What’s Sign Zone Filter?

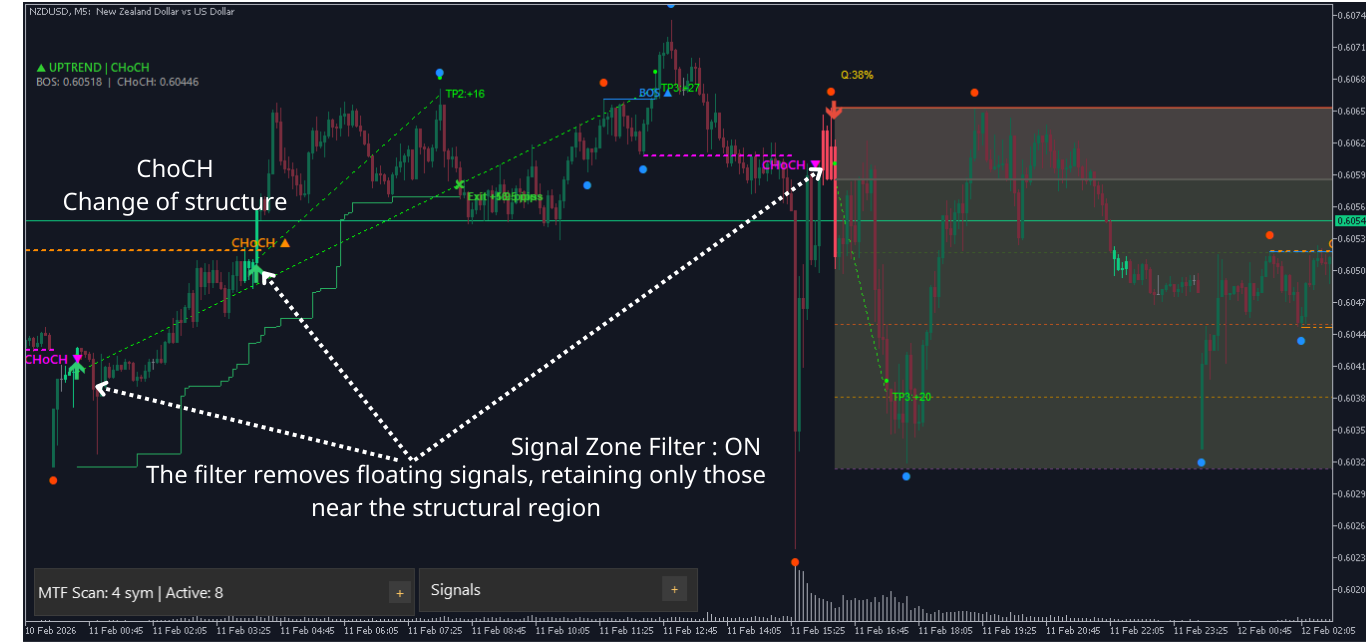

Sign Zone Filter helps remove indicators that seem in “floating” positions — that means they don’t seem to be close to any vital value zones. It solely retains indicators which can be linked to market construction zones (swing excessive/low, BOS, CHoCH).

Merely put:

Objective: Scale back noise indicators, commerce solely at structurally important value zones.

The way it works (2 OR situations)

The filter makes use of 2 impartial checks; only one of the two must be glad for a sign to move:

Verify 1: Swing Sweep

-

Purchase: Sample low should contact beneath a close-by swing low (sweep assist zone HL/LL)

-

Promote: Sample excessive should spike above a close-by swing excessive (sweep resistance zone HH/LH)

-

Sweep distance is proscribed by Swing Sweep Max Depth to keep away from mistaking actual breakouts

Why “sweep”? In value motion evaluation, when value sweeps previous a excessive/low then reverses → that is usually an indication of liquidity sweep. Indicators showing proper after a sweep sometimes have larger success likelihood.

Verify 2: Occasion Recency

Why current occasions? If there was only a BOS/CHoCH → market construction simply confirmed the route → indicators in that route are extra dependable.

The way to allow Sign Zone Filter

Sign Zone Filter is constructed into these indicators: Mirage (Fakey), PinBar, InvertedHammer (and Template). By default, the filter is off (false).

