By InvestMacro

The most recent replace for the weekly Dedication of Merchants (COT) report was launched by the Commodity Futures Buying and selling Fee (CFTC) on Friday for knowledge ending on February third.

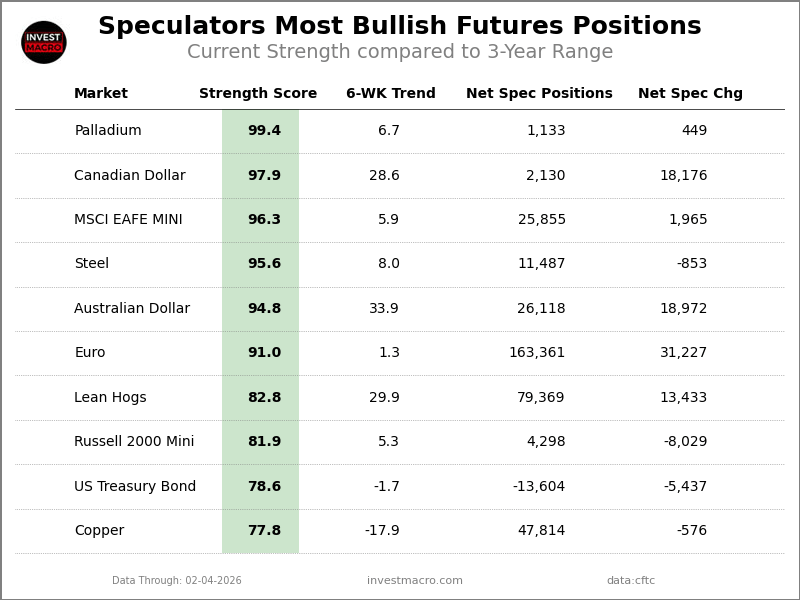

This weekly Excessive Positions report highlights the Most Bullish and Most Bearish Positions for the speculator class. Excessive positioning in these markets can foreshadow robust strikes within the underlying market.

To indicate an excessive place, we use the Power Index (often known as the COT Index) of every instrument, a typical methodology of measuring COT knowledge. The Power Index is just a comparability of present dealer positions in opposition to the vary of positions over the earlier 3 years. We use over 80 % as extraordinarily bullish and beneath 20 % as extraordinarily bearish. (Evaluate Power Index scores throughout all markets within the knowledge desk or cot leaders desk)

Right here Are This Week’s Most Bullish Speculator Positions:

Palladium

The Palladium speculator place is available in as essentially the most bullish excessive standing this week because the Palladium speculator stage is presently at a 99 % rating of its 3-year vary.

The six-week pattern for the % power rating totaled a achieve of seven share factors this week. The general internet speculator place was a complete of 1,133 internet contracts this week with a rise of 449 contract within the weekly speculator bets.

Speculators or Non-Commercials Notes:

Speculators, categorized as non-commercial merchants by the CFTC, are made up of enormous commodity funds, hedge funds and different important for-profit individuals. The Specs are usually thought to be trend-followers of their habits in the direction of worth motion – internet speculator bets and costs are likely to go in the identical instructions. These merchants typically look to purchase when costs are rising and promote when costs are falling. As an example this level, many occasions speculator contracts will be discovered at their most extremes (bullish or bearish) when costs are additionally near their highest or lowest ranges.

These excessive ranges will be harmful for the massive speculators because the commerce is most crowded, there’s much less buying and selling ammunition nonetheless sitting on the sidelines to push the pattern additional and costs have moved a major distance. When the pattern turns into exhausted, some speculators take earnings whereas others look to additionally exit positions when costs fail to proceed in the identical path. This course of often performs out over many months to years and may in the end create a reverse impact the place costs begin to fall and speculators begin a strategy of promoting when costs are falling.

Canadian Greenback

The Canadian Greenback speculator place comes subsequent within the excessive standings this week with the CAD speculator stage now at a 98 % rating of its 3-year vary.

The six-week pattern for the % power rating was a leap by 29 share factors this week. The speculator place registered 2,130 internet contracts this week with a weekly enhance of 18,176 contracts in speculator bets.

Metal

The Metal speculator place is available in third this week within the excessive standings. The Metal speculator stage resides at a 96 % rating of its 3-year vary.

