setup above a pin bar with a wide range kinds and rejects lows of the day.

Moreover, there’s a rise in quantity signaling sturdy purchaser aggression.

The extra items of context you’ll be able to add to a method the higher off you’re going to be.

Pin Bar Technique Suggestions

Outline your technique in nice element.

I attempt REALLY exhausting to convey to new merchants that it’s EXTREMELY essential to be very descriptive when defining your buying and selling methods.

After you have a powerful definition of the patterns you’ll commerce in addition to beneath what context you’ll commerce them, do you even have a buying and selling technique.

Profitable buying and selling methods are worthwhile as a result of they’re repeatable, whereas random patterns are usually not.

Pin Bar Vary

Keep away from buying and selling pin bars with small ranges relative to surrounding value motion. Search for the pin bars that stick out like a sore thumb from the remainder of value motion.

The Pattern is Your Pal

On sturdy trending days don’t commerce pins towards the development. Odds are you will note a ton of them and they’ll all fail.

Create some kind of context to filter out fading sturdy traits.

Strive Quantity Evaluation

As an order movement dealer, on the core of most my methods is quantity evaluation. It’s an effective way to construct context for any buying and selling technique.

Quantity is arms down the primary indicator utilized in nearly each technique I commerce.

Conclusion

Don’t let the simplistic nature of a buying and selling sample like a pin bar mislead you into pondering it’s ineffective.

Together with correct context, pin bars can produce some excessive R multiples.

Changing into a profitable dealer requires quite a lot of display time and testing. It’s time so that you can get to work!

In the event you use pin bars and have one thing cool to share or a query go away a remark under!