To allow: right-click the indicator → Properties (or press F7) → discover parameter Allow Sign Zone Filter → change to true.

Essential be aware: Sign Zone Filter requires Market Construction to be working (as a result of it wants swing and BOS/CHoCH knowledge from Market Construction). Market Construction is all the time enabled by default, so that you needn’t do something further.

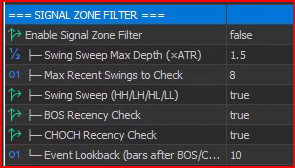

Enter parameters defined

1. Allow Sign Zone Filter — Flip filter on/off

| Information | Particulars |

|---|---|

| Identify in indicator | Allow Sign Zone Filter |

| Default | false (off) |

| Values | true / false |

Which means: Most important change. When false, all indicators are saved (filter doesn’t intervene). When true, filter begins checking and blocking indicators that do not meet standards.

Tip: Allow filter if you see the indicator displaying too many indicators, particularly indicators in “empty house” (not close to any excessive/low).

2. Swing Sweep Max Depth (×ATR) — Most sweep distance

| Information | Particulars |

|---|---|

| Identify in indicator | Swing Sweep Max Depth (×ATR) |

| Default | 1.5 |

| Vary | 0.1 to five.0 |

| Unit | ATR multiplier (×ATR) |

Which means: Limits the utmost distance a sample is allowed to comb previous a swing. If the sample exceeds this distance, it is thought-about an actual breakout (not a sweep) → would not rely.

Components: Max sweep distance = Swing Sweep Max Depth × ATR

Instance: ATR = 50 pips, Max Depth = 1.5 → sample can solely sweep most 75 pips (1.5 × 50) previous the swing stage. If it sweeps greater than 75 pips → would not rely as sweep.

When altering:

-

Enhance (2.0, 3.0…) → settle for farther sweeps → simpler to move filter → extra indicators

-

Lower (0.5, 0.8…) → solely settle for sweeps near swing stage → fewer indicators however extra correct

Tip: 1.5 works for many instances. If buying and selling Gold (massive vary), can improve to 2.0–2.5. If buying and selling foreign exchange majors (smaller vary), hold 1.0–1.5.

3. Max Latest Swings to Verify — Variety of current swings to test

| Information | Particulars |

|---|---|

| Identify in indicator | Max Latest Swings to Verify |

| Default | 8 |

| Vary | 1 to twenty |

| Unit | Variety of swings |

Which means: Filter will test as much as N most up-to-date swings (from latest to oldest) to see if sample swept previous any of them.

When altering:

-

Enhance (12, 15, 20) → test extra older swings → simpler to discover a sweep → extra indicators move

-

Lower (3, 5) → solely test a number of current swings → sign have to be close to newer swings to move

Tip: Worth of 8 is properly balanced. On small timeframes (M5–M15) can improve to 10–12 as a result of swings type sooner. On massive timeframes (H4–D1) hold 5–8.

4. Swing Sweep (HH/LH/HL/LL) — Allow/disable swing sweep test

| Information | Particulars |

|---|---|

| Identify in indicator | Swing Sweep (HH/LH/HL/LL) |

| Default | true |

| Values | true / false |

Which means: Allow/disable the swing sweep test (test 1). If disabled, filter depends solely on current BOS/CHoCH occasions.

Tip: Ought to hold true. Solely disable in order for you the filter to rely solely on BOS/CHoCH occasions as an alternative of swing zones.

5. BOS Recency Verify — Allow/disable current BOS test

| Information | Particulars |

|---|---|

| Identify in indicator | BOS Recency Verify |

| Default | true |

| Values | true / false |

Which means: Permit sign to move if there is a same-direction BOS (Break of Construction) occasion just lately.

Tip: Ought to hold true. BOS is a development continuation sign — very dependable.

6. CHOCH Recency Verify — Allow/disable current CHoCH test

| nfo | Particulars |

|---|---|

| Identify in indicator | CHOCH Recency Verify |

| Default | true |

| Values | true / false |

Which means: Permit sign to move if there is a same-direction CHoCH (Change of Character — reversal signal) occasion just lately.

When to disable: If you happen to solely wish to commerce with the development (not commerce reversals), disable CHOCH Recency Verify so filter solely passes indicators with BOS or sweep.