The six-week pattern for the power rating got here in at a rise by 8 share factors this week. The general speculator place was 11,487 internet contracts this week with a dip of -853 contracts within the weekly speculator bets.

MSCI EAFE MINI

The MSCI EAFE MINI speculator place comes up quantity 4 within the excessive standings this week. The MSCI EAFE-Mini speculator stage is at a 96 % rating of its 3-year vary.

The six-week pattern for the speculator power rating totaled an increase of 6 share factors this week. The general speculator place was 25,855 internet contracts this week with an increase of 1,965 contracts within the speculator bets.

Australian Greenback

The Australian Greenback speculator place rounds out the highest 5 on this week’s bullish excessive standings. The AUD speculator stage sits at a 95 % rating of its 3-year vary whereas the six-week pattern for the speculator power rating was a leap of 34 share factors this week.

The speculator place was 26,118 internet contracts this week with a robust achieve of 18,972 contracts within the weekly speculator bets.

The Most Bearish Speculator Positions of the Week:

Sugar

The Sugar speculator place is available in as essentially the most bearish excessive standing this week with the Sugar speculator stage is at a minimal 0 % rating of its 3-year vary.

The six-week pattern for the speculator power rating was a drop by -12 share factors this week. The general speculator place was -210,289 internet contracts this week with a fall of -42,536 contracts within the speculator bets.

Cocoa Futures

The Cocoa Futures speculator place is available in subsequent for essentially the most bearish excessive standing on the week because the Cocoa speculator stage is at a 3 % rating of its 3-year vary.

The six-week pattern for the speculator power rating was a decline of -16 share factors this week. The speculator place was -14,508 internet contracts this week with an increase of 994 contracts within the weekly speculator bets.

Cotton

The Cotton speculator place is available in as third most bearish excessive standing of the week. The Cotton speculator stage resides at a 14 % rating of its 3-year vary.

The six-week pattern for the speculator power rating was a decline of -7 share factors this week whereas the general speculator place was -42,744 internet contracts this week with a lower of -3,777 contracts within the speculator bets.

2-Yr Bond

The two-Yr Bond speculator place is available in as this week’s fourth most bearish excessive standing. The two-Yr speculator stage is at a 14 % rating of its 3-year vary.

The six-week pattern for the speculator power rating was an edge increased by 1 share level this week. The speculator place was -1,347,602 internet contracts this week with a decline of -128,603 contracts within the weekly speculator bets.

Pure Fuel

Subsequent, the Pure Fuel speculator place is available in because the fifth most bearish excessive standing for this week with the Pure Fuel speculator stage at a 15 % rating of its 3-year vary.

The six-week pattern for the speculator power rating was a fall by -11 share factors this week whereas the speculator place was -172,310 internet contracts this week with a lower by -8,704 contracts within the weekly speculator bets.

Article By InvestMacro – Obtain our weekly COT E-newsletter

*COT Report: The COT knowledge, launched weekly to the general public every Friday, is up to date by way of the latest Tuesday (knowledge is 3 days outdated) and exhibits a fast view of how massive speculators or non-commercials (for-profit merchants) had been positioned within the futures markets.

The CFTC categorizes dealer positions based on business hedgers (merchants who use futures contracts for hedging as a part of the enterprise), non-commercials (massive merchants who speculate to understand buying and selling earnings) and nonreportable merchants (often small merchants/speculators) in addition to their open curiosity (contracts open out there at time of reporting). See CFTC standards right here.

- COT Metals Charts: Speculators drop Gold Bets for fifth time in 6 Weeks Feb 8, 2026

- COT Bonds Charts: Speculator Bets led by SOFR 1-Months, SOFR 3-Months & Extremely 10-Yr Bonds Feb 8, 2026

- COT Power Charts: Weekly Speculator Bets led by WTI Crude & Brent Oil Feb 8, 2026

- COT Gentle Commodities Charts: Sugar Speculator Bets hit All-Time Document Low Feb 8, 2026

- Bitcoin has dropped beneath $70,000. The Financial institution of Mexico held its fee at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Dangers Feb 6, 2026

- The British Index has hit a brand new all-time excessive. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Beneath Native Stress: Concentrate on Financial institution of England Indicators Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by greater than 10% Feb 4, 2026

- Gold is Again within the Black: Geopolitics Dictates Situations Once more Feb 4, 2026