7. Occasion Lookback (bars after BOS/CHOCH) — Occasion time window

| Information | Particulars |

|---|---|

| Identify in indicator | Occasion Lookback (bars after BOS/CHOCH) |

| Default | 10 |

| Vary | 1 to 50 |

| Unit | Variety of candles (bars) |

Which means: After BOS/CHoCH happens, sign should seem throughout the subsequent N candles to be thought-about “current”. If sign seems after greater than N candles → occasion is taken into account previous → would not rely.

Instance: Occasion Lookback = 10, on H1 timeframe. If BOS ▲ happens at 10:00 → Purchase sign should seem earlier than 20:00 (10 H1 candles = 10 hours) to move due to this occasion.

When altering:

-

Enhance (20, 30, 50) → wider “window” → older occasions nonetheless rely → simpler to move however much less significant

-

Lower (3, 5) → solely indicators showing very quickly after occasion move → stricter, extra correct

Tip: On M15–H1, worth of 10 works properly. On H4–D1, ought to lower to five–7 (every candle is already lengthy, 10 H4 candles = practically 2 days). On M1–M5 can improve to fifteen–20.

Indicators seen on chart

Sign Zone Filter is a hidden filter — it would not draw any extra objects on the chart. As an alternative, it blocks or permits sample indicators (Fakey, PinBar, Inverted Hammer) to be displayed.

When filter is ON (enabled = true):

-

Sign passes filter → shows usually (arrow, zone fill, buying and selling line…)

-

Sign is blocked → not displayed on chart (disappears fully)

When filter is OFF (enabled = false):

The way to know filter is working:

-

Allow Debug Mode (in indicator parameters) → open Professional tab → discover log traces tagged [SZ-FILTER] or [SZ_FILTER]

-

Log will present: which sign PASS (and motive: swept which swing, or which occasion), which sign BLOCK

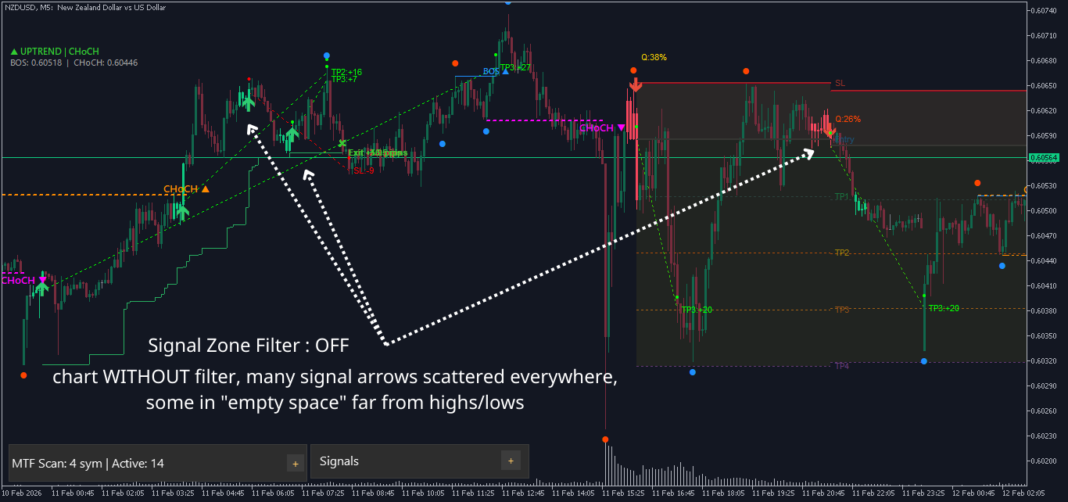

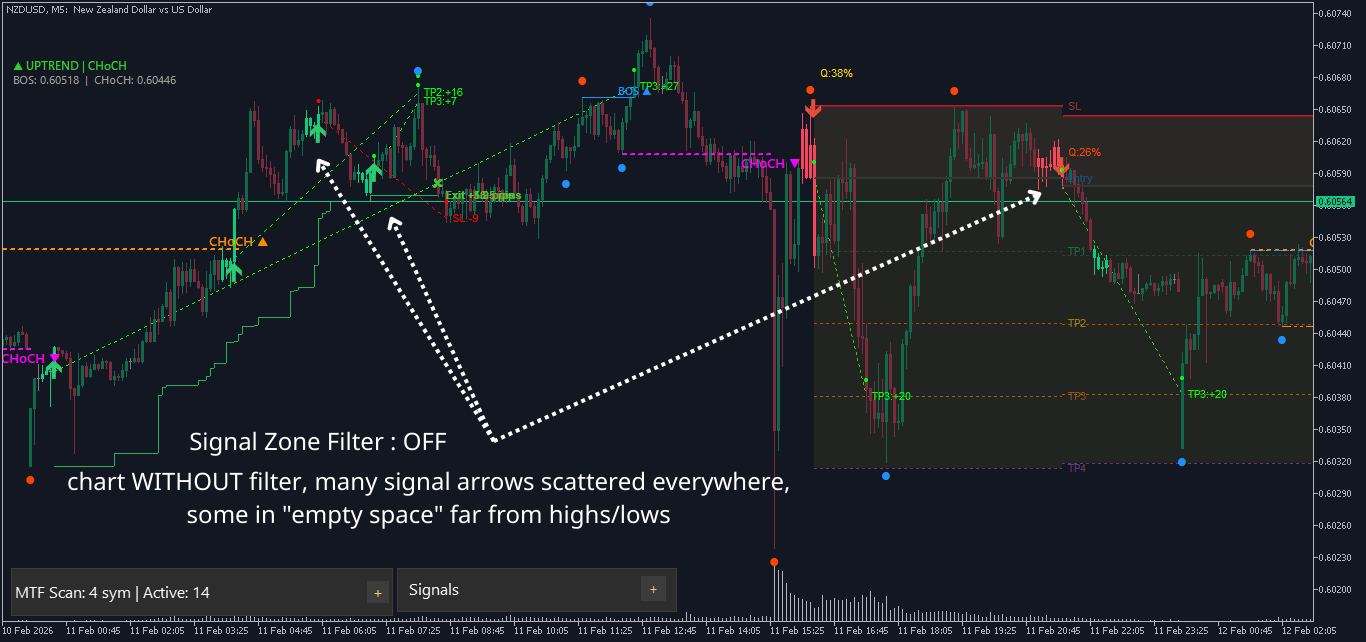

Earlier than/after filter comparability:

| Standing | Variety of indicators | High quality |

|---|---|---|

| Filter OFF | Extra | Combine of excellent indicators and noise |

| Filter ON | Fewer (sometimes 30–60% discount) | Solely retains indicators close to construction zones |

Buying and selling eventualities (examples)

Situation 1: Purchase sign passes by way of Swing Sweep

-

Market Construction reveals ▲ UPTREND , newest swing low (HL) at 2,030

-

Purchase sample seems (e.g., Fakey Bullish), sample low touches 2,028 (2 pips beneath HL)

-

Filter checks: “Sample low 2,028 < HL 2,030? → Sure. Distance 2 pips < Max Depth 75 pips? → Sure”

-

Outcome: PASS — Sample swept assist zone → dependable sign → shows on chart

-

Situation 2: Purchase sign passes by way of current BOS

-

No close by swing (sample would not sweep previous any excessive/low)

-

However 5 candles in the past, BOS ▲ (bullish Break of Construction) occurred

-

Filter checks: “Is there bullish BOS inside 10 candles? → Sure (5 candles in the past)”

-

Outcome: PASS — Construction simply confirmed bullish → Purchase sign is cheap

Situation 3: Sign blocked

-

Promote sign seems, however sample excessive would not spike above any swing excessive

-

And no bearish BOS/CHoCH throughout the final 10 candles

-

Filter checks: “Sweep? → No. Occasion? → No”

-

Outcome: BLOCK — Sign is “floating”, not linked to construction zone → eradicated

Sensible ideas

Tip 1: Begin with default values, fine-tune later

Allow filter with all default parameters first. Observe for 1–2 weeks what number of indicators the filter removes. If too few indicators blocked → improve strictness. If too many good indicators blocked → lower strictness.

Tip 2: Mix with Market Construction to know that means

When sign passes filter, open Professional tab to see motive:

-

If handed by way of sweep HL → sample swept bullish assist zone → very sturdy in Uptrend

-

If handed by way of sweep LL → sample swept new low → could also be reversal signal (be extra cautious)

-

If handed by way of same-direction BOS → momentum is powerful → trend-following sign

Tip 3: Disable CHoCH in the event you solely commerce with development

In case your buying and selling model is trend-only (no catching reversals):

-

Maintain BOS Recency Verify = true

-

Set CHOCH Recency Verify = false

-

Outcome: indicators solely move when sweeping swing or having BOS (development continuation) — do not move due to CHoCH (reversal)

Tip 4: Warning about “false sense of safety”

Filter helps remove weak indicators, however would not assure 100% remaining indicators will win. Dangers nonetheless exist:

-

Sweep is likely to be an actual breakout (value continues far, would not return)

-

Latest BOS/CHoCH would not assure momentum will maintain

-

All the time use cease loss and correct cash administration, no matter what filter says

Tip 5: Regulate Occasion Lookback by timeframe

| Timeframe | Advised Occasion Lookback | Purpose |

|---|---|---|

| M1–M5 | 15–20 bars | Brief candles, “current” occasion wants extra candles |

| M15–H1 | 8–12 bars | Balanced (default 10 works properly) |

| H4–D1 | 5–7 bars | Every candle is lengthy, too-old occasion loses that means |

Tip 6: Use Debug Mode to know filter

Allow Debug Mode = true in indicator parameters, then open MT5 → View → Toolbox → Professional tab. You will see log traces like:

textual content

[SZ-FILTER] BUY PASS: Swept HL at 2030.50 (depth=2.3 pips) [SZ-FILTER] SELL BLOCK: No sweep at 2045.20, no current bearish occasion

Use this info to:

Tip 7: Watch out utilizing filter on small timeframes + ranging markets

In ranging markets (Market Construction reveals ◆ RANGING ), swing highs/lows alternate shut collectively. Patterns simply “sweep” previous swings → most indicators move → filter is much less efficient.

Suggestion: Mix Sign Zone Filter with Course Filter. Course Filter will block indicators in ranging markets, whereas Sign Zone Filter filters place in trending markets.

Optimize by buying and selling model

| Type | Swing ATR Mult | Max Zones | Occasion Lookback | CHoCH | Notes |

|---|---|---|---|---|---|

| Scalp (M1–M5) | 1.0–1.5 | 10–12 | 15–20 | true | Want many swings, broad occasion window |

| Intraday (M15–H1) | 1.5 (default) | 8 | 10 | true | Balanced — advisable for many |

| Swing (H4–D1) | 2.0–2.5 | 5–8 | 5–7 | false | Strict filtering, solely massive sweeps + BOS, no CHoCH |

Fast abstract

| If you wish to… | Do that |

|---|---|

| Allow filter | Set Allow Sign Zone Filter = true |

| Maintain extra indicators | Enhance Swing ATR Mult, Max Zones, Occasion Lookback |

| Filter extra strictly | Lower above values, disable CHoCH |

| Solely commerce with development | Disable CHOCH Recency Verify |

| Perceive why sign was blocked | Allow Debug Mode, learn Professional tab |

| Indicators disappeared after enabling | Regular — filter is eradicating weak indicators |

Continuously Requested Questions (FAQ)

Q: After enabling filter, all indicators disappeared?

A: Presumably market is ranging + no current BOS/CHoCH. Strive rising Occasion Lookback or Swing ATR Mult. If nonetheless none → market actually has no appropriate construction zones.

Q: Does filter draw something on chart?

A: No. Filter works “behind the scenes” — solely blocks/permits indicators. To see swing zones (HH/HL/LH/LL) and BOS/CHoCH, allow Present Swing Markers and Present BOS/CHOCH Traces in Market Construction part.

Q: Should Market Construction be enabled for filter to work?

A: Sure. Market Construction gives swing and occasion knowledge for the filter. Market Construction is all the time enabled by default, so no want to fret.

Q: Ought to I allow filter from the beginning or solely when wanted?

A: Beneficial to make use of indicator with out filter first to get accustomed to indicators. Then allow filter to cut back noise when you perceive how the indicator works.